Fintech IPOs And Trade Wars: The Case Of Affirm Holdings (AFRM) And Trump Tariffs

Table of Contents

The volatile world of Fintech IPOs is further complicated by the unpredictable impact of global trade wars. Affirm Holdings (AFRM), a prominent player in the "buy now, pay later" market, provides a compelling case study for understanding how Trump-era tariffs affected a major Fintech IPO and the broader sector. This article analyzes the impact of these trade wars, specifically Trump Tariffs, on Affirm's initial public offering and explores the wider implications for the Fintech landscape. We will examine Affirm's resilience (or vulnerability) to these trade tensions and draw conclusions about the challenges and opportunities for future Fintech companies navigating a globalized, and often protectionist, market.

2. Main Points:

H2: The Rise of Affirm Holdings (AFRM) and its IPO:

H3: Affirm's Business Model and Market Position: Affirm disrupted the traditional lending market with its innovative "buy now, pay later" (BNPL) model. This allows consumers to make purchases and pay in installments, typically interest-free, attracting a younger demographic less reliant on traditional credit cards. Its seamless integration into e-commerce platforms gave Affirm a significant competitive advantage, rapidly expanding its market share. Key differentiators included its focus on responsible lending practices and transparent fee structures.

H3: The IPO Process and Market Reception: Affirm's IPO in January 2021 was highly anticipated, reflecting the burgeoning interest in the Fintech sector. The pricing and initial market performance reflected investor confidence in its growth trajectory. However, like many stocks, AFRM experienced fluctuations in its early trading days, mirroring the overall market volatility.

- Key investors in Affirm's IPO: Included prominent venture capital firms and institutional investors. (Specific names and details would require further research and should be added here).

- Initial valuation and market capitalization: (Insert data on initial valuation and market cap at IPO).

- Comparison to other Fintech IPOs during the same period: (Compare Affirm's IPO performance to other similar Fintech IPOs around the same time, highlighting similarities and differences in market reception and long-term performance).

H2: The Impact of Trump Tariffs on the Fintech Sector:

H3: Direct and Indirect Effects of Tariffs: While the impact of tariffs on a purely digital company like Affirm might seem minimal at first glance, indirect effects were significant. Tariffs on imported components used in servers, data centers, and other technology infrastructure increased operating costs for many Fintech firms. Furthermore, reduced consumer spending due to higher prices on goods affected demand for BNPL services. Supply chain disruptions caused by tariffs also presented challenges for Affirm and its technology partners.

H3: Specific Examples of Tariff Impacts on Similar Businesses: Companies reliant on imported hardware or software for their operations experienced direct cost increases due to tariffs. Companies in related sectors, like e-commerce platforms that partnered with Affirm, also faced increased operational expenses. For example, tariffs on certain components used in payment processing terminals could indirectly impact the overall costs associated with BNPL services.

- Specific tariffs imposed during the Trump administration that could affect Fintech: (List specific tariffs and their impact on technology imports).

- Examples of how tariffs increased costs for businesses: (Provide concrete examples and cite relevant sources).

- Analysis of how these increased costs impacted profitability: (Analyze how increased costs translate to reduced profit margins for Fintech businesses).

H2: Analyzing Affirm's Resilience (or Vulnerability) to Trade Wars:

H3: Affirm's Strategic Responses to Trade Tensions: Affirm likely focused on mitigating risk through diversification of suppliers and potentially negotiating favorable terms with vendors. Cost-cutting measures and operational efficiencies might have been implemented to offset increased expenses. (This section requires further research on Affirm's specific actions).

H3: Performance Analysis Post-Tariff Implementation: (This section requires detailed financial analysis of Affirm's performance pre- and post-tariff implementation. Compare revenue growth, profit margins, and stock performance). A comparative analysis is crucial to determine if the tariffs had a demonstrably negative impact on Affirm's financial health.

- Affirm's financial results (revenue, profit, etc.) during and after the tariff period: (Insert specific data and charts).

- Stock price performance in relation to tariff announcements and implementation: (Analyze stock price movements relative to tariff-related news).

- Changes in Affirm's business strategy related to trade policies: (Identify any publicly available information on strategic shifts in response to trade tensions).

H2: Long-Term Implications for Fintech IPOs and Trade Policy:

H3: Lessons Learned from Affirm's Experience: Affirm's experience highlights the importance of considering trade policy risks when evaluating Fintech IPOs. Future investors need to conduct thorough due diligence, assessing supply chain vulnerabilities and potential exposure to tariffs or other trade-related disruptions.

H3: Future Predictions for Fintech IPOs in a Globalized Market: The increasing interconnectedness of the global economy means that future Fintech IPOs will need to incorporate robust strategies for managing trade risks. Geopolitical instability and fluctuating trade policies will remain significant challenges. The "buy now, pay later" sector specifically needs to anticipate potential changes in consumer spending patterns resulting from global economic shifts.

- Recommendations for future Fintech IPOs considering potential trade risks: (Suggest strategies for mitigating trade risks).

- Potential geopolitical factors affecting the Fintech industry: (Discuss potential geopolitical risks and their impact on Fintech).

