Elon Musk: Trump's Plan Threatens Dogecoin's Future

Table of Contents

Trump's Economic Policies and Their Potential Impact on Cryptocurrencies

A potential Trump administration's economic policies could significantly alter the cryptocurrency landscape, presenting considerable challenges for Dogecoin.

Increased Regulation

Increased cryptocurrency regulation is a major concern. A Trump administration might prioritize stricter oversight, leading to:

- Increased scrutiny of exchanges: More stringent audits and compliance requirements could increase operational costs for exchanges, potentially affecting Dogecoin trading volume and liquidity.

- Stricter KYC/AML requirements: Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations could become more rigorous, making it harder for some users to access and trade Dogecoin.

- Potential bans or limitations on crypto transactions: In the worst-case scenario, outright bans or significant limitations on cryptocurrency transactions could severely cripple Dogecoin's functionality.

These regulations could stifle Dogecoin's accessibility and liquidity, driving down its price and adoption rate. The increased compliance burden could also disproportionately impact smaller exchanges and Dogecoin users. The resulting decrease in Dogecoin trading would negatively affect its overall market capitalization.

Focus on the US Dollar

Trump's emphasis on strengthening the US dollar could indirectly harm cryptocurrencies like Dogecoin.

- Reduced appeal of alternative currencies: A stronger dollar might reduce the appeal of alternative assets, including cryptocurrencies, as investors flock to the perceived safety and stability of the US dollar.

- Potential for capital flight away from crypto: Investors might shift their assets from riskier crypto investments, like Dogecoin, towards more stable dollar-denominated assets.

A stronger dollar could decrease the demand for Dogecoin, leading to a potential price drop. This shift in investor sentiment would be driven by a perceived reduction in the relative value and risk-adjusted return of Dogecoin compared to the US dollar.

Uncertainty and Investor Sentiment

Political uncertainty is a major factor influencing investor confidence in cryptocurrencies.

- Increased volatility: Uncertainty surrounding Trump's economic policies could create increased volatility in the cryptocurrency market, making Dogecoin a riskier investment.

- Potential capital flight: Investors might withdraw their funds from Dogecoin and other cryptocurrencies to avoid potential losses due to policy changes.

- Decreased investor confidence: The overall uncertainty could erode investor confidence, impacting the long-term growth potential of Dogecoin.

This uncertainty would make it difficult for investors to accurately assess the risk and reward associated with Dogecoin, potentially causing a significant decline in investment.

Elon Musk's Influence and the Dogecoin Community

Elon Musk's influence on Dogecoin is undeniable, but his support could be affected by a Trump administration's policies.

Musk's Past Support

Elon Musk's past actions have significantly impacted Dogecoin's price:

- Tweets: Musk's tweets mentioning Dogecoin have historically caused dramatic price swings.

- Endorsements: Public endorsements and appearances have further fueled the Dogecoin hype.

- Public appearances: His public statements regarding Dogecoin have significantly swayed investor sentiment.

Musk's past actions demonstrate his substantial influence on Dogecoin's market performance.

The Risk of Diminished Support

A Trump administration's policies could lead to a reduction in Musk's support for Dogecoin:

- Potential regulatory pressure: Increased regulatory scrutiny might discourage Musk from actively promoting Dogecoin.

- Change in personal views: Changes in Musk's own views on cryptocurrencies due to the policy changes could impact his level of involvement.

- Distraction from other ventures: The political climate and potential regulatory battles might distract Musk from focusing on Dogecoin.

A shift in Musk's stance could negatively affect investor confidence and ultimately impact Dogecoin's price.

The Community's Response

The Dogecoin community's response to political and economic uncertainty is crucial.

- Community support: The community's strength and resilience could be a significant factor in weathering the storm.

- Resilience: The community's ability to adapt and innovate will be key to surviving potential challenges.

- Potential for diversification: The community might explore alternative strategies to maintain Dogecoin's value and appeal.

The Dogecoin community's reaction will significantly shape the cryptocurrency's trajectory under a potentially more restrictive regulatory environment.

Alternative Scenarios and Future Predictions

While a negative impact is a strong possibility, it's important to consider both positive and negative scenarios.

Best-Case Scenarios

Despite potential challenges, Dogecoin might benefit from increased community engagement and innovative solutions. A rise in decentralized finance (DeFi) applications or integrations could increase its utility.

Worst-Case Scenarios

Increased regulation could severely restrict Dogecoin's accessibility and use cases. A significant drop in price and decreased adoption are possible outcomes.

The Importance of Diversification

Given the inherent volatility of the cryptocurrency market, diversification is crucial. Investors should never put all their eggs in one basket and spread their investments across different asset classes, including other cryptocurrencies and traditional investments.

Conclusion

Trump's potential economic policies present significant challenges to Dogecoin's future, potentially impacting Elon Musk's influence and the overall market sentiment. Increased regulation, a stronger dollar, and the uncertainty surrounding Trump's plans create considerable risk for investors. While the Dogecoin community demonstrates resilience, understanding these potential threats is crucial for informed decision-making. Stay informed about political and economic developments, and remember to diversify your cryptocurrency portfolio to mitigate risks associated with investing in Dogecoin. Understanding the relationship between Elon Musk, Trump's policies, and the future of Dogecoin is critical for navigating the ever-changing landscape of the cryptocurrency market.

