Federal Election And The Canadian Dollar: A Potential Downward Trend

Table of Contents

Political Uncertainty and Market Volatility

Political uncertainty is a significant driver of market volatility, and elections are no exception. The period leading up to and immediately following a federal election often sees increased uncertainty as different parties present contrasting policy platforms. This uncertainty directly impacts currency exchange rates, including the CAD. The lack of clarity about the future economic direction can trigger several reactions:

- Increased volatility in stock markets: Investors become hesitant to make significant investments, leading to fluctuations in stock prices and a general sense of market instability. This uncertainty spills over into the currency market, affecting the CAD's value.

- Potential flight to safety: Investors may move their capital to safer havens, such as the US dollar or other stable currencies, perceived as less risky during periods of political uncertainty. This capital outflow weakens the demand for the CAD, causing its value to decline.

- Uncertainty regarding future government policies: Different political parties often propose vastly different economic policies. This uncertainty makes it difficult for businesses to plan for the future, impacting investment decisions and potentially leading to a weaker CAD.

Historically, Canadian federal elections have shown a correlation between increased political uncertainty and fluctuations in the CAD. For instance, the 2015 election saw some volatility in the days leading up to the results, reflecting investor hesitancy.

Potential Policy Changes and their Impact

Specific policy proposals by different political parties can significantly influence the Canadian economy and, consequently, the CAD. Key areas to watch include:

- Taxation: Changes to corporate tax rates, personal income tax brackets, or capital gains taxes can significantly affect investor confidence and business investment. Lower taxes might attract foreign investment, strengthening the CAD, while higher taxes could have the opposite effect.

- Trade: Canada's trade relationships are vital to its economy. Any changes to trade agreements (e.g., renegotiating NAFTA or pursuing new trade deals) will impact export and import volumes, directly influencing the CAD. Trade disputes can also negatively impact investor sentiment and lead to a weaker CAD.

- Environmental Regulations: Canada's resource-based industries are crucial to its economy. Stringent new environmental regulations could impact these industries, potentially affecting economic growth and the CAD's value. Conversely, policies promoting sustainable development could attract environmentally conscious investors.

Analyzing the potential consequences of each party's policy platform on the Canadian dollar requires careful consideration of its impact on various economic sectors.

Investor Sentiment and Capital Flows

Investor sentiment plays a crucial role in currency fluctuations. Positive news and clear policy platforms tend to attract foreign investment, strengthening the CAD. Conversely, negative news or uncertainty can lead to capital outflow, weakening the currency.

- Capital outflow: Negative news related to the election, such as unexpected election results or policy announcements, can cause investors to withdraw their investments from Canada, leading to a decrease in demand for the CAD.

- Attracting foreign investment: A clear and stable post-election policy environment can reassure investors, encouraging them to invest in Canadian assets and boosting demand for the CAD.

- International investment: The flow of international investment into and out of Canada significantly impacts the CAD's value. A decrease in foreign investment weakens the currency, while an increase strengthens it.

News coverage and media narratives surrounding the election profoundly influence investor decisions and capital flows. Negative or uncertain news tends to drive capital out of Canada, while positive news attracts investment.

The Role of the Bank of Canada

The Bank of Canada plays a critical role in managing the Canadian economy and responding to economic shocks, including those resulting from elections. The Bank might employ several strategies to mitigate election-related volatility:

- Potential interest rate hikes: To combat inflation or stabilize the currency, the Bank of Canada might increase interest rates, making Canadian assets more attractive to foreign investors and potentially supporting the CAD.

- Interventions in the foreign exchange market: In extreme cases, the Bank might intervene directly in the foreign exchange market to influence the CAD's value.

- Communication strategies: The Bank will likely use its communication channels to manage investor expectations and provide guidance on its policy responses to the election outcome.

