Federal Election And The Loonie: A Potential Fall?

Table of Contents

Historical Precedents: How Past Elections Affected the Loonie

Examining past Canadian federal elections reveals a correlation between political uncertainty and fluctuations in the Loonie's value. While not always directly causal, elections often introduce volatility into the currency exchange rate. For example, the 2015 federal election saw a period of slight weakening in the Loonie leading up to the vote, followed by a period of stabilization after a clear winner emerged. Similarly, the 2019 election saw some minor fluctuations, though less pronounced than in previous elections.

Key factors influencing these fluctuations include:

- Policy uncertainty: The uncertainty surrounding the potential policy changes of a new government can create market hesitancy.

- Market sentiment: Investor confidence, or lack thereof, plays a significant role in currency trading. Negative sentiment can lead to a weaker Loonie.

- Investor confidence: A clear mandate and a stable government generally boost investor confidence, strengthening the currency. Conversely, a minority government or a hung parliament can lead to uncertainty and weaken the Loonie.

- International market conditions: Global economic factors, independent of the Canadian election, can amplify or dampen the election's impact on the Loonie.

Key Policy Platforms and Their Potential Impact

Analyzing the major parties' economic platforms is crucial to understanding their potential impact on the Loonie. Key areas to examine include fiscal policy, monetary policy, and trade policy.

-

Fiscal policy: Differing approaches to government spending and budget deficits will directly impact the CAD. A platform promoting increased government spending may lead to a weaker Loonie due to increased borrowing, while a fiscally conservative approach might strengthen it.

-

Monetary policy: Each party's stance on interest rates affects the Loonie. Higher interest rates typically attract foreign investment, strengthening the currency. Lower interest rates can weaken the currency, as investors might seek higher returns elsewhere.

Let's consider hypothetical examples:

- Party A's stance on increased infrastructure spending: This could lead to a short-term weakening of the Loonie due to increased government borrowing, but potentially strengthen it long-term if the spending boosts economic growth.

- Party B's stance on fiscal austerity: This could lead to a stronger Loonie in the short term due to reduced government debt, but potentially slower economic growth.

- Party C's stance on renegotiating trade deals: This could impact the Loonie positively or negatively depending on the success of these negotiations and their effects on exports and imports.

External Factors Influencing the Loonie Beyond the Election

It's vital to remember that the Loonie's value isn't solely determined by domestic political events. Several global economic factors significantly influence its performance:

- Global economic growth: A strong global economy generally benefits commodity-exporting nations like Canada, strengthening the Loonie.

- Commodity prices (oil, etc.): As a major exporter of commodities, Canada's currency is highly sensitive to fluctuations in commodity prices, particularly oil. Higher prices generally strengthen the Loonie.

- US dollar movements: The US dollar is a major player in the global currency market, and its movements significantly impact the Loonie, given the close economic ties between Canada and the US. A stronger US dollar typically weakens the Loonie.

- Interest rate differentials: The difference between Canadian and US interest rates influences capital flows and, consequently, the Loonie's value.

The Role of Investor Sentiment and Market Volatility

Investor sentiment and market volatility play a crucial role in determining currency exchange rates. During an election, uncertainty creates volatility. Investors may adopt a "wait-and-see" approach, reducing investment and potentially weakening the Loonie. Increased volatility makes it harder to predict the Loonie's future value, creating risks for businesses involved in international trade. Uncertainty can also lead to capital flight, further impacting the currency's value.

Conclusion: Navigating the Federal Election and the Loonie's Future

The upcoming federal election presents both opportunities and risks for the Loonie. While historical precedents show some correlation between elections and currency fluctuations, the ultimate impact will depend on a complex interplay of domestic policies and external economic factors. Investors and businesses need to consider both the potential positive and negative scenarios stemming from the election results. A strong, decisive government might boost investor confidence, strengthening the Loonie, while uncertainty surrounding a minority government or closely contested results could weaken it. Careful monitoring of market sentiment, economic indicators, and global events is critical for effective currency risk management.