Featured Posts

-

Tim Meyers Successor Named Cargotec Veteran Takes Helm At Meyer Turku

May 29, 2025

Tim Meyers Successor Named Cargotec Veteran Takes Helm At Meyer Turku

May 29, 2025 -

Cota Moto Gp Johann Zarcos Substantial Progress And Future Implications

May 29, 2025

Cota Moto Gp Johann Zarcos Substantial Progress And Future Implications

May 29, 2025 -

Indonesia Weighs Israel Relations Palestine Statehood A Key Factor

May 29, 2025

Indonesia Weighs Israel Relations Palestine Statehood A Key Factor

May 29, 2025 -

Zes Wissels Toegestaan Liverpool Vs Southampton De Verklaring

May 29, 2025

Zes Wissels Toegestaan Liverpool Vs Southampton De Verklaring

May 29, 2025 -

Texas Showdown Mir And Marini Prepare For Cota Moto Gp Challenge

May 29, 2025

Texas Showdown Mir And Marini Prepare For Cota Moto Gp Challenge

May 29, 2025

Latest Posts

-

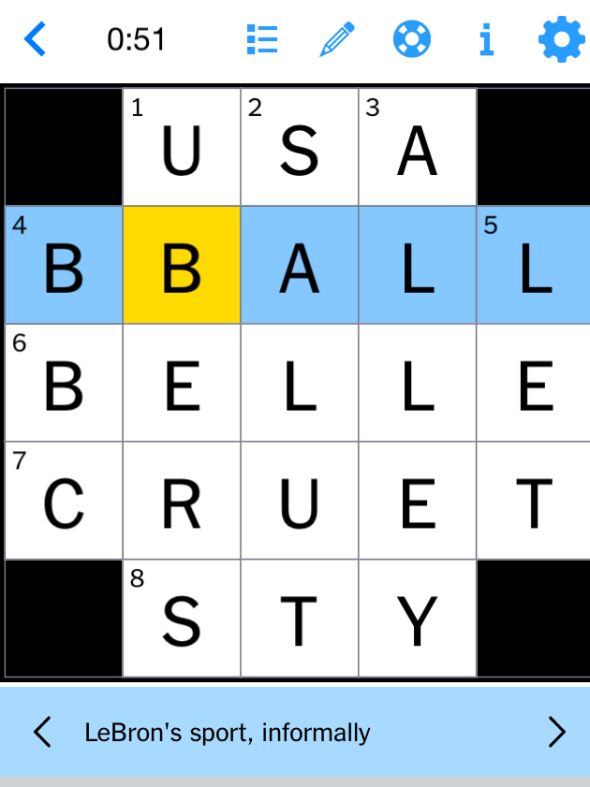

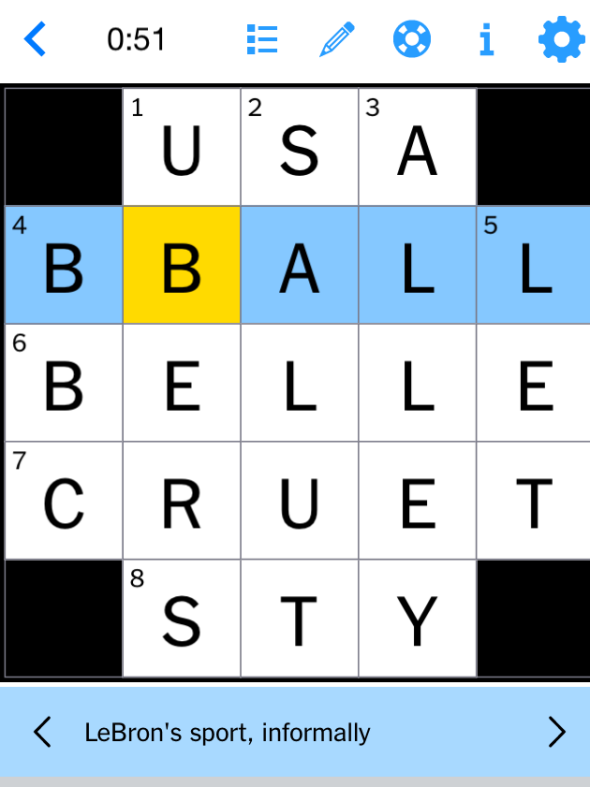

Nyt Mini Crossword Answers For Monday March 31 2025

May 31, 2025

Nyt Mini Crossword Answers For Monday March 31 2025

May 31, 2025 -

Solve The Nyt Mini Crossword Hints For March 31 2025

May 31, 2025

Solve The Nyt Mini Crossword Hints For March 31 2025

May 31, 2025 -

Nyt Mini Crossword Today March 31 2025 Complete Answers

May 31, 2025

Nyt Mini Crossword Today March 31 2025 Complete Answers

May 31, 2025 -

Solve The Nyt Mini Crossword Hints And Answers For April 19th Saturday

May 31, 2025

Solve The Nyt Mini Crossword Hints And Answers For April 19th Saturday

May 31, 2025 -

Todays Nyt Mini Crossword May 7 Answers And Explanations

May 31, 2025

Todays Nyt Mini Crossword May 7 Answers And Explanations

May 31, 2025