European Stock Market Midday Briefing: Focus On PMI Numbers

Table of Contents

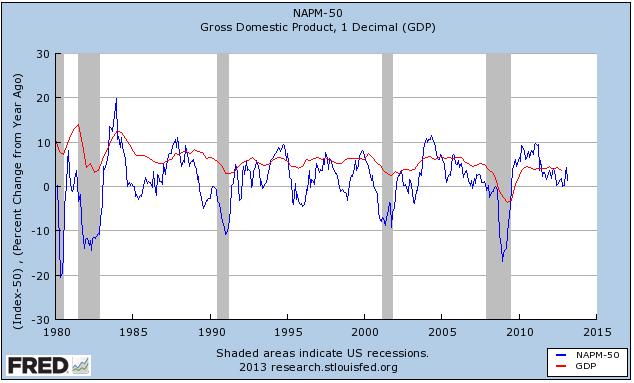

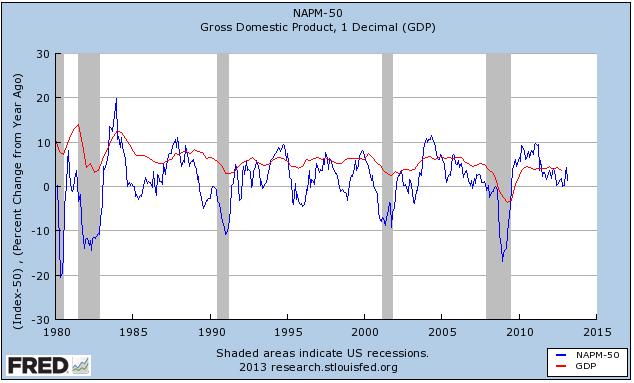

<p>The European stock market is experiencing significant movement this midday, largely driven by the latest release of Purchasing Managers' Index (PMI) numbers. This briefing will analyze the key PMI data and its impact on major European indices and sectors. We’ll examine the implications for investors and highlight key trends to watch. Understanding these economic indicators is crucial for effective trading and investment in European markets.</p>

<h2>PMI Data Deep Dive</h2>

<h3>Manufacturing PMI</h3> <p>The manufacturing PMI provides a crucial snapshot of the health of the European manufacturing sector. Today's numbers reveal a [insert actual or hypothetical data, e.g., mixed picture]. Let's break down the key figures:</p> <ul> <li><strong>Germany:</strong> [Insert PMI score] – [Comparison to previous month and expectations, e.g., a slight dip from last month's 52.1, but still above the 50-point mark indicating expansion]. This impacted automotive stocks particularly, with [mention specific stock examples and percentage changes].</li> <li><strong>France:</strong> [Insert PMI score] – [Comparison to previous month and expectations, e.g., a significant increase suggesting renewed growth in the manufacturing sector]. This positive data boosted investor confidence in the French market, leading to gains in [mention specific stock examples and percentage changes].</li> <li><strong>UK:</strong> [Insert PMI score] – [Comparison to previous month and expectations, e.g., a contraction, signaling ongoing challenges for the UK manufacturing sector]. This contributed to a downturn in several industrial stocks, notably [mention specific stock examples and percentage changes].</li> <li><strong>Italy:</strong> [Insert PMI score] – [Comparison to previous month and expectations, e.g., remained largely stagnant]. This suggests a continued period of consolidation in the Italian manufacturing sector.</li> </ul> <p>Unexpectedly, [mention any surprising data points and their potential causes]. This deviation from predictions will likely influence future market performance.</p>

<h3>Services PMI</h3> <p>The services PMI, which encompasses a broad range of sectors from retail and hospitality to finance and technology, provides a significant indication of overall economic activity. Its correlation with stock market performance is generally strong. Today’s data shows [insert actual or hypothetical data, e.g., robust growth in the services sector].</p> <ul> <li><strong>Germany:</strong> [Insert PMI score] – [Comparison to manufacturing PMI and previous month's data, e.g., outperforming the manufacturing sector, suggesting a resilient services sector]. This supported the performance of companies like [mention specific stock examples and percentage changes].</li> <li><strong>France:</strong> [Insert PMI score] – [Comparison to manufacturing PMI and previous month's data, e.g., a slight slowdown compared to last month]. This indicates a potential cooling off in the French services sector.</li> <li><strong>UK:</strong> [Insert PMI score] – [Comparison to manufacturing PMI and previous month's data, e.g., a similar trend to the manufacturing sector, highlighting widespread economic challenges]. This impacted several service-related stocks negatively.</li> <li><strong>Italy:</strong> [Insert PMI score] – [Comparison to manufacturing PMI and previous month's data, e.g., a slight improvement, signifying modest growth].</li> </ul> <p>Factors contributing to this performance include [mention potential contributing factors like consumer spending, tourism, or business investment].</p>

<h3>Composite PMI</h3> <p>The composite PMI, a combined measure of both manufacturing and services activity, provides a comprehensive overview of the European economy. Today's composite PMI stands at [Insert score] indicating [Interpretation, e.g., moderate growth].</p> <ul> <li>This figure combines the strengths and weaknesses observed in the manufacturing and services sectors, providing a holistic economic picture.</li> <li>Historically, a strong composite PMI has correlated with positive stock market performance, while a weak reading often signals potential market downturns.</li> <li>The implications for the European Central Bank (ECB) are significant. This data may influence their decisions regarding future monetary policy, such as interest rate adjustments.</li> </ul>

