Finding Your Place In The Sun: A Guide To Overseas Property

Table of Contents

Researching Your Ideal Overseas Property Location

Before diving into the specifics, thorough research is paramount. This involves two key stages: choosing the right country and identifying your ideal property type.

Choosing the Right Country

Selecting the perfect country for your overseas property hinges on various factors that align with your lifestyle and financial goals. Consider the following:

- Climate: Do you prefer year-round sunshine or distinct seasons?

- Cost of Living: Research the cost of everyday expenses, including groceries, transportation, and utilities.

- Visa Requirements: Investigate the visa regulations for long-term stays or residency.

- Language Barriers: Assess your language skills and the prevalence of English speakers in your desired location.

- Healthcare System: Research the quality and accessibility of healthcare in the chosen country.

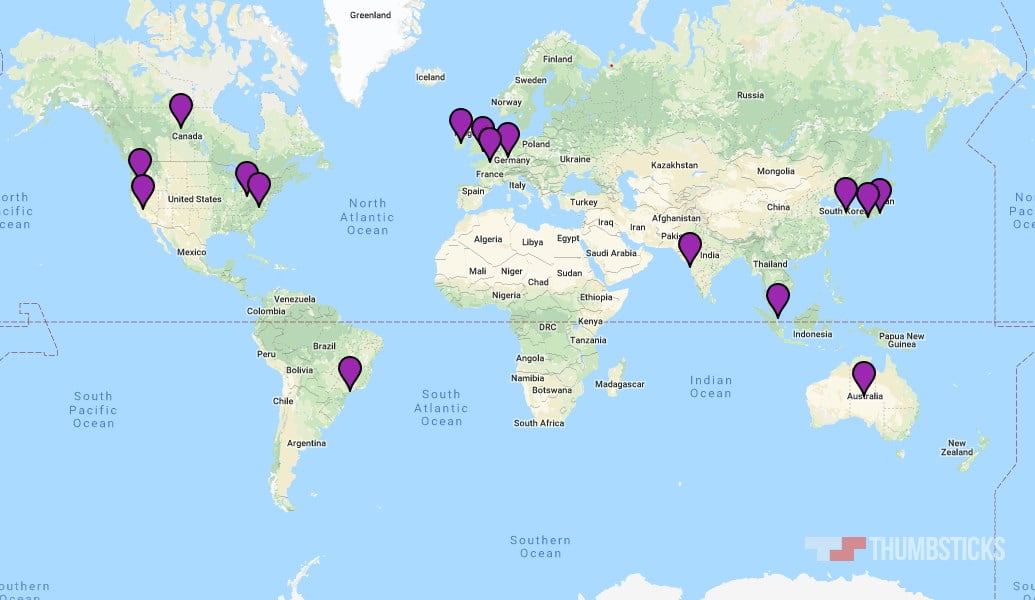

Popular destinations for overseas property include:

- Spain: Known for its beautiful beaches, vibrant culture, and relatively affordable property prices in certain regions.

- Portugal: Offers a relaxed lifestyle, stunning coastline, and attractive tax benefits for foreign residents.

- Italy: A timeless classic, boasting rich history, stunning landscapes, and a high demand for rental properties.

- Greece: Island living at its finest, with idyllic beaches, charming villages, and a strong tourism sector.

- Thailand: Offers a tropical climate, affordable living, and a thriving expat community.

- Florida (USA): A popular choice for North Americans seeking warmer weather and access to excellent amenities.

When comparing countries, also analyze:

- Tax Implications: Understand capital gains tax, property tax, and inheritance tax regulations.

- Property Laws: Familiarize yourself with local property laws and regulations, including buying and selling processes.

- Potential Rental Income: Research rental yields and the potential for generating passive income from your property.

Identifying Your Ideal Property Type

Your choice of property type should align with your lifestyle and intended use:

- Apartments: Offer convenience, often located in city centers or resort areas, ideal for shorter stays or city living.

- Villas: Provide privacy and space, perfect for families or those seeking a more secluded lifestyle.

- Townhouses: Offer a balance between apartment-style living and the benefits of a private garden or patio.

- Land Plots: Ideal for those wanting to build their dream home from scratch, offering greater customization but requiring more investment and planning.

Consider your lifestyle needs:

- Retirement: Prioritize proximity to healthcare facilities, amenities, and a comfortable climate.

- Vacation Home: Focus on location, proximity to beaches, attractions, or ski slopes.

- Investment Property: Look for high rental yields, strong capital appreciation potential, and easy management options.

Factors impacting property prices include:

- Location: Properties in prime locations command higher prices.

- Size: Larger properties generally cost more.

- Amenities: Features like swimming pools, sea views, and modern appliances increase value.

Navigating the Legal and Financial Aspects of Overseas Property Purchases

Buying international property involves significant financial and legal considerations. Careful planning and professional advice are essential.

Securing Financing for Overseas Property

Securing a mortgage for overseas property can be more complex than a domestic purchase. Explore options such as:

-

International Mortgages: Some banks offer mortgages for foreign properties, but interest rates and lending criteria may differ.

-

International Bank Transfers: Transferring funds internationally incurs fees and exchange rate fluctuations.

-

Currency Exchange: Protect yourself from unfavorable exchange rates by using a reputable currency exchange service.

-

Pre-approval: Obtain pre-approval for a mortgage from a lender before starting your property search to understand your budget limitations.

