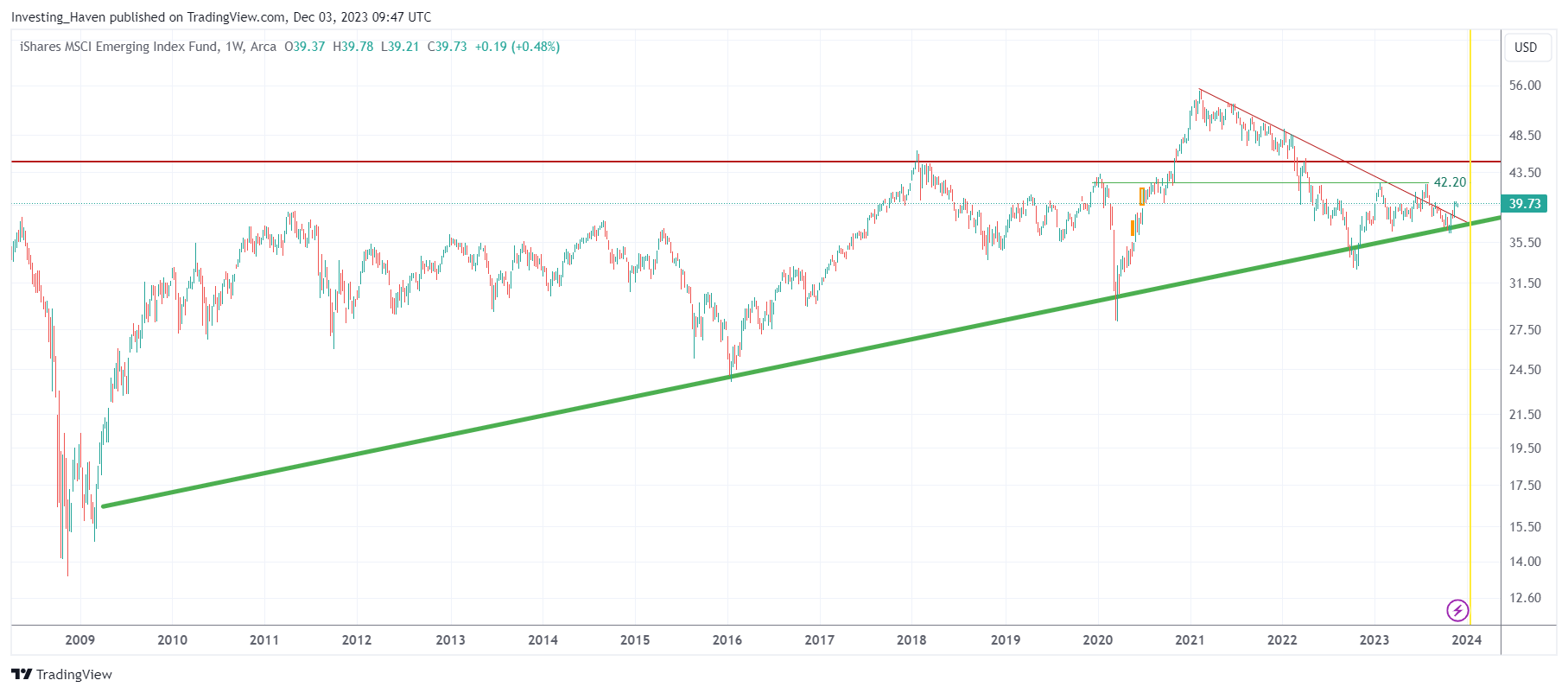

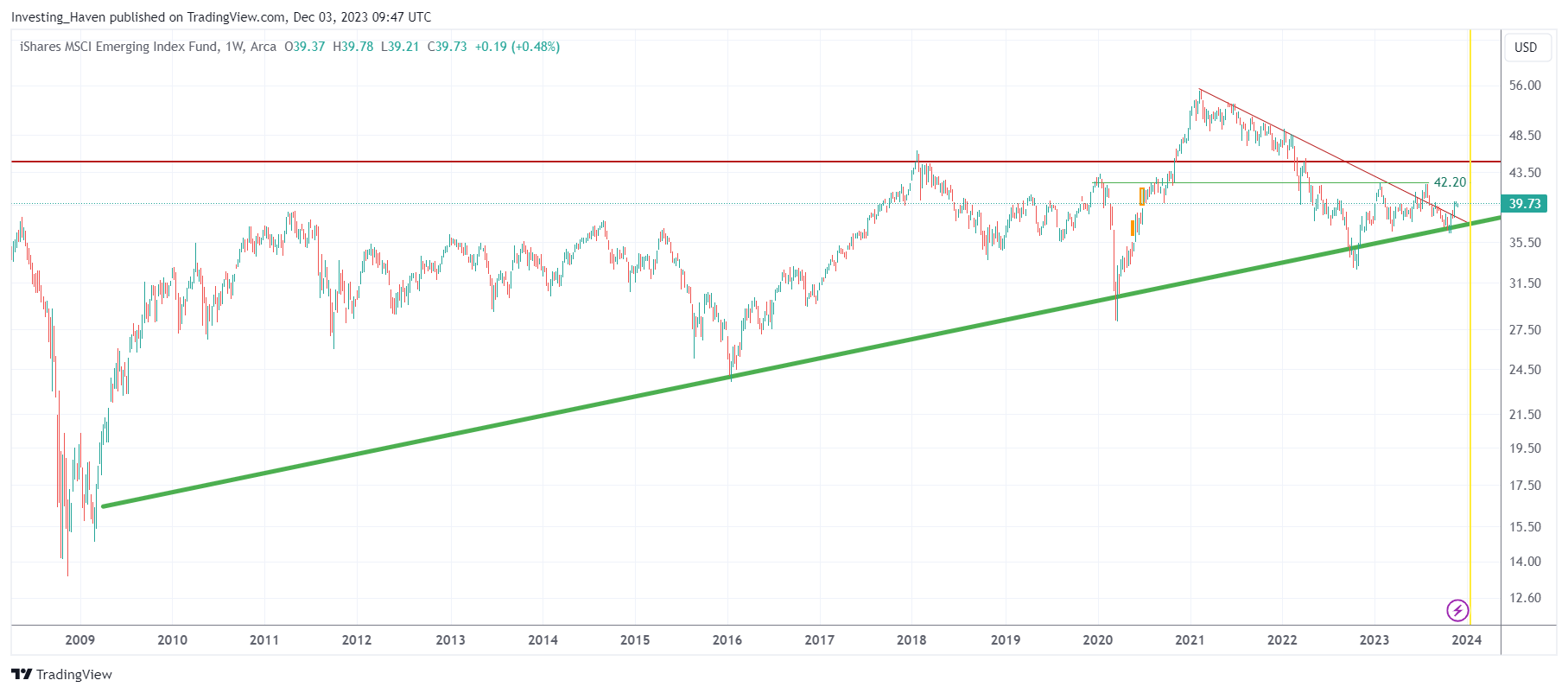

Emerging Market Stocks Outperform US Equities In 2024

Table of Contents

Stronger Growth Prospects in Emerging Economies

Many emerging economies are experiencing faster GDP growth than developed nations, driven by factors such as increasing urbanization, rising middle classes, and technological advancements. This robust growth directly translates into significant opportunities for investors in emerging market stocks.

Robust GDP Growth in Key Markets

- Examples of high-growth emerging markets: India, Indonesia, Vietnam, the Philippines, and several countries in Sub-Saharan Africa consistently show impressive GDP growth rates.

- Supporting details: While precise projections vary depending on the source, many reputable economic forecasts predict significantly higher GDP growth rates in these regions compared to the US for the foreseeable future. For example, the International Monetary Fund (IMF) often publishes detailed forecasts that highlight this disparity. This faster economic expansion fuels demand for goods and services, boosting the performance of companies listed on emerging markets exchanges.

- Keyword integration: The growth potential of emerging market stocks is intrinsically linked to the underlying economic expansion in these dynamic regions. This presents a compelling case for portfolio diversification towards these markets.

Valuation Advantages of Emerging Market Equities

Emerging market stocks often trade at lower Price-to-Earnings (P/E) ratios compared to their US counterparts. This valuation gap presents potentially higher value opportunities for investors willing to explore these markets.