Stay informed about the upcoming federal election and its potential impact on the Loonie to make informed financial decisions. For further information, consult resources such as [link to Bank of Canada forecasts] and [link to reputable economic analysis website].

Featured Posts

-

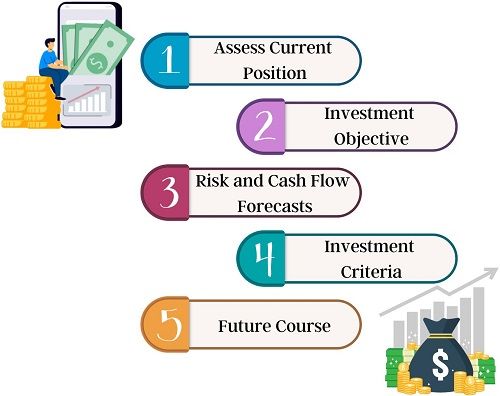

Understanding The Dragons Den Investment Process From Application To Deal

May 01, 2025

Understanding The Dragons Den Investment Process From Application To Deal

May 01, 2025 -

The Crucial Role Of Middle Managers In Employee Development And Company Growth

May 01, 2025

The Crucial Role Of Middle Managers In Employee Development And Company Growth

May 01, 2025 -

Angels Season Starts With Injury And Walk Woes

May 01, 2025

Angels Season Starts With Injury And Walk Woes

May 01, 2025 -

Ripple And Sec Near Settlement Latest News On Xrp Classification

May 01, 2025

Ripple And Sec Near Settlement Latest News On Xrp Classification

May 01, 2025 -

Royals Fall To Guardians In Extra Innings Thriller

May 01, 2025

Royals Fall To Guardians In Extra Innings Thriller

May 01, 2025

Latest Posts

-

Ricordando Mario Nanni Maestro Del Giornalismo E Della Politica Italiana

May 01, 2025

Ricordando Mario Nanni Maestro Del Giornalismo E Della Politica Italiana

May 01, 2025 -

Feltri E La Crocifissione Un Interpretazione

May 01, 2025

Feltri E La Crocifissione Un Interpretazione

May 01, 2025 -

Mario Nanni Celebrazione Della Sua Carriera Nel Giornalismo Parlamentare

May 01, 2025

Mario Nanni Celebrazione Della Sua Carriera Nel Giornalismo Parlamentare

May 01, 2025 -

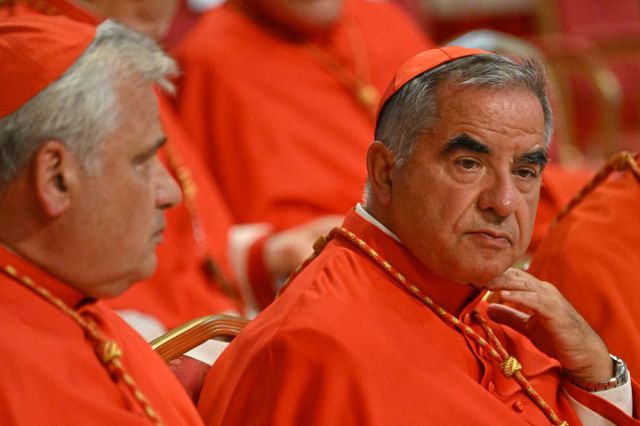

Papa Francesco Aggiornamenti Sul Caso Cardinale Becciu E Le Sue Dimissioni

May 01, 2025

Papa Francesco Aggiornamenti Sul Caso Cardinale Becciu E Le Sue Dimissioni

May 01, 2025 -

Chat Compromettenti Pubblicate Da Domani Il Complotto Becciu E Le Sue Conseguenze

May 01, 2025

Chat Compromettenti Pubblicate Da Domani Il Complotto Becciu E Le Sue Conseguenze

May 01, 2025