Federal Student Loan Privatization: Examining Trump's Proposals And Their Implications

Table of Contents

Trump's Proposed Changes to the Federal Student Loan System

During the Trump administration, several proposals aimed to reshape the federal student loan system, moving towards a more privatized model. While not explicitly advocating for complete privatization, these proposals signaled a shift toward greater private sector involvement. The specifics were often debated and evolved, but core elements included:

- Changes to Loan Servicing: Proposals suggested exploring the use of private companies to manage and service federal student loans, potentially leading to increased competition and efficiency, but also raising concerns about potential conflicts of interest and reduced borrower protections.

- Repayment Plan Modifications: Discussions included adjustments to income-driven repayment (IDR) plans, potentially making them less generous or more complex for borrowers. This could increase the burden of repayment for many.

- Eligibility Criteria Adjustments: Potential changes to eligibility criteria could have limited access to federal student loans for certain borrowers, pushing them towards potentially less favorable private loan options.

The overarching goal, as articulated by the administration, was to streamline the student loan system and improve efficiency. However, the specifics of how this would be achieved and the impact on borrowers remained points of significant contention. The Trump student loan plan, though never fully implemented, laid the groundwork for a substantial shift in how the federal government approaches student loan privatization policy and student loan refinancing.

Potential Benefits of Federal Student Loan Privatization

Proponents of federal student loan privatization argue that it could lead to several benefits:

- Increased Efficiency and Competition: Private lenders, they claim, are more efficient and responsive to market demands, potentially leading to lower costs and better customer service. A competitive student loan market could drive innovation.

- Innovation in Repayment Options: Private companies may be more willing to experiment with new and innovative repayment options tailored to individual borrowers' needs, potentially offering more flexible plans than those currently available through the federal government. This could address issues surrounding flexible repayment options.

- Enhanced Customer Service: Some argue that private lenders would offer improved customer service compared to the often-criticized federal student loan servicing system.

However, these purported benefits are not without significant caveats, as discussed in the following sections. The potential for increased efficiency needs to be carefully weighed against potential risks to borrowers.

Potential Drawbacks and Risks of Federal Student Loan Privatization

Despite the arguments in favor, significant concerns exist about the potential negative consequences of federal student loan privatization:

- Higher Interest Rates: Private lenders typically charge higher interest rates than the federal government, potentially resulting in substantially increased borrowing costs for students. This could exacerbate the existing student loan debt crisis.

- Predatory Lending Practices: The risk of predatory lending increases significantly with greater private sector involvement. Vulnerable borrowers could be targeted with unfair loan terms and hidden fees, leading to financial distress.

- Reduced Borrower Protections: Federal student loans offer several important protections for borrowers, such as income-driven repayment plans and loan forgiveness programs. Privatization could weaken or eliminate these protections, leaving borrowers more exposed to financial hardship. This heightened risk underscores the importance of robust borrower protections.

- Increased Inequality in Access to Higher Education: Privatization could exacerbate existing inequalities in access to higher education, potentially making it more difficult for low-income students to afford college.

The potential for high-interest student loans and the spread of predatory lending are major concerns that cannot be ignored when considering the potential ramifications of federal student loan privatization.

Comparison with Existing Private Student Loan Market

The current private student loan market offers valuable insights into the potential consequences of privatization. Private student loan interest rates are generally higher than federal rates, and the range of repayment options and borrower protections is often less generous. A shift towards a more privatized system could lead to a scenario similar to the current private market, with borrowers facing increased financial burdens. Furthermore, the role of government student loans and their regulatory framework in protecting borrowers becomes crucial when comparing the two systems. The strength and effectiveness of student loan regulations are vital in ensuring a fair and transparent market, no matter the level of private sector involvement.

The Long-Term Economic Implications of Privatization

The economic implications of federal student loan privatization are complex and far-reaching:

- Impact on Consumer Spending and Economic Growth: Increased student loan debt due to higher interest rates could negatively impact consumer spending and economic growth.

- Implications for the Federal Budget: While transferring the financial burden to the private sector might seem attractive from a federal budget perspective, the consequences of a potential surge in loan defaults and the need for government intervention could offset any initial gains.

- Broader Societal Impact: Reduced access to higher education due to increased costs could have long-term societal consequences.

The potential economic impact of student loan debt is a significant concern, and understanding the intricate relationship between student loan forgiveness and overall economic stability is paramount. The affordability of higher education is inextricably linked to the stability of the economy.

Conclusion: Weighing the Pros and Cons of Federal Student Loan Privatization

The debate surrounding federal student loan privatization is multifaceted and complex. While proponents argue for increased efficiency and innovation, the potential risks—including higher interest rates, predatory lending, and reduced borrower protections—are substantial. Trump's proposals, though never fully implemented, highlighted the potential for significant shifts in the student loan landscape. A balanced assessment necessitates careful consideration of both the potential benefits and the significant drawbacks. Before drawing conclusions, further research into the existing private student loan market, the specifics of various proposed reforms, and the potential long-term economic effects is crucial.

We encourage you to delve deeper into this critical issue. Explore resources from reputable financial institutions, government agencies, and academic institutions to form your own informed opinion on federal student loan privatization and its potential impacts on the future of higher education. Understanding the nuances of this debate is essential for advocating for policies that promote both access to higher education and responsible lending practices.

Featured Posts

-

Unlock All Fortnite Teenage Mutant Ninja Turtles Skins The Ultimate Guide

May 17, 2025

Unlock All Fortnite Teenage Mutant Ninja Turtles Skins The Ultimate Guide

May 17, 2025 -

Knicks Derrotan A Sixers Anunoby Brilla Con 27 Puntos

May 17, 2025

Knicks Derrotan A Sixers Anunoby Brilla Con 27 Puntos

May 17, 2025 -

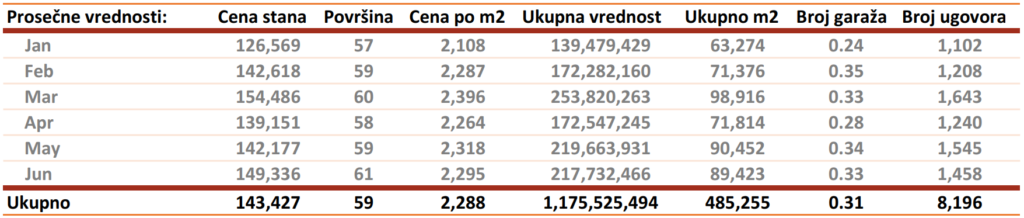

Analiza Trzista Nekretnina Srpski Kupci U Fokus

May 17, 2025

Analiza Trzista Nekretnina Srpski Kupci U Fokus

May 17, 2025 -

Luxury Real Estate A Resilient Asset Class For The Ultra Wealthy

May 17, 2025

Luxury Real Estate A Resilient Asset Class For The Ultra Wealthy

May 17, 2025 -

The Importance Of Reviewing Proxy Statements Form Def 14 A

May 17, 2025

The Importance Of Reviewing Proxy Statements Form Def 14 A

May 17, 2025