FirstUp: IMF To Review Pakistan's $1.3 Billion Loan Package

Table of Contents

The Stakes for Pakistan: Economic Stability and Political Implications

Pakistan's economy is facing a perfect storm. High inflation, dwindling foreign exchange reserves, and a crippling debt burden have pushed the nation to the brink. The IMF loan is considered vital for preventing a full-blown financial crisis and averting further economic hardship. The success or failure of the review holds immense weight, with far-reaching consequences:

- Soaring Inflation: Inflation rates have skyrocketed, impacting the purchasing power of ordinary citizens and exacerbating poverty. The IMF loan is seen as a crucial tool to curb inflation and stabilize prices.

- Depleting Foreign Exchange Reserves: Pakistan's foreign exchange reserves have fallen dangerously low, limiting its ability to import essential goods and services. The loan is intended to bolster these reserves and stabilize the currency.

- Potential Social Unrest: The economic hardship experienced by many Pakistanis fuels social unrest and political instability. The IMF loan's success could mitigate this risk by providing relief and fostering economic recovery.

- Political Ramifications: The approval or rejection of the loan will have significant political repercussions. Failure to secure the loan could trigger further political instability and uncertainty. The government's success in navigating this process will heavily influence its political standing.

Key Conditions for IMF Approval: Structural Reforms and Policy Adjustments

To secure the $1.3 billion loan, Pakistan must meet stringent conditions imposed by the IMF, demanding significant structural reforms and policy adjustments. These conditions are aimed at fostering sustainable economic growth and ensuring the long-term viability of the economy. The key conditions include:

- Fiscal Consolidation Measures: This involves implementing comprehensive tax reforms to broaden the tax base and increase revenue collection, coupled with significant cuts in government spending. Efficient resource allocation is key.

- Monetary Policy Adjustments: The State Bank of Pakistan (SBP) will likely need to continue raising interest rates to control inflation, a measure which could further dampen economic growth in the short term.

- Structural Reforms: The IMF is likely to demand significant reforms in various sectors, including the energy sector (to reduce reliance on costly imports), and privatization of state-owned enterprises to improve efficiency and reduce the burden on the national budget.

- Anti-Corruption Measures: Strengthening governance and tackling corruption are crucial for ensuring the effective use of the loan funds and promoting transparency and accountability.

Pakistan's Preparedness for IMF Review: Progress and Challenges

Pakistan's progress in implementing the required reforms has been mixed. While some steps have been taken, significant challenges remain. The government's ability to meet the IMF's conditions hinges on several factors:

- Progress Made: The government has made efforts to implement some tax reforms and has taken steps to improve governance. However, the pace of implementation needs to accelerate.

- Remaining Challenges: Political will and bureaucratic inertia remain significant obstacles. The implementation of unpopular reforms, such as fuel price hikes, is politically challenging.

- Political Will and Capacity: The government's commitment to implementing the reforms and its capacity to overcome bureaucratic hurdles will be crucial in determining the outcome of the review.

- Potential Roadblocks and Setbacks: Unforeseen events, political instability, or resistance to reforms could derail the process and compromise the chances of securing the loan.

Global Impact and International Implications of the IMF's Decision

The IMF's decision on Pakistan's loan package will have far-reaching global implications:

- Impact on Regional Stability: Pakistan's economic stability is crucial for regional stability in South Asia. A major economic crisis in Pakistan could destabilize the region.

- Influence on Global Financial Markets: The outcome of the review could impact investor confidence in emerging markets and global financial markets more broadly.

- Significance for Other Countries: The IMF's approach to Pakistan will set a precedent for how it addresses similar economic challenges faced by other developing nations.

