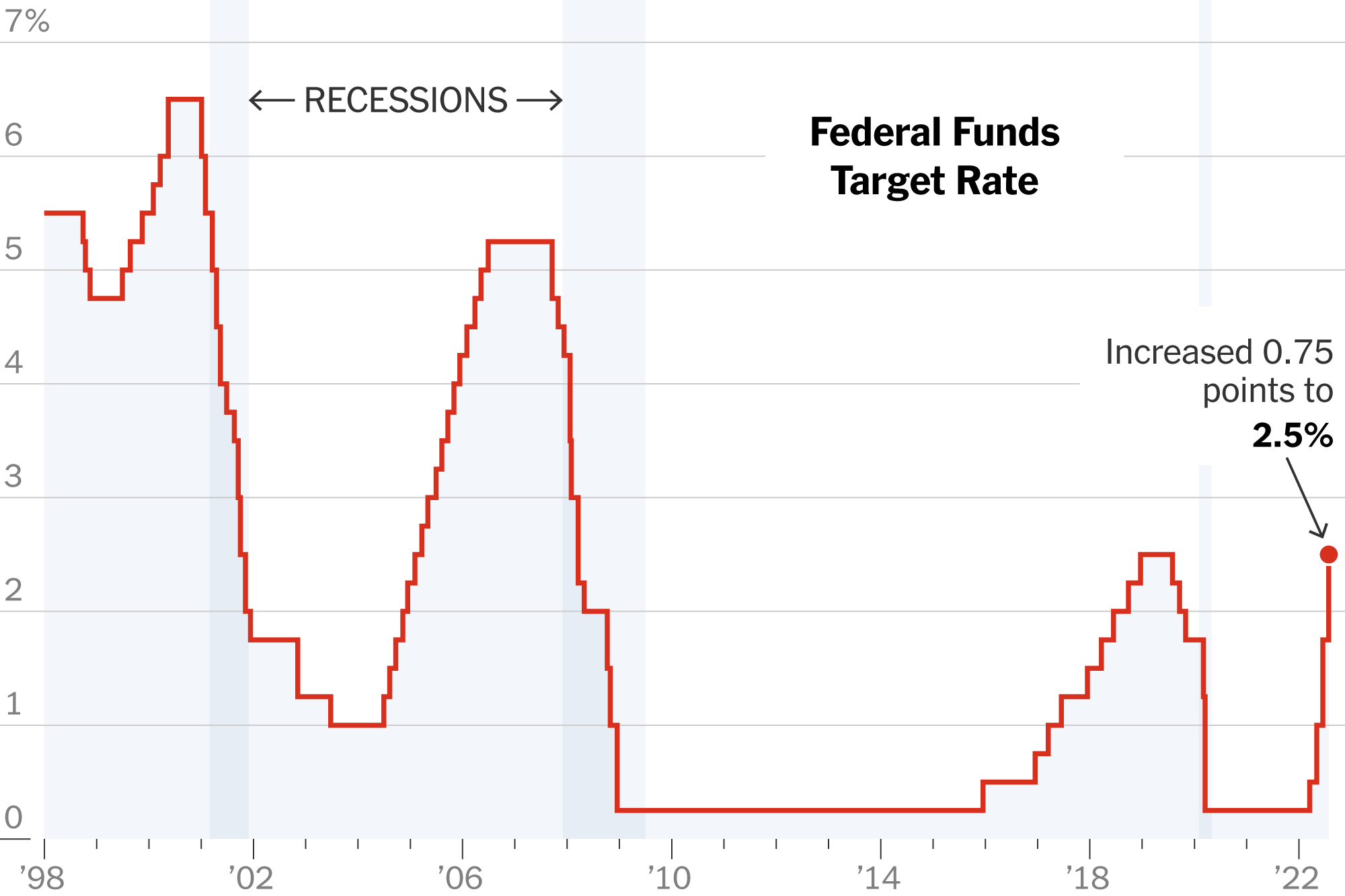

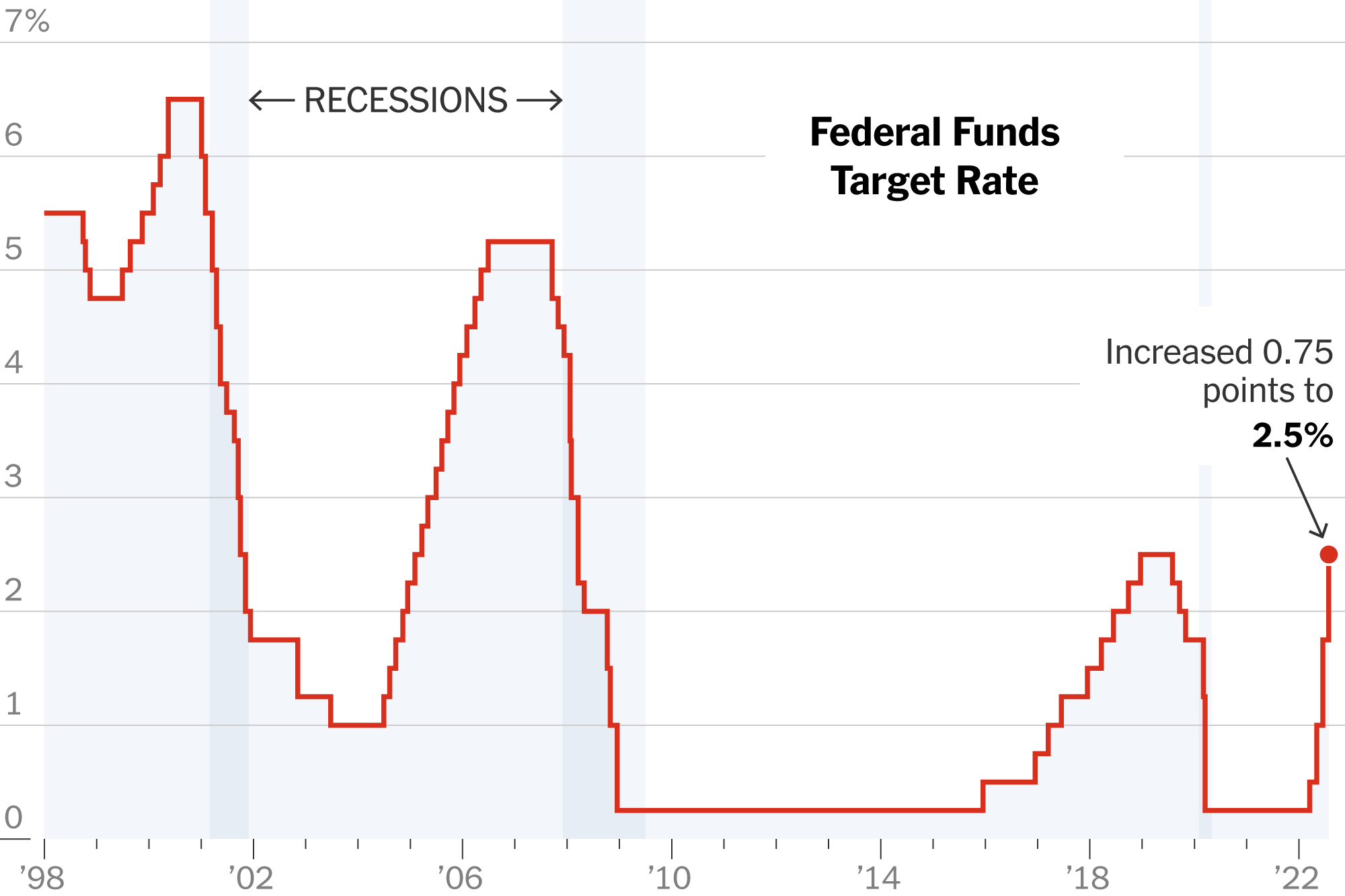

Federal Reserve Rate Decision: Holding Steady Amidst Economic Uncertainty

Table of Contents

Current Economic Conditions and Inflation

The Federal Reserve's decision on interest rates is heavily influenced by the prevailing economic conditions, particularly inflation and GDP growth. Analyzing these factors provides crucial context for understanding the recent "hold" decision.

- Recent CPI and PPI data showing inflation trends: Recent data reveals a mixed picture. While the Consumer Price Index (CPI) shows a slight deceleration in inflation, Producer Price Index (PPI) figures suggest persistent inflationary pressures in the pipeline. This divergence complicates the Fed's assessment of the overall inflationary landscape.

- Unemployment rate and its impact on the Fed's decision: The unemployment rate remains relatively low, suggesting a strong labor market. While this is generally positive, it also contributes to upward pressure on wages, potentially fueling further inflation. This tight labor market is a key factor the Fed considers when evaluating the risks of further rate hikes.

- Growth forecasts from leading economic institutions: Leading economic institutions offer varied forecasts for GDP growth in the coming quarters. Some predict a slowdown, even a potential recession, while others maintain a more optimistic outlook. This uncertainty necessitates a cautious approach from the Federal Reserve.

- Mentions of potential recessionary risks: The possibility of a recession looms large, adding another layer of complexity to the Fed's decision-making process. Recessionary pressures could significantly impact inflation and employment, requiring a different monetary policy response.

These factors collectively inform the Fed's assessment of the economy's health and dictate the appropriate course of action regarding interest rate adjustments. The interplay between inflation rate, GDP growth, unemployment figures, and recessionary pressures heavily influences the Federal Reserve rate decision.

The Federal Open Market Committee (FOMC) Meeting

The Federal Open Market Committee (FOMC) meeting is the central forum where interest rate decisions are made. This committee comprises key members of the Federal Reserve System, including the Board of Governors and presidents of various Federal Reserve Banks.

