Ethereum's Bullish Trend: Analysis Of Recent Accumulation And Price Movement

Table of Contents

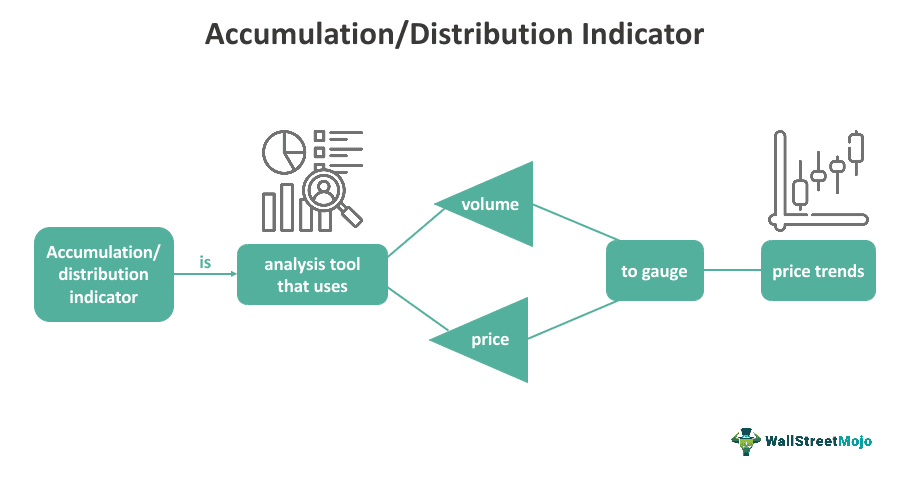

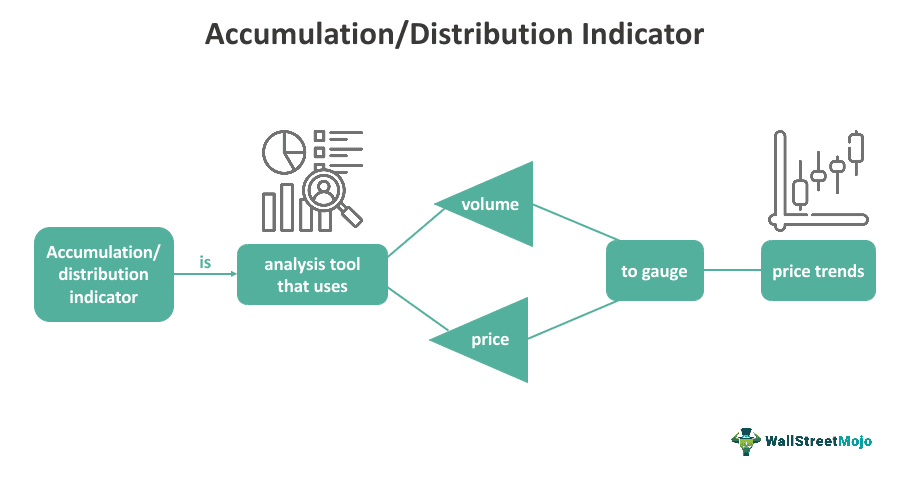

On-Chain Data Indicating Accumulation

On-chain data provides crucial insights into the behavior of market participants, offering a more objective view of market sentiment than traditional price charts alone. Analyzing on-chain metrics helps us understand the underlying strength of Ethereum's bullish trend.

- What is On-Chain Data? On-chain data refers to information directly recorded on the Ethereum blockchain, providing a transparent record of transactions, balances, and network activity. This data is invaluable for gauging market sentiment and predicting price movements.

Exchange Reserves

A significant indicator of a bullish trend is the decrease in ETH reserves held on major cryptocurrency exchanges. Reduced exchange reserves suggest less selling pressure, as fewer coins are readily available for immediate liquidation. Recent data shows a consistent decline in ETH held on exchanges like Coinbase and Binance, indicating potential accumulation by large investors and a reduced likelihood of large sell-offs. [Insert chart showing decreasing exchange reserves here].

