Ethereum Liquidations Surge To $67M: More Selloff Imminent?

Table of Contents

Understanding the Surge in Ethereum Liquidations

Ethereum liquidations occur when a trader's margin account falls below the required collateral level, forcing the liquidation of their position to cover losses. This typically happens in margin trading, where traders borrow funds to amplify their potential returns (and losses). Leveraged trading on decentralized finance (DeFi) platforms, particularly those involving ETH, is a significant contributor to these events. Key terms to understand include:

- Margin Trading: Borrowing funds to increase trading positions, magnifying both profits and losses.

- Liquidation Price: The price at which a trader's position is automatically closed due to insufficient collateral.

- Collateral: The assets pledged by a trader to secure a margin loan.

Several factors contributed to the recent surge in Ethereum liquidations:

- Market Downturn: A broader cryptocurrency market downturn often triggers widespread margin calls and liquidations as prices fall below critical support levels.

- Specific Events: Negative news impacting ETH, such as regulatory announcements or significant security breaches on DeFi platforms, can lead to panic selling and liquidations.

- Changes in DeFi Lending Protocols: Modifications to lending parameters or interest rates on DeFi platforms can also influence the frequency of margin calls and liquidations.

Data supporting this surge comes from reputable analytics platforms like Glassnode and CoinGlass, offering reliable insights into market trends and liquidation events. While past liquidation events have occurred, the scale of the recent $67 million surge surpasses many previously observed events, signaling a potentially more significant market correction.

Analyzing the Impact on the Ethereum Price

The correlation between the surge in Ethereum liquidations and the subsequent drop in ETH price is undeniable. Liquidations often exacerbate downward price pressure, creating a feedback loop where falling prices trigger more margin calls, leading to further sell-offs. This isn't simply about the direct financial impact; the psychological impact is significant. Large-scale liquidations can trigger fear and uncertainty among investors, leading to a broader market sell-off.

- Short-term vs. Long-term Implications: The short-term impact is usually a sharp price decrease. Long-term effects are harder to predict and depend on broader market conditions and the overall adoption of Ethereum.

- Technical Analysis Indicators: Support and resistance levels, moving averages, and relative strength index (RSI) are crucial indicators to watch for potential future price movements following the liquidations.

- Potential Price Scenarios: Following the liquidations, the ETH price could stabilize, experience a further drop, or potentially bounce back depending on various market forces.

Assessing the Risk of Further Selloff

Several factors could contribute to a further sell-off in the Ethereum market:

- Macroeconomic Factors: Global economic uncertainty and interest rate hikes often negatively impact riskier assets like cryptocurrencies, increasing the likelihood of further liquidations.

- Regulatory Uncertainty: Regulatory changes and unclear legal frameworks surrounding cryptocurrencies can erode investor confidence, potentially leading to more selling pressure.

- Cascading Liquidations: A significant drop in ETH could trigger cascading liquidations across other DeFi protocols using ETH as collateral, amplifying the sell-off.

Identifying Potential Safeguards and Mitigation Strategies

Mitigating the risk associated with potential further Ethereum liquidations requires careful risk management and responsible trading practices.

- Reduce Exposure to Leveraged Trading: Avoid excessive leverage, understanding that it significantly amplifies both potential profits and losses.

- Understand DeFi Risks: Thoroughly research and understand the risks involved before participating in DeFi lending and borrowing protocols.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying investments across various assets can help reduce exposure to the volatility of a single cryptocurrency.

Conclusion

The recent surge in Ethereum liquidations, reaching $67 million, highlights the significant volatility within the cryptocurrency market. The correlation between these liquidations and the ETH price drop is evident, raising concerns about the potential for a further sell-off. While the future is uncertain, understanding the factors influencing Ethereum liquidations and employing sound risk management strategies is crucial. Monitor Ethereum liquidations closely, track the ETH price, and stay updated on crypto market news to make informed investment decisions. Return to this site for future updates on Ethereum liquidations and the evolving landscape of the crypto market.

Featured Posts

-

Partly Cloudy Skies Your Guide To Todays Weather

May 08, 2025

Partly Cloudy Skies Your Guide To Todays Weather

May 08, 2025 -

Dwp To Issue Universal Credit Refunds Following 5 Billion Cuts

May 08, 2025

Dwp To Issue Universal Credit Refunds Following 5 Billion Cuts

May 08, 2025 -

Jayson Tatum Takes A Hilarious Hit From Tnt Announcers In Abc Promo

May 08, 2025

Jayson Tatum Takes A Hilarious Hit From Tnt Announcers In Abc Promo

May 08, 2025 -

Ahtsab Edaltwn Ka Khatmh Wfaqy Hkwmt Ka Lahwr Myn Fyslh

May 08, 2025

Ahtsab Edaltwn Ka Khatmh Wfaqy Hkwmt Ka Lahwr Myn Fyslh

May 08, 2025 -

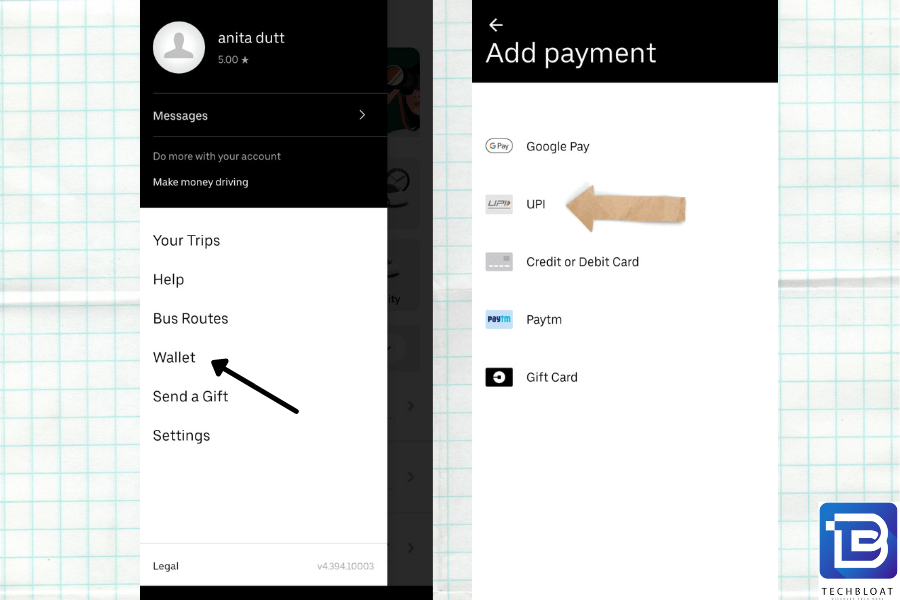

Digital Payments On Uber Auto The Latest On Upi And Other Options

May 08, 2025

Digital Payments On Uber Auto The Latest On Upi And Other Options

May 08, 2025