Elon Musk's Billions: Recent Market Volatility And Its Impact

Table of Contents

Tesla Stock Performance and Market Sentiment

Tesla's stock price, a major component of Elon Musk's net worth, has been highly volatile. Understanding this volatility requires examining several key factors.

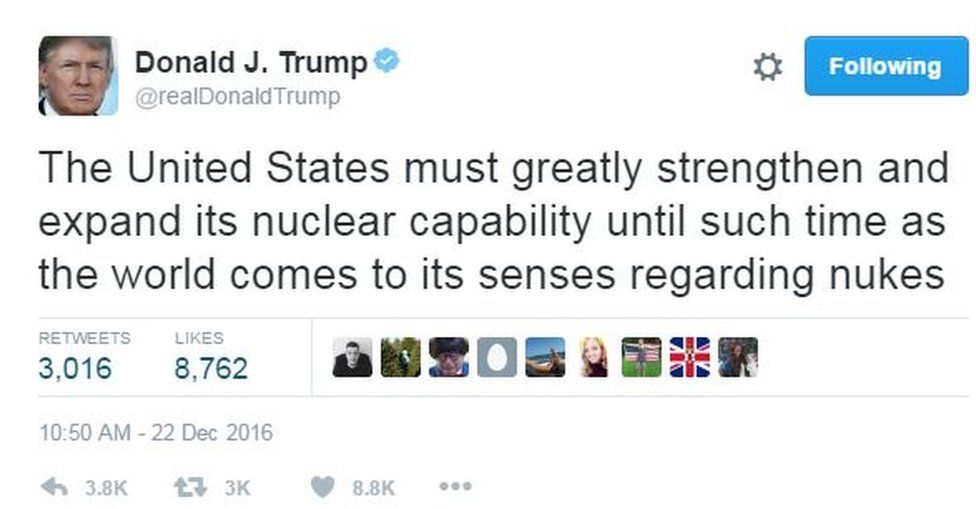

The Impact of Elon Musk's Tweets and Public Statements

Elon Musk's frequent and often controversial tweets and public pronouncements have a significant and demonstrable impact on Tesla's stock price. His pronouncements, ranging from product announcements to political commentary, can cause immediate and substantial market reactions.

- Examples of tweets causing stock price fluctuations: Musk's tweets about taking Tesla private, his comments on Dogecoin, and his announcements regarding production targets have all historically led to significant stock price swings, both positive and negative.

- Analysis of the positive and negative effects of his communication style: While some tweets generate excitement and positive investor sentiment, others have led to regulatory scrutiny and negative market reactions, highlighting the risks associated with his communication style. A more measured approach could stabilize Tesla's stock price.

- Discussion of regulatory scrutiny related to his social media activity: The Securities and Exchange Commission (SEC) has investigated Musk's tweets in the past, underscoring the need for greater caution and adherence to regulations regarding public statements about his companies.

Competition and the Electric Vehicle Market

The electric vehicle (EV) market is rapidly evolving, with numerous established and emerging competitors vying for market share. This intense competition directly impacts Tesla's valuation.

- Key competitors: Companies like Volkswagen, Ford, General Motors, and Rivian pose significant challenges to Tesla's dominance in the EV sector. Chinese EV manufacturers are also gaining traction globally.

- Advancements in EV technology: Continuous advancements in battery technology, charging infrastructure, and autonomous driving capabilities are reshaping the competitive landscape and impacting Tesla's need to innovate.

- Shifting consumer preferences: Consumer preferences are dynamic; factors such as price, range, features, and brand loyalty play significant roles in market share. Tesla's ability to adapt to these changes will be crucial for maintaining its competitive edge.

- Tesla's strategies to maintain its competitive edge: Tesla is investing heavily in research and development, expanding its charging network, and introducing new models to stay ahead of the competition. Successful execution of these strategies is paramount.

Macroeconomic Factors Affecting Tesla's Valuation

Broader macroeconomic factors, such as inflation, interest rates, and recessionary fears, significantly influence Tesla's stock price and valuation.

- Correlation between macroeconomic indicators and Tesla's stock: Historically, periods of economic uncertainty have negatively correlated with Tesla's stock performance, reflecting investor risk aversion.

- Investor sentiment in times of economic uncertainty: During times of economic instability, investors often shift towards safer investments, leading to capital flight from more volatile stocks like Tesla's.

- Strategies for managing risk in volatile markets: Diversification of investment portfolios and hedging strategies can mitigate the risks associated with investing in Tesla during periods of high market volatility.

