Exclusive: Wall Street Banks Offload Remaining Elon Musk X Debt

Table of Contents

The Scale of the Elon Musk X Debt Offloading

Elon Musk's acquisition of X was financed with a significant amount of debt, reportedly around $13 billion. Major Wall Street banks, including Morgan Stanley, Bank of America, and Barclays, were initially involved in providing this financing. The current offloading of Elon Musk X debt represents a partial divestment, with banks seeking to reduce their exposure to the risk associated with the platform's performance. While the exact figures are still emerging, reports suggest a substantial portion of the initial debt has been successfully offloaded.

- Total debt amount offloaded: The precise amount remains undisclosed, but reports suggest billions of dollars.

- Banks involved in the offloading process: Morgan Stanley, Bank of America, Barclays, and potentially other institutions are reportedly involved.

- Methods used for offloading: The banks likely employed a combination of strategies including sales to other investment firms, securitization (packaging the debt into tradable securities), and potentially even write-downs.

- Potential impact on bank balance sheets: This move will likely improve the banks' risk profiles and free up capital for other investments.

Reasons Behind the Elon Musk X Debt Sale

The decision by Wall Street banks to offload Elon Musk X debt is likely driven by a confluence of factors. Concerns about X's profitability and future revenue streams are central to this decision. Since the acquisition, X has faced challenges including advertiser hesitancy, increased competition, and significant losses.

- Concerns about X's profitability and future revenue streams: Advertiser flight and struggles to monetize the platform effectively are major concerns.

- Decreased investor confidence in X's long-term prospects: The platform's fluctuating user base and uncertain financial trajectory are impacting investor sentiment.

- Pressure from regulatory bodies or internal risk assessments: Banks may be facing internal pressure to reduce risk exposure, influenced by regulatory scrutiny and internal risk models.

- Opportunities for higher returns in other investment avenues: The current market conditions may present more lucrative investment opportunities, prompting banks to reallocate their capital.

Implications for Elon Musk and X

The offloading of Elon Musk X debt has significant implications for both Musk and the platform itself. The reduction in readily available credit could put pressure on Musk to improve X's financial performance significantly.

- Potential for increased pressure on Musk to improve X's performance: Securing additional funding may become more challenging, forcing Musk to prioritize profitability.

- Impact on X's ability to invest in new features and technologies: Reduced access to capital could hinder X's ability to innovate and compete effectively.

- Potential for changes in X's management or strategic direction: Financial pressures may lead to changes in leadership or a shift in the platform's strategic focus.

- Long-term effects on X's market position and competitiveness: The debt situation could impact X's ability to maintain its market position against competitors.

Market Reaction and Future Outlook for Elon Musk X Debt

The market's response to the news of the Elon Musk X debt offloading has been mixed. While some analysts express concern over X's financial stability, others see it as a sign that banks are managing their risk effectively.

- Analysis of stock market reactions: While X is not a publicly traded company, the news likely affected the stock prices of involved banks.

- Potential credit rating changes for X: The offloading might influence X's credit rating, potentially making it more difficult to secure future financing.

- Predictions for future fundraising efforts by X: X might need to explore alternative fundraising avenues, potentially involving equity financing or partnerships.

- Long-term outlook for the value of the remaining Elon Musk X debt: The long-term value of the remaining debt depends heavily on X's ability to improve its financial performance and attract new investors.

Conclusion

The offloading of Elon Musk X debt by Wall Street banks marks a significant development in the ongoing financial saga surrounding the platform. The move reflects concerns about X's profitability and future prospects, creating uncertainty surrounding its financial stability. The implications for both Elon Musk and the future direction of X are substantial. The ability to secure further funding and navigate the competitive social media landscape will be critical for X’s long-term success. Stay informed about the evolving situation surrounding Elon Musk X debt and its impact on the social media landscape. Follow us for the latest updates and analysis on this developing story. Continue to follow our coverage for further insights into the intricacies of the Elon Musk X debt situation and its long-term consequences.

