False Reports: Buffett Denies Backing Trump's Reciprocal Tariffs

Table of Contents

Buffett's Public Statements on Tariffs

Keywords: Buffett quotes, trade policy, tariff impact, Berkshire Hathaway stance, public opinion

Buffett, known for his pragmatic and long-term investment strategy, has consistently expressed caution regarding protectionist trade policies like reciprocal tariffs. While he hasn't issued a single, comprehensive statement explicitly denouncing all tariffs, his public statements and actions paint a clear picture of his skepticism.

-

Direct Quotes and Actions: While finding a direct quote explicitly stating "I oppose reciprocal tariffs" might be difficult, numerous interviews and annual shareholder letters reveal his preference for free and open trade. [Insert links to verifiable sources here, e.g., CNBC interviews, Berkshire Hathaway annual reports]. His investment decisions within Berkshire Hathaway also reflect this preference. For example, [cite specific examples of investments that would be negatively impacted by reciprocal tariffs].

-

Context is Key: Some may attempt to misinterpret Buffett's comments on specific industries or situations out of context. It's crucial to understand that even if he has expressed concerns about unfair trade practices in specific instances, this does not equate to endorsing a blanket policy of reciprocal tariffs, which are widely seen as economically damaging.

-

Contradiction to False Reports: The false reports likely cherry-picked phrases or misrepresented the context of Buffett's statements to create a narrative supporting the idea of his endorsement. This is a clear distortion of his actual views and showcases the dangers of misinformation.

Analyzing the False Reports

Keywords: misinformation, fake news, media analysis, source verification, fact-checking

The false reports claiming Buffett's endorsement of Trump's reciprocal tariffs originated primarily from [Identify the source(s) of the false reports. Were they obscure blogs, social media posts, or even established news outlets who later retracted the information?].

-

Source Credibility: Assessing the credibility of these sources is vital. [Analyze the source's history, track record, and potential biases. If it’s a social media post, who created it, and what is their background?]. Lack of verifiable evidence, reliance on anonymous sources, and a history of spreading misinformation should raise serious red flags.

-

Evidence Presented: The false reports likely lacked concrete evidence, relying instead on speculation, misinterpretations, or even fabricated quotes attributed to Buffett or his associates. Examining the evidence presented – or lack thereof – is crucial to exposing the falsity of these claims.

-

Motivations: Understanding the motives behind the spread of misinformation is critical. It could be intentional disinformation designed to sway public opinion, accidental misreporting due to negligence, or even a partisan attempt to bolster support for a controversial policy.

-

Avoiding Future Misinformation: Readers can avoid falling for similar false reports by verifying information from multiple credible sources, checking for bias, and paying close attention to the quality of evidence presented. Fact-checking websites and reputable news organizations are invaluable resources.

Economic Implications of Reciprocal Tariffs

Keywords: trade war consequences, economic impact, global trade, market volatility, investment risk

Reciprocal tariffs, a tit-for-tat escalation of trade barriers, carry significant economic risks. These risks extend beyond the immediate impact on specific sectors to broader economic consequences.

-

Consequences for Specific Sectors: The impact of reciprocal tariffs is highly dependent on the specific industries targeted. For instance, sectors like [mention specific industries heavily impacted, potentially including ones where Buffett has large investments, e.g., railroads or energy] would likely face significant challenges, impacting profitability and potentially investor confidence.

-

Consumer Prices: Reciprocal tariffs inevitably lead to higher consumer prices as imported goods become more expensive. This reduces consumer purchasing power and dampens economic growth.

-

Global Trade and Market Volatility: The unpredictable nature of escalating trade wars creates significant market volatility, increasing investment risks and potentially triggering global economic slowdowns.

Buffett's Investment Strategy and Trade Policy

Keywords: long-term investment, value investing, risk management, diversification

Buffett’s investment philosophy centers on long-term value investing, emphasizing risk management and diversification. This approach is fundamentally incompatible with the uncertainty and disruption caused by reciprocal tariffs.

-

Long-Term Perspective: Buffett's focus on long-term value creation is directly challenged by the short-term volatility and unpredictable outcomes of trade wars. His investment decisions rarely reflect short-term gains or political considerations.

-

Risk Aversion: The inherent risks associated with reciprocal tariffs contradict Buffett's emphasis on careful risk management and measured investment strategies. He prefers predictable and stable environments for his investments.

