Ethereum Price Forecast: Comprehensive Analysis Of Market Trends And Predictions

Table of Contents

Current Market Conditions and Ethereum's Position

Analyzing Recent Price Fluctuations

The Ethereum price has experienced significant volatility in recent months. While it reached highs of [Insert recent high and date], it has also seen considerable dips, reaching lows of [Insert recent low and date]. These fluctuations are largely attributable to several key events:

- The Shanghai Upgrade: This significant network upgrade, allowing for the withdrawal of staked ETH, initially caused some price uncertainty but ultimately had a positive long-term impact on ETH price.

- Regulatory Uncertainty: Ongoing regulatory discussions and actions globally have created periods of both optimism and pessimism impacting the overall crypto market, including Ethereum.

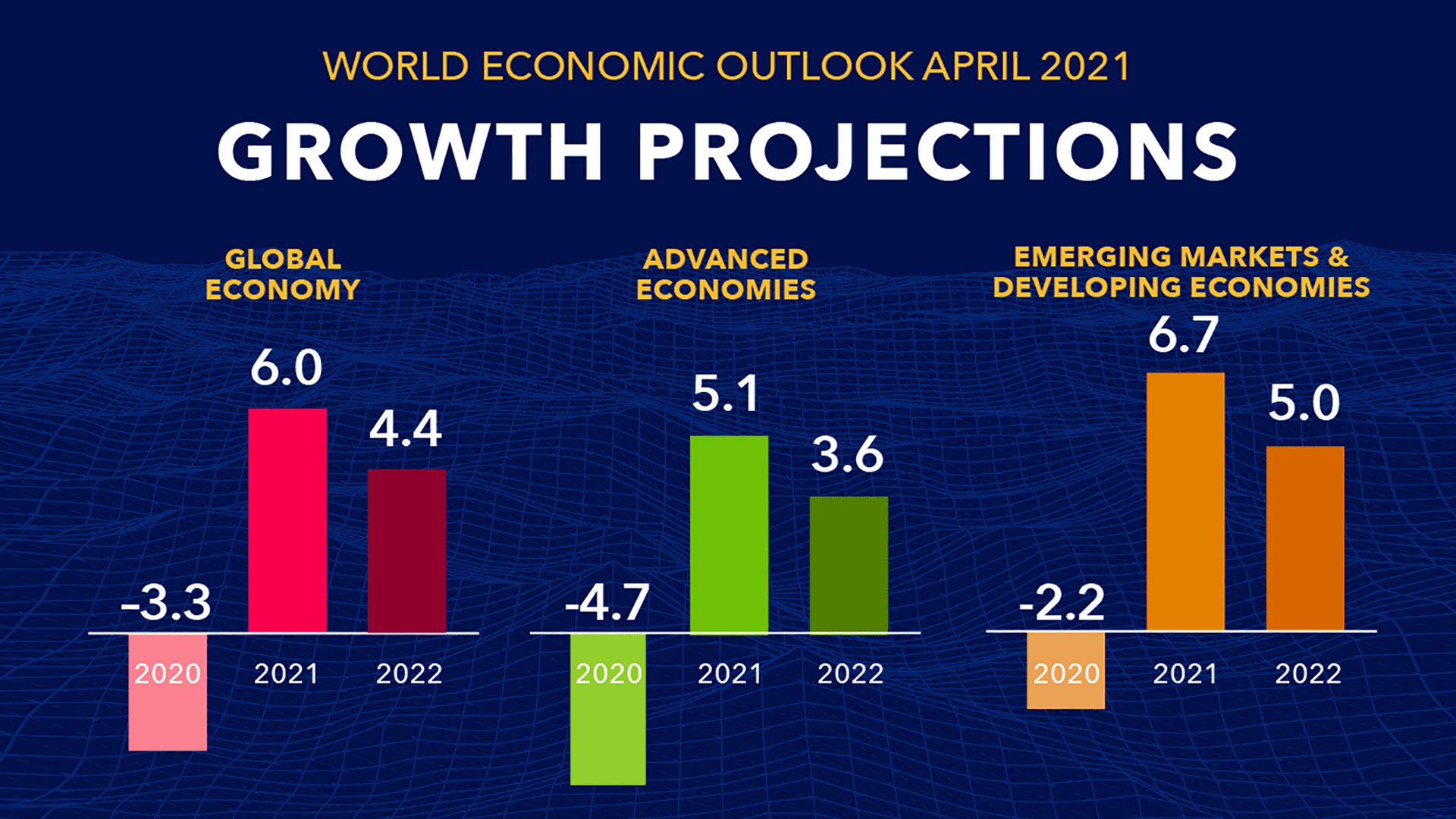

- Macroeconomic Factors: Broader economic conditions, such as inflation and interest rate hikes, have influenced investor sentiment and risk appetite, affecting the ETH price.

[Insert relevant chart/graph showing ETH price fluctuations over the past few months]

Assessing Market Sentiment and Investor Confidence

Current market sentiment towards Ethereum is mixed. Social media analysis reveals a combination of bullish and bearish opinions. Trading volume data suggests periods of both high enthusiasm and apprehension.

- Positive Indicators: The success of the Shanghai upgrade, along with continued development and adoption of Ethereum-based decentralized applications (dApps), are boosting confidence for some investors.

- Negative Indicators: Regulatory uncertainty and macroeconomic headwinds are tempering enthusiasm for others.

The actions of large institutional investors and "whales" continue to exert a significant influence on the ETH price. Their buying and selling activities can trigger substantial price swings.

