Financial Imbalance In Marriage: Navigating Income Disparity

Table of Contents

Identifying and Acknowledging the Imbalance

Defining a "significant" income disparity in a marriage is subjective, but it generally refers to a noticeable difference that creates stress or imbalance. This could be a large gap between salaries, one partner's significantly higher earning potential, or a situation where one partner is the sole provider. The emotional and practical implications of such an imbalance can be profound. It can lead to feelings of resentment, power imbalances, and difficulty making joint financial decisions.

- Honest self-assessment of individual incomes and spending habits: Before tackling the issue, each partner needs a clear understanding of their individual financial situation. This includes income, debts, savings, and spending patterns.

- Identifying potential sources of stress related to the income difference: Pinpointing specific areas of concern, such as unequal contribution to household expenses or differing views on saving and spending, is crucial.

- Recognizing the emotional impact on both partners: The higher-earning partner might feel pressured or resentful, while the lower-earning partner might feel inadequate or dependent. Acknowledging these feelings is the first step towards addressing them.

Keywords: Income disparity, financial stress in marriage, communication in marriage finances.

Open and Honest Communication: The Foundation of Financial Stability

Open and honest communication is paramount when dealing with a financial imbalance in marriage. This means having regular, transparent discussions about finances, addressing fears and insecurities related to money without judgment. It's essential to create a safe space where both partners feel comfortable expressing their concerns and vulnerabilities.

- Regular budget meetings – establishing a shared financial vision: Scheduled meetings, even if just once a month, help maintain open dialogue and track progress towards shared financial goals.

- Discussing financial goals – short-term and long-term: Openly discussing short-term goals like paying off debt or saving for a vacation, and long-term goals like buying a house or planning for retirement, aligns expectations and fosters a shared sense of purpose.

- Creating a safe space for vulnerability and honest conversations about money: This requires active listening, empathy, and a willingness to understand each other's perspectives, even if they differ significantly.

Keywords: Marriage finances, open communication, financial transparency, couple's budgeting.

Strategies for Managing Financial Imbalance

Several methods can help couples balance financial contributions and manage income disparities effectively. These methods need to be tailored to the specific circumstances of each couple.

- Joint account for shared expenses (rent/mortgage, utilities, groceries): A joint account simplifies the management of shared household expenses.

- Separate accounts for personal spending and savings goals: Maintaining separate accounts allows each partner to manage personal spending and pursue individual savings goals without impacting the shared budget.

- Understanding the pros and cons of pre-nuptial agreements: A pre-nuptial agreement can clarify the division of assets in case of separation or divorce, especially when there’s a significant income disparity.

- Considering proportional contribution based on income: A fair system might involve each partner contributing a percentage of their income towards shared expenses, rather than an equal amount.

Addressing Power Dynamics and Resentment

Income disparity can sometimes create power imbalances within a marriage, leading to resentment. Addressing this requires conscious effort from both partners.

- Acknowledging potential feelings of inequality or resentment: Openly acknowledging these feelings is vital for addressing them constructively.

- Sharing decision-making power, regardless of income level: Decisions about spending, saving, and investments should be made jointly, respecting each partner’s input.

- Focusing on mutual respect and appreciation for contributions: Acknowledging each partner's contributions to the household, whether financial or otherwise, is essential for maintaining a healthy relationship.

Keywords: Relationship dynamics, financial resentment, marital equality.

Seeking Professional Help

Navigating a financial imbalance in marriage can be challenging. Seeking professional guidance from financial advisors or marriage counselors can provide invaluable support and perspective.

- Financial advisors to create a personalized financial plan: A financial advisor can help create a budget, develop investment strategies, and plan for the future.

- Marriage counselors to navigate emotional challenges related to money: A counselor can provide a safe space to discuss feelings of resentment, insecurity, and power imbalance.

- Benefits of seeking outside perspective and support: An objective third party can offer guidance, strategies, and support to help couples effectively navigate these challenges.

Keywords: Financial advisor, marriage counseling, financial therapy, professional help.

Conclusion

Successfully navigating a financial imbalance in marriage requires commitment, understanding, and proactive strategies. By prioritizing open communication, implementing effective financial management techniques, and seeking professional support when needed, couples can build a strong financial foundation and a lasting, fulfilling relationship. Don't let financial imbalance in marriage define your future; take control and create a financially secure and happy partnership. Begin by having an honest conversation about your finances today. Learn more about managing financial imbalance in marriage and find resources to help you thrive.

