Expected PFC Dividend 2025: March 12 Announcement Date

Table of Contents

Understanding the PFC Dividend History and Projections

Understanding the PFC dividend history is crucial for predicting the 2025 payment. Analyzing past PFC dividends helps establish trends and expectations for the upcoming announcement. Keywords: PFC Dividend History, Past PFC Dividends, PFC Dividend Growth, Dividend Yield PFC

-

Brief overview of PFC's dividend payout history, highlighting trends and consistency: PFC has a history of [Insert data here: e.g., consistent dividend payments for the past X years, with an average annual growth rate of Y%]. This demonstrates a commitment to returning value to shareholders. However, it is important to note any instances of dividend reductions or suspensions in the past and the reasons behind them. Analyzing this data will allow investors to form a realistic expectation for the March 12th announcement.

-

Analysis of past dividend announcements and their impact on the stock price: Examining the market's reaction to previous PFC dividend announcements provides valuable insight. Did the stock price increase or decrease following the announcement? By what percentage? Understanding this correlation can help investors gauge the potential market response to the March 12th news. [Insert relevant data and analysis here].

-

Discussion of factors that typically influence PFC's dividend decisions (e.g., profitability, financial performance, market conditions): PFC's dividend decisions are likely influenced by various factors, including its profitability, earnings per share (EPS), financial leverage, and overall financial health. Market conditions, such as economic growth or recessionary pressures, also play a significant role. A strong financial performance typically leads to a higher dividend payout, while economic uncertainty might prompt a more conservative approach.

-

Presentation of analyst predictions and estimations for the 2025 PFC dividend, citing credible sources: Several financial analysts have offered their predictions for the 2025 PFC dividend. [Cite sources and mention specific predictions, making sure to qualify them with phrases like "according to," or "analyst projections suggest"]. It’s vital to remember that these are estimations, and the actual dividend may differ.

Factors Affecting the March 12th PFC Dividend Announcement

The March 12th PFC dividend announcement will be influenced by a complex interplay of factors. Keywords: PFC Financial Performance, Market Volatility, Economic Factors, PFC Dividend Policy

-

Detailed examination of PFC's recent financial performance, including revenue growth, earnings, and debt levels: A thorough review of PFC's recent financial statements is essential. Strong revenue growth, high earnings, and manageable debt levels suggest a higher likelihood of a substantial dividend. Conversely, weak financial performance may result in a lower dividend or even a suspension. [Include data points and analysis here].

-

Analysis of current market conditions and their potential impact on the dividend payout: Market volatility and economic uncertainty can significantly influence PFC's decision. A volatile market might lead to a more cautious approach, potentially resulting in a lower dividend payout. Conversely, a stable and growing market could allow for a more generous dividend.

-

Discussion of any significant economic events that could influence PFC's decision: Any significant economic events, such as changes in interest rates, inflation levels, or geopolitical instability, could affect PFC's financial performance and its ability to maintain a consistent dividend. [Discuss any relevant current events].

-

Explanation of PFC's dividend policy and its implications for the upcoming announcement: Understanding PFC's official dividend policy is vital. Does the company have a target payout ratio? What are its priorities regarding dividend growth versus reinvestment in the business? This information will provide further context for the upcoming announcement.

Preparing for the PFC Dividend Announcement on March 12th

The March 12th announcement requires preparation from investors. Keywords: PFC Stock, Investment Strategy, Dividend Investing, Tax Implications

-

Advice for investors on how to prepare for the announcement (e.g., reviewing their investment strategy, understanding tax implications): Before the announcement, investors should review their overall investment strategy. They should also understand the tax implications of receiving dividends. This includes understanding their tax bracket and any applicable tax rates on dividend income.

-

Guidance on how to react to the announcement depending on the declared dividend amount (e.g., holding, buying, selling): The investor's reaction will depend on the declared dividend and their individual investment goals. A higher-than-expected dividend might encourage holding or even buying more shares, while a lower-than-expected dividend might lead some investors to consider selling.

-

Discussion of the potential impact of the announcement on PFC's stock price: The announcement is likely to affect PFC's stock price. A higher-than-expected dividend could lead to a short-term price increase, while a lower-than-expected dividend could result in a price drop. Investors should be prepared for potential volatility.

