Fed Chairman Powell: Trade Tariffs Pose Significant Economic Risks

Table of Contents

Powell's Concerns Regarding Inflationary Pressures from Tariffs

Trade tariffs, essentially taxes on imported goods, directly increase the cost of those goods. This increase is not absorbed by importers; instead, it's largely passed on to consumers, leading to higher prices and fueling inflationary pressures. This is a significant concern, especially in a climate already grappling with potential inflation.

- The Mechanism: Tariffs directly increase the price of imported goods at the point of entry into the country. This added cost is then factored into the final price paid by consumers.

- Secondary Inflationary Effects: Businesses, facing higher input costs due to tariffs, often pass these increased costs onto consumers to maintain profit margins, further exacerbating inflationary pressures.

- Sectoral Impact: Industries heavily reliant on imported components or raw materials, such as manufacturing and construction, are particularly vulnerable to tariff-induced price increases.

- Data and Evidence: Recent data showing a surge in import prices and a rise in consumer price indices (CPI) in certain sectors strongly corroborates Powell's concerns. [Link to relevant data source here].

The Impact of Tariffs on Economic Growth and Potential Recession

The uncertainty created by trade tariffs significantly dampens business investment. Businesses are hesitant to expand or invest in new projects when facing unpredictable trade policies and potential retaliatory measures. This hesitancy leads to slower economic growth and, in severe cases, can even trigger a recession.

- Uncertainty and Investment: The unpredictable nature of trade wars discourages long-term planning and investment. Businesses prefer stability and predictability when making capital investment decisions.

- Consumer Confidence and Spending: Increased prices due to tariffs negatively impact consumer purchasing power and confidence, leading to reduced consumer spending, a key driver of economic growth.

- Ripple Effects and Job Losses: Reduced investment and decreased production due to tariffs result in job losses across various sectors, further depressing economic activity.

- GDP Forecasts: Economic models suggest that escalating trade tensions and tariffs could significantly reduce GDP growth, with some forecasts predicting a contraction under certain scenarios. [Link to relevant economic forecast here].

Global Trade Implications and Geopolitical Risks

The imposition of trade tariffs rarely remains unilateral. Retaliatory tariffs from other countries often lead to full-blown trade wars, significantly disrupting global trade relationships and posing serious geopolitical risks. The impact on global supply chains is particularly concerning.

- Trade Wars and Retaliation: The tit-for-tat nature of trade disputes can quickly escalate, harming all participating economies and creating widespread economic instability.

- Disrupted Supply Chains: Tariffs disrupt established global supply chains, forcing businesses to find alternative, often more expensive, suppliers, increasing costs and reducing efficiency.

- International Tensions: Trade disputes can exacerbate existing geopolitical tensions, damaging diplomatic relations and undermining international cooperation on other critical issues.

- Historical Precedents: History is rife with examples of trade wars that had severely negative economic and geopolitical consequences. The Smoot-Hawley Tariff Act of 1930 serves as a stark reminder of the devastating impact of protectionist trade policies.

Powell's Recommendations and Policy Responses

While the Federal Reserve cannot directly address the root causes of trade disputes, it can utilize monetary policy tools to mitigate the negative economic consequences. Powell has alluded to the need for careful monitoring and potential adjustments to interest rates to counter inflationary pressures, though he has emphasized the limitations of such measures.

- Monetary Policy Adjustments: The Fed might adjust interest rates to cool down an overheating economy driven by tariff-induced inflation, but this could also negatively impact economic growth.

- Targeted Interventions: The Fed might consider other targeted interventions to support specific sectors most severely impacted by the trade war.

- Limitations of Monetary Policy: Monetary policy alone cannot solve the problems created by trade tariffs; addressing the underlying trade issues is paramount.

Conclusion

Fed Chairman Powell's warnings about the significant economic risks posed by trade tariffs are a serious cause for concern. The potential for increased inflation, slower economic growth, and disruptions to global trade are substantial. The uncertainty surrounding the trajectory of trade relations adds to the risks, underscoring the need for careful consideration of the potential economic consequences. Stay informed about the ongoing impact of trade tariffs on the US economy, understand the risks associated with escalating trade wars, and learn more about the Fed's response to trade tariff pressures. The implications of Fed Chairman Powell's warnings about trade tariffs and their potential economic risks cannot be overstated.