Active Addresses

The number of active addresses on the Ethereum network reflects user engagement and network growth. A rising number of active addresses suggests increased adoption and transaction volume, often correlating with price appreciation. [Insert chart showing increasing active addresses here]. This increased activity strengthens the narrative supporting Ethereum's bullish trend. This demonstrates growing user confidence and network participation.

Whale Accumulation

Large ETH holders, often referred to as "whales," significantly influence the market. Their accumulation of ETH signals confidence in the long-term prospects of the cryptocurrency. Analysis of blockchain explorer data reveals that several large wallets have been actively accumulating ETH recently. [Insert example data from a blockchain explorer, citing specific addresses if possible, but always maintaining anonymity and privacy considerations]. This significant accumulation supports the bullish price movement.

Factors Driving Ethereum's Price Movement

Several factors beyond on-chain data contribute to Ethereum's bullish trend. Understanding these fundamental elements helps solidify our analysis.

- Macroeconomic Factors: The overall macroeconomic environment, including inflation rates and global market sentiment, impacts all cryptocurrencies, including ETH. Positive global economic news can generally fuel a bullish environment for crypto assets.

- Technological Advancements: Ethereum's ongoing development and upgrades, especially the implementation of sharding, significantly improve scalability and transaction speed. Increased efficiency attracts more users and developers, boosting demand and the Ethereum price.

- DeFi Ecosystem Growth: The flourishing Decentralized Finance (DeFi) ecosystem built on Ethereum is a major driver of demand for ETH. Many DeFi applications require ETH for transactions and staking, creating substantial demand.

- Institutional Investment and Regulatory Developments: Growing institutional adoption and clearer regulatory frameworks are creating more avenues for large-scale investments in Ethereum, contributing to price stability and upward momentum.

Technical Analysis of Ethereum's Price Charts

Technical analysis uses price charts and indicators to predict future price movements. Analyzing Ethereum's price charts provides additional evidence supporting the bullish trend.

- Key Indicators: Studying indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) helps identify trends and potential turning points. [Insert chart illustrating these indicators applied to the ETH price chart].

- Support and Resistance Levels: Identifying key support and resistance levels on the chart can help estimate potential price targets and potential points of consolidation or reversal.

- Chart Patterns: Recognizing bullish chart patterns, such as ascending triangles or double bottoms, can further support the bullish narrative for Ethereum's price. [Insert example chart showing a relevant bullish chart pattern].

Ethereum's Bullish Future: A Call to Action

Our analysis of on-chain data, fundamental factors, and technical indicators strongly suggests a potential bullish trend for Ethereum. The decreased exchange reserves, increased active addresses, whale accumulation, technological advancements, thriving DeFi ecosystem, and positive technical signals all contribute to a positive outlook for the ETH price.

However, it's crucial to remember that the cryptocurrency market is inherently volatile. While the evidence points towards a potential uptrend, it's impossible to predict the future with certainty.

Stay informed on Ethereum's bullish trend by following our updates and conducting your own thorough research before making any investment decisions. Consider exploring further resources on ETH investment strategies and technical analysis to enhance your understanding and make informed choices. Remember to only invest what you can afford to lose.

Featured Posts

-

Xrp Price Surge Can It Continue Its 400 Rise

May 08, 2025

Xrp Price Surge Can It Continue Its 400 Rise

May 08, 2025 -

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025 -

Tatum On Curry An Honest Post All Star Game Reflection

May 08, 2025

Tatum On Curry An Honest Post All Star Game Reflection

May 08, 2025 -

First Look Dystopian Horror Movie Based On Stephen Kings Novel Title

May 08, 2025

First Look Dystopian Horror Movie Based On Stephen Kings Novel Title

May 08, 2025 -

Arsenal News Collymores Pressure Mounts On Arteta

May 08, 2025

Arsenal News Collymores Pressure Mounts On Arteta

May 08, 2025