-

Recommendations on where to find official updates and reliable information about the PFC dividend: Investors should rely on official company announcements and reputable financial news sources for accurate information. Avoid relying on unverified sources or social media speculation.

Conclusion

The March 12th announcement regarding the 2025 PFC dividend is a pivotal event for investors. Understanding the historical context, influencing factors, and potential implications allows for informed decision-making. By carefully considering PFC’s financial performance and market conditions, investors can better prepare for the announcement and adjust their investment strategies accordingly.

Call to Action: Stay informed about the upcoming PFC Dividend 2025 announcement on March 12th. Monitor reliable financial news sources and consider consulting a financial advisor to optimize your investment strategy regarding the expected PFC dividend payment. Don't miss out on crucial information regarding your PFC investment!

Featured Posts

-

Pfc Dividend 2025 Expected Cash Reward Announcement Date Confirmed

Apr 27, 2025

Pfc Dividend 2025 Expected Cash Reward Announcement Date Confirmed

Apr 27, 2025 -

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 27, 2025

Justin Herbert Chargers 2025 Season Opener In Brazil Confirmed

Apr 27, 2025 -

1050 V Mware Price Hike At And T Sounds Alarm On Broadcoms Acquisition

Apr 27, 2025

1050 V Mware Price Hike At And T Sounds Alarm On Broadcoms Acquisition

Apr 27, 2025 -

The Psychology Behind Ariana Grandes Style Change Hair Tattoos And Professional Assistance

Apr 27, 2025

The Psychology Behind Ariana Grandes Style Change Hair Tattoos And Professional Assistance

