Ethereum Price Prediction: $2,700 Target As Wyckoff Accumulation Concludes?

Table of Contents

Understanding the Wyckoff Accumulation Phase in Ethereum

The Wyckoff Accumulation method is a technical analysis technique used to identify periods of significant price consolidation before a potential price breakout. Understanding its phases is crucial for accurate Ethereum price prediction.

Identifying Key Characteristics of Wyckoff Accumulation:

Wyckoff Accumulation typically unfolds in four stages:

- Spring: A small, deceptive price drop designed to shake out weak holders, often accompanied by increased trading volume.

- Markup: A gradual price increase, testing resistance levels, with increasing volume signaling buying pressure.

- Secondary Test: A brief retest of the prior support level, confirming the strength of the accumulation. Lower volume than the markup phase confirms buying confidence.

- Sign of Strength (SOS): A significant price increase on strong volume, breaking through resistance and confirming the end of accumulation.

(Insert chart/graph here illustrating these stages in Ethereum's historical price action) Using Ethereum chart analysis, we can identify these stages through careful examination of price action, trading volume, and support/resistance levels. Successful Wyckoff accumulation patterns often lead to substantial price increases.

Applying Wyckoff to Ethereum's Current Market Conditions:

Analyzing recent Ethereum price action, we see signs that could align with the Wyckoff Accumulation model. (Insert current data: price, volume, market sentiment). Observing support and resistance levels on Ethereum charts helps pinpoint potential turning points. For example, the $X level appears to be a strong support, while the $Y level may act as immediate resistance. This analysis considers on-chain data and bullish signals.

Potential Challenges and Risks:

While the Wyckoff method offers valuable insights, it's not foolproof. Several factors could invalidate the prediction:

- Unexpected regulatory changes: Government regulations can significantly impact cryptocurrency prices, potentially disrupting the accumulation phase.

- Market crashes: A broader cryptocurrency market crash could easily negate any bullish signals, causing a significant drop in Ethereum's price.

- Bearish sentiment shifts: A sudden shift in market sentiment could lead to a prolonged period of price consolidation or even a decline.

Factors Supporting the $2,700 Ethereum Price Prediction

Several fundamental factors support the potential for Ethereum to reach the $2,700 target.

Increasing Ethereum Network Adoption:

Ethereum's expanding ecosystem is a significant bullish signal:

- DeFi growth: The decentralized finance (DeFi) sector built on Ethereum continues to expand rapidly, increasing demand for ETH.

- NFT boom: The popularity of Non-Fungible Tokens (NFTs) further fuels the Ethereum network, driving up transaction volume and usage.

- High TVL: The total value locked (TVL) in DeFi protocols on Ethereum remains substantial, indicating strong investor confidence. These metrics are key indicators of network health and future potential.

The Ethereum Merge and its Long-Term Implications:

The successful transition to a Proof-of-Stake (PoS) consensus mechanism dramatically improved Ethereum's efficiency and scalability:

- Reduced energy consumption: The Merge significantly lowered Ethereum's energy footprint, addressing previous environmental concerns.

- Enhanced scalability: Improved scalability means faster and cheaper transactions, boosting network usability.

- Increased demand: These positive developments are likely to attract new users and investors, increasing demand for ETH.

Institutional Investment in Ethereum:

Institutional investors are increasingly allocating capital to Ethereum, indicating growing confidence in its long-term prospects:

- Major fund investments: Large-cap investment funds are actively acquiring significant amounts of ETH, driving up market capitalization.

- Portfolio diversification: Many institutions view Ethereum as a key asset for portfolio diversification within their crypto holdings.

- Long-term strategic allocation: These strategic investments reflect a belief in Ethereum's long-term value and potential for growth.

Potential Risks and Challenges to the Prediction

Despite the positive indicators, several challenges could hinder Ethereum's price appreciation.

Macroeconomic Factors and Market Volatility:

Global economic conditions significantly impact the cryptocurrency market:

- Inflationary pressures: High inflation can negatively impact investor sentiment and potentially cause a market correction.

- Recessionary fears: Concerns about a potential recession could lead investors to liquidate their crypto holdings.

- Geopolitical instability: Geopolitical events can trigger market volatility and negatively affect risk assets like cryptocurrencies.

Competition from Other Cryptocurrencies:

Ethereum faces competition from other blockchain platforms:

- Layer-1 competitors: Rival Layer-1 blockchains are vying for market share, offering potentially faster and cheaper transactions.

- Altcoin dominance: The rise of other cryptocurrencies (altcoins) could divert investment away from Ethereum.

Conclusion: Ethereum Price Prediction – A Cautious Optimism

Based on the Wyckoff Accumulation theory and the factors discussed above, a $2,700 Ethereum price target appears plausible. However, it's crucial to acknowledge the inherent risks associated with cryptocurrency investments. Macroeconomic factors, regulatory uncertainty, and competition could significantly impact the price. Conduct thorough research, manage your risk effectively, and diversify your portfolio. Stay informed on the latest developments in the Ethereum market and continue to monitor our Ethereum price predictions for updates. Further research into Ethereum price prediction and Wyckoff analysis is strongly recommended before making any investment decisions.

