Federal Student Loan Refinancing: A Complete Guide

Table of Contents

Understanding Federal Student Loan Refinancing

What is Federal Student Loan Refinancing?

Federal student loan refinancing involves consolidating multiple federal student loans into a single new private loan. This process essentially replaces your existing federal loans with a private loan from a bank or credit union. It's important to understand that once you refinance your federal student loans, you lose the benefits and protections afforded by the federal government. However, the potential benefits can be significant, including lower interest rates and more manageable monthly payments. This can lead to significant student loan debt relief over the life of the loan.

Federal vs. Private Student Loans:

The key difference lies in the lender and the protections offered. Understanding these differences is crucial before pursuing refinancing.

-

Federal Loan Benefits:

- Access to income-driven repayment plans, tailoring payments to your income.

- Deferment and forbearance options for temporary payment pauses during financial hardship.

- Potential eligibility for loan forgiveness programs, depending on your profession and repayment history.

-

Private Loan Features:

- Often offer lower interest rates than your existing federal loans, especially for borrowers with good credit.

- Interest rates can be fixed or variable – fixed rates provide predictability, while variable rates fluctuate with market conditions.

-

Loss of Federal Protections: Refinancing means losing all federal protections, including the options listed above. This is a significant consideration before proceeding.

How to Determine if Refinancing is Right for You

Assessing Your Current Loan Situation:

Before considering refinancing, carefully analyze your current student loan portfolio.

- Interest Rates: Note the interest rate on each of your federal loans. A higher rate signifies a greater potential for savings through refinancing.

- Loan Balances: The total amount you owe influences the potential savings and the interest rate you qualify for.

- Monthly Payments: Your current monthly payments give you a benchmark against which to compare potential savings from refinancing.

- Credit Score and Financial Stability: A strong credit score is crucial for securing favorable interest rates. Ensure your financial situation allows for consistent loan repayments.

Comparing Lenders and Interest Rates:

Don't settle for the first offer you receive. Shop around and compare offers from multiple lenders.

- Factors Influencing Interest Rates: Your credit score, loan amount, loan term, and the presence of a co-signer all significantly impact the interest rate you'll be offered.

- Key Factors to Compare:

- APR (Annual Percentage Rate): The true cost of borrowing, including interest and fees.

- Fees: Origination fees, prepayment penalties, and other charges.

- Repayment Terms: Loan length and monthly payment amounts.

- Customer Reviews: Check online reviews to gauge lender reliability and customer service quality.

- Use Online Comparison Tools: Many websites offer tools to compare student loan refinance offers from various lenders, streamlining the process.

The Refinancing Process: Step-by-Step Guide

Pre-qualification and Application:

- Pre-qualification: This process provides an estimate of the interest rate and loan terms you're likely to qualify for without impacting your credit score significantly.

- Application: Gather necessary documents such as pay stubs, tax returns, and proof of employment. Complete the lender's application form thoroughly and accurately.

Loan Approval and Closing:

- Loan Approval: The lender will review your application and conduct an underwriting process to assess your creditworthiness.

- Closing: Once approved, you'll finalize the loan documents electronically or in person. The funds will then be disbursed to pay off your existing federal student loans.

Potential Pitfalls to Avoid:

- Hidden Fees and Prepayment Penalties: Carefully review the loan agreement to identify any hidden fees or penalties for early repayment.

- Variable Interest Rates: While potentially lower initially, variable rates can increase unpredictably, leading to higher payments. Consider a fixed-rate loan for stability.

- Impact on Credit Score: Multiple hard inquiries during the application process can temporarily lower your credit score. Try to obtain pre-qualification offers first.

Alternatives to Refinancing

If refinancing isn't the right choice for you, explore federal student loan repayment options.

- Income-Driven Repayment Plans: Adjust your monthly payments based on your income and family size.

- Deferment/Forbearance: Temporarily postpone or reduce your payments during financial hardship. This is a short-term measure.

- Other Federal Programs: Investigate programs like Public Service Loan Forgiveness (PSLF) if applicable.

Conclusion:

Federal student loan refinancing can be a powerful tool for managing your student loan debt, but it's crucial to understand the implications before making a decision. Carefully weigh the benefits of lower monthly payments and interest rates against the loss of federal loan protections. Compare offers from various lenders, assess your financial situation, and proceed thoughtfully. Remember to prioritize transparency and understand all associated costs and terms.

Call to Action: Ready to explore your federal student loan refinancing options? Start comparing lenders today and take control of your student loan debt! Don't wait – find the best refinancing solution for your individual needs and start saving money on your student loans.

Featured Posts

-

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 17, 2025

New York Knicks Thibodeau Demands More Resolve After Crushing Defeat

May 17, 2025 -

Seven Month Bonus For Singapore Airlines Staff Details From The Straits Times

May 17, 2025

Seven Month Bonus For Singapore Airlines Staff Details From The Straits Times

May 17, 2025 -

Boston Celtics Gear Shop The Latest Styles At Fanatics For The Playoffs

May 17, 2025

Boston Celtics Gear Shop The Latest Styles At Fanatics For The Playoffs

May 17, 2025 -

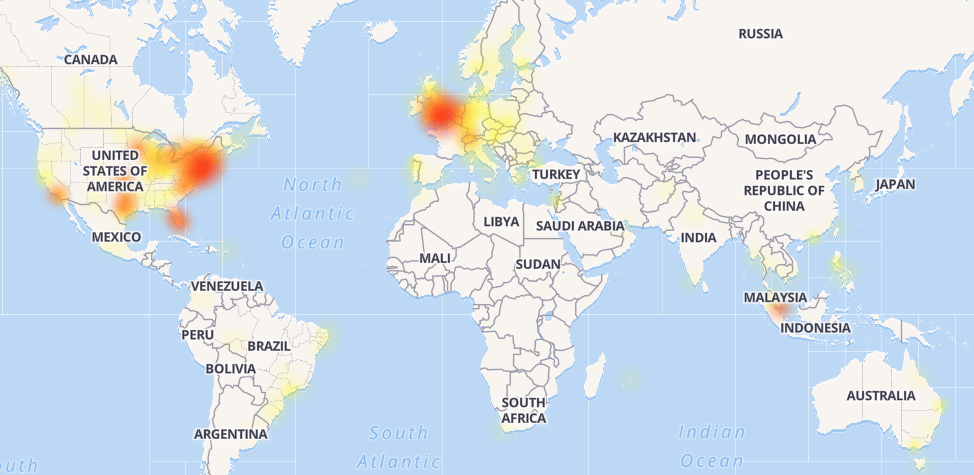

Global Reddit Outage Leaves Users Offline

May 17, 2025

Global Reddit Outage Leaves Users Offline

May 17, 2025 -

Rockwell Automation Earnings Surprise Stock Surge And Market Movers

May 17, 2025

Rockwell Automation Earnings Surprise Stock Surge And Market Movers

May 17, 2025