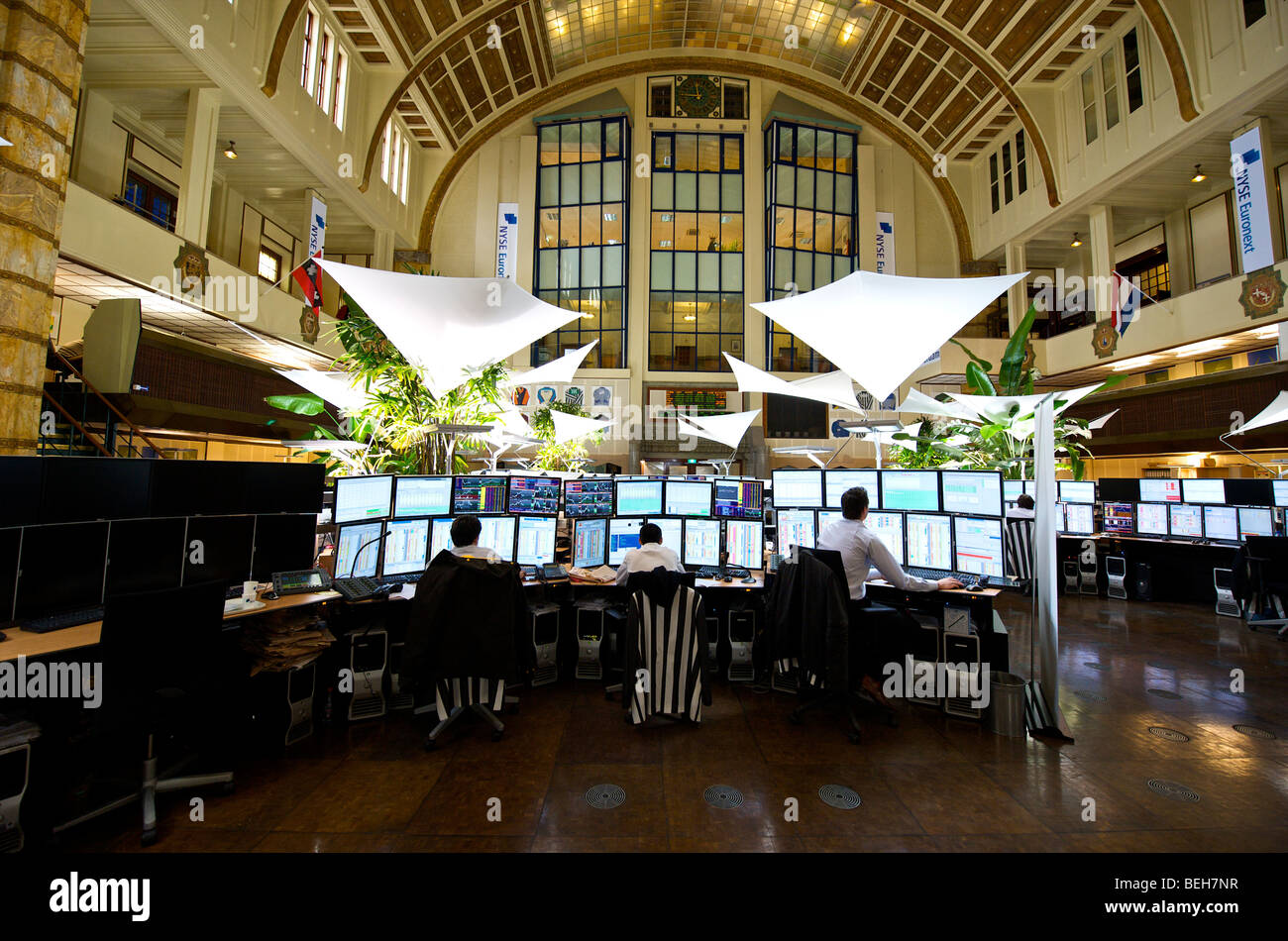

Euronext Amsterdam Stock Market Up 8% Following U.S. Tariff Suspension

Table of Contents

The Impact of U.S. Tariff Suspension on Euronext Amsterdam

The recent suspension of specific US tariffs targeting Dutch imports, particularly in the technology and agricultural sectors, significantly impacted the Euronext Amsterdam Stock Market. These tariffs, imposed previously, had created uncertainty and hampered the growth of several Dutch businesses listed on the exchange. The removal of these trade barriers has injected much-needed confidence into the market.

- Key Sectors Affected: The previous tariffs disproportionately affected the technology and agricultural sectors, impacting companies involved in exporting semiconductors, precision instruments, and agricultural products to the US.

- Economic Benefits: Estimates suggest the tariff suspension could boost the Dutch economy by billions of euros, significantly benefiting companies directly involved in US trade. This translates to increased revenue, improved profitability, and ultimately, higher share prices.

- Specific Companies: Several companies listed on Euronext Amsterdam, including [Insert example company names if available and relevant, e.g., ASML Holding, a major semiconductor equipment manufacturer], saw considerable share price increases immediately following the tariff suspension announcement.