Featured Posts

-

Witt And Garcia Lead Royals To 4 3 Victory Over Guardians

Apr 30, 2025

Witt And Garcia Lead Royals To 4 3 Victory Over Guardians

Apr 30, 2025 -

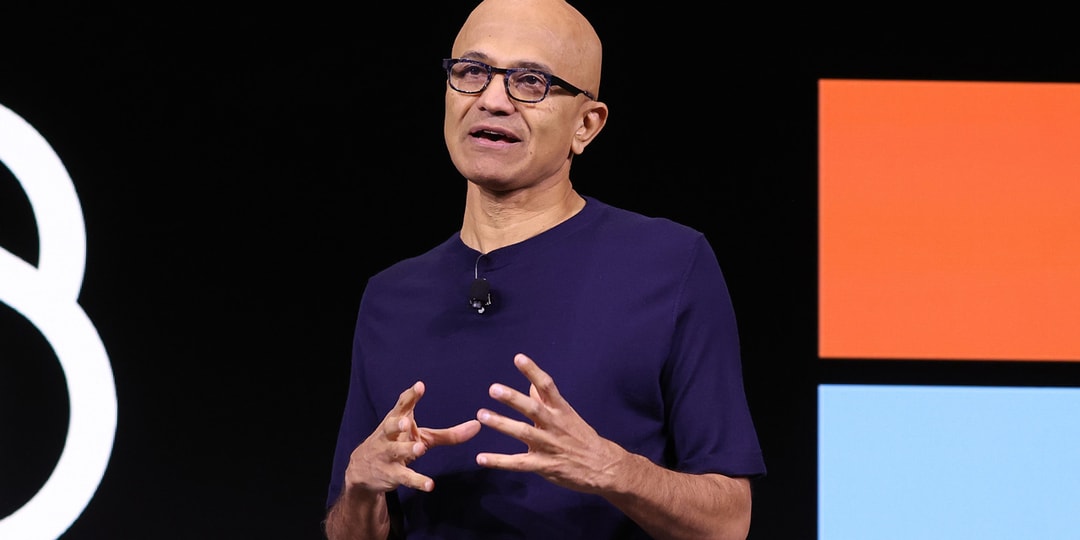

Is The Ai Partnership Between Altman And Nadella Fracturing

Apr 30, 2025

Is The Ai Partnership Between Altman And Nadella Fracturing

Apr 30, 2025 -

Is Blue Ivy Carter The Brow Guru Behind Tina Knowles Look

Apr 30, 2025

Is Blue Ivy Carter The Brow Guru Behind Tina Knowles Look

Apr 30, 2025 -

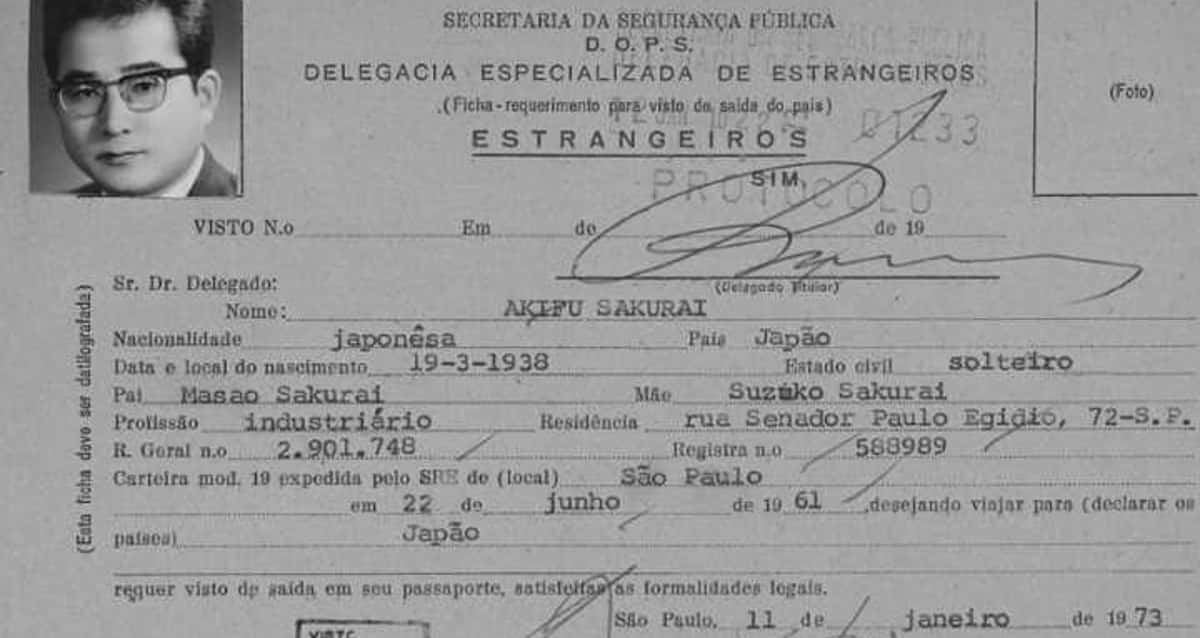

Famosos Que Vieram Ao Brasil Sem Avisar Mais Que Angelina Jolie

Apr 30, 2025

Famosos Que Vieram Ao Brasil Sem Avisar Mais Que Angelina Jolie

Apr 30, 2025 -

Targets Response To The Boycott Following Dei Program Changes

Apr 30, 2025

Targets Response To The Boycott Following Dei Program Changes

Apr 30, 2025