Ethereum Reaches New Highs: $2,000 On The Horizon?

Table of Contents

Factors Driving Ethereum's Price Surge

Several converging forces have propelled Ethereum's price to new highs, creating a compelling case for continued growth.

Increased DeFi Activity

The Decentralized Finance (DeFi) ecosystem built on Ethereum is experiencing explosive growth, significantly impacting demand for ETH. The total value locked (TVL) in DeFi protocols has reached unprecedented levels, demonstrating the burgeoning popularity of these innovative financial applications.

- Growth in Total Value Locked (TVL): The TVL in Ethereum-based DeFi protocols has consistently increased, reaching tens of billions of dollars. This signifies the massive amount of capital flowing into the Ethereum ecosystem.

- Popular DeFi Applications: Platforms like Aave, Compound, Uniswap, and Curve have become household names in the crypto space, attracting millions of users and driving significant demand for ETH.

- Yield Farming and Lending Platforms: The high yields offered by yield farming and lending protocols have incentivized users to lock up their ETH, further increasing demand and reducing circulating supply. This scarcity contributes to price appreciation.

NFT Market Boom

Non-Fungible Tokens (NFTs) have taken the world by storm, and Ethereum is the dominant blockchain for NFT creation and trading. The soaring popularity of NFTs has created substantial demand for ETH, as it's the primary currency used for transactions on major NFT marketplaces.

- Popularity of NFT Marketplaces: OpenSea and Rarible have become leading platforms for buying, selling, and trading NFTs, processing millions of dollars worth of transactions daily, driving significant ETH demand.

- High-Value NFT Sales: Record-breaking NFT sales, often involving digital art, collectibles, and virtual real estate, showcase the massive potential of the NFT market and its influence on ETH price.

- Impact of Celebrity Endorsements: High-profile celebrities and influencers endorsing NFTs have helped to broaden their appeal and attract new users to the Ethereum blockchain, further fueling the price increase.

Ethereum 2.0 Development

The ongoing development of Ethereum 2.0 is another significant factor driving the price. This major upgrade promises to dramatically improve Ethereum's scalability, security, and efficiency, addressing some of its current limitations.

- Staking Rewards: Ethereum 2.0 introduces staking, allowing users to earn rewards for securing the network, incentivizing participation and further reducing circulating supply.

- Improved Scalability: Ethereum 2.0 aims to significantly increase transaction throughput, reducing congestion and lowering transaction fees, making it more attractive for broader adoption.

- Reduced Transaction Fees (Gas Fees): Lower transaction fees are crucial for mass adoption. Ethereum 2.0's improvements in this area are highly anticipated by the community.

- Enhanced Security: The transition to a proof-of-stake consensus mechanism will enhance Ethereum's security and resilience against attacks.

Institutional Investment

The growing interest from institutional investors is a significant factor contributing to Ethereum's price appreciation. Major financial players are increasingly recognizing Ethereum's potential as a long-term investment.

- Grayscale Ethereum Trust: Grayscale Investments, a leading digital asset management firm, offers an Ethereum Trust, providing institutional investors with exposure to ETH.

- MicroStrategy's Investments: MicroStrategy, known for its Bitcoin holdings, has also shown interest in Ethereum, signaling a growing acceptance of cryptocurrencies by established corporations.

- Other Notable Institutional Players: Several other significant institutional investors are reportedly accumulating ETH, demonstrating growing confidence in its future.

$2,000 Price Target: Realistic or Overly Optimistic?

While Ethereum's price trajectory is impressive, the question remains: is a $2,000 price target realistic?