Featured Posts

-

Nathan Fillions Brief But Powerful Role In Saving Private Ryan

May 08, 2025

Nathan Fillions Brief But Powerful Role In Saving Private Ryan

May 08, 2025 -

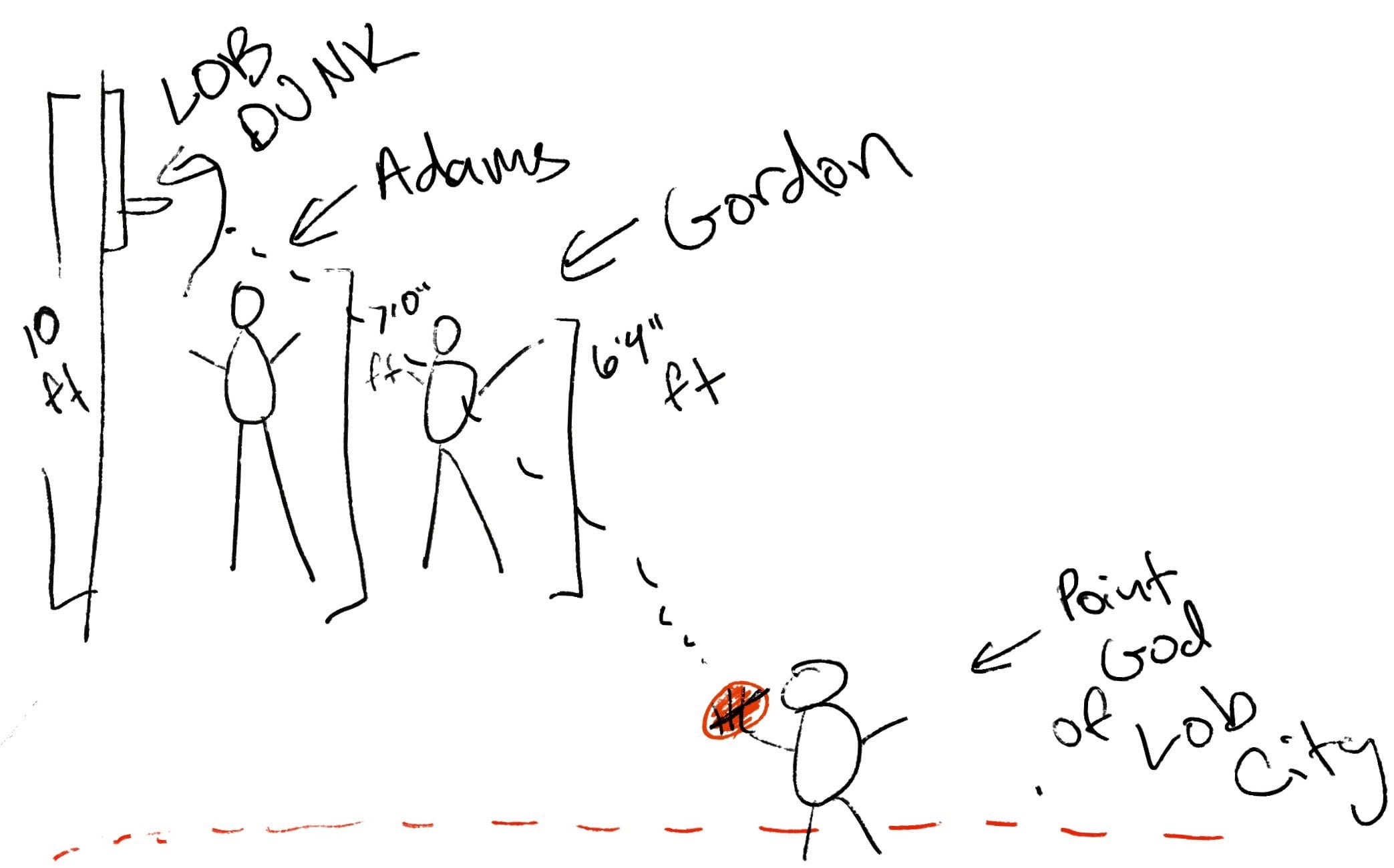

De Andre Jordan Makes Nba History In Nuggets Bulls Matchup

May 08, 2025

De Andre Jordan Makes Nba History In Nuggets Bulls Matchup

May 08, 2025 -

Thunder Players Respond To National Media Criticism

May 08, 2025

Thunder Players Respond To National Media Criticism

May 08, 2025 -

Vesprem Go Sobori Ps Zh Desetta Poredna Pobeda Vo Ligata Na Shampionite

May 08, 2025

Vesprem Go Sobori Ps Zh Desetta Poredna Pobeda Vo Ligata Na Shampionite

May 08, 2025 -

Angels And Dodgers Battle Through Shortstop Shortages

May 08, 2025

Angels And Dodgers Battle Through Shortstop Shortages

May 08, 2025