Falling Dutch Stock Prices Reflect US Trade Tensions

Table of Contents

The Impact of US Trade Policies on the Dutch Economy

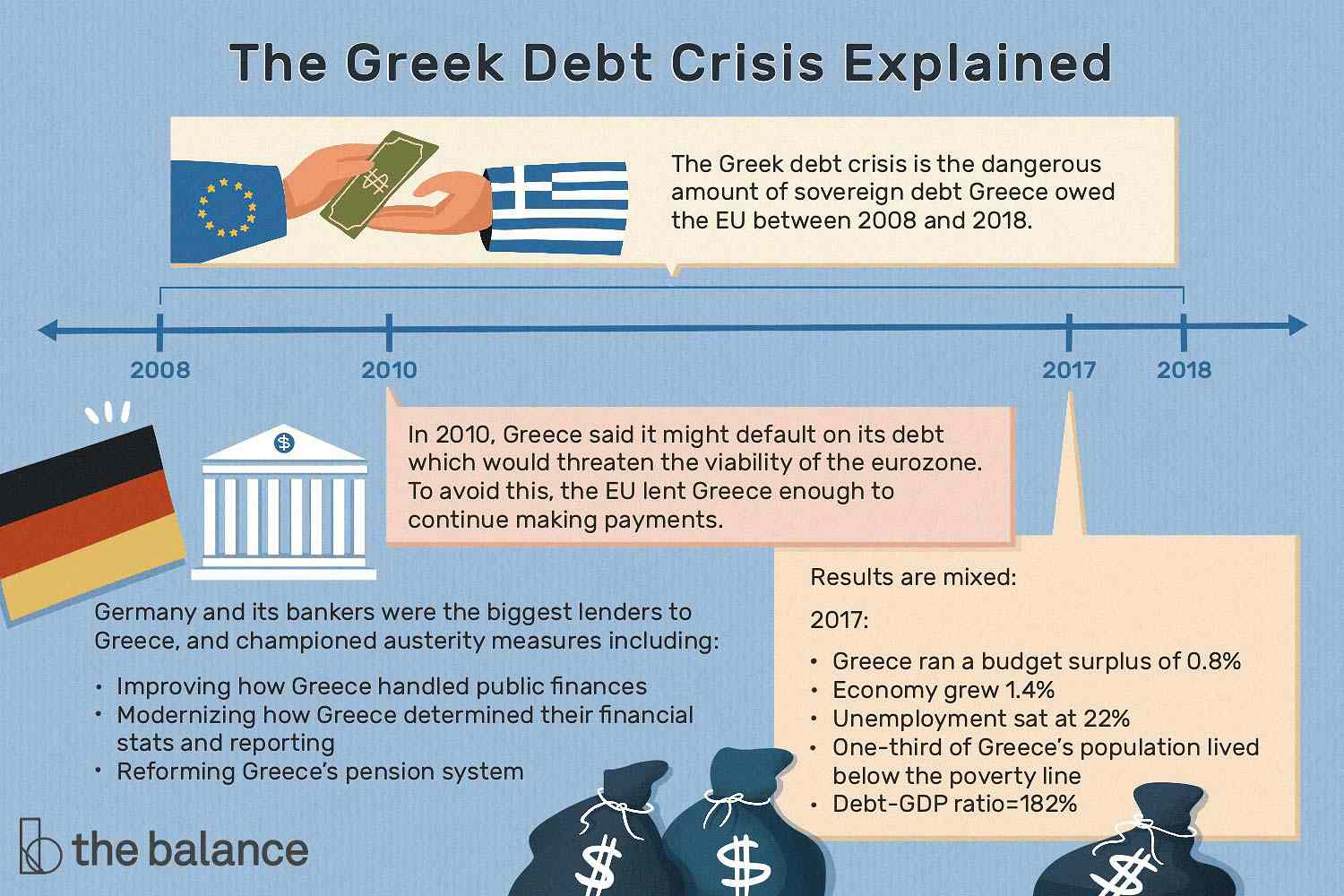

The US and Dutch economies are deeply interconnected through extensive trade relationships and investment flows. The Netherlands, a major hub for international trade and finance, is particularly vulnerable to shifts in US trade policy. Specific US trade policies significantly impacting Dutch businesses include:

- Tariffs on Dutch exports to the US: These tariffs, particularly affecting agricultural products (like dairy and flowers) and technology exports, directly reduce the profitability of Dutch companies and hinder their competitiveness in the US market. Increased costs are passed on to consumers, impacting demand.

- Trade disputes and their effect on supply chains: The ongoing trade disputes disrupt established supply chains, leading to delays, increased costs, and uncertainty for Dutch businesses reliant on US imports or exports. This uncertainty makes long-term planning difficult.

