Finance Loans 101: How To Apply, Calculate EMIs & Choose The Right Loan Tenure

Table of Contents

Understanding Different Types of Finance Loans

Finance loans come in various forms, each designed for specific purposes. Understanding the differences is crucial for choosing the right one.

Personal Loans: Your Flexible Financing Solution

Personal loans offer flexibility for various needs, from debt consolidation and home improvements to medical expenses and travel. They are unsecured loans, meaning they don't require collateral.

- Uses: Debt consolidation, home improvements, medical expenses, vacations, wedding expenses.

- Eligibility Criteria: Generally requires a stable income, good credit history, and proof of identity and address.

- Typical Interest Rates: Vary depending on your credit score, loan amount, and repayment period. Expect higher interest rates compared to secured loans.

- Repayment Options: Typically repaid in monthly installments over a fixed period (loan tenure).

Keywords: Personal loan interest rates, personal loan eligibility, best personal loans, unsecured loan.

Home Loans (Mortgages): Financing Your Dream Home

Home loans, or mortgages, are specifically designed for purchasing or constructing a home. They are secured loans, meaning your home serves as collateral.

- Types of Mortgages: Fixed-rate mortgages (consistent interest rate throughout the loan term) and adjustable-rate mortgages (interest rate fluctuates based on market conditions).

- Down Payment Requirements: Typically requires a down payment, which can range from 5% to 20% or more of the home's value.

- Loan-to-Value Ratios (LTV): The ratio of the loan amount to the property's value. A lower LTV generally results in better interest rates.

- Mortgage Insurance: May be required if your down payment is less than 20%.

Keywords: Home loan interest rates, home loan eligibility, mortgage calculator, mortgage insurance, fixed-rate mortgage, adjustable-rate mortgage.

Auto Loans: Driving Towards Ownership

Auto loans finance the purchase of a new or used vehicle. They are secured loans, with the vehicle serving as collateral.

- Loan Terms: Typically range from 24 to 72 months.

- Interest Rates: Vary depending on your credit score, loan amount, and the vehicle's value.

- Down Payment Requirements: A down payment is usually required, reducing the loan amount and potentially lowering the interest rate.

- Factors Affecting Approval: Credit score, income, debt-to-income ratio, and the vehicle's condition.

Keywords: Auto loan interest rates, auto loan calculator, best auto loan offers, secured loan.

The Loan Application Process: A Step-by-Step Guide

Securing a loan involves a series of steps. Careful preparation and attention to detail are crucial for a smooth process.

Gathering Required Documents

Complete and accurate documentation is essential for a timely loan application process. Missing or incorrect documents can significantly delay approval.

- Key Documents: Proof of income (payslips, tax returns), proof of address (utility bills, rental agreement), proof of identity (passport, driver's license), bank statements.

- Importance of Accuracy: Inaccurate information can lead to rejection or delays.

- Impact of Missing Documents: Missing documents will prolong the processing time.

Keywords: Loan application documents, loan application process, online loan application.

Completing the Application Form

Accuracy is paramount when filling out the loan application form. Carefully review all information before submitting.

- Provide Accurate Information: Double-check all details to ensure accuracy.

- Avoiding Common Mistakes: Read instructions carefully and seek clarification if needed.

- Online vs. In-Person Applications: Many lenders offer convenient online application options.

Keywords: Loan application form, online loan application form, loan application requirements.

Loan Approval and Disbursement

Once you submit your application, the lender will review your information and determine your eligibility.

- Factors Affecting Loan Approval: Credit score, income, debt-to-income ratio, and loan amount.

- What to Expect After Approval: You will receive a loan agreement outlining the terms and conditions. The funds will then be disbursed according to the agreed-upon timeline.

Keywords: Loan approval process, loan disbursement, loan approval timeline.

Calculating EMIs (Equated Monthly Installments)

Understanding EMIs is crucial for budgeting and managing your loan repayments.