- Long-term outlook for the "buy now, pay later" sector in relation to global trade: (Provide a forward-looking perspective on the future of BNPL in a globalized market).

3. Conclusion: Understanding the Interplay Between Fintech IPOs and Trade Wars – The Affirm Case Study

This analysis demonstrates the significant, albeit often indirect, impact of Trump-era tariffs on Affirm Holdings (AFRM) and the broader Fintech landscape. While Affirm may have shown resilience, the experience underscores the vital need for Fintech companies to proactively address geopolitical and trade-related risks. Understanding the interplay between global trade and Fintech is crucial for investors and entrepreneurs alike.

Key takeaways: Fintech IPOs are vulnerable to both direct and indirect impacts of trade wars. Proactive risk management strategies are essential for navigating trade uncertainties. Thorough due diligence, diversification of suppliers, and flexible business models are key to success in a globalized, and often unpredictable, market.

Call to action: To gain a deeper understanding of the interplay between global trade and the Fintech industry, we encourage further research into "Fintech IPO analysis," the "trade war impact on Fintech," "Affirm Holdings (AFRM) stock," and "buy now, pay later investments." Explore case studies of other Fintech companies that have navigated similar challenges, and delve deeper into the evolving geopolitical landscape shaping the future of finance.

Featured Posts

-

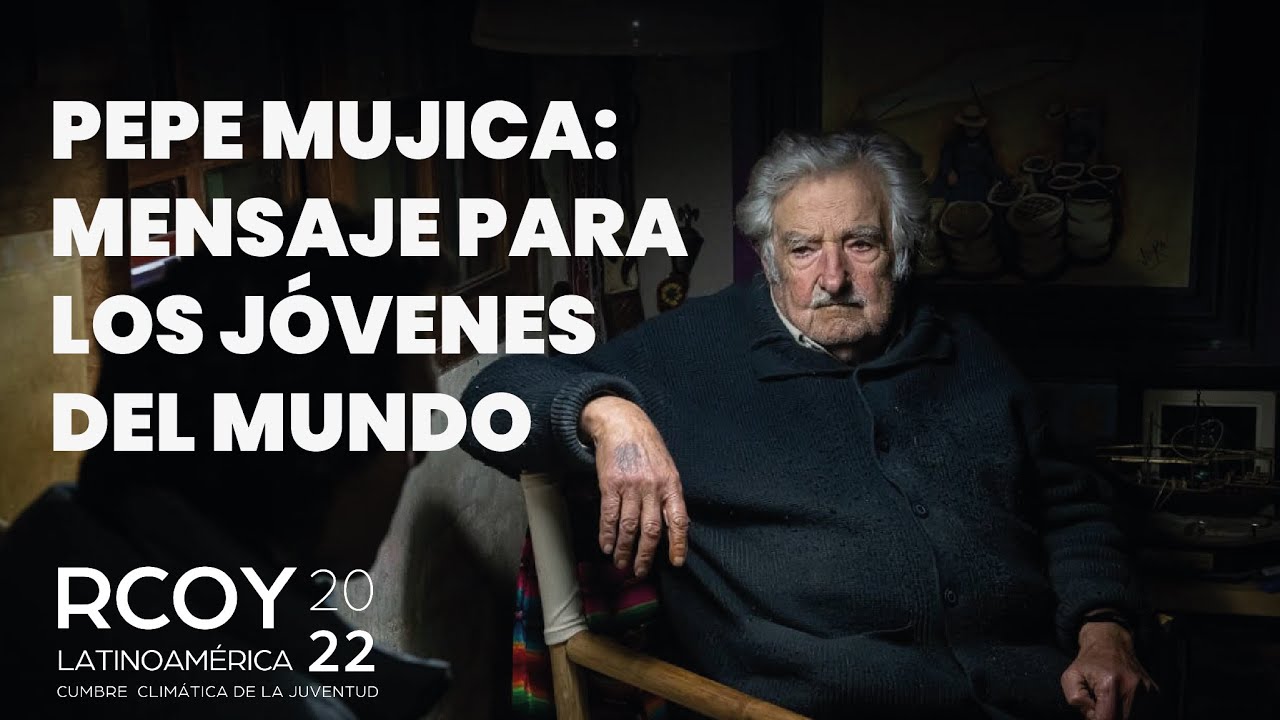

Fallecimiento De Jose Mujica Recordando Al Presidente Que Cambio Uruguay

May 14, 2025

Fallecimiento De Jose Mujica Recordando Al Presidente Que Cambio Uruguay

May 14, 2025 -

Awoniyi Injury Nottingham Forest Provide Latest Update

May 14, 2025

Awoniyi Injury Nottingham Forest Provide Latest Update

May 14, 2025 -

Borussia Dortmund Leading The Race For Jobe Bellingham

May 14, 2025

Borussia Dortmund Leading The Race For Jobe Bellingham

May 14, 2025 -

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025 -

Analiza Dokovicev Utjecaj Na Federerove Rekorde

May 14, 2025

Analiza Dokovicev Utjecaj Na Federerove Rekorde

May 14, 2025