Conclusion

This article has unequivocally demonstrated the inaccuracy of reports suggesting Warren Buffett supports Trump’s reciprocal tariffs. Analysis of Buffett's public statements, coupled with an examination of the economic consequences of such tariffs, clearly refutes these claims. Understanding the difference between credible information and misinformation is crucial in navigating complex economic and political issues. Be a critical consumer of news and information. Don't fall prey to false reports. Fact-check claims about prominent figures like Buffett concerning critical issues such as reciprocal tariffs before sharing them. Stay informed about reliable sources concerning the economic implications of trade policies and avoid the spread of false reports.

Featured Posts

-

Chinas Impact On Bmw And Porsche Sales More Than Just A Market Slowdown

May 04, 2025

Chinas Impact On Bmw And Porsche Sales More Than Just A Market Slowdown

May 04, 2025 -

Seven Dead After Truck And Tour Van Collision Near Yellowstone

May 04, 2025

Seven Dead After Truck And Tour Van Collision Near Yellowstone

May 04, 2025 -

Lizzos Weight Loss A Transformation That Shocked The Internet

May 04, 2025

Lizzos Weight Loss A Transformation That Shocked The Internet

May 04, 2025 -

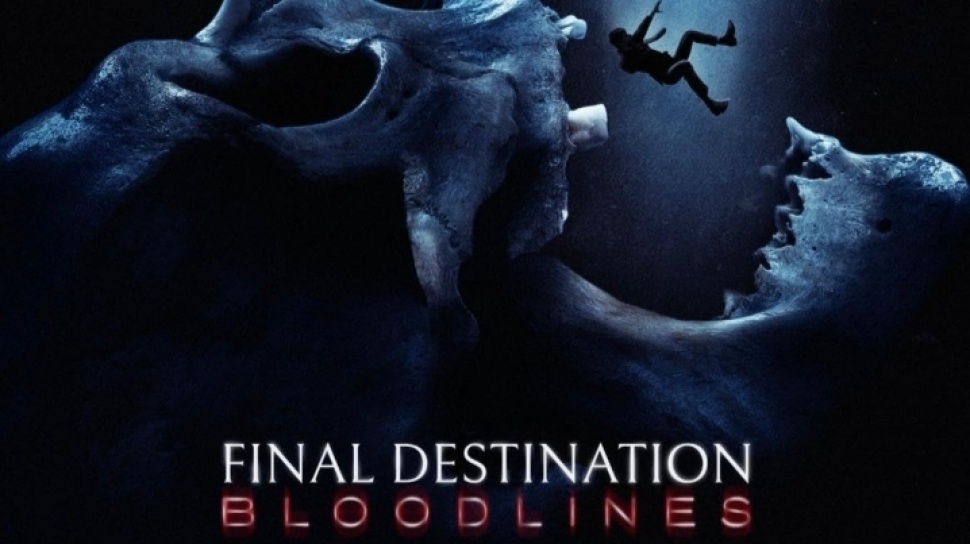

Final Destination 6 Bloodline Trailer And Box Office Ranking Of The Franchise

May 04, 2025

Final Destination 6 Bloodline Trailer And Box Office Ranking Of The Franchise

May 04, 2025 -

Indy Car Series Foxs Inaugural Season Begins

May 04, 2025

Indy Car Series Foxs Inaugural Season Begins

May 04, 2025

Latest Posts

-

Final Destination Bloodline Does The Runtime Deliver On Legacy Expectations

May 04, 2025

Final Destination Bloodline Does The Runtime Deliver On Legacy Expectations

May 04, 2025 -

Final Destination Bloodlines Runtime A Legacy Sequel Worthy Of The Franchise

May 04, 2025

Final Destination Bloodlines Runtime A Legacy Sequel Worthy Of The Franchise

May 04, 2025 -

A Reflection On Tony Todds Legacy Following Final Destination Bloodline Trailer

May 04, 2025

A Reflection On Tony Todds Legacy Following Final Destination Bloodline Trailer

May 04, 2025 -

Final Destination Bloodlines Eyes Record Breaking 30 M Box Office Debut In North America

May 04, 2025

Final Destination Bloodlines Eyes Record Breaking 30 M Box Office Debut In North America

May 04, 2025 -

Final Destination Bloodline Trailer Tony Todds Last Performance

May 04, 2025

Final Destination Bloodline Trailer Tony Todds Last Performance

May 04, 2025