Finding The Real Safe Bet: A Practical Guide To Secure Investments

Table of Contents

Understanding Your Risk Tolerance

Before diving into the world of investing, understanding your risk tolerance is paramount. This crucial step determines the types of investments suitable for your financial situation and personal comfort level. Ignoring your risk profile can lead to impulsive decisions and potential losses.

-

Consider your age and financial goals: Younger investors often have a higher risk tolerance, allowing them to invest in potentially higher-return, higher-risk options. Those nearing retirement typically prioritize capital preservation and seek safer, lower-risk investments. Short-term goals require more conservative approaches than long-term goals.

-

Define your investment approach: Are you a conservative investor prioritizing capital preservation, a moderate investor balancing risk and return, or an aggressive investor willing to accept higher risk for potentially greater returns?

-

Utilize online risk tolerance questionnaires: Many reputable financial websites offer free questionnaires to help you assess your risk profile. These assessments provide a personalized perspective, guiding your investment choices.

-

Seek professional advice: Consulting a certified financial advisor is invaluable. They can conduct a thorough assessment of your financial situation, goals, and risk tolerance, providing personalized recommendations tailored to your specific needs.

Diversification: Spreading Your Investments

Diversification is a cornerstone of secure investment strategies. It involves spreading your investments across various asset classes to mitigate risk. Don't put all your eggs in one basket!

-

Asset class diversification: Invest in a mix of stocks, bonds, real estate, and potentially alternative investments like commodities or precious metals. This diversification helps to balance your portfolio, reducing overall volatility.

-

Market sector and geographic diversification: Don't concentrate your investments in a single sector (e.g., technology) or country. Spread your investments across different sectors and geographies to lessen your exposure to specific market downturns.

-

Reducing portfolio volatility: A well-diversified portfolio tends to be less volatile than one heavily concentrated in a single asset class or sector. This stability provides a buffer against market fluctuations.

-

Examples of diversified portfolios: A conservative portfolio might consist mainly of bonds and high-yield savings accounts, while a moderate portfolio could include a mix of stocks and bonds, and an aggressive portfolio may have a higher allocation to stocks and alternative investments.

Exploring Low-Risk Investment Options

Several low-risk investment options provide a safe haven for your capital while offering modest returns. These options are ideal for conservative investors or those nearing retirement.

-

High-yield savings accounts: These accounts offer competitive interest rates and easy access to your funds. Many are FDIC-insured, providing an added layer of security.

-

Certificates of Deposit (CDs): CDs offer a fixed interest rate for a specified term. While the returns are generally modest, they are guaranteed, making them a secure option for short-term goals. Be aware of early withdrawal penalties.

-

Government bonds (Treasuries): Considered among the safest investments, government bonds offer a relatively low risk of default. They provide a steady stream of interest payments until maturity.

-

Money market accounts (MMAs): MMAs offer higher interest rates than savings accounts but may have higher minimum balance requirements. They provide relatively easy access to your funds.

-

Annuities: Annuities offer a guaranteed stream of income, making them attractive for retirement planning. However, they often come with fees and limitations, so careful research is essential.

Due Diligence and Research

Thorough research is crucial before investing in any asset. Impulsive decisions without adequate knowledge can lead to significant losses.

-

Company research (for stocks): Before investing in a company's stock, carefully analyze its financial health, including its revenue, profits, debt levels, and future growth prospects.

-

Risk assessment: Understand the inherent risks associated with each investment option. No investment is entirely risk-free, but some are demonstrably less risky than others.

-

Reliable information sources: Utilize reputable sources like financial news websites, company reports, and independent financial analysis.

-

Read prospectuses and investment documents: Carefully review all relevant documents before investing to fully understand the terms and conditions.

-

Seek professional guidance: Consulting a financial advisor provides invaluable insights and helps you make informed decisions.

The Role of a Financial Advisor

A financial advisor can significantly enhance your journey towards secure investments. Their expertise helps navigate the complexities of the financial markets and make informed decisions.

-

Personalized financial planning: Advisors create customized financial plans aligning with your goals, risk tolerance, and financial situation.

-

Investment selection: They provide tailored recommendations for investment options based on your individual circumstances.

-

Portfolio management and adjustments: They regularly review and adjust your portfolio to optimize performance and manage risk.

-

Access to resources: Advisors often have access to advanced investment tools and resources unavailable to individual investors.

-

Tax optimization strategies: They can help minimize your tax burden through strategic investment planning.

Conclusion

Finding secure investments requires a multi-faceted approach. Understanding your risk tolerance, diversifying your portfolio, conducting thorough research, and potentially working with a qualified financial advisor are crucial steps. Making informed decisions helps minimize risk and maximize returns in the long run. Start your journey towards securing your financial future by researching different options for secure investments and working with a qualified advisor. Take control of your finances and find the real safe bet today!