<h2>Market Reactions to PMI Numbers</h2>

<h3>Impact on Major Indices</h3> <p>The release of the PMI numbers has had a noticeable impact on major European stock market indices.</p> <ul> <li><strong>DAX (Germany):</strong> [Percentage change since PMI release and explanation].</li> <li><strong>CAC 40 (France):</strong> [Percentage change since PMI release and explanation].</li> <li><strong>FTSE 100 (UK):</strong> [Percentage change since PMI release and explanation].</li> </ul> <p>Leading sectors within these indices include [mention leading sectors], while lagging sectors are [mention lagging sectors]. Overall investor sentiment appears to be [describe investor sentiment based on market movements].</p>

<h3>Sector-Specific Performance</h3> <p>Different sectors are reacting differently to the PMI data.</p> <ul> <li><strong>Automotive:</strong> [Performance and explanation related to PMI data].</li> <li><strong>Technology:</strong> [Performance and explanation related to PMI data].</li> <li><strong>Financials:</strong> [Performance and explanation related to PMI data].</li> </ul> <p>Cyclical sectors, sensitive to economic fluctuations, are [describe performance], while defensive sectors are [describe performance].</p>

<h3>Currency Implications</h3> <p>The PMI data has also influenced currency markets.</p> <ul> <li><strong>Euro/USD:</strong> [Exchange rate movement and explanation].</li> <li><strong>Euro/GBP:</strong> [Exchange rate movement and explanation].</li> </ul> <p>These currency fluctuations have potential ripple effects across international markets, impacting trade and investment flows.</p>

<h2>Investment Strategies in Light of PMI Data</h2>

<h3>Opportunities and Risks</h3> <p>The PMI data presents both opportunities and risks for investors.</p> <ul> <li>For investors with a higher risk tolerance, [suggest specific investment strategies, e.g., investing in cyclical stocks that are expected to benefit from economic recovery].</li> <li>More conservative investors might consider [suggest specific investment strategies, e.g., allocating more funds to defensive sectors or diversifying their portfolios].</li> </ul> <p>Stocks like [mention specific stock examples] might be poised for growth, while others, such as [mention specific stock examples], may face challenges.</p>

<h3>Expert Opinion</h3> <p>[Summarize expert opinions from financial analysts or economists regarding the implications of the PMI data for future market movements. Include links to reputable sources, e.g., "According to Goldman Sachs' latest report, the PMI data suggests a potential slowdown in economic growth..." ]</p>

<h2>Conclusion</h2>

<p>This midday briefing analyzed the impact of the latest PMI numbers on the European stock market. We examined the manufacturing, services, and composite PMI data, observing their effects on major indices, sectors, and currency markets. The data suggests [brief, data-driven conclusion, e.g., a cautiously optimistic outlook for the European economy, with growth potential tempered by ongoing global uncertainties].</p>

<p><strong>Call to Action:</strong> Stay informed about the evolving European stock market landscape by checking back for our regular European Stock Market Midday Briefings focusing on key economic indicators like PMI and other market-moving data. Follow us for timely updates and insightful analysis on European stock market performance. Understand the impact of PMI numbers on your investment strategy.</p>

Featured Posts

-

Analyzing The Karate Kid Story Themes And Cultural Significance

May 23, 2025

Analyzing The Karate Kid Story Themes And Cultural Significance

May 23, 2025 -

Hollywood Legends Oscar Winning Role And Early Debut Available On Disney

May 23, 2025

Hollywood Legends Oscar Winning Role And Early Debut Available On Disney

May 23, 2025 -

Brundles Report Unsettling Information On Lewis Hamilton Revealed

May 23, 2025

Brundles Report Unsettling Information On Lewis Hamilton Revealed

May 23, 2025 -

Khsart Nady Qtr Amam Alkhwr Msharkt Ebd Alqadr

May 23, 2025

Khsart Nady Qtr Amam Alkhwr Msharkt Ebd Alqadr

May 23, 2025 -

Erik Ten Hag To Juventus Managers Future Uncertain After Motta Sacking

May 23, 2025

Erik Ten Hag To Juventus Managers Future Uncertain After Motta Sacking

May 23, 2025

Latest Posts

-

Betting On Calamity The Moral Quandary Of Wildfire Wagers In Los Angeles

May 23, 2025

Betting On Calamity The Moral Quandary Of Wildfire Wagers In Los Angeles

May 23, 2025 -

Thames Waters Troubled Waters Executive Bonuses Under Fire

May 23, 2025

Thames Waters Troubled Waters Executive Bonuses Under Fire

May 23, 2025 -

Los Angeles Rental Market Exploiting Fire Victims Through Price Gouging

May 23, 2025

Los Angeles Rental Market Exploiting Fire Victims Through Price Gouging

May 23, 2025 -

The Los Angeles Wildfires A New Frontier For Speculative Betting

May 23, 2025

The Los Angeles Wildfires A New Frontier For Speculative Betting

May 23, 2025 -

Public Outcry Over Thames Water Executive Bonuses A Deep Dive

May 23, 2025

Public Outcry Over Thames Water Executive Bonuses A Deep Dive

May 23, 2025