Ethereum Market Crash? Recent $67M Liquidation Raises Concerns

Table of Contents

Understanding the $67M Liquidation Event

What is Liquidation in Crypto?

Liquidation in the context of decentralized finance (DeFi) and margin trading occurs when a trader's position falls below a certain threshold, forcing the exchange or lending platform to sell their assets to cover their debt. This usually happens when traders leverage their positions, borrowing funds to amplify their potential gains. If the market moves against them, their losses can exceed their initial investment, triggering a liquidation. This process can have a cascading effect, impacting market prices and other traders.

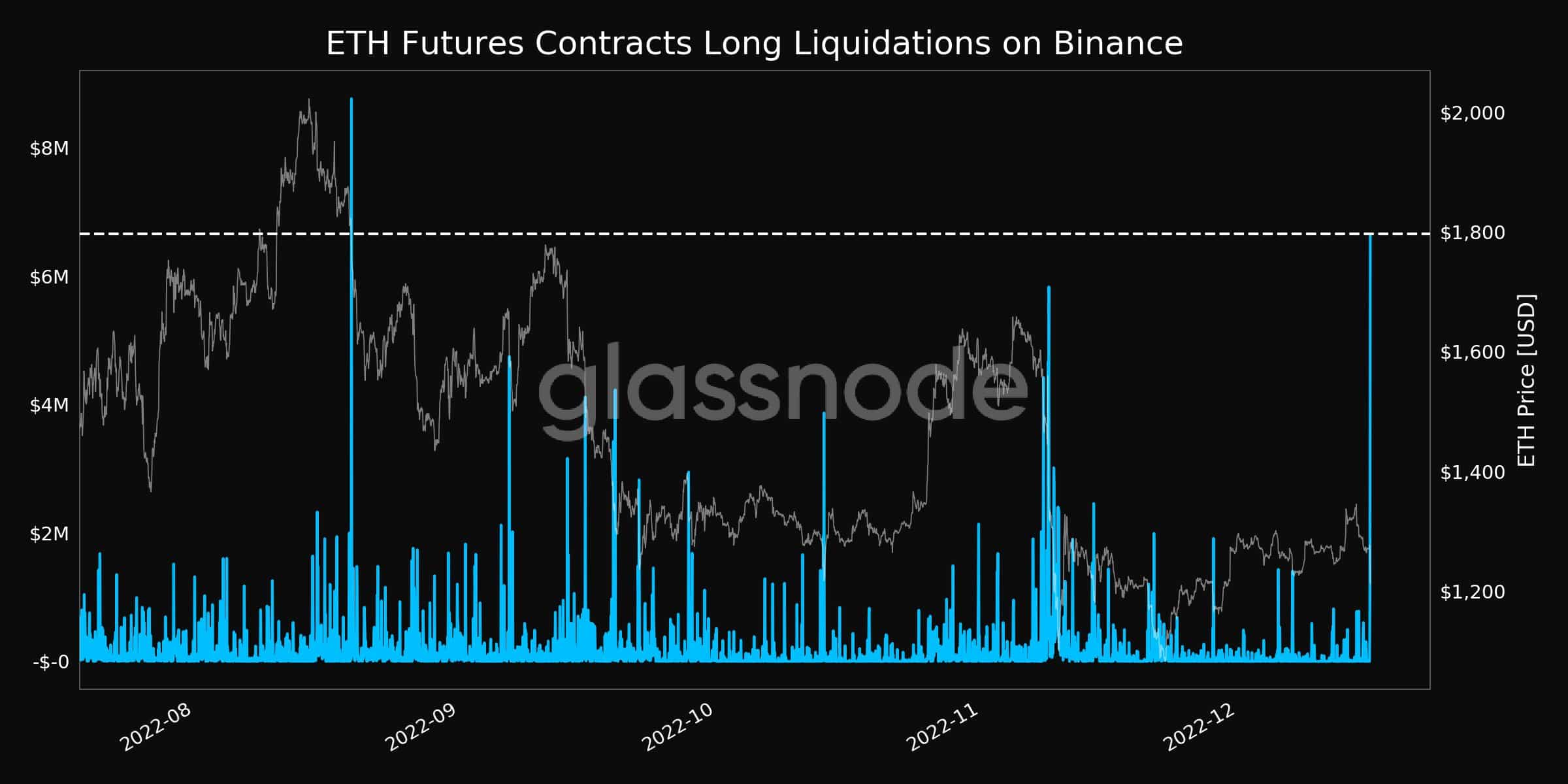

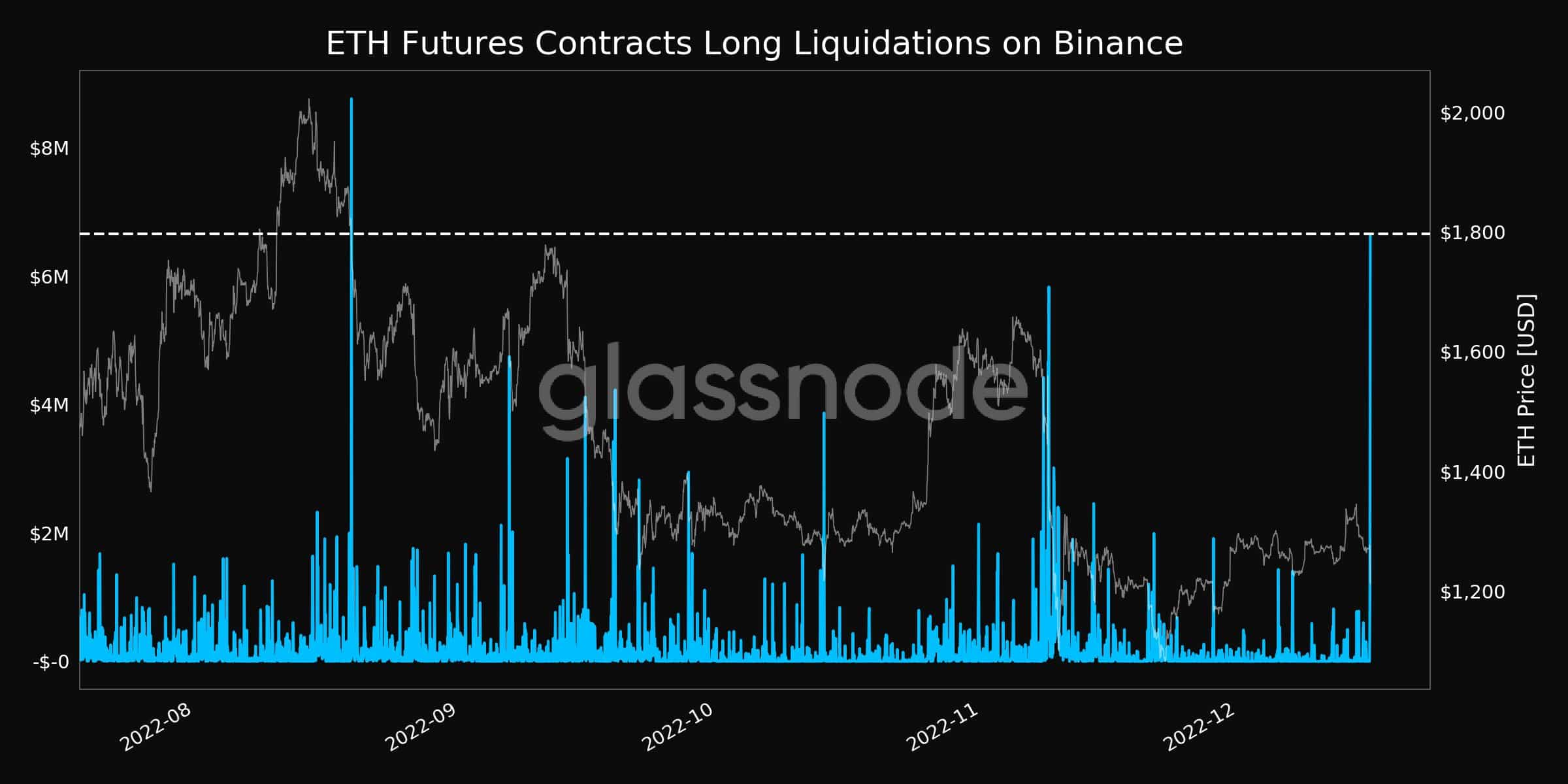

Details of the Recent $67M ETH Liquidation

The recent $67 million Ethereum liquidation, occurring on [insert date and time of event], involved multiple DeFi platforms and primarily affected traders with leveraged long positions in ETH. The exact platforms involved are still being investigated, but initial reports suggest [mention specific platforms if known]. This substantial liquidation impacted the price of Ethereum, causing a temporary [percentage] drop. The event highlights the interconnectedness of the DeFi ecosystem and the potential for ripple effects across different platforms.