Key Factors Influencing Ethereum's Future Price

Technological Advancements and Development

Ethereum's ongoing development is a critical factor in its price forecast. Upcoming upgrades and scaling solutions are designed to enhance its functionality and efficiency.

- Layer-2 Scaling Solutions: Solutions like Optimism, Arbitrum, and Polygon aim to significantly improve transaction speed and reduce gas fees, increasing Ethereum's usability and attracting more users.

- Sharding: The implementation of sharding will further enhance scalability, enabling Ethereum to process a vastly larger number of transactions per second.

- The Ethereum Virtual Machine (EVM): The EVM's versatility and the vast developer community building upon it are key strengths that underpin ETH's long-term potential.

These technological advancements are expected to drive increased adoption and potentially boost the ETH price.

Regulatory Landscape and Governmental Policies

The regulatory landscape surrounding cryptocurrencies, particularly Ethereum, plays a significant role in its price prediction.

- Varying Regulatory Approaches: Different countries have adopted vastly different approaches to regulating cryptocurrencies, ranging from outright bans to more permissive frameworks.

- Regulatory Clarity (or Lack Thereof): Increased regulatory clarity could provide stability and potentially attract more institutional investment, while uncertainty could lead to price volatility.

Competition from Other Cryptocurrencies

Ethereum faces competition from other blockchain platforms, including Solana, Cardano, and Avalanche.

- Competitor Strengths and Weaknesses: While competitors often offer faster transaction speeds or lower fees, Ethereum maintains a significant advantage in terms of its established ecosystem, developer community, and network security.

- Market Share Dynamics: The competition is fierce, and shifts in market share could impact Ethereum's price.

The ability of Ethereum to maintain its dominance in the decentralized finance (DeFi) and non-fungible token (NFT) spaces will be key in determining its future price.

Macroeconomic Factors and Global Events

Broader macroeconomic trends significantly impact the cryptocurrency market and, consequently, the ETH price.

- Inflation and Interest Rates: High inflation and rising interest rates can reduce investor risk appetite, leading to capital flight from riskier assets like cryptocurrencies.

- Recessionary Fears: Economic downturns can negatively impact investor sentiment and reduce demand for cryptocurrencies.

The correlation between traditional markets and the cryptocurrency market is complex and not always straightforward, but macroeconomic factors undoubtedly play a role.

Ethereum Price Prediction Scenarios

Bullish Scenario

A bullish scenario for Ethereum hinges on several optimistic assumptions:

- Widespread Adoption: Increased mainstream adoption of Ethereum-based applications and services.

- Successful Network Upgrades: Successful implementation of planned upgrades leading to enhanced scalability and efficiency.

- Positive Regulatory Developments: Favorable regulatory frameworks that foster growth and innovation in the crypto sector.

In this scenario, the ETH price could reach [Insert price target] by [Insert timeframe].

Bearish Scenario

A bearish scenario incorporates less optimistic assumptions:

- Increased Regulatory Scrutiny: Stringent regulatory measures that stifle innovation and adoption.

- Intense Competition: Strong competition from other blockchain platforms leading to a loss of market share.

- Prolonged Macroeconomic Downturn: A prolonged economic downturn reducing investor risk appetite.

In a bearish scenario, the ETH price could fall to [Insert price target] by [Insert timeframe].

Most Likely Scenario

Considering both bullish and bearish factors, the most likely scenario is a moderate price increase for ETH. This assumes continued innovation and development, alongside a period of regulatory uncertainty that eventually resolves itself.

- Gradual Growth: A gradual increase in ETH price driven by ongoing development and adoption, but tempered by macroeconomic headwinds.

We anticipate a price range of [Insert price target range] within the next [Insert timeframe]. It's crucial to remember that cryptocurrency price predictions are inherently uncertain, and this forecast should be considered just one perspective among many.

Conclusion

Several key factors influence Ethereum's price, including technological advancements, regulatory developments, competition, and macroeconomic conditions. While bullish scenarios envision significant price increases, bearish scenarios highlight potential risks. Our most likely scenario suggests moderate growth, but the inherent volatility of the cryptocurrency market must be acknowledged. While this Ethereum price forecast offers valuable insights, remember that cryptocurrency investments are inherently risky. Conduct thorough research and consider your risk tolerance before investing in Ethereum or any other cryptocurrency. Stay informed about the latest Ethereum price predictions and market trends to make well-informed investment decisions. Continue your research on the Ethereum price forecast and stay updated on the latest market developments.

Featured Posts

-

Grbovic O Prelaznoj Vladi Svi Predlozi Su Na Stolu

May 08, 2025

Grbovic O Prelaznoj Vladi Svi Predlozi Su Na Stolu

May 08, 2025 -

Us Presidents Post On Trump And Ripple Sends Xrp Soaring

May 08, 2025

Us Presidents Post On Trump And Ripple Sends Xrp Soaring

May 08, 2025 -

Lahwr Ky Ahtsab Edaltwn Myn 5 Ky Tedad Myn Kmy

May 08, 2025

Lahwr Ky Ahtsab Edaltwn Myn 5 Ky Tedad Myn Kmy

May 08, 2025 -

The Life Of Chuck Movie Trailer Stephen King Weighs In

May 08, 2025

The Life Of Chuck Movie Trailer Stephen King Weighs In

May 08, 2025 -

Soulja Boys Sexual Assault Lawsuit Jury Awards Over 6 Million

May 08, 2025

Soulja Boys Sexual Assault Lawsuit Jury Awards Over 6 Million

May 08, 2025