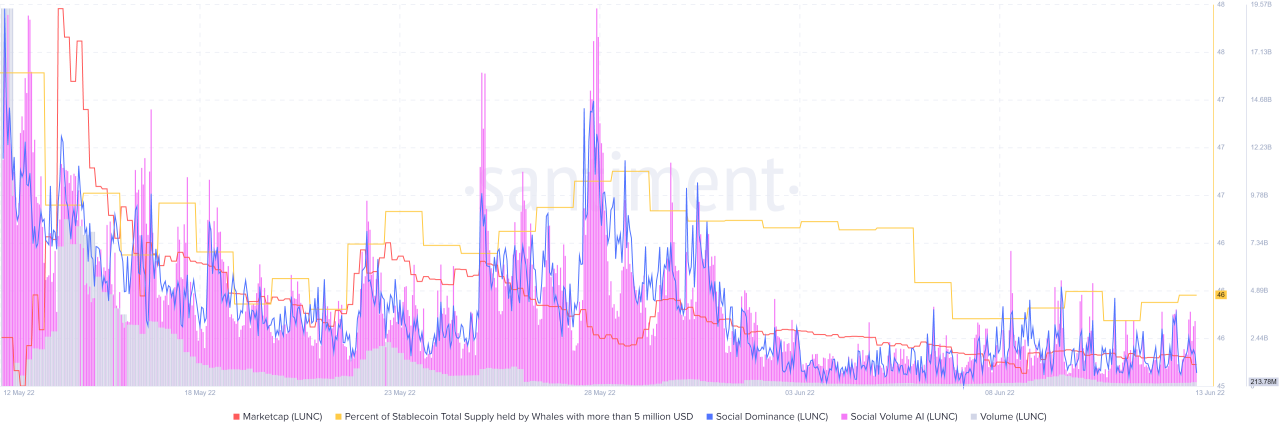

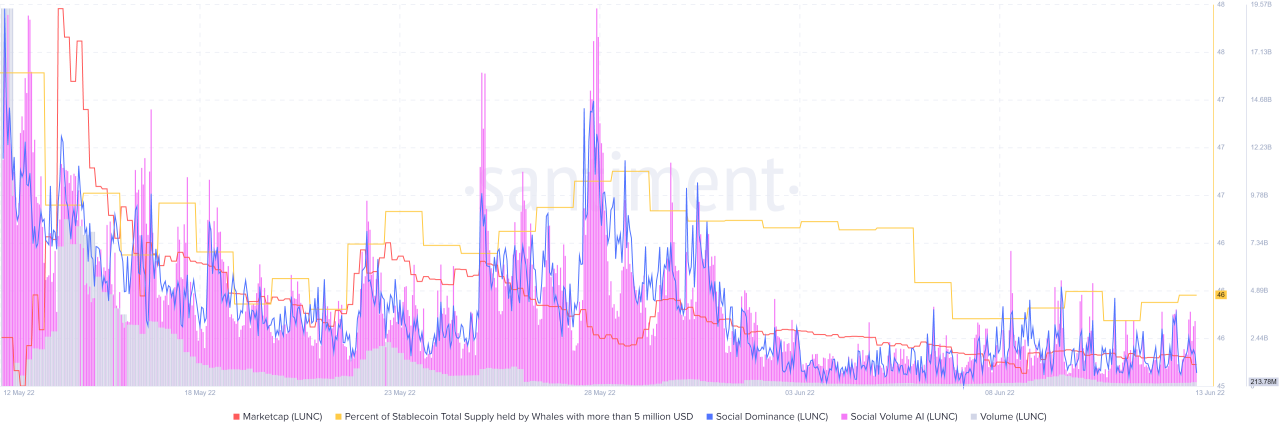

Analyzing Market Sentiment

Current market sentiment towards Ethereum is largely positive, with many analysts predicting further price appreciation. Social media discussions and online forums showcase widespread bullish sentiment. Technical analysis charts indicate strong support levels, suggesting further upward momentum. However, it's crucial to remember that market sentiment can shift rapidly.

Potential Headwinds

Despite the positive outlook, several potential headwinds could hinder Ethereum's price rise.

- Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies poses a risk, as governments worldwide grapple with how to regulate this new asset class.

- Competition from Other Cryptocurrencies: Ethereum faces competition from other blockchain platforms and cryptocurrencies, some of which offer faster transaction speeds or lower fees.

- Market Corrections: The cryptocurrency market is inherently volatile, and periodic corrections are to be expected. A significant market downturn could impact Ethereum's price negatively.

Long-Term Growth Prospects

Despite the potential challenges, Ethereum's long-term growth prospects remain strong. Its underlying technology has significant potential for widespread adoption and integration into existing financial systems.

- Adoption by Businesses: More businesses are exploring the use of blockchain technology and Ethereum for various applications, potentially driving demand for ETH.

- Integration with Existing Financial Systems: As Ethereum's technology matures, its integration with traditional financial systems is likely to increase, further boosting its value.

- Future Development Roadmap: The ongoing development and innovation within the Ethereum ecosystem continue to enhance its capabilities and attract new users and developers.

Conclusion

Ethereum's recent price surge is driven by a combination of factors, including the growth of DeFi, the NFT boom, the development of Ethereum 2.0, and increasing institutional investment. While a $2,000 price target is ambitious, the underlying fundamentals of Ethereum are strong, suggesting significant long-term potential. However, investors should be aware of potential headwinds, such as regulatory uncertainty and market volatility.

Stay updated on the exciting developments in the Ethereum market and track the potential for ETH to hit $2,000. Keep learning about Ethereum and its potential for future growth! For more information, explore resources like [link to reputable crypto news site] and [link to Ethereum community forum].

Featured Posts

-

Liga De Quito Flamengo Todo Sobre El Partido De La Copa Libertadores Grupo C Fecha 3

May 08, 2025

Liga De Quito Flamengo Todo Sobre El Partido De La Copa Libertadores Grupo C Fecha 3

May 08, 2025 -

Boston Celtics Coach Updates On Jayson Tatums Wrist Injury

May 08, 2025

Boston Celtics Coach Updates On Jayson Tatums Wrist Injury

May 08, 2025 -

Scholar Rock Stock Mondays Negative Market Movement Explained

May 08, 2025

Scholar Rock Stock Mondays Negative Market Movement Explained

May 08, 2025 -

Facing Cuts Understanding The Dwps Universal Credit Overhaul

May 08, 2025

Facing Cuts Understanding The Dwps Universal Credit Overhaul

May 08, 2025 -

Exploring The Best Krypto Stories

May 08, 2025

Exploring The Best Krypto Stories

May 08, 2025