Figma IPO Filing: One Year Post-Adobe Deal Rejection

Table of Contents

Figma's Performance Since the Adobe Deal Rejection

Since the rejection of Adobe's acquisition bid, Figma has demonstrated impressive growth. Key performance indicators highlight a significant strengthening of its market position. The keywords here are Figma growth, Figma revenue, Figma user base, and Figma market share.

- Revenue Growth and User Base Expansion: While exact figures remain confidential pre-IPO, reports suggest a substantial increase in both revenue and user base. Industry analysts estimate revenue growth exceeding X% year-over-year, fueled by a rapidly expanding user base of designers, developers, and product managers. This demonstrates strong organic growth and market demand.

- Market Share Gains: Figma has consistently gained market share against competitors like Sketch and Adobe XD. While Adobe XD remains a significant player, Figma's collaborative features and ease of use have attracted many users, solidifying its position as a leading design software platform.

- Product Innovation and Updates: Post-Adobe deal, Figma has continued to innovate with new features and updates. These include enhancements to collaborative workflows, improved prototyping capabilities, and integrations with other popular software, further strengthening its competitive advantage.

- Strategic Partnerships and Acquisitions: To bolster its growth trajectory and broaden its capabilities, Figma has strategically partnered with key players in the technology ecosystem and explored targeted acquisitions (although specifics might be limited before the IPO filing).

Factors Influencing Figma's IPO Valuation

Figma's IPO valuation will depend on several intertwined factors, primarily the keywords Figma valuation, IPO valuation, SaaS valuation multiples, Figma profitability, and Figma investors.

- SaaS Market Conditions: The current market climate for SaaS IPOs plays a significant role. Investor sentiment and prevailing interest rates directly impact valuations in the tech sector. A positive market outlook generally leads to higher valuations.

- Profitability and Path to Profitability: While many SaaS companies prioritize rapid growth over immediate profitability, Figma's profitability (or lack thereof) and its clear path towards profitability will significantly influence investor confidence and, subsequently, its valuation.

- Investor Expectations: Existing investors and those anticipating participation in the IPO will have significant influence on the valuation. Their expectations regarding future growth, market share, and profitability will shape the final pricing.

- Challenges to Valuation: Potential challenges to Figma's valuation include increasing competition, market saturation in certain segments, and potential integration issues as it grows.

Comparison to Adobe's Post-Acquisition Strategy

Adobe's response to the failed acquisition provides valuable context for understanding Figma's positioning. The relevant keywords here are Adobe Figma integration, Adobe Creative Cloud, Adobe XD, and competitor analysis.

- Adobe's Revised XD Strategy: Following the failed acquisition, Adobe likely revisited its strategy for Adobe XD, potentially focusing on integration with other Creative Cloud applications and enhancing its collaborative features to compete more effectively with Figma.

- Adobe's Influence on Figma's IPO: Adobe's actions, including its investment in product improvements and marketing campaigns for XD, will influence Figma's IPO valuation and its future market share. A robust competitive response from Adobe could potentially lower Figma’s valuation.

- Competitive Landscape: The competitive landscape between Figma and Adobe, encompassing other design software providers, remains dynamic. Figma's success in the IPO will depend largely on its ability to maintain and expand its market share against increasingly sophisticated competitors.

Potential Impact of the IPO on the Design Software Market

Figma's IPO will likely have a significant impact on the design software market. Keywords include design software market, IPO impact, industry disruption, and Figma competition.

- Ripple Effects: Figma's IPO could trigger further consolidation within the design software industry, with potential acquisitions of smaller players by larger companies.

- Increased Competition and Innovation: The influx of capital from the IPO could accelerate innovation and competition, potentially leading to enhanced product features and functionalities across the market.

- Market Consolidation: The IPO could lead to increased competition and potentially even further consolidation through acquisition, impacting the landscape for smaller players.

Conclusion

Figma's journey since the failed Adobe acquisition demonstrates remarkable growth and resilience. Its upcoming IPO is a significant event, influenced by strong performance, market conditions, and the ongoing competition with Adobe. The Figma IPO valuation will depend on its ability to maintain its growth trajectory, improve profitability, and continue to innovate in the face of competition. Understanding the factors influencing its valuation and the broader impact on the design software market is crucial for investors and industry professionals alike.

Call to Action: Stay informed about the upcoming Figma IPO and its implications for the design software market. Follow us for updates on the Figma IPO filing and its potential impact on the future of design collaboration. Learn more about Figma and its competitors by exploring our other articles on [link to relevant articles].