- Key members and their voting power: The FOMC's voting structure ensures a balanced representation of perspectives across the country. The weight each member holds in voting decisions contributes to the final consensus.

- Summary of the FOMC statement released following the meeting: The post-meeting statement provides crucial insight into the committee's rationale for its decision. This statement typically outlines the current economic assessment, the committee's outlook for inflation and employment, and the reasons for maintaining, raising, or lowering interest rates.

- Discussion points regarding inflation targets and economic outlook: The FOMC's discussions revolve around achieving its dual mandate of maximum employment and price stability. The committee carefully weighs the risks and benefits of various interest rate policies in relation to these targets.

- Any dissenting opinions within the committee: The presence of dissenting opinions highlights the complexity of the economic situation and the diversity of views within the committee. These dissenting views offer valuable insights into alternative perspectives on the current economic climate.

The FOMC meeting minutes, providing a detailed account of these discussions, are released with a delay to ensure transparency and contribute to the public understanding of the Federal Reserve rate decision-making process and monetary policy. The interest rate target is a key outcome of this vital meeting.

Impact of the "Hold" Decision

The decision to hold interest rates steady has significant implications across various sectors of the economy.

- Potential effects on borrowing costs for businesses and consumers: A hold decision generally maintains existing borrowing costs for businesses seeking loans for expansion and consumers looking for mortgages or other credit products. This stability can provide a degree of predictability for financial planning.

- Implications for the stock market and investment strategies: The stock market often reacts to Federal Reserve rate decisions. A "hold" decision can lead to either increased or decreased market volatility depending on the market's expectation, causing shifts in investment strategies.

- Predicted impact on the US dollar and foreign exchange markets: Interest rate decisions can influence the value of the US dollar relative to other currencies. A "hold" decision might lead to moderate changes in currency exchange rates, impacting international trade and investment.

- Long-term implications for economic growth: The long-term impact of a "hold" on economic growth depends on several factors. It can support continued growth if the economy remains robust or could hinder recovery if inflationary pressures persist or recessionary risks materialize. An interest rate hike or cut would drastically change this outlook.

Future Outlook and Potential Rate Changes

Predicting future interest rate adjustments requires careful consideration of evolving economic factors.

- Forecasting inflation trends in the coming months and years: Forecasting inflation remains a challenge, with various economic models predicting different trajectories. The Fed will closely monitor inflation indicators to gauge the effectiveness of its current policy.

- Projected GDP growth and its influence on future Fed decisions: Future GDP growth projections significantly influence the Fed's decision-making. Stronger-than-expected growth could warrant future rate increases, while a slowdown might necessitate a different approach.

- Analysis of potential economic shocks and their impact: Unexpected economic shocks, such as geopolitical events or supply chain disruptions, could drastically alter the economic outlook and trigger adjustments in monetary policy. The Fed must remain agile in responding to unforeseen circumstances.

- Speculation on the timing and magnitude of future rate adjustments: Market analysts offer diverse views on the timing and magnitude of future rate changes. These speculations are heavily influenced by current economic indicators and evolving market sentiment.

Future interest rates will depend on the interplay between inflation expectations and economic forecast. The Federal Reserve’s monetary policy outlook will remain flexible in adapting to changing circumstances.

Conclusion

The Federal Reserve's recent decision to hold interest rates steady reflects a careful balancing act amidst ongoing economic uncertainty. The current economic climate, characterized by mixed inflation signals and potential recessionary risks, influenced the FOMC's decision. The impact of this "hold" decision will ripple through various aspects of the economy, from borrowing costs to market volatility. Understanding the Federal Reserve rate decision is crucial for businesses and individuals to adapt to the evolving economic landscape.

Stay informed about future Federal Reserve rate decisions and their potential impacts by regularly checking reputable financial news sources and engaging with economic analysis. Understanding the nuances of monetary policy is crucial for navigating the complexities of the current economic climate.

Featured Posts

-

Transgender Pregnancy Activist Advocates For Uterine Transplant Solutions

May 10, 2025

Transgender Pregnancy Activist Advocates For Uterine Transplant Solutions

May 10, 2025 -

Fentanyl Crisis Record Seizure Announced By Pam Bondi

May 10, 2025

Fentanyl Crisis Record Seizure Announced By Pam Bondi

May 10, 2025 -

What Is A Safe Bet Defining Security And Return In Your Investments

May 10, 2025

What Is A Safe Bet Defining Security And Return In Your Investments

May 10, 2025 -

The Snl Impression Harry Styles Couldnt Stand His Reaction Revealed

May 10, 2025

The Snl Impression Harry Styles Couldnt Stand His Reaction Revealed

May 10, 2025 -

Landlords Accused Of Exploiting La Fire Victims A Selling Sunset Star Speaks Out

May 10, 2025

Landlords Accused Of Exploiting La Fire Victims A Selling Sunset Star Speaks Out

May 10, 2025