Lower Price-to-Earnings Ratios

- Comparison of average P/E ratios: Historically, many emerging markets have exhibited significantly lower average P/E ratios than the US stock market. This means you might be able to buy a share of an emerging market company for a lower price relative to its earnings than a comparable US company.

- Supporting details: This valuation discrepancy can be attributed to several factors, including perceived higher risk, lower analyst coverage, and sometimes a lag in market recognition of growth potential. However, this can also create attractive entry points for long-term investors.

- Keyword integration: The emerging market stock valuation advantage is a crucial factor to consider when building a diversified investment portfolio. The potential for higher returns from these undervalued assets is significant.

Currency Fluctuations and Their Impact

While currency fluctuations introduce risk to emerging market stocks investments, the potential for appreciation in emerging market currencies can offset this and contribute to overall returns.

Navigating Currency Risk

- Discuss hedging strategies: Investors can mitigate currency risk through various hedging strategies, including using currency forwards or options contracts. Diversification across different emerging markets can also help to reduce the impact of currency fluctuations on the overall portfolio.

- Supporting details: Some emerging market currencies, especially those of rapidly growing economies, have shown a tendency for appreciation against the US dollar over the long term.

- Keyword integration: Understanding and managing currency risk is an essential part of successful emerging market stocks investment. However, the potential for currency appreciation shouldn't be overlooked.

Sector-Specific Opportunities in Emerging Markets

Certain sectors within emerging markets offer particularly attractive growth prospects, such as technology, infrastructure development, and consumer goods. This makes emerging market stocks in these sectors especially compelling.

Growth in Technology, Infrastructure, and Consumer Goods

- Examples of specific companies or sectors: The technology sector in India, the infrastructure boom in Southeast Asia, and the burgeoning consumer goods markets across Africa all present unique opportunities.

- Supporting details: Government initiatives, increasing investments in these sectors, and rapidly growing populations contribute to this impressive growth potential. Research specific companies within these sectors to identify potential high-growth opportunities.

- Keyword integration: Targeting specific sectors within emerging market stocks allows investors to capitalize on structural growth and potentially achieve higher returns.

Risks Associated with Investing in Emerging Markets

Emerging markets can be subject to greater political and economic volatility than developed markets. Understanding and managing these risks is crucial for any investor considering emerging market stocks.

Political and Economic Instability

- Examples of potential risks: Geopolitical instability, regulatory changes, currency devaluations, and economic slowdowns can all impact returns from emerging market stocks.

- Supporting details: Thorough due diligence, diversification across multiple markets and sectors, and a long-term investment horizon are key strategies for mitigating these risks.

- Keyword integration: While the rewards of emerging market stocks are significant, it's essential to acknowledge and manage the inherent risks associated with these investments.

Conclusion

The evidence suggests that emerging market stocks hold significant promise for outperformance in 2024, driven by robust growth, attractive valuations, and sector-specific opportunities. While risks exist, a well-diversified portfolio incorporating carefully selected emerging market equities can offer attractive returns. Don't miss out on the potential of emerging market stocks; conduct thorough research and consider consulting a financial advisor to make informed investment decisions. Start exploring the world of emerging market investment today.

Featured Posts

-

The Bold And The Beautiful April 16 A Recap Of Liam Hope And Bridgets Storylines

Apr 24, 2025

The Bold And The Beautiful April 16 A Recap Of Liam Hope And Bridgets Storylines

Apr 24, 2025 -

77 Inch Lg C3 Oled The Good The Bad And The Verdict

Apr 24, 2025

77 Inch Lg C3 Oled The Good The Bad And The Verdict

Apr 24, 2025 -

Hegseths Loyalty To Trump Navigating The Signal App Debate

Apr 24, 2025

Hegseths Loyalty To Trump Navigating The Signal App Debate

Apr 24, 2025 -

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025

O Thanatos Toy Tzin Xakman I Sygkinitiki Anartisi Toy Tzon Travolta

Apr 24, 2025 -

Impact Of Chinas Rare Earth Export Restrictions On Teslas Optimus Robot

Apr 24, 2025

Impact Of Chinas Rare Earth Export Restrictions On Teslas Optimus Robot

Apr 24, 2025