Farage Reaches Agreement With NatWest After De-banking Row

Table of Contents

The Details of the Settlement

While the exact terms of the agreement reached between Nigel Farage and NatWest remain largely confidential, certain key outcomes have been made public. The settlement represents a significant conclusion to a protracted and highly publicized battle. The specifics of any financial compensation remain undisclosed, however, the focus is shifted away from the financial aspects and towards the broader implications of the de-banking controversy.

-

Key Outcomes: While details are limited, reports suggest a key element involved an apology from NatWest, acknowledging the negative impact of the account closure on Mr. Farage. Whether the account was reinstated or alternative banking arrangements were made has not been publicly confirmed. The absence of a full admission of liability from NatWest is also a notable aspect.

-

Public Statements: Both parties released carefully worded statements following the settlement. NatWest emphasized its commitment to upholding high standards in its customer service, while Farage highlighted the importance of fair treatment for all customers.

-

Lack of Liability Admission: Crucially, NatWest has reportedly avoided a formal admission of liability in the settlement. This nuanced aspect of the agreement leaves open the possibility of future legal challenges or further investigations into the de-banking process.

The Wider Implications of the De-banking Controversy

The Farage-NatWest de-banking row has far-reaching consequences, extending beyond the immediate parties involved. Its ramifications touch upon the political landscape, the financial services industry, and fundamental rights.

Political Ramifications

The de-banking controversy has had significant political fallout. The case fueled accusations of political bias within the financial sector and sparked calls for increased regulatory scrutiny of banking practices.

-

Political Pressure: The case attracted significant political attention, with prominent figures across the political spectrum weighing in on the issue. This public scrutiny placed considerable pressure on NatWest.

-

Potential Regulatory Changes: The incident has prompted discussions regarding the need for new regulations to prevent politically motivated de-banking. Expect greater transparency requirements and potentially stronger oversight of financial institutions' client selection processes.

-

Farage's Political Capital: The controversy undoubtedly boosted Farage’s profile and served to solidify his narrative of being unfairly targeted for his political views. However, the long-term impact on his political standing remains to be seen.

Impact on Financial Institutions

The de-banking of Nigel Farage has prompted a serious reassessment of risk management procedures by financial institutions across the UK. It raises significant questions about how banks handle high-profile or controversial clients.

-

Changes in Risk Assessment: Banks are likely to review their risk assessment procedures, aiming to avoid similar controversies in the future. This could lead to increased scrutiny of clients' political affiliations and public statements.

-

Legal Ramifications: The case sets a precedent, raising the potential for legal challenges against banks involved in similar de-banking situations. Lawsuits from those alleging political bias are a growing concern.

-

Impact on Customer Trust: The controversy has eroded public trust in the impartiality of some financial institutions. Concerns about freedom of expression and the potential for political interference in banking decisions now permeate public discourse.

Freedom of Speech and Due Process

The central debate surrounding this case centers on the interplay between freedom of speech and a bank's right to choose its clients. Does de-banking constitute an infringement on fundamental rights?

-

Arguments For and Against: Proponents of banks' rights emphasize the need for financial institutions to manage risk, arguing that association with controversial individuals could damage their reputation. Conversely, critics highlight potential for bias and the importance of protecting freedom of expression.

-

Legal Aspects of De-banking: The legal framework surrounding de-banking remains unclear. This case is set to influence future court challenges, establishing precedence in the complex intersection of banking regulations and individual rights.

-

Setting a Precedent: The outcome of the Farage-NatWest settlement, especially any further legal challenges, will have a significant impact on future cases of de-banking and may lead to significant changes in how financial institutions operate and how customers are treated.

The Future of De-banking

The Farage-NatWest case is unlikely to be an isolated incident. The question remains: what measures can be implemented to prevent similar situations from arising in the future?

-

Regulatory Changes: Increased regulation aimed at preventing politically motivated de-banking appears inevitable. Expect greater transparency and stricter guidelines surrounding client selection.

-

Improving Bank Transparency: Banks need to improve transparency and accountability in their decision-making processes. Clearer guidelines and greater scrutiny of these processes will be necessary to restore customer confidence.

-

Ongoing Inquiries: Expect further inquiries and investigations into de-banking practices, leading to potential reforms and a reassessment of the relationship between financial institutions and their customers.

Conclusion

The settlement between Nigel Farage and NatWest concludes a significant chapter in the ongoing debate surrounding de-banking. The agreement, while shrouded in some secrecy, highlights the complex interplay between freedom of speech, political influence, and the responsibilities of financial institutions. This case has raised critical questions regarding customer rights, banking practices, and the potential for political bias in the financial sector. The implications for banking regulations, freedom of expression, and the overall trust in the financial system are far-reaching and deserve continuous scrutiny. Stay informed on developments in this evolving situation to fully understand the future of de-banking and related financial controversies. Follow our updates for further analysis on de-banking and related financial controversies.