The EMI Formula

The EMI is calculated using a formula that considers the principal loan amount, interest rate, and loan tenure. While the formula itself is complex, many online calculators simplify the process.

- EMI Components: Each EMI payment consists of both principal repayment and interest.

- Using Online EMI Calculators: Many websites and apps offer free EMI calculators, allowing you to quickly estimate your monthly payments.

Keywords: EMI calculator, EMI formula, calculate EMI, equated monthly installment.

Factors Affecting EMI Amounts

Several factors influence your EMI amount. Understanding these factors helps in budgeting and choosing a suitable loan.

- Interest Rates: Higher interest rates lead to higher EMIs.

- Loan Amount: A larger loan amount results in higher EMIs.

- Loan Tenure: A longer loan tenure means lower EMIs but higher overall interest paid.

Keywords: EMI calculation, interest rate impact on EMI, loan tenure impact on EMI.

Choosing the Right Loan Tenure

Selecting the right loan tenure involves balancing affordability with overall interest costs.

Balancing Affordability and Interest Costs

Shorter tenures mean higher monthly payments but lower overall interest paid. Longer tenures offer lower monthly payments but result in higher overall interest.

- Advantages of Shorter Tenures: Lower total interest paid, quicker debt repayment.

- Advantages of Longer Tenures: Lower monthly payments, improved cash flow.

Keywords: Loan tenure, optimal loan tenure, best loan repayment plan.

Factors to Consider When Selecting a Tenure

Consider your financial goals, long-term affordability, and potential changes in your financial situation.

- Impact of Changing Income or Expenses: Consider potential salary increases or unexpected expenses.

- Future Financial Plans: Align your loan repayment plan with other financial goals (saving, investing).

- Unexpected Events: Prepare for unforeseen circumstances that might affect your repayment ability.

Keywords: Loan repayment plan, choosing loan tenure, loan repayment strategy.

Conclusion

Securing the right finance loan involves understanding different loan types, navigating the application process, calculating EMIs, and choosing a suitable loan tenure. By following the steps outlined above, you can make informed decisions and find the best financing solution to meet your needs. Remember to carefully compare offers from different lenders before making a final choice on your finance loans to secure the most favorable terms. Start your journey towards securing the perfect finance loan today!

Featured Posts

-

Waspada Hujan Petir Menerjang Jawa Timur Besok 29 Maret 2024

May 28, 2025

Waspada Hujan Petir Menerjang Jawa Timur Besok 29 Maret 2024

May 28, 2025 -

Salengs Salary Moroka Swallows Vs Orlando Pirates

May 28, 2025

Salengs Salary Moroka Swallows Vs Orlando Pirates

May 28, 2025 -

Angels Win Fifth Straight Game Behind Moncadas Power

May 28, 2025

Angels Win Fifth Straight Game Behind Moncadas Power

May 28, 2025 -

Padres Vs Opponent In Denver A High Altitude Showdown

May 28, 2025

Padres Vs Opponent In Denver A High Altitude Showdown

May 28, 2025 -

Khyu Dzhakman Posledniyat Uchastnik V Dramata Mezhdu Bleyk Layvli I Dzhstin Baldoni

May 28, 2025

Khyu Dzhakman Posledniyat Uchastnik V Dramata Mezhdu Bleyk Layvli I Dzhstin Baldoni

