Ethereum Price Strength: Bulls In Control, Upside Potential

Table of Contents

Technical Analysis Showing Strength

Technical analysis provides compelling evidence supporting the current Ethereum price strength. Several key indicators point towards further gains, painting a bullish picture for the near future.

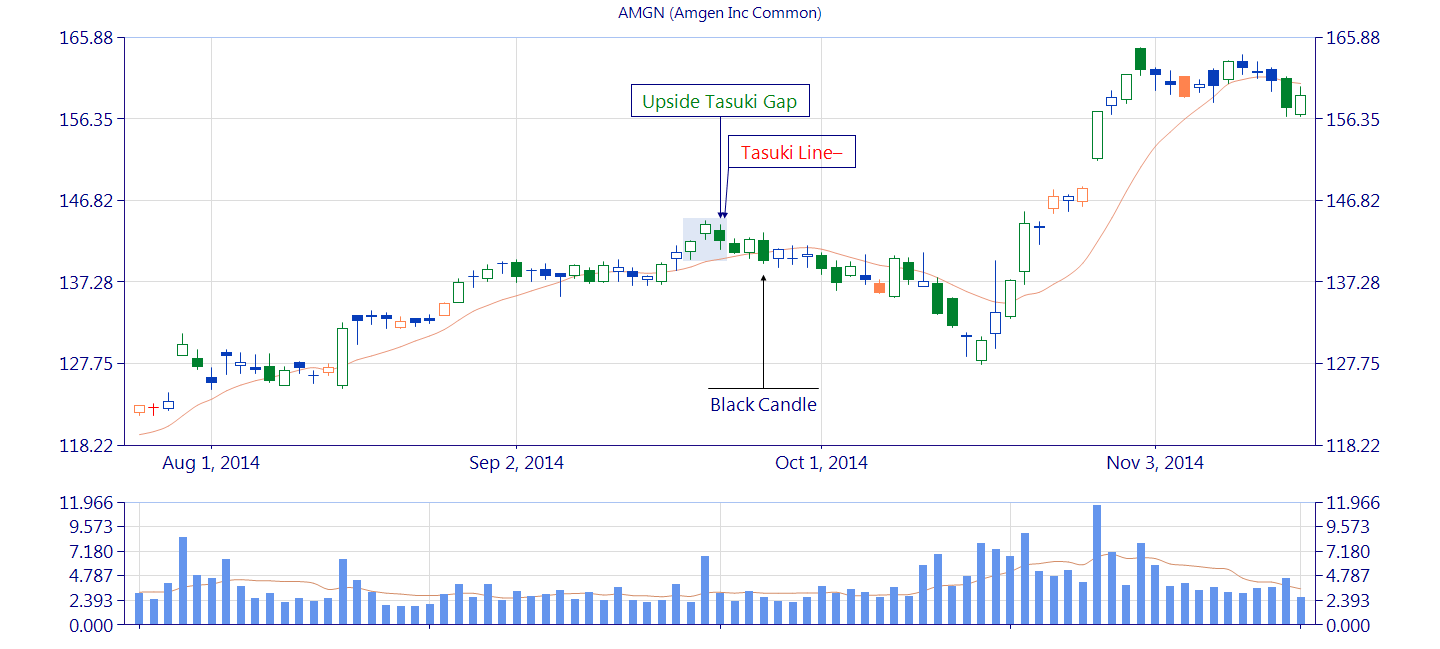

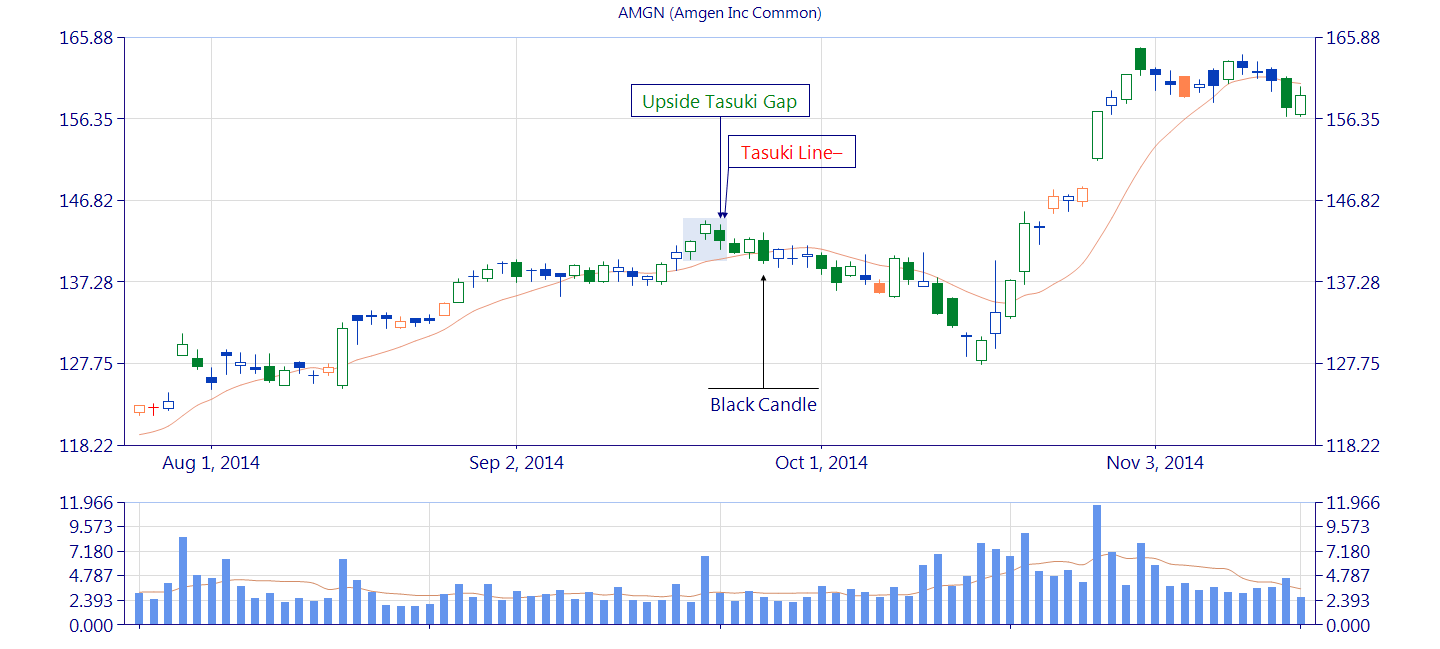

Chart Patterns Suggesting Further Gains

Ethereum price charts are displaying classic bullish patterns that suggest continued upward momentum. These patterns, when interpreted correctly, offer valuable insights into potential price movements.

- Head and Shoulders Reversal: Recent price action has shown a potential head and shoulders reversal pattern, a strong bullish signal indicating a shift from a bearish to a bullish trend. This is often followed by a significant price increase.

- Bullish Flags: The formation of bullish flags on various timeframes (daily, weekly) suggests a temporary pause in the upward trend before a renewed surge. These flags represent periods of consolidation before a breakout.

- Support and Resistance Levels: Ethereum has consistently bounced off key support levels, demonstrating buying pressure and indicating that the price is likely to hold above these crucial points. Conversely, resistance levels have been consistently broken, indicating strength.

- Moving Average Crossovers: The 50-day moving average crossing above the 200-day moving average (a "golden cross") is a classic bullish signal that suggests a long-term upward trend. This has been observed recently on Ethereum price charts.

Positive Indicators from Key Metrics

Beyond chart patterns, key technical indicators further corroborate the bullish sentiment surrounding Ethereum.

- Ethereum RSI: The Relative Strength Index (RSI) is currently above 50, indicating bullish momentum. Readings above 70 suggest overbought conditions, while readings below 30 indicate oversold conditions. The current RSI level suggests further upside potential before reaching overbought territory.

- Ethereum MACD: The Moving Average Convergence Divergence (MACD) is showing a clear bullish signal with the MACD line crossing above the signal line, indicating a strengthening upward trend. This is reinforced by a positive histogram.

- Ethereum Bollinger Bands: The price of Ethereum is currently trading near the upper band of the Bollinger Bands, suggesting strong upward momentum. However, it is important to note that a break above the upper band could potentially indicate an overbought situation.

Fundamental Factors Supporting the Bullish Trend

The current Ethereum price strength is not just a technical phenomenon; underlying fundamental factors are also driving the bullish trend.