- The liquidated positions were largely leveraged long positions, indicating traders betting on a price increase of Ethereum.

- The price of Ethereum experienced a temporary dip of approximately [percentage]% following the liquidation event.

- The event triggered a period of increased volatility and uncertainty within the broader DeFi ecosystem.

Analyzing the Potential for an Ethereum Market Crash

Market Sentiment and Fear

Current market sentiment surrounding Ethereum and the broader crypto market is characterized by a mix of fear, uncertainty, and doubt (FUD). News articles are highlighting the potential risks, social media discussions are amplifying concerns, and expert opinions are divided on the future trajectory of ETH's price. This negative sentiment can exacerbate price drops and contribute to a self-fulfilling prophecy.

Macroeconomic Factors

Several macroeconomic factors are contributing to the volatility of the Ethereum market. High inflation rates, rising interest rates, and ongoing geopolitical instability are creating a challenging environment for risk assets, including cryptocurrencies. These factors can negatively impact investor confidence and lead to sell-offs.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions. Governments worldwide are grappling with how to regulate decentralized technologies, and this uncertainty can create volatility in the market. Any significant regulatory crackdown could trigger a sell-off and potentially contribute to an Ethereum market crash.

- Further large-scale liquidations, similar to the recent $67 million event, could trigger a cascade of selling pressure.

- A major security breach affecting a major DeFi platform could shake investor confidence and lead to a market downturn.

- A sudden and unexpected regulatory crackdown on cryptocurrencies could severely impact prices and investor sentiment.

- Historical data suggests that previous significant liquidations have been followed by periods of increased volatility and price corrections. Comparisons to those events should be made cautiously, as market conditions are constantly evolving.

- Various price prediction models exist, some predicting continued growth while others forecast further declines; investors should interpret these predictions with caution.

Mitigating Risks in the Ethereum Market

Diversification and Risk Management

To mitigate the risks associated with investing in Ethereum, diversification is crucial. Don't put all your eggs in one basket. Spreading your investments across various cryptocurrencies and asset classes reduces your exposure to the volatility of any single asset. Robust risk management strategies, such as setting stop-loss orders and avoiding excessive leverage, are essential to protect your capital.

Understanding Your Risk Tolerance

Before investing in any cryptocurrency, assess your risk tolerance. Ethereum, like other cryptocurrencies, is a highly volatile asset. Only invest what you can afford to lose. Avoid making emotional investment decisions driven by fear or greed.

- Implement stop-loss orders to automatically sell your Ethereum if the price falls below a predetermined level.

- Avoid using excessive leverage in margin trading, as it significantly amplifies both profits and losses.

- Diversify your crypto portfolio by investing in a range of different cryptocurrencies with varying market caps and use cases.

- Consider allocating a portion of your investment portfolio to less volatile assets such as stocks, bonds, or real estate.

- Thoroughly research any DeFi project before participating, understanding the risks involved and the potential for smart contract vulnerabilities.

Conclusion

The recent $67 million Ethereum liquidation serves as a stark reminder of the volatility inherent in the cryptocurrency market. While the potential for an Ethereum market crash cannot be ruled out, understanding market dynamics, implementing effective risk management strategies, and staying informed are crucial for navigating this environment. By diversifying your investments, understanding your risk tolerance, and conducting thorough research, you can better mitigate Ethereum market risks and avoid an Ethereum market crash. Stay informed on Ethereum price movements and analyze market trends to make well-informed investment decisions. Remember, thorough research and careful planning are paramount in the dynamic world of Ethereum market analysis.

Featured Posts

-

Krypto The Last Dog Of Krypton Is It Worth Watching

May 08, 2025

Krypto The Last Dog Of Krypton Is It Worth Watching

May 08, 2025 -

Stephen Kings The Long Walk Movie Cinema Con Reveals Release Date

May 08, 2025

Stephen Kings The Long Walk Movie Cinema Con Reveals Release Date

May 08, 2025 -

April May Universal Credit Refunds Dwp Addresses 5 Billion In Cuts

May 08, 2025

April May Universal Credit Refunds Dwp Addresses 5 Billion In Cuts

May 08, 2025 -

The Long Road Back To Yavin 4 Insights From A George Lucas Protege

May 08, 2025

The Long Road Back To Yavin 4 Insights From A George Lucas Protege

May 08, 2025 -

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025