May 28, 2025

Latest Posts

-

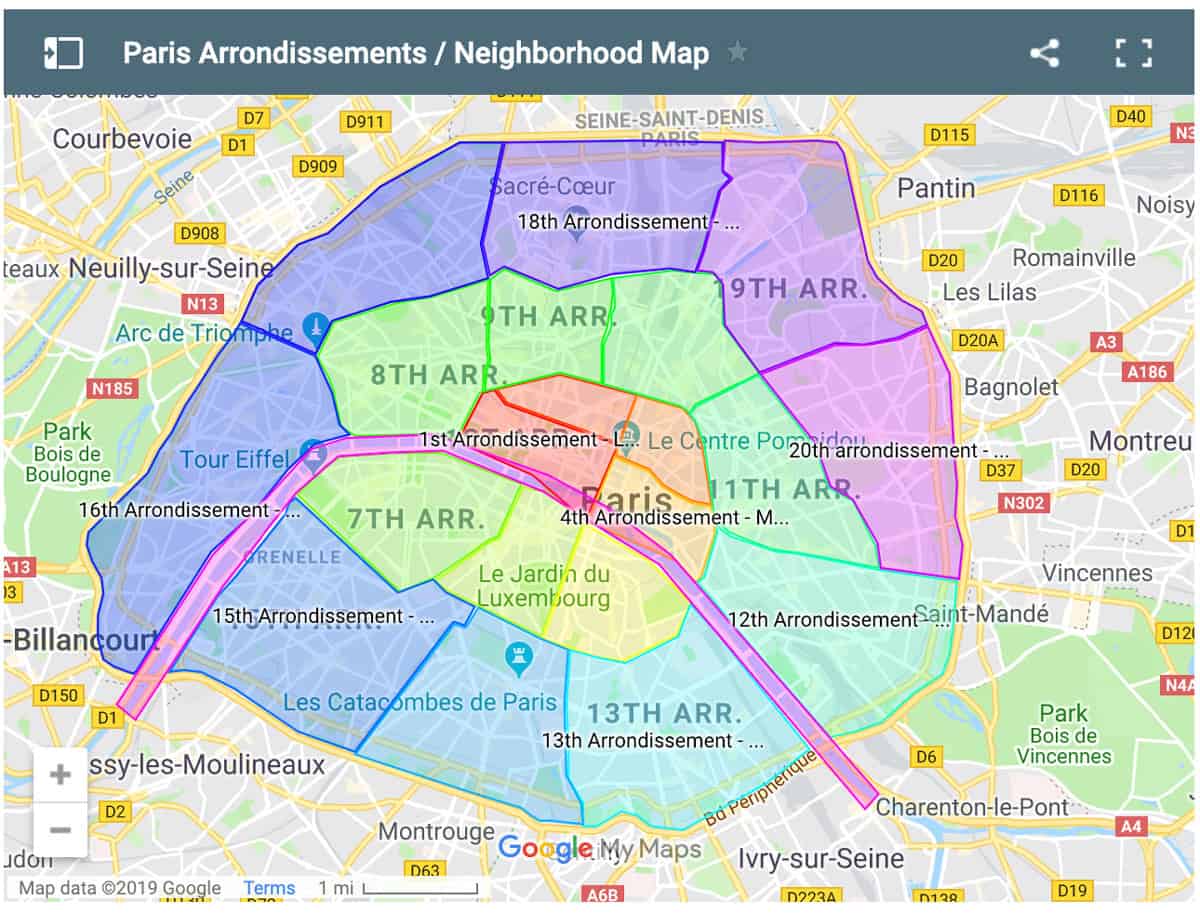

Finding The Perfect Parisian Neighborhood An Insiders Guide

May 30, 2025

Finding The Perfect Parisian Neighborhood An Insiders Guide

May 30, 2025 -

Tunnel De Tende Ouverture Prevue En Juin Selon Le Ministre Tabarot

May 30, 2025

Tunnel De Tende Ouverture Prevue En Juin Selon Le Ministre Tabarot

May 30, 2025 -

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025

Ouverture Du Tunnel De Tende En Juin Confirmation Du Ministre Tabarot

May 30, 2025 -

Where To Stay In Paris A Guide To The Citys Best Neighborhoods

May 30, 2025

Where To Stay In Paris A Guide To The Citys Best Neighborhoods

May 30, 2025 -

Epcots Flower And Garden Festival What To Expect

May 30, 2025

Epcots Flower And Garden Festival What To Expect

May 30, 2025