- Uncertainty caused by fluctuating US trade policies: The unpredictable nature of US trade policies creates a climate of instability, discouraging investment and hindering economic growth in the Netherlands. Businesses hesitate to make long-term commitments in such an uncertain environment.

The agricultural and manufacturing sectors in the Netherlands are particularly vulnerable to US trade decisions. Data from the Netherlands Bureau for Economic Policy Analysis (CPB) shows a clear correlation between increased US tariffs and a slowdown in Dutch export growth to the US. For instance, a recent report indicated a [Insert Percentage]% decrease in agricultural exports following the implementation of specific US tariffs. This directly affects GDP growth and overall economic performance.

Analysis of Falling Dutch Stock Prices

Recent trends in the AEX index, the benchmark for the Amsterdam Stock Exchange, reflect a concerning decline in Dutch stock prices. [Insert a graph or chart visually representing the decline in the AEX index]. This downturn is not solely attributable to US trade tensions but is significantly influenced by them. Contributing factors include:

- Investor sentiment and decreased confidence: Escalating trade tensions lead to decreased investor confidence, prompting many to withdraw investments from Dutch markets and seek safer havens.

- Capital flight: As investors seek less risky investment opportunities, capital is flowing out of the Dutch market, further depressing stock prices.

- Decreased profitability for Dutch companies: Companies directly impacted by US tariffs experience reduced profitability, lowering their stock valuations.

Specific Dutch companies heavily reliant on US trade, such as those in the agricultural and technology sectors, have witnessed disproportionately large drops in their share prices compared to companies with more diversified export markets. For example, [mention a specific company and its stock performance].

The Role of Global Uncertainty in Exacerbating the Decline

The decline in Dutch stock prices isn't solely a result of US trade tensions; broader global economic uncertainty plays a significant role. This includes:

- Brexit and its uncertainty: The ongoing Brexit situation creates global economic instability, impacting investor confidence and affecting Dutch businesses trading with the UK.

- Geopolitical tensions: Global geopolitical tensions, including conflicts and regional instability, further contribute to market volatility and influence investor decisions negatively impacting the Dutch market.

- The impact of rising interest rates: Rising interest rates globally impact borrowing costs for businesses and investors, decreasing overall confidence and leading to a sell-off in stock markets, including the Netherlands.

These global factors amplify the impact of US trade tensions, creating a perfect storm that negatively affects Dutch stock prices.

Mitigation Strategies for Dutch Businesses

Dutch businesses can implement various strategies to mitigate the impact of US trade tensions and global uncertainty:

- Diversification of export markets: Reducing reliance on the US market by diversifying export destinations can lessen the impact of US tariffs and trade disputes.

- Hedging strategies: Implementing hedging strategies to mitigate currency risks and protect against price fluctuations can help companies to better manage their financial exposure.

- Risk management techniques: Employing robust risk management techniques helps businesses anticipate and prepare for potential disruptions in supply chains and trade flows.

The Dutch government can also play a role by offering financial support, promoting diversification, and actively engaging in diplomatic efforts to resolve trade disputes.

Conclusion

The fall in Dutch stock prices is demonstrably linked to escalating US trade tensions, further amplified by broader global uncertainties. The impact is felt across various Dutch sectors, particularly those heavily reliant on US trade. The interconnectedness of global markets underscores the significant ripple effect of US trade policies. To effectively manage risks and navigate this changing landscape, it's crucial to stay informed about developments in US trade policy and global economics. Closely monitor Dutch stock prices and their correlation with US trade tensions for informed investment decisions. Understanding these dynamics is essential for making sound investment decisions and ensuring the long-term health of the Dutch economy.

Featured Posts

-

Paris Luxury Goods Downturn Impacts Citys Finances

May 25, 2025

Paris Luxury Goods Downturn Impacts Citys Finances

May 25, 2025 -

Sadie Sink And Mia Farrow Backstage At Photo 5162787

May 25, 2025

Sadie Sink And Mia Farrow Backstage At Photo 5162787

May 25, 2025 -

40 Svadeb Na Kharkovschine Kakaya Data Stala Stol Populyarnoy Foto

May 25, 2025

40 Svadeb Na Kharkovschine Kakaya Data Stala Stol Populyarnoy Foto

May 25, 2025 -

Uncovering The History Of Burys Proposed M62 Relief Route

May 25, 2025

Uncovering The History Of Burys Proposed M62 Relief Route

May 25, 2025 -

Yevrobachennya 2025 Chotiri Potentsiynikh Peremozhtsi Za Versiyeyu Konchiti Vurst Unian

May 25, 2025

Yevrobachennya 2025 Chotiri Potentsiynikh Peremozhtsi Za Versiyeyu Konchiti Vurst Unian

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025 -

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025 -

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025 -

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025