Elon Musk Net Worth: A Deep Dive Below $300 Billion

Table of Contents

The Sources of Elon Musk's Wealth

Elon Musk's immense fortune stems primarily from two major sources: his significant stake in Tesla and the burgeoning valuation of SpaceX. Let's break down each component:

Tesla Stock Performance

Tesla's stock price is the single most significant driver of Elon Musk's net worth. His substantial ownership stake means that any fluctuation in Tesla's market capitalization directly impacts his personal wealth.

- Stock Market Volatility: The volatile nature of the stock market plays a crucial role. Positive news and strong financial performance send Tesla's stock soaring, boosting Musk's net worth, while negative news or market corrections lead to a decline.

- Investor Sentiment: Investor confidence in Tesla and its future prospects significantly impacts the stock price. Positive sentiment leads to higher demand and increased stock prices, while negative sentiment has the opposite effect. Musk's own public statements often influence this sentiment.

- Competition in the EV Market: The growing competition in the electric vehicle (EV) market presents challenges. The emergence of new players and their innovative products can put pressure on Tesla's market share and, consequently, its stock price.

- Tesla's Overall Financial Performance: Tesla's quarterly earnings reports, production figures, and overall financial health are closely scrutinized by investors. Strong performance generally translates to higher stock prices, while weak performance can lead to declines. Keywords like Tesla stock price, EV market, and market capitalization are key to understanding this dynamic.

SpaceX Valuation and Future Prospects

SpaceX, Musk's aerospace manufacturer and space exploration company, is another substantial contributor to his wealth, although its impact is less directly visible due to its private nature.

- SpaceX Valuation: While SpaceX hasn't gone public (IPO), its private valuation is substantial and continues to grow based on its contracts, technological advancements, and future projections.

- Starlink and Satellite Internet: SpaceX's Starlink satellite internet project has the potential to generate significant revenue and further increase the company's valuation, impacting Musk's net worth positively.

- Space Tourism and Exploration: SpaceX's ventures into space tourism and its ambitious plans for Mars colonization represent significant long-term growth potential, further influencing its valuation. Keywords like SpaceX valuation, Starlink, space exploration, and private space company are vital here.

Other Investments and Holdings

Beyond Tesla and SpaceX, Elon Musk likely has other investments and holdings, though details are less publicly available. This diversification likely contributes to his overall net worth but to a lesser extent than his major holdings.

- Diversification: While the exact details are unknown, it's plausible he holds investments in other companies, real estate, and potentially other assets.

- Limited Public Information: The lack of transparency regarding these private holdings makes it difficult to accurately assess their impact on his overall net worth.

Factors Contributing to the Decline Below $300 Billion

Several factors have contributed to the recent decline in Elon Musk's net worth, primarily focusing on Tesla's stock performance and broader market trends.

Market Corrections and Economic Downturns

Broader economic forces significantly influence high-growth tech stocks like Tesla.

- Recession Fears: Concerns about a potential recession often lead investors to sell off riskier assets, including growth stocks. This selling pressure can cause a significant drop in stock prices.

- Inflation and Interest Rate Hikes: Inflation and subsequent interest rate hikes by central banks impact market valuations. Higher interest rates increase borrowing costs for companies, potentially slowing down growth and reducing investor appetite for growth stocks. Keywords like market correction, economic downturn, inflation, and interest rates are crucial for understanding these trends.

Tesla's Recent Performance and Challenges

Tesla's recent performance has also played a key role in the fluctuation of Musk's net worth.

- Production Issues: Any disruptions to Tesla's production, such as supply chain problems or factory shutdowns, can impact its financial performance and stock price.

- Competition from Other EV Manufacturers: The increased competition in the EV market from established automakers and new entrants puts downward pressure on Tesla's market share and stock valuation.

- Supply Chain Disruptions: Global supply chain issues can constrain Tesla's ability to produce vehicles, impacting its profitability and investor sentiment. Keywords like Tesla production, EV competition, and supply chain are essential to understanding this context.

Musk's Public Statements and Actions

Elon Musk's public statements and actions have, at times, influenced investor confidence.

- Controversies and Tweets: Musk's controversial tweets and public actions can negatively impact investor sentiment, leading to a decline in Tesla's stock price.

- Impact on Investor Sentiment: Negative publicity and controversies surrounding Musk can erode investor confidence, leading them to sell their Tesla shares, which further reduces the stock's price and Musk's net worth. Keywords such as Elon Musk Twitter, Elon Musk controversy, and investor sentiment are relevant here.

Calculating Elon Musk's Net Worth: The Challenges

Accurately calculating Elon Musk's real-time net worth is inherently challenging.

