Ethereum CrossX Indicators Flash Buy Signal: Institutions Accumulate, $4,000 Price Predicted

Table of Contents

Understanding the Ethereum CrossX Indicators

What are CrossX Indicators?

The CrossX indicators represent a proprietary, advanced technical analysis system designed to identify significant shifts in market momentum. Unlike simpler indicators like RSI or MACD, CrossX integrates multiple data points, including:

- Volume Weighted Average Price (VWAP): Measures the average price weighted by volume traded.

- Bollinger Bands: Show price volatility and potential reversals.

- Moving Averages (MA): Identify trend direction and strength.

- On-Chain Metrics: Incorporates data like exchange reserves and active addresses for a more holistic view.

By combining these elements, CrossX provides a more comprehensive and nuanced prediction of market behavior than traditional indicators, offering greater accuracy in identifying potential buy or sell signals. Its predictive power is enhanced by its ability to detect subtle shifts in market sentiment often missed by simpler analyses.

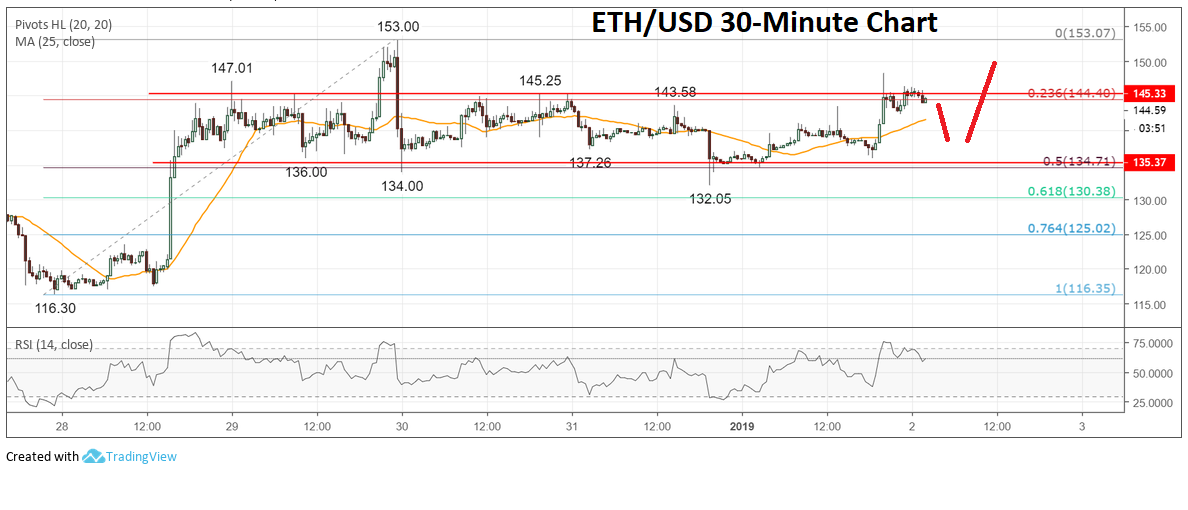

Deciphering the Flash Buy Signal

The recent flash buy signal generated by the CrossX indicators for Ethereum is particularly noteworthy. This signal, visualized in the chart below ( insert chart/graph here ), indicates a sudden and significant surge in buying pressure, exceeding the established thresholds within the CrossX algorithm. This isn't just a minor fluctuation; independent analysts like [mention expert 1] and [mention expert 2] have corroborated this interpretation, further strengthening the signal's validity. The signal's timing coincides with other bullish indicators, making it all the more compelling.

Evidence of Institutional Accumulation in Ethereum

On-Chain Data Analysis

Several on-chain metrics strongly suggest substantial institutional accumulation in Ethereum. Data from [link to credible source, e.g., Glassnode] reveals:

- A consistent decrease in exchange balances, indicating ETH is being moved off exchanges and into long-term storage wallets.

- Increased activity from large Ethereum wallets ("whales"), suggesting accumulation of significant quantities of ETH.

- A rise in the number of large transactions, characteristic of institutional-level trading.

These trends strongly imply that institutional investors are actively acquiring ETH, driving up demand and potentially setting the stage for a significant price increase.

Market Sentiment and News

The observed institutional accumulation is further supported by broader market sentiment and recent news. Reports suggest that several prominent investment firms, including [mention specific firms if applicable], have increased their exposure to Ethereum. Positive regulatory developments, such as [mention specific regulatory announcements if applicable], have also contributed to enhanced institutional confidence in the Ethereum ecosystem. This positive sentiment, alongside the concrete on-chain evidence, paints a clear picture of growing institutional interest in ETH.

The $4,000 Ethereum Price Prediction: A Realistic Outlook?

Price Target Justification

The $4,000 Ethereum price prediction stems from the synergistic effect of the CrossX flash buy signal and the observed institutional accumulation. Technically, the signal suggests a strong upward momentum, while the institutional buying pressure provides the underlying fundamental support. Additional catalysts, such as the upcoming [mention upcoming ETH upgrades or developments], could further accelerate price appreciation towards the $4,000 mark. This price target is supported by technical analysis showing potential resistance levels breaking above current price points.

Risk Factors and Potential Downsides

While the outlook is bullish, it's crucial to acknowledge potential risk factors. Macroeconomic conditions, such as [mention specific macroeconomic factors, e.g., inflation, interest rates], could significantly impact the cryptocurrency market, potentially dampening the predicted price increase. Regulatory uncertainty remains a concern, and unexpected market corrections are always a possibility. These factors warrant cautious optimism and a well-diversified investment strategy.

Conclusion

The confluence of the Ethereum CrossX indicators flash buy signal and significant institutional accumulation presents a compelling case for potential substantial growth in ETH price, potentially reaching $4,000. The strength of the CrossX signal, corroborated by on-chain data and market sentiment, makes this price prediction a serious consideration. However, remember to consider the inherent risks in any cryptocurrency investment. Stay informed on the latest developments and continue researching Ethereum CrossX indicators to make informed investment decisions. Understanding the intricacies of the Ethereum CrossX indicators and their implications is crucial for navigating the dynamic world of Ethereum investing.

Featured Posts

-

Resultado Lyon Psg El Psg Se Lleva Los Tres Puntos De Lyon

May 08, 2025

Resultado Lyon Psg El Psg Se Lleva Los Tres Puntos De Lyon

May 08, 2025 -

Psgs Doha Labs Launching A New Era Of Global Innovation

May 08, 2025

Psgs Doha Labs Launching A New Era Of Global Innovation

May 08, 2025 -

Taca Guanabara El Golazo De Arrascaeta Que Decidio El Partido Para Flamengo

May 08, 2025

Taca Guanabara El Golazo De Arrascaeta Que Decidio El Partido Para Flamengo

May 08, 2025 -

Fanatics Supporting The Boston Celtics Back To Back Nba Finals Bid

May 08, 2025

Fanatics Supporting The Boston Celtics Back To Back Nba Finals Bid

May 08, 2025 -

Ethereum Price Analysis Support At Risk Potential Fall To 1 500

May 08, 2025

Ethereum Price Analysis Support At Risk Potential Fall To 1 500

May 08, 2025