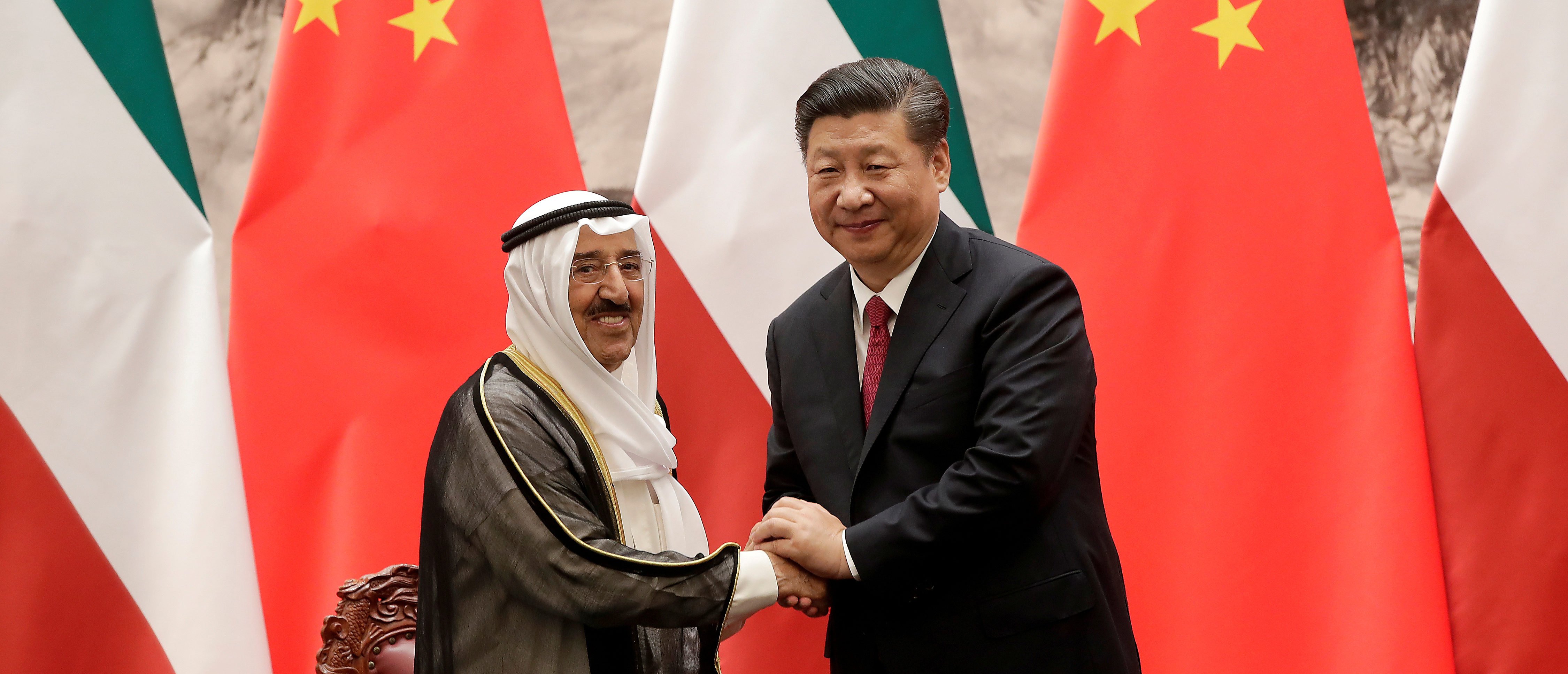

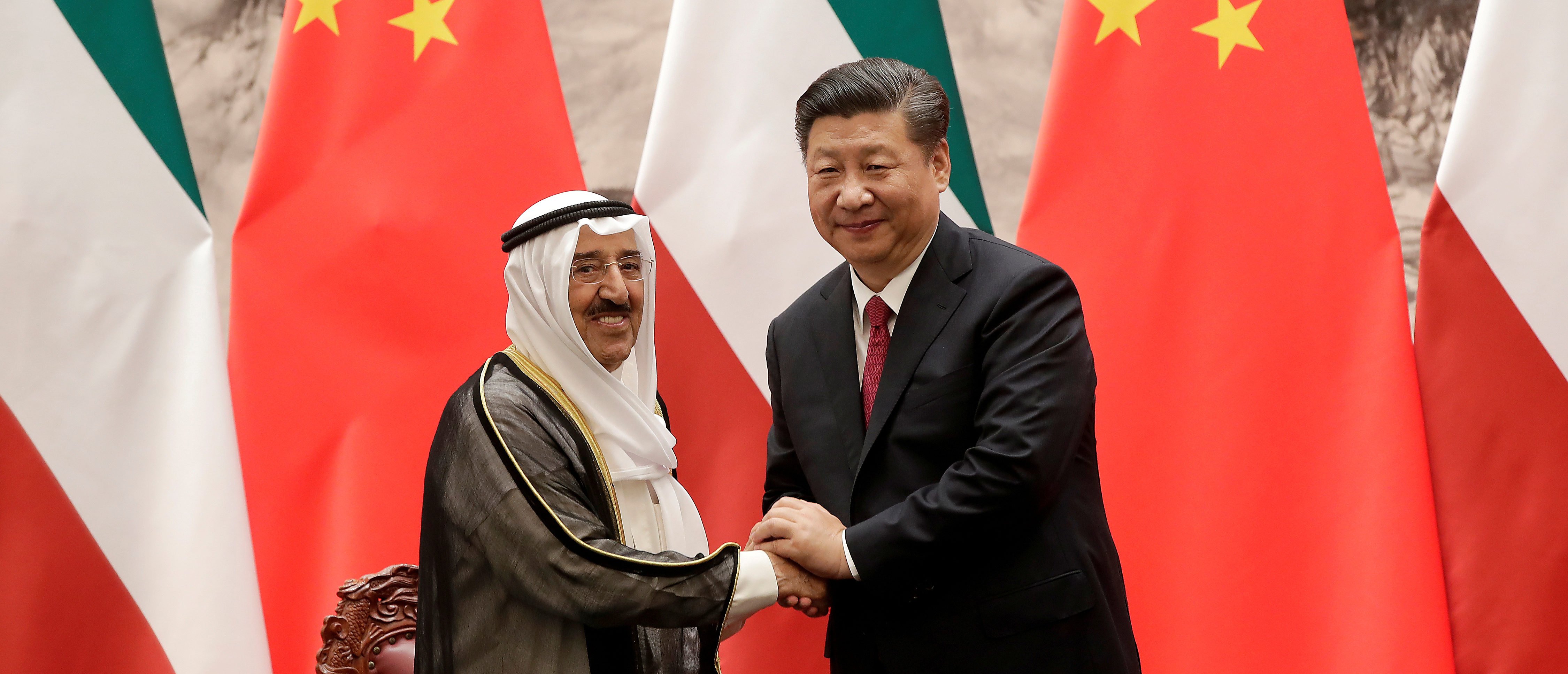

- Role of International Partners: The support of international partners, like the World Bank and other bilateral creditors, will be critical in helping Pakistan navigate its economic challenges.

Conclusion: The Future of Pakistan's Economy Hinges on the IMF Loan Package Review

The IMF's review of Pakistan's $1.3 billion loan package is a pivotal moment for the nation's economic future. The conditions imposed by the IMF, ranging from fiscal consolidation to structural reforms, demand significant adjustments. While Pakistan has made some progress, significant challenges remain. The outcome of this review will not only impact Pakistan's immediate economic trajectory but also its long-term stability and its standing within the global community. To stay updated on the outcome of the IMF review and its implications for Pakistan's economic outlook, follow reputable news sources and financial institutions for the latest developments. The future of the Pakistani economy and its ability to achieve financial stability hinges on the successful negotiation and implementation of this crucial IMF loan.

