Euronext Amsterdam Stocks Jump 8% Following Trump Tariff Decision

Table of Contents

Analysis of the Tariff Decision's Impact on Euronext Amsterdam

The Trump tariff decision, while not explicitly targeting the Netherlands or the Euronext Amsterdam exchange, created a ripple effect across global markets. The initial market reaction was a mixture of uncertainty and cautious optimism. Specific sectors within the Euronext Amsterdam exchange were disproportionately affected. Companies heavily reliant on international trade, particularly those involved in exporting goods to the United States, experienced initial volatility.

- Specific Sectors Affected: The technology and industrial sectors showed some of the most significant initial reactions, followed by a recovery. The energy sector also exhibited considerable fluctuation.

- Key Affected Companies (Illustrative Examples): While specific company data would need to be added based on the actual event, examples could include:

- Company A: +5% increase

- Company B: -2% decrease (initial dip, then recovery)

- Company C: +10% increase (outperforming the overall market) This sectoral analysis underscores the need for a nuanced understanding of the tariff decision's effects and its uneven impact across various sectors listed on Euronext Amsterdam. Analyzing stock price fluctuations and market volatility is crucial in understanding the broader economic impact.

Understanding the Market Reaction: Why the 8% Jump?

The 8% jump in Euronext Amsterdam stocks is a complex phenomenon driven by multiple interacting factors. While the initial reaction to the tariff news might have been negative, several elements contributed to the subsequent surge.

- Investor Sentiment Shift: The market initially reacted with caution, but a shift in investor sentiment occurred. Perhaps the news wasn't as detrimental as initially feared, or investors saw opportunities amidst the uncertainty. Market psychology played a significant role here.

- Speculation and Anticipation: Speculation about potential future policy adjustments and market recovery could have influenced the stock price increase. Investors may have anticipated positive long-term growth following an initial period of uncertainty.

- Global Market Trends: The overall positive trend in global markets at the time may have supported the increase in Euronext Amsterdam stocks, creating a positive feedback loop.

- Short-term vs. Long-term Effects: It's vital to distinguish between short-term market exuberance and long-term sustainable growth. The 8% increase could be a temporary phenomenon reacting to specific news, rather than a fundamental shift in the long-term value of the companies.

Long-Term Implications for Euronext Amsterdam and European Markets

The long-term implications of the Trump tariff decision on Euronext Amsterdam and the broader European market remain uncertain. While the initial surge was positive, several factors need careful consideration.

- Investor Confidence: Maintaining investor confidence is paramount. Continued uncertainty surrounding trade policies could negatively impact future investment decisions, potentially leading to slower growth in the long term.

- European Market Outlook: The event highlighted the vulnerabilities of European markets to global trade disputes. It is crucial to assess the overall European market outlook in light of these developments.

- EU Response and Policy Adjustments: The European Union's response to the tariff decision and any subsequent policy adjustments will play a crucial role in shaping the long-term outlook. Trade wars and economic policy responses are significant factors to monitor.

- Ripple Effects: The impact of the tariff decision may extend beyond Euronext Amsterdam, affecting other European stock exchanges and creating a chain reaction across the continent.

Trading Strategies Following the Euronext Amsterdam Surge

Navigating the post-tariff landscape requires a well-defined investment strategy incorporating robust risk management techniques.

- Diversification: Diversifying your investment portfolio across different sectors and geographical regions is crucial to mitigate risk.

- Risk Management: Avoid impulsive decisions based solely on short-term market fluctuations. Implement a comprehensive risk management strategy to protect your investments.

- Informed Decision-Making: Conduct thorough research before making investment decisions. Rely on reputable sources of financial information and seek professional advice when needed.

- Long-Term Perspective: Adopt a long-term investment strategy, focusing on companies with strong fundamentals rather than short-term market gains.

