Finance Loans 101: A Beginner's Guide To Loan Applications And Repayments

Table of Contents

Understanding Different Types of Finance Loans

Choosing the right finance loan depends heavily on your needs and financial situation. Let's explore some common types:

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, including debt consolidation, home improvements, or covering unexpected expenses. They offer flexibility but typically come with higher interest rates than secured loans.

- Fixed vs. variable interest rates: Fixed rates remain constant throughout the loan term, providing predictability. Variable rates fluctuate with market changes, potentially leading to higher or lower payments.

- Loan amounts: Personal loans are available in various amounts, depending on your creditworthiness and the lender's policies.

- Eligibility criteria: Lenders assess your credit score, income, and debt-to-income ratio to determine your eligibility for a personal loan. Good credit generally qualifies you for better interest rates and higher loan amounts. Keywords: Personal loan interest rates, personal loan eligibility, unsecured personal loans, secured personal loans.

Secured Loans

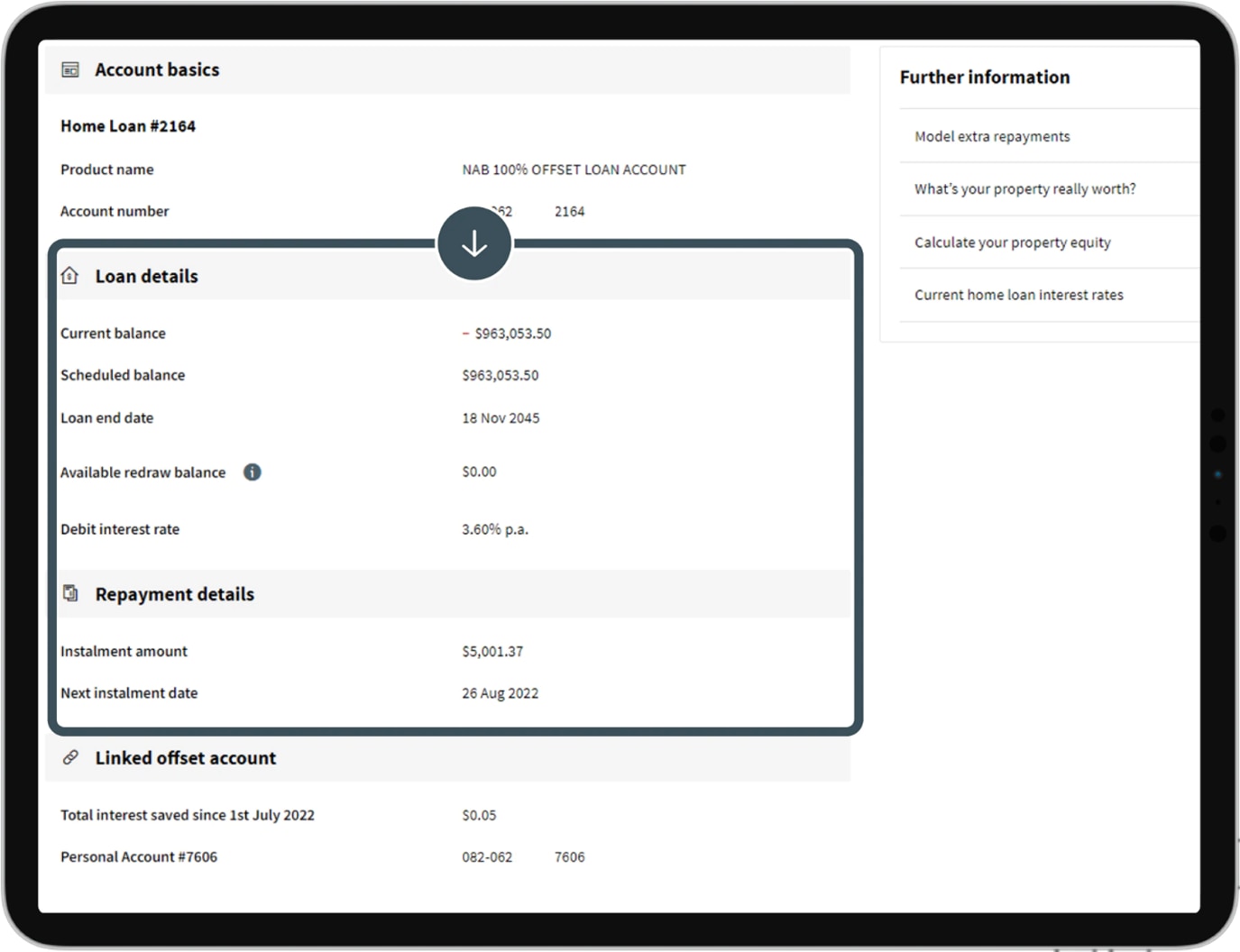

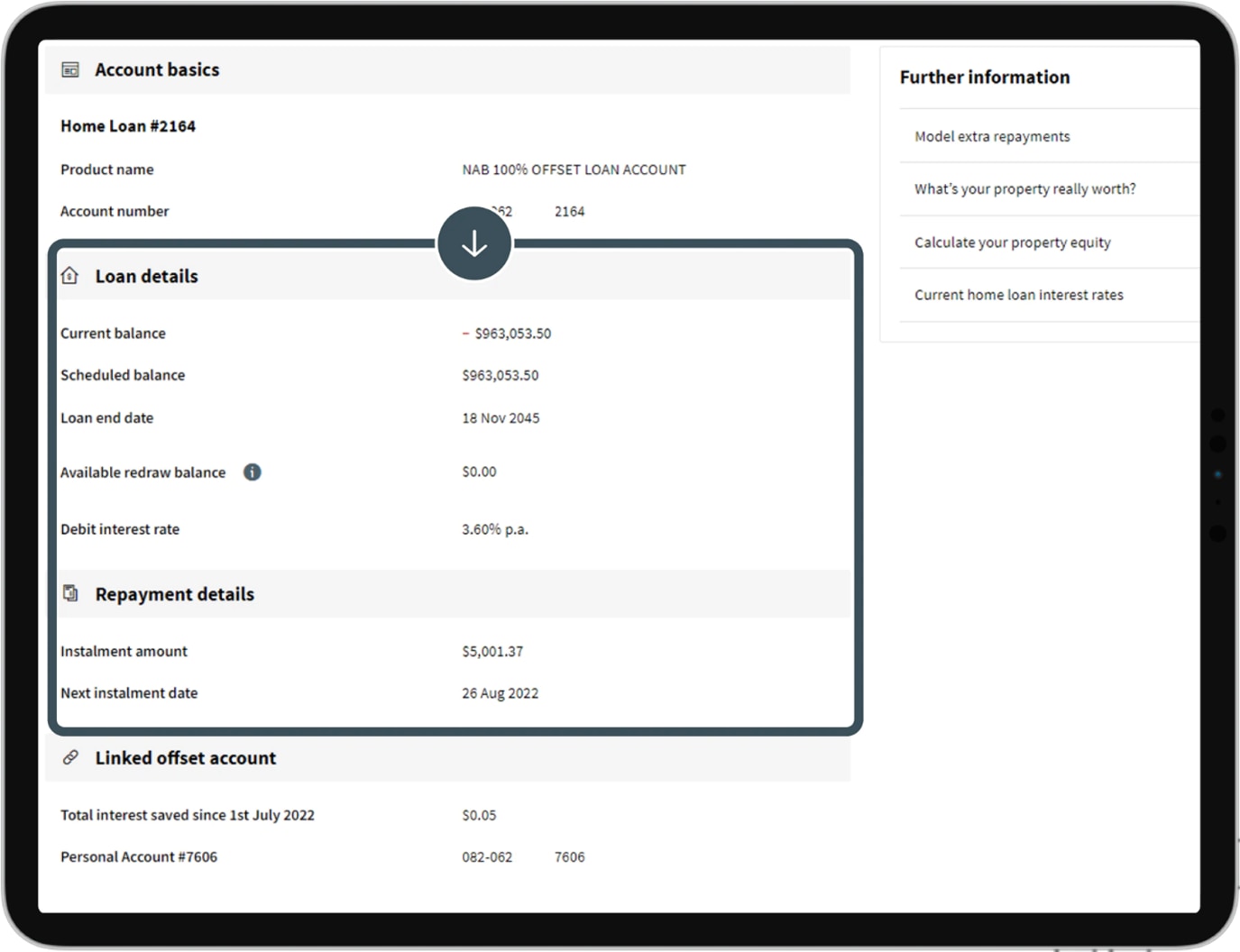

Secured loans, such as mortgages and auto loans, require collateral—an asset you pledge to the lender as security. This collateral reduces the lender's risk, resulting in lower interest rates. However, defaulting on a secured loan can lead to the loss of your collateral.

- Types of collateral: Common collateral includes houses (for mortgages), vehicles (for auto loans), or other valuable assets.

- Loan-to-value ratios (LTV): This ratio compares the loan amount to the value of the collateral. A lower LTV typically results in better loan terms.

- Foreclosure implications: Failure to repay a secured loan can result in foreclosure, repossession, or other legal actions to recover the lender's losses. Keywords: Mortgage loans, auto loans, secured loan interest rates, collateral, loan-to-value.

Unsecured Loans

Unsecured loans, like credit cards and payday loans, don't require collateral. This convenience often comes with a trade-off: higher interest rates and a greater impact on your credit score if you miss payments.

- Credit score requirements: Lenders use your credit score to assess your creditworthiness. A higher credit score often qualifies you for better loan terms.

- APR (Annual Percentage Rate): This represents the annual cost of borrowing, including interest and fees. Pay close attention to the APR, as it can significantly impact your overall repayment cost.

- Potential for high-interest charges: Unsecured loans can have significantly higher interest rates compared to secured loans, leading to substantial interest charges over time. Keywords: Unsecured loan interest rates, credit card debt, payday loan alternatives, credit score impact.