Featured Posts

-

Islanders Fall To Oilers In Overtime Draisaitl Reaches 100 Points

May 10, 2025

Islanders Fall To Oilers In Overtime Draisaitl Reaches 100 Points

May 10, 2025 -

French Minister Advocates For European Nuclear Sharing

May 10, 2025

French Minister Advocates For European Nuclear Sharing

May 10, 2025 -

Ihsaa Bans Transgender Athletes Following Trump Administration Order

May 10, 2025

Ihsaa Bans Transgender Athletes Following Trump Administration Order

May 10, 2025 -

Millions Stolen Federal Investigation Into Office365 Executive Account Breaches

May 10, 2025

Millions Stolen Federal Investigation Into Office365 Executive Account Breaches

May 10, 2025 -

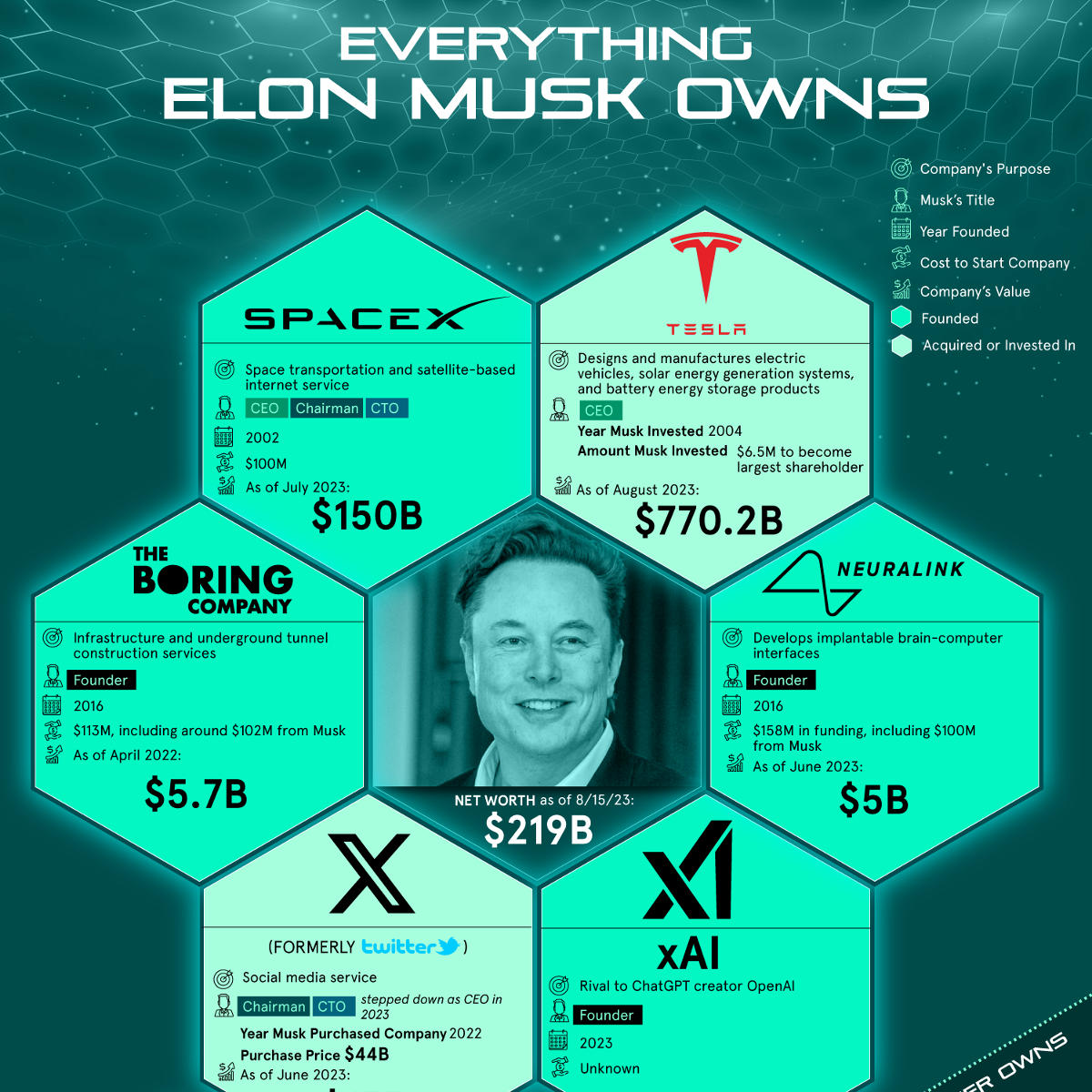

Hurun Report 2025 Elon Musk Still Tops Global Rich List Despite Significant Wealth Loss

May 10, 2025

Hurun Report 2025 Elon Musk Still Tops Global Rich List Despite Significant Wealth Loss

May 10, 2025