Featured Posts

-

Eneco Innomotics And Johnson Controls Partner On Gigantic Heat Pump Project

May 03, 2025

Eneco Innomotics And Johnson Controls Partner On Gigantic Heat Pump Project

May 03, 2025 -

Vuelta Ciclista A Murcia Christen Conquista La Victoria

May 03, 2025

Vuelta Ciclista A Murcia Christen Conquista La Victoria

May 03, 2025 -

Macron Et Sardou Un Diner Tendu Ca Vient Du Ventre

May 03, 2025

Macron Et Sardou Un Diner Tendu Ca Vient Du Ventre

May 03, 2025 -

New Fortnite Leak Points To Lara Crofts Speedy Return

May 03, 2025

New Fortnite Leak Points To Lara Crofts Speedy Return

May 03, 2025 -

Fortnite Community Outraged By Recent Shop Update Changes

May 03, 2025

Fortnite Community Outraged By Recent Shop Update Changes

May 03, 2025

Latest Posts

-

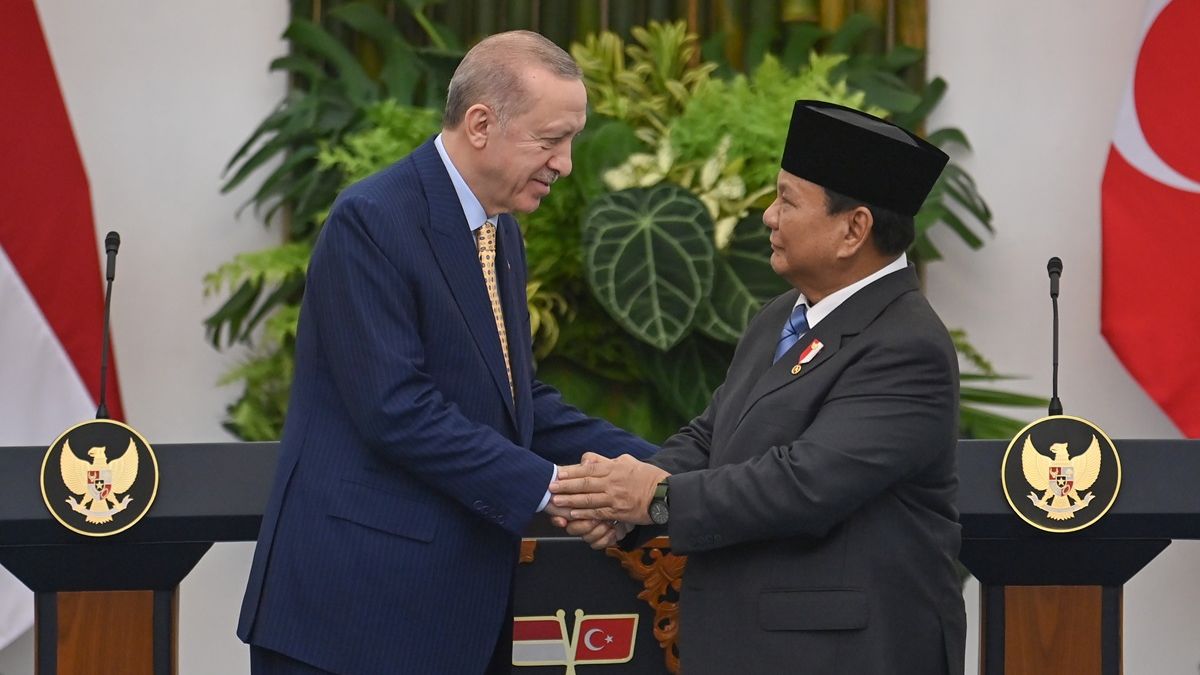

13 Kesepakatan Kerja Sama Ri Turkiye Suksesnya Kunjungan Presiden Erdogan Ke Indonesia

May 03, 2025

13 Kesepakatan Kerja Sama Ri Turkiye Suksesnya Kunjungan Presiden Erdogan Ke Indonesia

May 03, 2025 -

Indonesia Turkiye Perkuat Kerja Sama 13 Poin Kesepakatan Kunjungan Presiden Erdogan

May 03, 2025

Indonesia Turkiye Perkuat Kerja Sama 13 Poin Kesepakatan Kunjungan Presiden Erdogan

May 03, 2025 -

Kunjungan Presiden Erdogan Ke Indonesia 13 Kerja Sama Ri Turkiye Disepakati

May 03, 2025

Kunjungan Presiden Erdogan Ke Indonesia 13 Kerja Sama Ri Turkiye Disepakati

May 03, 2025 -

Torgovlya Lyudmi V Sogde Obsuzhdenie Mer Protivodeystviya I Plany Na Buduschee

May 03, 2025

Torgovlya Lyudmi V Sogde Obsuzhdenie Mer Protivodeystviya I Plany Na Buduschee

May 03, 2025 -

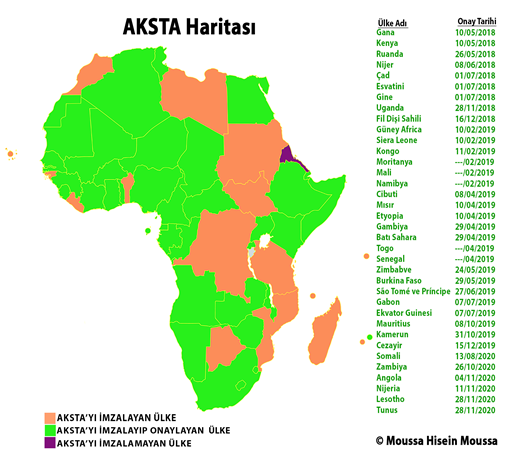

Birlesik Arap Emirlikleri Ve Orta Afrika Cumhuriyeti Nin Ticaret Anlasmasi

May 03, 2025

Birlesik Arap Emirlikleri Ve Orta Afrika Cumhuriyeti Nin Ticaret Anlasmasi

May 03, 2025