- Market Valuation vs. Actual Net Worth: The publicly available net worth figures are typically based on the market valuation of his publicly traded assets, particularly his Tesla shares. This doesn't account for the true value of his assets.

- Lack of Transparency in Private Company Valuations: SpaceX's valuation is based on estimates and private funding rounds, making it inherently less precise than a publicly traded company's market cap.

- Volatility of Asset Values: The value of assets like Tesla stock and even SpaceX's valuation fluctuates constantly due to market forces and company performance, making it hard to pin down a precise number. Keywords such as net worth calculation, market valuation, and private company valuation are vital for understanding this complexity.

Conclusion

Elon Musk's net worth, while remaining substantial, has demonstrated significant volatility. Understanding the sources of his wealth, the contributing factors to its fluctuations, and the challenges in calculating a precise figure provide a more nuanced understanding of his financial standing. While the number fluctuates, continued monitoring of Tesla's performance, SpaceX's progress, and overall market conditions are crucial for understanding the dynamics of Elon Musk's net worth. Stay informed and continue exploring the evolving financial landscape of this influential figure.

Featured Posts

-

Stiven King Snova Atakuet Politikov Tramp I Mask V Tsentre Vnimaniya

May 10, 2025

Stiven King Snova Atakuet Politikov Tramp I Mask V Tsentre Vnimaniya

May 10, 2025 -

Arrestan A Universitaria Transgenero Por Usar Bano Femenino El Caso Que Genera Debate

May 10, 2025

Arrestan A Universitaria Transgenero Por Usar Bano Femenino El Caso Que Genera Debate

May 10, 2025 -

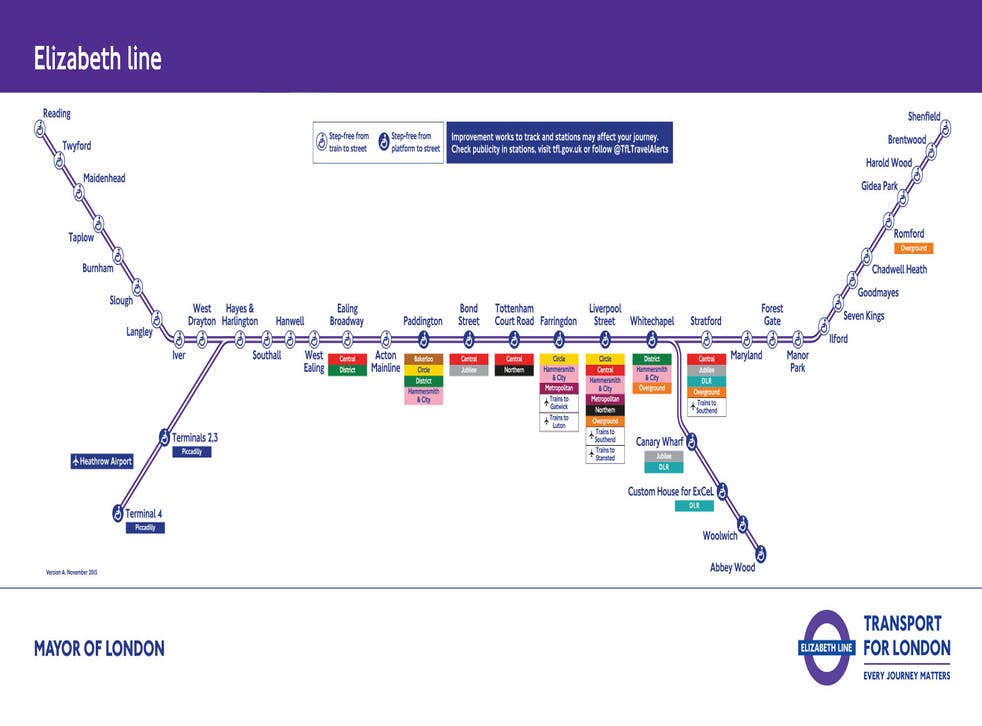

Tf Ls Elizabeth Line A Focus On Wheelchair User Accessibility And Gap Challenges

May 10, 2025

Tf Ls Elizabeth Line A Focus On Wheelchair User Accessibility And Gap Challenges

May 10, 2025 -

Intriguing Theory Could David Expose Morgans Biggest Weakness

May 10, 2025

Intriguing Theory Could David Expose Morgans Biggest Weakness

May 10, 2025 -

Two Men Convicted For Destroying Sycamore Gap Tree

May 10, 2025

Two Men Convicted For Destroying Sycamore Gap Tree

May 10, 2025