Growing Ethereum Ecosystem and DeFi Adoption

The Ethereum ecosystem is expanding rapidly, fuelled by the burgeoning decentralized finance (DeFi) sector. This growth is underpinning the increasing demand for ETH.

- DeFi Growth Statistics: The total value locked (TVL) in Ethereum-based DeFi protocols has reached record highs, demonstrating widespread adoption and confidence in the Ethereum network.

- Notable New Projects: Numerous innovative DeFi projects and applications continue to emerge on the Ethereum blockchain, attracting new users and developers.

- Increasing Transaction Volume: The high and steadily increasing number of transactions processed on the Ethereum network further validates its utility and reinforces its role as a leading blockchain platform. This increased activity drives demand for ETH.

Upcoming Ethereum Upgrades and Improvements

Anticipated upgrades to the Ethereum network will likely further enhance its capabilities and drive future price appreciation.

- Ethereum 2.0: The much-anticipated transition to Ethereum 2.0 is underway, promising significant improvements in scalability, security, and energy efficiency. These improvements should attract even more users and developers.

- Ethereum Upgrades: Other scheduled upgrades and improvements to the network will enhance its overall functionality and performance, making it even more attractive to users and developers.

- Ethereum Scalability: The improvements in scalability will directly address one of the biggest challenges faced by the network, allowing for faster and cheaper transactions.

Potential Risks and Challenges

Despite the positive outlook, it's crucial to acknowledge potential risks and challenges that could impact the Ethereum price.

Market Volatility and External Factors

The cryptocurrency market is inherently volatile, and external factors can significantly influence Ethereum's price.

- Ethereum Market Volatility: Sudden price swings are common, and investors should be prepared for potential dips and corrections. Risk management strategies are crucial.

- Ethereum Price Prediction: Predicting future price movements with absolute certainty is impossible. While the outlook is currently bullish, unforeseen events could negatively impact the price.

- Ethereum Risk Factors: Regulatory uncertainty, macroeconomic conditions, and geopolitical events can all influence the price of Ethereum.

Competition from Other Blockchains

Ethereum faces competition from other blockchain platforms, and this competition could potentially impact its market share and price.

- Ethereum Competitors: Several alternative blockchain networks offer competing solutions and technologies.

- Ethereum Blockchain Competition: While Ethereum maintains a significant advantage, the competition is constantly evolving, and it's important to monitor the developments of competing platforms.

Conclusion

The evidence strongly suggests that the current Ethereum price strength is underpinned by both robust technical indicators and positive fundamental factors. Bullish chart patterns, positive readings from key technical indicators such as the RSI and MACD, and the continued growth of the Ethereum ecosystem and DeFi all point towards further upside potential. However, investors must remain cognizant of the inherent volatility of the cryptocurrency market and the potential impact of external factors and competition. Strong Ethereum price strength is currently evident, but careful analysis and risk management are vital for navigating this dynamic market. To stay abreast of the latest Ethereum price analysis and potential future developments, continue your research, monitor market trends, and consult reputable resources. Consider diversifying your portfolio and conducting thorough due diligence before making any investment decisions. Remember, this is not financial advice. For more information on Ethereum price outlook and investment opportunities, explore resources such as [link to a reputable crypto news site or trading platform].

Featured Posts

-

Lahwr Myn Py Ays Ayl Trafy Ka Shandar Khyrmqdm

May 08, 2025

Lahwr Myn Py Ays Ayl Trafy Ka Shandar Khyrmqdm

May 08, 2025 -

The Zuckerberg Trump Dynamic Impact On Technology And Policy

May 08, 2025

The Zuckerberg Trump Dynamic Impact On Technology And Policy

May 08, 2025 -

Confirmado Neymar Vuelve A La Seleccion Y Jugara Contra Messi En El Monumental

May 08, 2025

Confirmado Neymar Vuelve A La Seleccion Y Jugara Contra Messi En El Monumental

May 08, 2025 -

Gambits New Weapon A Poignant Tribute To Rogue

May 08, 2025

Gambits New Weapon A Poignant Tribute To Rogue

May 08, 2025 -

Dodge Urges Carney To Prioritize Productivity Boost

May 08, 2025

Dodge Urges Carney To Prioritize Productivity Boost

May 08, 2025