Featured Posts

-

Gauff And Stearns Power Through To Rome Quarterfinals

May 14, 2025

Gauff And Stearns Power Through To Rome Quarterfinals

May 14, 2025 -

Leger Poll Canadian Businesses Cautious In Face Of Economic Uncertainty

May 14, 2025

Leger Poll Canadian Businesses Cautious In Face Of Economic Uncertainty

May 14, 2025 -

Strade Chiuse Lombardia Per Milano Sanremo 2025 Guida Completa

May 14, 2025

Strade Chiuse Lombardia Per Milano Sanremo 2025 Guida Completa

May 14, 2025 -

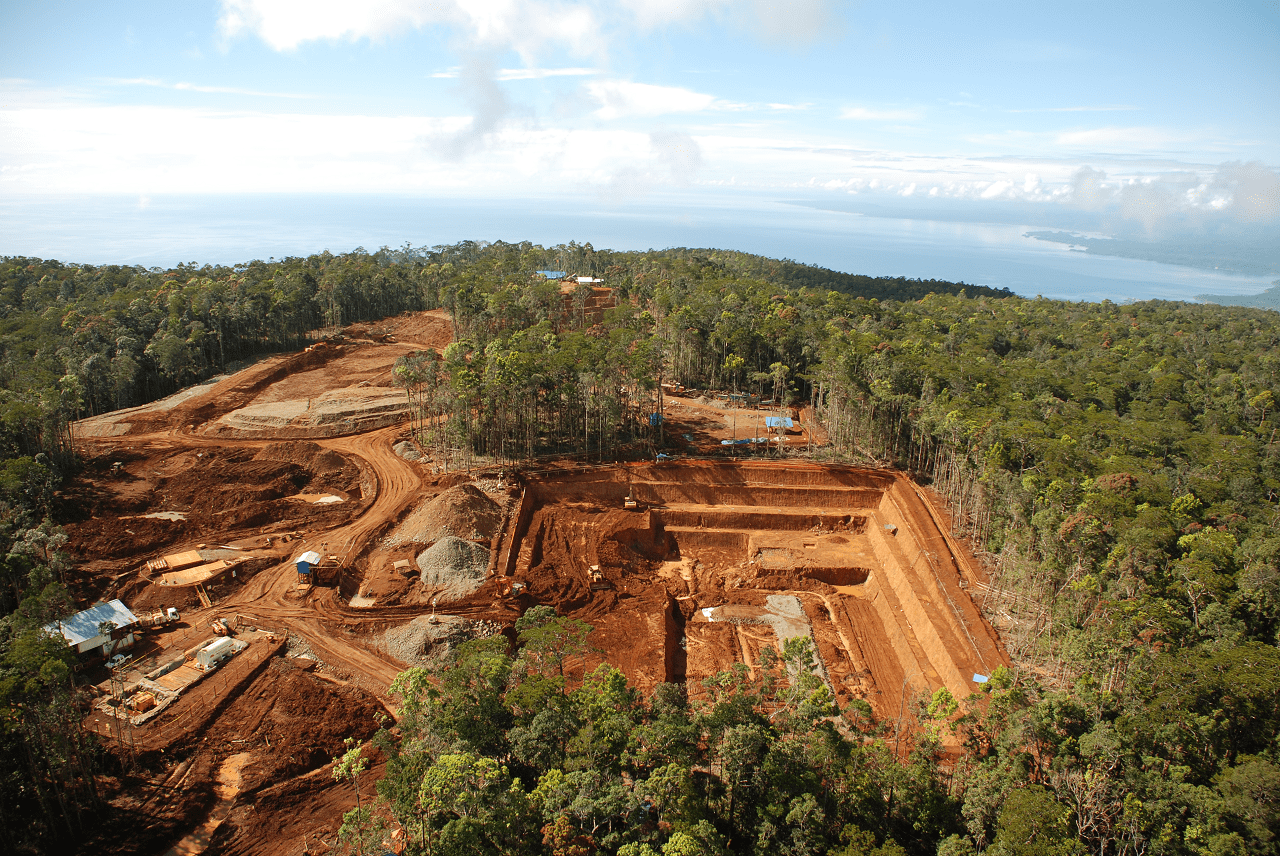

Indonesias Mining Sector Eramet And Danantara Forge Strategic Alliance

May 14, 2025

Indonesias Mining Sector Eramet And Danantara Forge Strategic Alliance

May 14, 2025 -

L Udr Poursuit L Etat Pour Indemniser Les Victimes De Violations De Droits Commises Par Un Oqtf

May 14, 2025

L Udr Poursuit L Etat Pour Indemniser Les Victimes De Violations De Droits Commises Par Un Oqtf

May 14, 2025