SpaceX's Valuation and Funding Rounds

SpaceX, another key component of Elon Musk's empire, faces its own set of challenges and opportunities in a dynamic space exploration market.

The Impact of Space Exploration Market Dynamics

SpaceX's valuation is influenced by several factors specific to the space industry.

- Key competitors in the space launch and satellite markets: Companies like Blue Origin and Rocket Lab, along with government space agencies, compete with SpaceX for contracts and market share.

- Analysis of SpaceX's innovative technologies: SpaceX's reusable rockets and advanced satellite technology provide a competitive edge, but maintaining this technological lead requires continuous innovation and investment.

- Discussion on future revenue streams and growth potential: SpaceX's future revenue will likely depend on its ability to secure contracts for satellite launches, space tourism, and potential interplanetary missions. The long-term potential is vast, but also highly uncertain.

Securing Funding and Investment in a Volatile Market

SpaceX's ambitious projects require substantial funding, and securing this funding during periods of market volatility presents unique challenges.

- Recent funding rounds: Analysis of SpaceX's recent funding rounds reveals its ability to attract investors even during uncertain economic times. Its strong track record and future prospects help attract capital.

- Strategies for attracting investors during uncertain economic times: SpaceX’s strong performance, innovative technologies, and long-term growth potential are key factors in attracting investors.

- Discussion of the long-term viability of SpaceX’s business model: The long-term viability hinges on successfully executing its ambitious projects, securing government and private contracts, and effectively managing its resources.

The Broader Impact of Musk's Financial Fluctuations

Elon Musk's financial influence extends beyond his own companies, rippling through various markets.

Ripple Effects on the Cryptocurrency Market

Musk's pronouncements have significantly influenced cryptocurrency markets, particularly Dogecoin and Bitcoin.

- Examples of Musk’s tweets impacting crypto prices: Musk's tweets have been known to cause dramatic price swings in cryptocurrencies, illustrating the powerful influence of a high-profile figure on market sentiment.

- Analysis of the ethical considerations: The ethical implications of such influence are significant; the potential for market manipulation and the impact on less sophisticated investors require careful consideration.

- Discussion of the regulatory implications of such influence: Regulators are increasingly focusing on the influence of social media on financial markets, and stricter guidelines are likely to be introduced to address such concerns.

Investor Confidence and Market Stability

Elon Musk's fluctuating net worth, driven by market volatility affecting Tesla and SpaceX, impacts overall investor confidence and market stability.

- The psychology of investor behavior: Investor behavior is often influenced by the actions and pronouncements of high-profile figures. Musk's influence underscores the importance of understanding this psychology.

- The impact of high-profile individuals on market sentiment: High-profile individuals can significantly influence market sentiment, creating both opportunities and risks.

- The role of media coverage in shaping market perceptions: Media coverage plays a critical role in shaping public and investor perceptions of Elon Musk, Tesla, and SpaceX, amplifying both positive and negative sentiment.

Conclusion

Elon Musk's billions, inextricably linked to the performance of Tesla and SpaceX, are significantly impacted by recent market volatility. While his influence on market sentiment is undeniable, understanding the interplay of macroeconomic factors, competitive pressures, and his own public pronouncements is crucial for assessing the long-term implications. By closely monitoring Tesla's stock performance, SpaceX's funding rounds, and the broader market trends, investors can better navigate this complex landscape. Stay informed about Elon Musk's activities and their impact on the market to make informed decisions regarding your investment strategy. Continue to follow the evolution of Elon Musk's billions and their impact on the market.

Featured Posts

-

Understanding The New Uk Immigration Rules English Language Test Implications

May 10, 2025

Understanding The New Uk Immigration Rules English Language Test Implications

May 10, 2025 -

The Trump Administration And The Future Of Nuclear Power Plant Construction

May 10, 2025

The Trump Administration And The Future Of Nuclear Power Plant Construction

May 10, 2025 -

Nhl Playoff Predictions Post 2025 Trade Deadline

May 10, 2025

Nhl Playoff Predictions Post 2025 Trade Deadline

May 10, 2025 -

Affordable Luxury Skincare Elizabeth Arden At Walmart

May 10, 2025

Affordable Luxury Skincare Elizabeth Arden At Walmart

May 10, 2025 -

Ftc Probe Into Open Ai Implications For Ai Regulation And The Future Of Chat Gpt

May 10, 2025

Ftc Probe Into Open Ai Implications For Ai Regulation And The Future Of Chat Gpt

May 10, 2025