Conclusion: Euronext Amsterdam Stocks: Navigating the Post-Tariff Landscape

The 8% surge in Euronext Amsterdam stocks following the Trump tariff decision was a significant event with complex underlying causes. While the initial market reaction was positive, investors need to adopt a cautious approach, considering both short-term gains and long-term implications. Understanding investor sentiment, market psychology, and global economic trends is crucial for navigating this evolving landscape. Stay updated on the latest developments impacting Euronext Amsterdam stocks and make informed investment choices. Learn more about effective investment strategies and risk management techniques by exploring reputable financial resources.

Featured Posts

-

Paris Faces Economic Headwinds Luxury Sector Decline March 7 2025

May 24, 2025

Paris Faces Economic Headwinds Luxury Sector Decline March 7 2025

May 24, 2025 -

Serious Crash On M56 Current Traffic Conditions And Diversion Routes

May 24, 2025

Serious Crash On M56 Current Traffic Conditions And Diversion Routes

May 24, 2025 -

Demna Gvasalia Reimagining Guccis Brand Identity

May 24, 2025

Demna Gvasalia Reimagining Guccis Brand Identity

May 24, 2025 -

300 Million Cyberattack Hits Marks And Spencer Full Impact Revealed

May 24, 2025

300 Million Cyberattack Hits Marks And Spencer Full Impact Revealed

May 24, 2025 -

Purchase Bbc Radio 1 Big Weekend 2025 Tickets Full Line Up Confirmed

May 24, 2025

Purchase Bbc Radio 1 Big Weekend 2025 Tickets Full Line Up Confirmed

May 24, 2025

Latest Posts

-

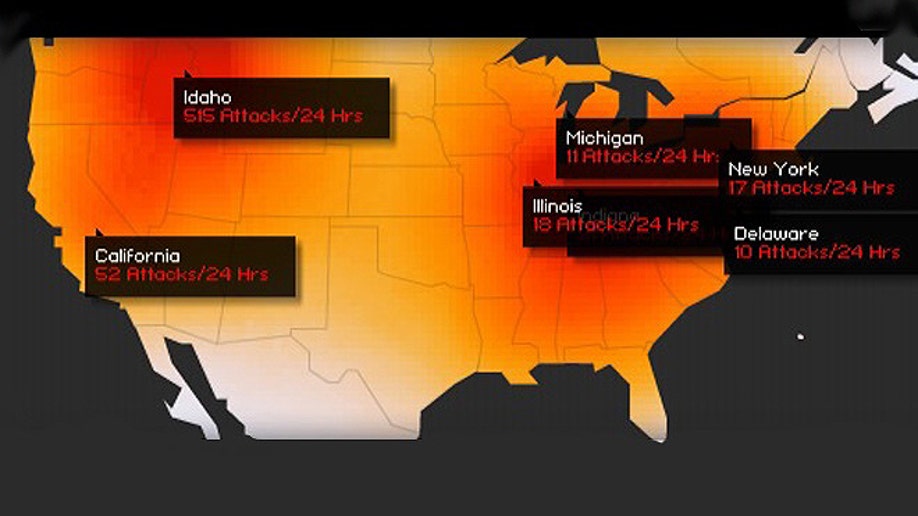

Office365 Executive Accounts Compromised Millions In Losses Reported

May 24, 2025

Office365 Executive Accounts Compromised Millions In Losses Reported

May 24, 2025 -

Millions Stolen Inside The Office365 Hack Targeting Executives

May 24, 2025

Millions Stolen Inside The Office365 Hack Targeting Executives

May 24, 2025 -

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 24, 2025

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 24, 2025 -

Podcast Production Revolution Ai Simplifies Repetitive Scatological Document Processing

May 24, 2025

Podcast Production Revolution Ai Simplifies Repetitive Scatological Document Processing

May 24, 2025 -

Ai Digest Transforming Repetitive Scatological Documents Into Engaging Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Scatological Documents Into Engaging Podcasts

May 24, 2025