Featured Posts

-

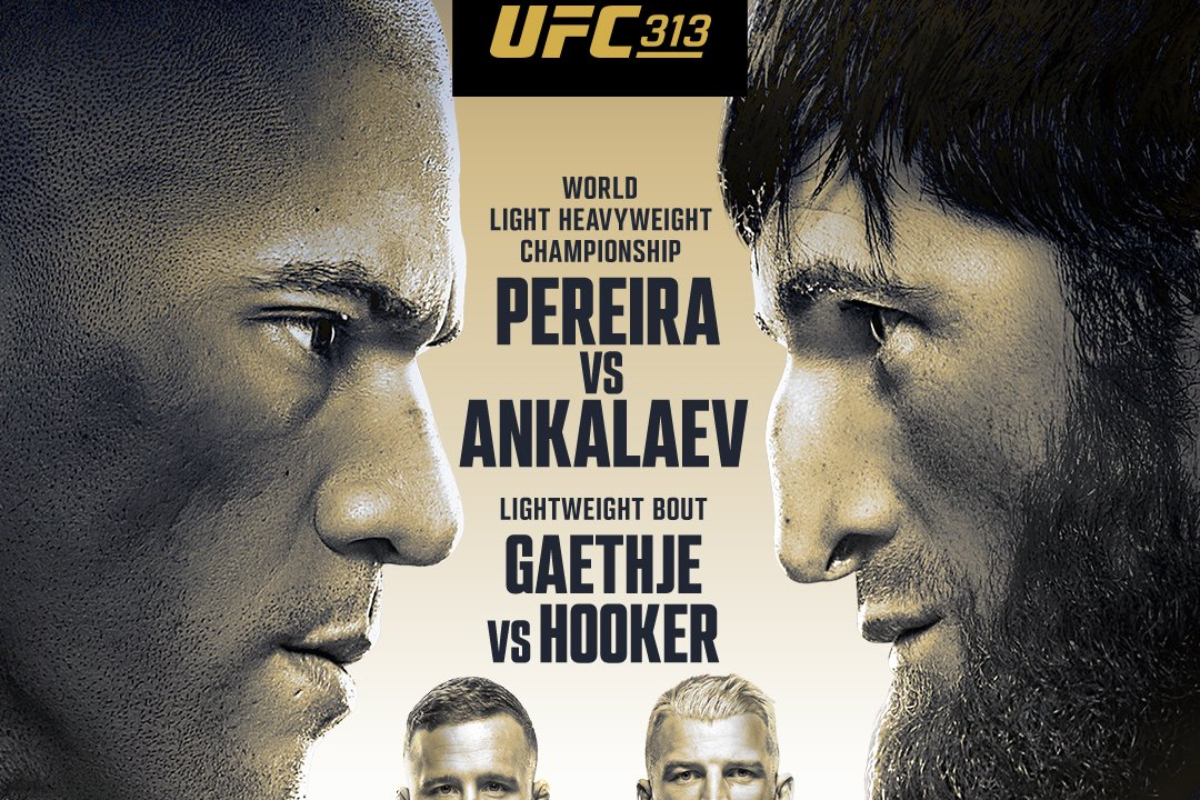

Ufc 313 Ko And Submission Highlights Full Event Breakdown

May 19, 2025

Ufc 313 Ko And Submission Highlights Full Event Breakdown

May 19, 2025 -

Cnn Correspondent Reports From Tornado Aftermath

May 19, 2025

Cnn Correspondent Reports From Tornado Aftermath

May 19, 2025 -

El Cne Y El Bloqueo De Su Sitio Web Analisis De Seis Enlaces Clave

May 19, 2025

El Cne Y El Bloqueo De Su Sitio Web Analisis De Seis Enlaces Clave

May 19, 2025 -

Filth Your Complete Guide To The Film4 Hd Tv Schedule

May 19, 2025

Filth Your Complete Guide To The Film4 Hd Tv Schedule

May 19, 2025 -

La Opinion De Alfonso Arus Sobre Melody Y Eurovision 2025 En Arusero

May 19, 2025

La Opinion De Alfonso Arus Sobre Melody Y Eurovision 2025 En Arusero

May 19, 2025