Ethereum's Bullish Run: Analyzing Price Strength And Future Outlook

Table of Contents

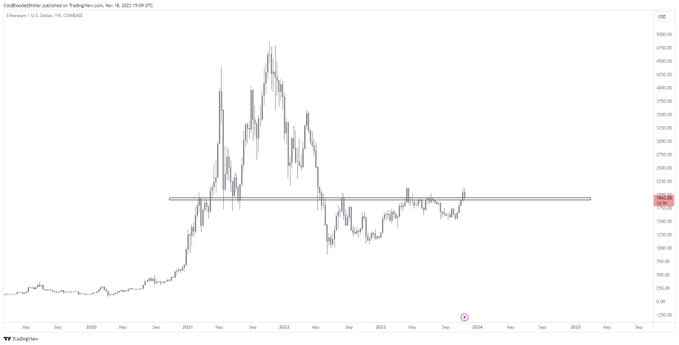

Analyzing Ethereum's Recent Price Strength

Key Factors Contributing to the Bullish Trend

Several converging factors have contributed to the recent Ethereum bullish trend. These include:

- Increased dApp Adoption: The Ethereum network continues to see explosive growth in decentralized applications (dApps), driving demand for ETH as the network's native token. This increased usage directly impacts the price.

- Growing Institutional Investment: Large institutional investors are increasingly allocating capital to ETH, recognizing its potential as a leading smart contract platform and a store of value. This influx of capital significantly supports the price.

- Ethereum 2.0 Upgrades: The successful implementation of Ethereum 2.0 upgrades, such as sharding, has improved network scalability and efficiency, addressing a long-standing concern. This enhances the network's overall attractiveness.

- Positive Regulatory Developments: The relatively positive regulatory environment (or lack of significant negative regulatory actions) surrounding cryptocurrencies globally has fostered investor confidence. This stability helps reduce volatility and encourage investment.

- Increased Network Activity: High network activity and transaction volume indicate strong demand and usage, further boosting the price of ETH. The higher the demand, the higher the price tends to go.

[Insert a chart or graph here illustrating Ethereum's price increase over a recent period, clearly labeled and referenced.]

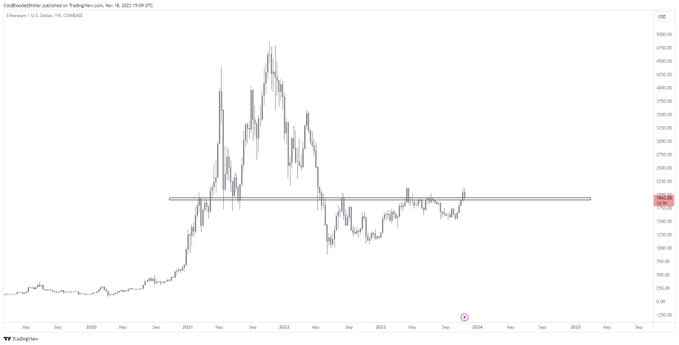

Technical Analysis of ETH Price

Technical analysis provides further insights into Ethereum's price strength. By examining key indicators, we can potentially identify support and resistance levels, and predict future price movements.

- Support and Resistance Levels: Identifying crucial support and resistance levels on price charts helps assess potential price reversals or breakouts.

- Technical Indicators: Analyzing indicators such as the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands provides signals about momentum, overbought/oversold conditions, and potential price trends.

- Price Targets: Based on technical analysis, potential price targets can be projected, although it's crucial to remember that these are just estimates.

[Insert a chart or graph here showing technical indicators like MACD, RSI, and Bollinger Bands applied to the ETH price chart.]

Assessing the Sustainability of the Bullish Run

While the current Ethereum bullish trend is encouraging, it's essential to consider potential risks and challenges that could impact its sustainability.

Potential Risks and Challenges

- Market Volatility: The cryptocurrency market is inherently volatile, and external factors like macroeconomic conditions and regulatory changes can significantly impact ETH's price.

- Competition: Competition from other layer-1 blockchains offering similar functionalities presents a challenge to Ethereum's dominance.

- Scalability Issues: Although Ethereum 2.0 addresses scalability, gas fees can still be a concern, especially during periods of high network congestion.

- Security Concerns: Security vulnerabilities, although rare, can negatively impact investor confidence and price.

Factors Supporting Long-Term Growth

Despite the risks, several factors suggest strong long-term growth potential for Ethereum:

- DeFi and NFT Utility: The growing utility of Ethereum as a platform for decentralized finance (DeFi) and non-fungible tokens (NFTs) fuels demand for ETH.

- Continued Development: Ongoing development and upgrades to the Ethereum network ensure its long-term viability and competitiveness.

- Institutional Adoption: The increasing adoption of Ethereum by institutional investors indicates growing confidence in the platform.

- Metaverse Potential: Ethereum's potential role in the metaverse further enhances its long-term value proposition.

Predicting Ethereum's Future Outlook

Predicting cryptocurrency prices is inherently speculative, but analyzing current trends and fundamental factors can offer potential insights.

Short-Term Price Predictions

Based on current market dynamics and technical analysis, we might see price fluctuations in the coming months. However, predicting precise short-term price movements is highly challenging and unreliable. [Disclaimer: Cryptocurrency investments are highly volatile and speculative. Any price prediction is not financial advice.]

Long-Term Price Predictions

The long-term potential of Ethereum is significant, driven by its foundational role in the decentralized web. While specific long-term price targets are highly uncertain, the underlying technology and growing adoption suggest considerable future growth. [Disclaimer: Long-term price predictions are highly speculative and should not be considered investment advice.]

Investment Strategies

For investors considering Ethereum investment, a diversified portfolio and thorough research are crucial. Risk management strategies, including dollar-cost averaging and setting stop-loss orders, can help mitigate potential losses.

Ethereum's Bullish Run: A Summary and Call to Action

This analysis highlights the key factors driving Ethereum's bullish run, including increased dApp adoption, institutional investment, and network upgrades. While potential risks exist, the long-term growth potential of Ethereum remains significant. Remember that thorough research is paramount before investing in cryptocurrencies. Stay ahead of the curve with the latest Ethereum insights, and consider beginning your Ethereum investment journey today, strategically and responsibly, to capitalize on Ethereum's bullish potential. Don't miss out on the opportunity presented by Ethereum's promising future!

Featured Posts

-

Gjranwalh Myn Wlyme Ky Tqryb Myn Dl Ka Dwrh Dlha Ky Mwt

May 08, 2025

Gjranwalh Myn Wlyme Ky Tqryb Myn Dl Ka Dwrh Dlha Ky Mwt

May 08, 2025 -

Este Betis Un Hito En La Historia Del Club

May 08, 2025

Este Betis Un Hito En La Historia Del Club

May 08, 2025 -

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025 -

Counting Crows 2025 Setlist Predictions What To Expect On Tour

May 08, 2025

Counting Crows 2025 Setlist Predictions What To Expect On Tour

May 08, 2025 -

Caruso Makes Nba Playoff History Thunder Game 1 Win

May 08, 2025

Caruso Makes Nba Playoff History Thunder Game 1 Win

May 08, 2025