-

Exchange Rates: Monitor exchange rates closely and consider strategies to mitigate risks associated with currency fluctuations.

Understanding Legal Requirements and Due Diligence

Navigating the legal aspects of buying foreign real estate is critical. Always:

-

Hire a Local Lawyer: A lawyer specializing in international property law is essential to ensure compliance with local regulations.

-

Use a Translator: Language barriers can lead to misunderstandings; a professional translator is crucial for contracts and legal documents.

-

Property Surveys and Title Searches: Thorough checks are necessary to verify ownership and identify any potential encumbrances on the property.

-

Verify Property Ownership: Ensure the seller legally owns the property and has the right to sell it.

-

Check for Legal Compliance: Confirm the property complies with all building codes and regulations.

Finding and Vetting Overseas Property Agents and Developers

Choosing reputable agents and developers is vital to a successful overseas property purchase.

Identifying Reputable Agents

Research is key when selecting an agent for foreign real estate:

-

Online Reviews: Check online reviews and testimonials from past clients.

-

Professional Affiliations: Look for agents affiliated with reputable organizations.

-

Ask Questions: Inquire about their experience with international clients, their knowledge of local laws, and their fee structure.

-

Transparency: A reputable agent will be transparent about all fees and commissions.

-

Red Flags: Be wary of agents who pressure you into making quick decisions or who seem unwilling to answer your questions thoroughly.

Due Diligence on Developers

When buying off-plan properties, due diligence on the developer is crucial:

-

Verify Credentials: Check the developer's track record, financial stability, and licenses.

-

Past Projects: Review the developer's past projects to assess their quality and completion timelines.

-

Financial Stability: Investigate the developer's financial health to mitigate the risk of project delays or cancellations.

-

Independent Verification: Verify developer information through independent sources.

-

Off-Plan Risks: Understand the risks associated with off-plan purchases, including potential delays and changes to the project.

Managing Your Overseas Property

Once you've purchased your overseas property, ongoing management is vital, especially if you plan to rent it out.

Property Management Services

Hiring a property management company offers many benefits:

-

Tenant Screening: Professional screening helps find reliable tenants and minimize the risk of rent arrears.

-

Rent Collection: The property manager handles rent collection and ensures timely payments.

-

Maintenance: They coordinate maintenance and repairs, saving you time and hassle.

-

Marketing and Advertising: Property managers can assist in finding tenants and managing advertising.

-

Costs: Consider the fees charged by property management companies, which typically range from 8% to 15% of the monthly rental income.

Insurance and Taxation

Protect your investment and understand your tax obligations:

-

Building Insurance: Essential to cover damage to the property from unforeseen events.

-

Liability Insurance: Protects you from legal liability for accidents or injuries on your property.

-

Rental Insurance: Covers loss of rental income due to unforeseen circumstances.

-

Tax Obligations: Understand your tax obligations in both your home country and the country where your property is located.

-

Consult Tax Professionals: Seek advice from tax professionals to ensure compliance with all tax regulations.

Conclusion

Finding and purchasing overseas property is a significant undertaking, requiring thorough research, careful planning, and professional advice. By following the steps outlined in this guide, focusing on diligent research of your ideal location, navigating the legal and financial intricacies, and choosing reputable professionals, you can increase your chances of a successful and rewarding experience. Remember the importance of legal counsel, thorough due diligence, and sound financial planning. Begin your search for your perfect overseas property today! Start exploring your overseas property options now!

Featured Posts

-

Lionesses Match Belgium Vs England Tv Channel And Kick Off Time Details

May 03, 2025

Lionesses Match Belgium Vs England Tv Channel And Kick Off Time Details

May 03, 2025 -

Reform Uks Agricultural Agenda A Farmers Perspective

May 03, 2025

Reform Uks Agricultural Agenda A Farmers Perspective

May 03, 2025 -

Fortnite Servers Down Players React To Prolonged Chapter 6 Season 2 Delay

May 03, 2025

Fortnite Servers Down Players React To Prolonged Chapter 6 Season 2 Delay

May 03, 2025 -

England Star Stanway Mourns Young Girl Killed On Football Pitch

May 03, 2025

England Star Stanway Mourns Young Girl Killed On Football Pitch

May 03, 2025 -

Birlesik Arap Emirlikleri Ve Orta Afrika Cumhuriyeti Nin Ticaret Anlasmasi

May 03, 2025

Birlesik Arap Emirlikleri Ve Orta Afrika Cumhuriyeti Nin Ticaret Anlasmasi

May 03, 2025

Latest Posts

-

Is Darjeeling Teas Production In Jeopardy

May 04, 2025

Is Darjeeling Teas Production In Jeopardy

May 04, 2025 -

Significant Temperature Drop Predicted For West Bengal

May 04, 2025

Significant Temperature Drop Predicted For West Bengal

May 04, 2025 -

5 South Bengal Districts Under Heatwave Warning Stay Safe

May 04, 2025

5 South Bengal Districts Under Heatwave Warning Stay Safe

May 04, 2025 -

1 2 Inches Of Spring Snow Possible In Some Nyc Suburbs Tomorrow

May 04, 2025

1 2 Inches Of Spring Snow Possible In Some Nyc Suburbs Tomorrow

May 04, 2025 -

Darjeeling Tea Facing Production Difficulties

May 04, 2025

Darjeeling Tea Facing Production Difficulties

May 04, 2025