Featured Posts

-

Us Uk Trade Deal Trumps Announcement And Its Implications

May 10, 2025

Us Uk Trade Deal Trumps Announcement And Its Implications

May 10, 2025 -

Assessing Nigel Farages Reform Party Action Vs Rhetoric

May 10, 2025

Assessing Nigel Farages Reform Party Action Vs Rhetoric

May 10, 2025 -

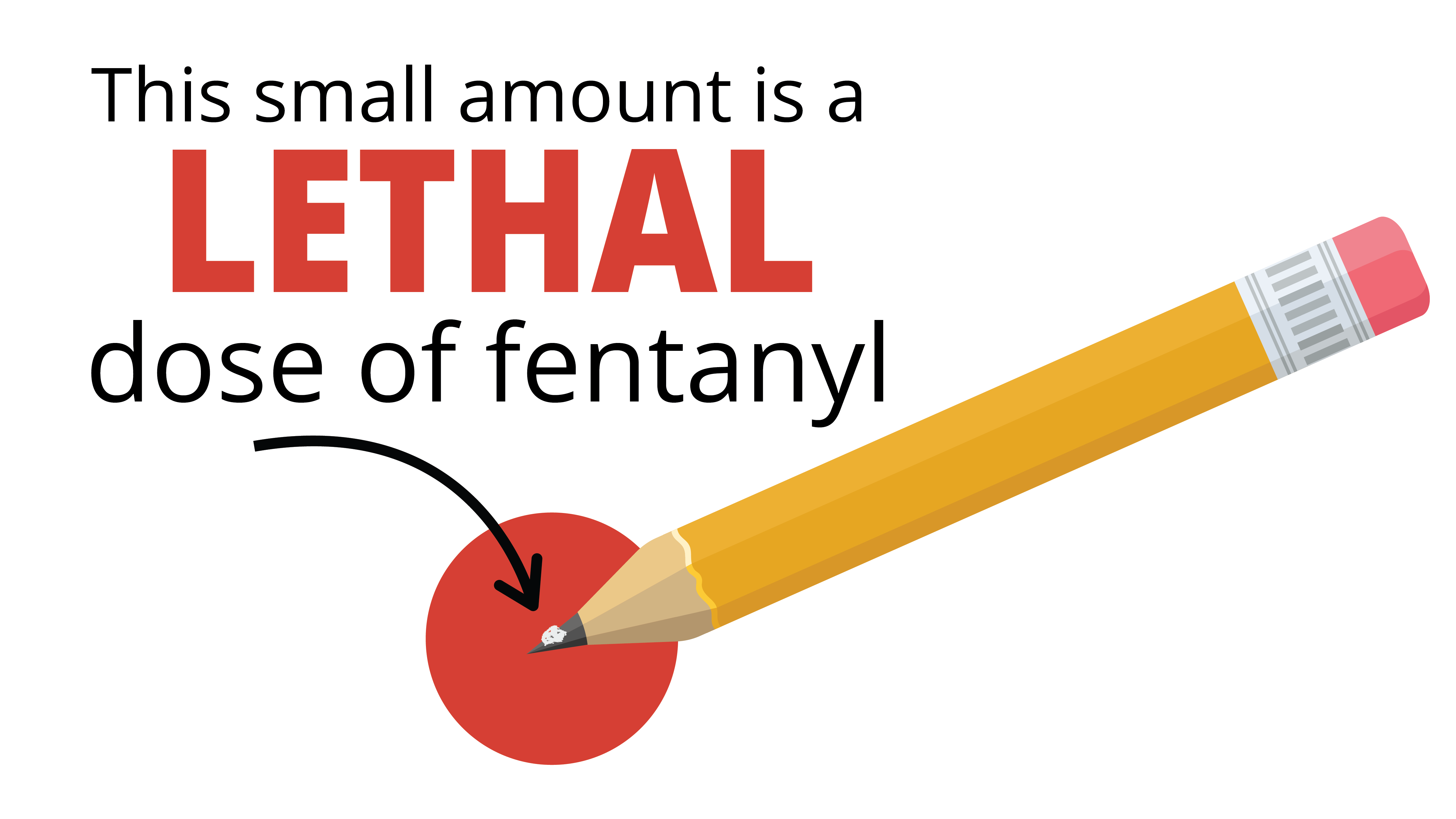

Record Fentanyl Seizure Announced Pam Bondis Update

May 10, 2025

Record Fentanyl Seizure Announced Pam Bondis Update

May 10, 2025 -

Wynne And Joanna All At Sea A Novels Journey

May 10, 2025

Wynne And Joanna All At Sea A Novels Journey

May 10, 2025 -

Eleven Years Later High Potentials Enduring Influence On Psych Spiritual Growth

May 10, 2025

Eleven Years Later High Potentials Enduring Influence On Psych Spiritual Growth

May 10, 2025