Featured Posts

-

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Anna Wintour Dispute

May 26, 2025

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Anna Wintour Dispute

May 26, 2025 -

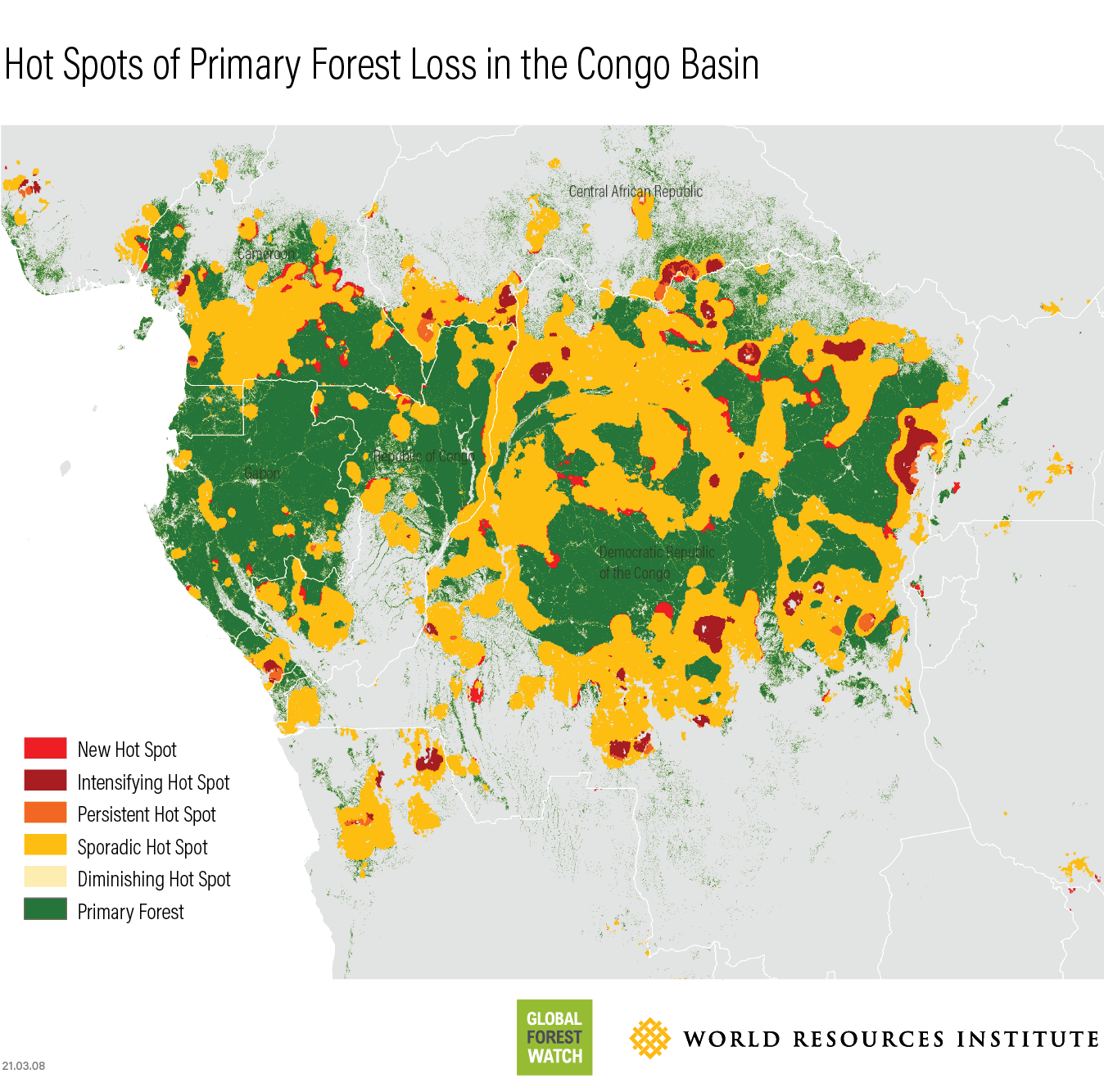

Addressing Record Breaking Global Forest Loss Wildfires And Solutions

May 26, 2025

Addressing Record Breaking Global Forest Loss Wildfires And Solutions

May 26, 2025 -

The Rise And Fall Of Black Lives Matter Plaza A Washington D C Story

May 26, 2025

The Rise And Fall Of Black Lives Matter Plaza A Washington D C Story

May 26, 2025 -

Kazuo Ishiguros Novels A Study Of Remembrance And Oblivion

May 26, 2025

Kazuo Ishiguros Novels A Study Of Remembrance And Oblivion

May 26, 2025 -

The Hells Angels Social Impact And Public Safety Concerns

May 26, 2025

The Hells Angels Social Impact And Public Safety Concerns

May 26, 2025

Latest Posts

-

Astratyjyt Alkhtwt Aljwyt Aljzayryt Lthqyq Alryadt Fy Ifryqya

May 27, 2025

Astratyjyt Alkhtwt Aljwyt Aljzayryt Lthqyq Alryadt Fy Ifryqya

May 27, 2025 -

Msabqt Twzyf Bryd Aljzayr Melwmat Llmtrshhyn Hwl Almrhlt Alqadmt

May 27, 2025

Msabqt Twzyf Bryd Aljzayr Melwmat Llmtrshhyn Hwl Almrhlt Alqadmt

May 27, 2025 -

Aljzayryt Lltyran Nhw Alryadt Fy Alswq Alifryqy

May 27, 2025

Aljzayryt Lltyran Nhw Alryadt Fy Alswq Alifryqy

May 27, 2025 -

Bryd Aljzayr Yeln En Ntayj Msabqt Altwzyf Qaymt Almqbwlyn

May 27, 2025

Bryd Aljzayr Yeln En Ntayj Msabqt Altwzyf Qaymt Almqbwlyn

May 27, 2025 -

Alkhtwt Aljwyt Aljzayryt Tmwh Alryadt Fy Alqart Alifryqyt

May 27, 2025

Alkhtwt Aljwyt Aljzayryt Tmwh Alryadt Fy Alqart Alifryqyt

May 27, 2025