Conclusion: Navigating the Federal Election and the Canadian Dollar

The Federal Election and the Canadian dollar are inextricably linked. Political uncertainty, potential policy changes, and investor sentiment all contribute to the potential for a downward trend in the CAD during and after the election. Understanding this relationship is essential for anyone with financial interests in Canada. Stay informed about the Federal Election and the Canadian dollar's trajectory by monitoring news from reliable sources and consulting financial experts. Monitor the Canadian dollar closely during this period of political uncertainty and prepare for potential volatility in the Canadian dollar linked to the Federal Election. For further information on currency exchange rates and political analysis, consider consulting reputable financial news websites and economic forecasting agencies.

Featured Posts

-

Glissieres De Securite Routiere Impact Sur La Mortalite Et Amelioration De La Securite

Apr 30, 2025

Glissieres De Securite Routiere Impact Sur La Mortalite Et Amelioration De La Securite

Apr 30, 2025 -

Quan Quan Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet

Apr 30, 2025

Quan Quan Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet

Apr 30, 2025 -

Communique De Presse Amf Kering 2025 E1021784 24 02 2025

Apr 30, 2025

Communique De Presse Amf Kering 2025 E1021784 24 02 2025

Apr 30, 2025 -

Rapport Sur Le Document Amf Cp 2025 E1029768 D Ubisoft

Apr 30, 2025

Rapport Sur Le Document Amf Cp 2025 E1029768 D Ubisoft

Apr 30, 2025 -

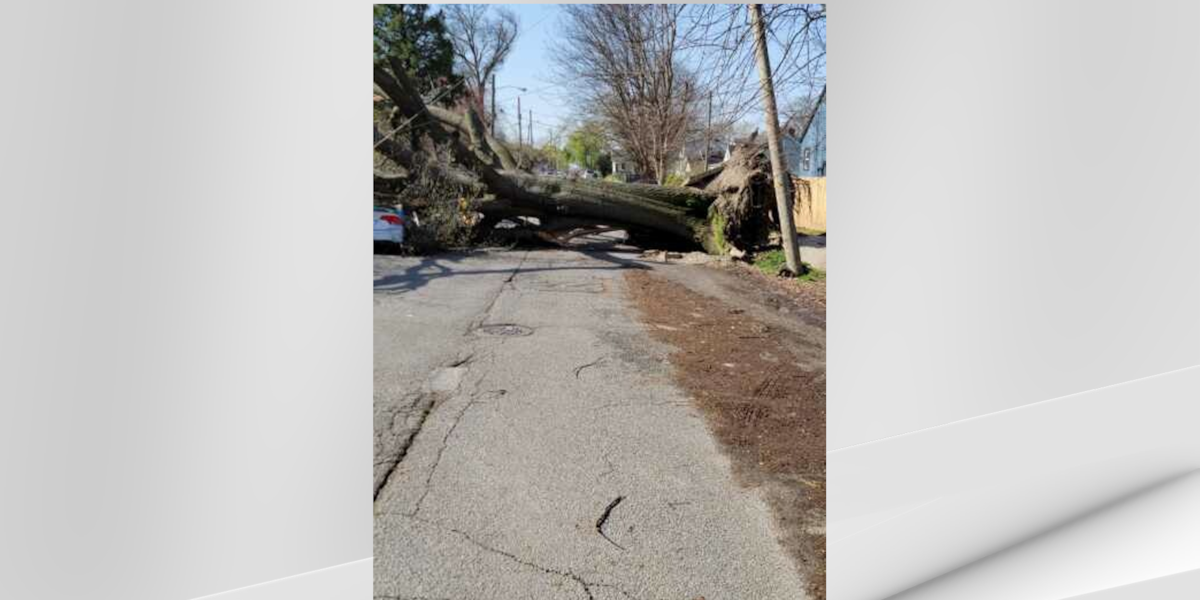

Louisville Opens Storm Debris Removal Request System

Apr 30, 2025

Louisville Opens Storm Debris Removal Request System

Apr 30, 2025