This positive news led to a significant boost in investor confidence. Trading volumes on Euronext Amsterdam increased substantially in the days following the announcement, indicating increased investor activity and a renewed appetite for Dutch equities.

Analyzing the Euronext Amsterdam Market Performance

The 8% increase in the Euronext Amsterdam Stock Market was a dramatic event. The AEX index, the primary benchmark for the exchange, closed at [Insert specific closing price before the news] before the announcement and surged to [Insert specific closing price after the news] within days. This significant upward movement affected various sectors and reflected a broad-based increase in investor optimism.

- Comparison to Previous Fluctuations: This 8% increase represents one of the most significant single-day gains for the Euronext Amsterdam Stock Market in recent years, exceeding the average daily fluctuations seen in the past 12 months.

- Comparative European Performance: Compared to other major European markets, such as the London Stock Exchange and the Frankfurt Stock Exchange, the Euronext Amsterdam Stock Market showed comparatively stronger performance during this period, suggesting the tariff suspension had a particularly positive impact on Dutch equities.

- Other Contributing Factors: While the tariff suspension played a major role, other factors, including positive macroeconomic data for the Eurozone and generally improved global sentiment, likely contributed to the market's upswing.

Future Outlook and Investment Implications for the Euronext Amsterdam Stock Market

While the tariff suspension offers a positive outlook for the Euronext Amsterdam Stock Market, several factors warrant careful consideration.

- Remaining Risks: Geopolitical instability, potential global economic slowdowns, and future changes in US trade policy remain potential risks. Investors need to remain vigilant and diversify their portfolios.

- Investment Strategies: Given the current market conditions, a balanced approach, incorporating both growth and value stocks, might be prudent. Sectors directly benefiting from the tariff suspension, such as technology and agriculture, could potentially offer higher returns in the short term.

- Sectors to Watch: Companies involved in sustainable energy, healthcare, and technology with a strong export focus to the US could see significant growth. Thorough due diligence is crucial before making any investment decisions.

The Interconnectedness of Global Markets and Trade Policy

The Euronext Amsterdam Stock Market's reaction to the US tariff suspension vividly illustrates the interconnectedness of global financial markets.

- Impact of US Trade Policy: This event underlines the significant influence that US trade policies can have on European economies and their respective stock markets. The ripple effects of these policies are far-reaching.

- Importance of International Trade Agreements: The incident underscores the importance of robust international trade agreements in fostering stability and predictability in global markets.

- Other Global Events: Historically, events such as Brexit, the COVID-19 pandemic, and fluctuations in oil prices have all had substantial impacts on the Euronext Amsterdam Stock Market, demonstrating its sensitivity to global events.

Conclusion

The suspension of US tariffs led to an 8% increase in the Euronext Amsterdam Stock Market, showcasing the significant impact of trade policy on investor sentiment and market performance. The interconnectedness of global markets is highlighted by this event, emphasizing the need for careful monitoring of international trade dynamics. Understanding the complexities of the Euronext Amsterdam Stock Market and its response to global events is crucial. Stay informed about the evolving situation on the Euronext Amsterdam Stock Market and its response to global events. For further analysis and investment advice related to the Euronext Amsterdam Stock Market, consult with a financial professional.

Featured Posts

-

Memorial Day 2025 Airfare When To Fly And Save Money

May 25, 2025

Memorial Day 2025 Airfare When To Fly And Save Money

May 25, 2025 -

Innokentiy Smoktunovskiy Dokumentalniy Film K Ego 100 Letiyu

May 25, 2025

Innokentiy Smoktunovskiy Dokumentalniy Film K Ego 100 Letiyu

May 25, 2025 -

The Elon Musk Dogecoin Relationship An Analysis

May 25, 2025

The Elon Musk Dogecoin Relationship An Analysis

May 25, 2025 -

Le Pens Support Rally Did The National Rally Fall Short Of Expectations

May 25, 2025

Le Pens Support Rally Did The National Rally Fall Short Of Expectations

May 25, 2025 -

Rio Tinto Rebuts Forrests Wasteland Claims Pilbaras Future Defended

May 25, 2025

Rio Tinto Rebuts Forrests Wasteland Claims Pilbaras Future Defended

May 25, 2025

Latest Posts

-

Office365 Security Breach Crook Makes Millions Targeting Executive Inboxes

May 25, 2025

Office365 Security Breach Crook Makes Millions Targeting Executive Inboxes

May 25, 2025 -

Millions Lost Inside Job Reveals Extensive Office365 Executive Account Breaches

May 25, 2025

Millions Lost Inside Job Reveals Extensive Office365 Executive Account Breaches

May 25, 2025 -

Office365 Executive Email Hacks Result In Multi Million Dollar Theft

May 25, 2025

Office365 Executive Email Hacks Result In Multi Million Dollar Theft

May 25, 2025 -

Podcast Production Revolutionized Ais Role In Processing Repetitive Documents

May 25, 2025

Podcast Production Revolutionized Ais Role In Processing Repetitive Documents

May 25, 2025 -

Ai Digest Transforming Repetitive Data Into Compelling Audio Content

May 25, 2025

Ai Digest Transforming Repetitive Data Into Compelling Audio Content

May 25, 2025