The Loan Application Process: A Step-by-Step Guide

Securing a finance loan involves a series of steps. Let's walk through the process:

Gathering Necessary Documentation

Before applying, gather all required documents to streamline the process. This typically includes:

- Pay stubs: Proof of your income and employment stability.

- Bank statements: Demonstrating your financial history and account activity.

- Tax returns: Supporting your income and financial stability.

- Credit report: A detailed report showing your credit history and score. Keywords: Loan application requirements, necessary documentation, income verification.

Choosing the Right Lender

Selecting the right lender is crucial. Consider these factors:

- Comparing loan offers: Shop around and compare interest rates, fees, and repayment terms from multiple lenders.

- Checking lender reviews: Research the lender's reputation and read reviews from other borrowers.

- Understanding hidden fees: Be aware of any additional fees, such as origination fees or prepayment penalties. Keywords: Best lenders, loan comparison, interest rate comparison, lender reviews.

Completing the Application

The application process may vary depending on the lender, but generally involves:

- Online applications: Many lenders offer convenient online application portals.

- In-person applications: Some lenders may require in-person applications.

- Required information: Be prepared to provide accurate and complete information, including personal details, financial information, and employment history. Keywords: Loan application form, online loan application, completing loan application.

Effective Finance Loan Repayment Strategies

Successful loan repayment requires planning and discipline:

Creating a Repayment Budget

A realistic budget is essential for managing loan repayments:

- Tracking income and expenses: Monitor your income and expenses to understand your cash flow.

- Allocating funds for loan payments: Prioritize loan payments and allocate sufficient funds each month.

- Creating a realistic budget: Develop a budget that aligns with your income and expenses, ensuring you can comfortably make your loan payments. Keywords: Budget planning, loan repayment budget, debt management.

Exploring Repayment Options

Several options can help you manage your loan repayments:

- Accelerated repayment: Making extra payments can significantly reduce your loan term and interest costs.

- Bi-weekly payments: Making half your monthly payment every two weeks effectively makes an extra monthly payment each year.

- Refinancing options: Refinancing your loan with a lower interest rate can reduce your monthly payments and overall costs. Keywords: Loan repayment schedule, amortization, debt consolidation, refinancing loans.

Managing Unexpected Expenses

Unexpected expenses can disrupt your repayment plan. Be prepared:

- Emergency funds: Building an emergency fund can help cover unexpected costs without jeopardizing your loan repayments.

- Seeking assistance from lenders: If you face financial hardship, contact your lender to explore options like forbearance or loan modifications.

- Exploring debt relief options: In extreme cases, consider debt relief options, but understand the potential consequences. Keywords: Debt management strategies, financial hardship, loan default prevention.

Conclusion

Understanding the intricacies of finance loans is crucial for making sound financial decisions. This "Finance Loans 101" guide provided a foundational understanding of different loan types, the application process, and effective repayment strategies. By carefully considering your financial needs, comparing loan offers, and creating a robust repayment plan, you can successfully navigate the world of finance loans. Remember to always research and compare different finance loan options before committing to any agreement. Start your journey towards financial freedom by exploring the best finance loan options available to you today!

Featured Posts

-

Romes Champion The Next Chapter Of Success

May 28, 2025

Romes Champion The Next Chapter Of Success

May 28, 2025 -

Bali Belly Diagnosis Treatment And Long Term Prevention Strategies

May 28, 2025

Bali Belly Diagnosis Treatment And Long Term Prevention Strategies

May 28, 2025 -

Repetitive Documents Ai Creates A Profound Poop Podcast

May 28, 2025

Repetitive Documents Ai Creates A Profound Poop Podcast

May 28, 2025 -

Man Utd Transfer News 50m Players Departure Imminent

May 28, 2025

Man Utd Transfer News 50m Players Departure Imminent

May 28, 2025 -

Prakiraan Cuaca Jabar Besok 7 5 Antisipasi Curah Hujan Tinggi

May 28, 2025

Prakiraan Cuaca Jabar Besok 7 5 Antisipasi Curah Hujan Tinggi

May 28, 2025

Latest Posts

-

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Sud Ouest

May 30, 2025

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Sud Ouest

May 30, 2025 -

Top Paris Neighborhoods A Locals Recommendations

May 30, 2025

Top Paris Neighborhoods A Locals Recommendations

May 30, 2025 -

Philippe Caveriviere Et Philippe Tabarot Replay Loeil Du 24 Avril 2025

May 30, 2025

Philippe Caveriviere Et Philippe Tabarot Replay Loeil Du 24 Avril 2025

May 30, 2025 -

Loeil De Philippe Caveriviere 24 Avril 2025 Replay Avec Philippe Tabarot

May 30, 2025

Loeil De Philippe Caveriviere 24 Avril 2025 Replay Avec Philippe Tabarot

May 30, 2025 -

A Comprehensive Guide To Paris Best Neighborhoods

May 30, 2025

A Comprehensive Guide To Paris Best Neighborhoods

May 30, 2025