Apr 27, 2025 -

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Latest Posts

-

World Mourns State Funeral For Pope Francis

Apr 28, 2025

World Mourns State Funeral For Pope Francis

Apr 28, 2025 -

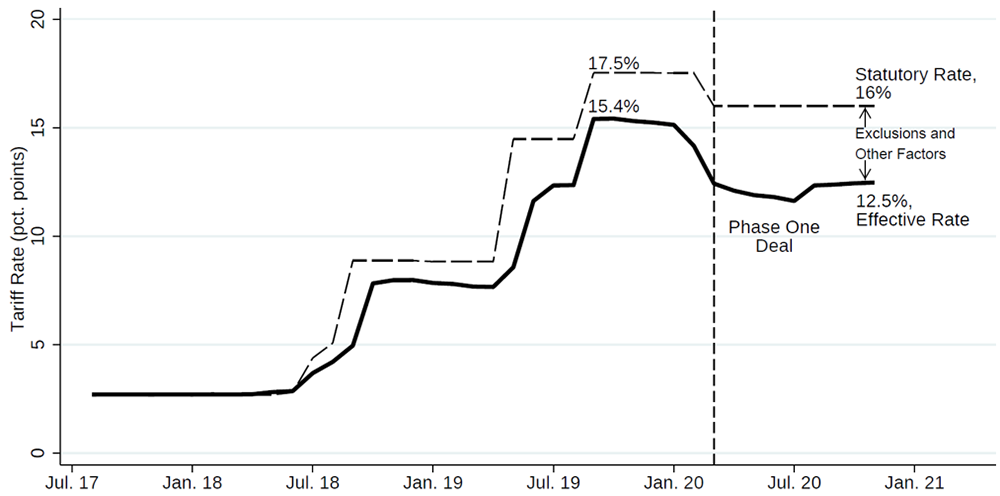

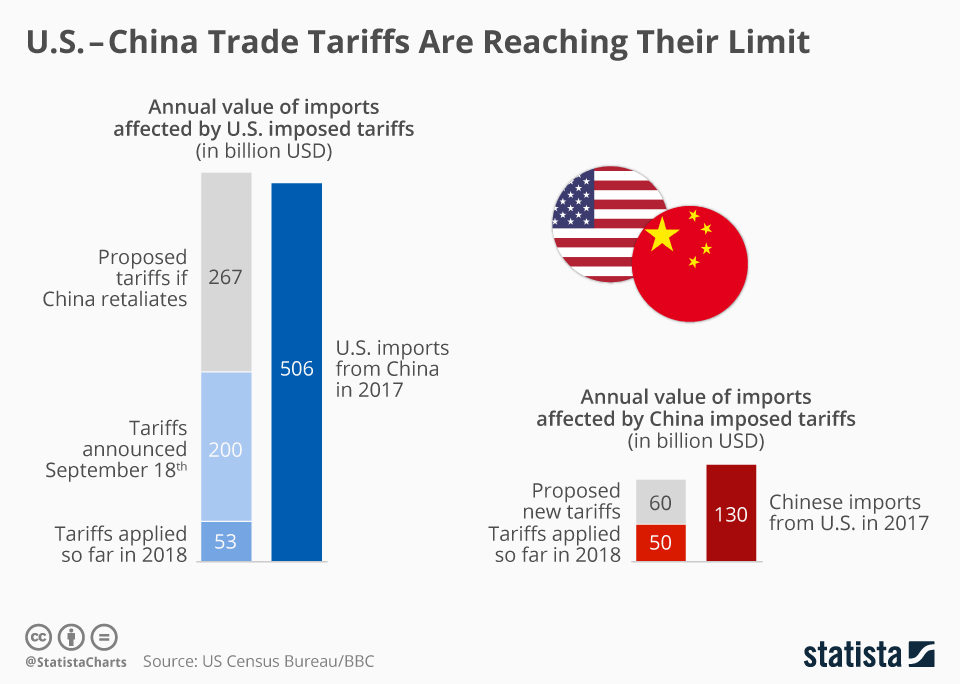

The Nuances Of Chinas Recent Tariff Adjustments On Us Imports

Apr 28, 2025

The Nuances Of Chinas Recent Tariff Adjustments On Us Imports

Apr 28, 2025 -

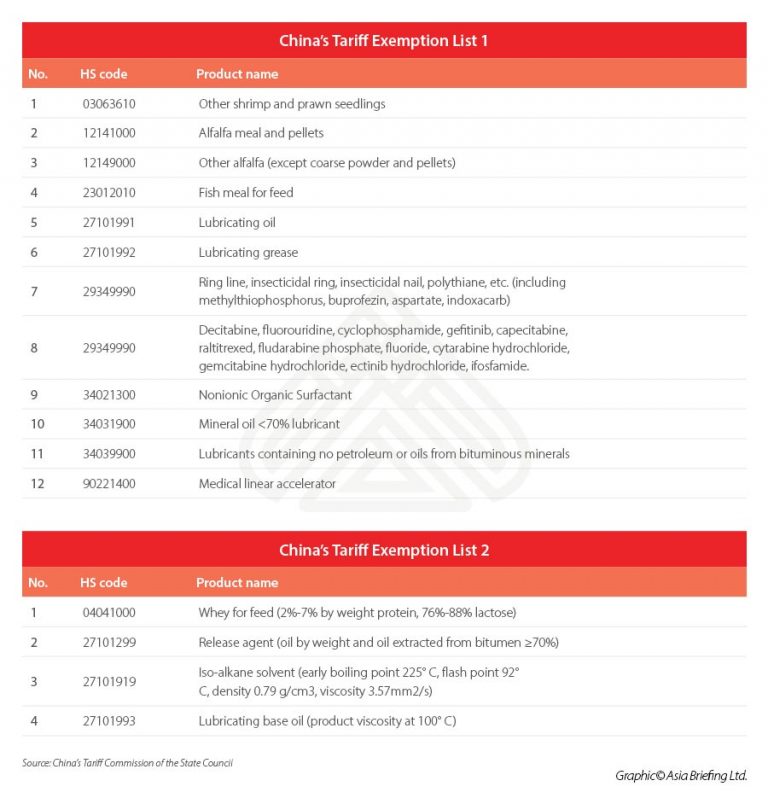

Understanding Chinas Selective Tariff Exemptions For Us Products

Apr 28, 2025

Understanding Chinas Selective Tariff Exemptions For Us Products

Apr 28, 2025 -

China Adjusts Tariffs Implications For Us China Trade Relations

Apr 28, 2025

China Adjusts Tariffs Implications For Us China Trade Relations

Apr 28, 2025 -

Shifting Trade Dynamics Chinas Partial Tariff Rollback On Us Goods

Apr 28, 2025

Shifting Trade Dynamics Chinas Partial Tariff Rollback On Us Goods

Apr 28, 2025