Five Key Charts To Watch In Global Commodity Markets This Week

Table of Contents

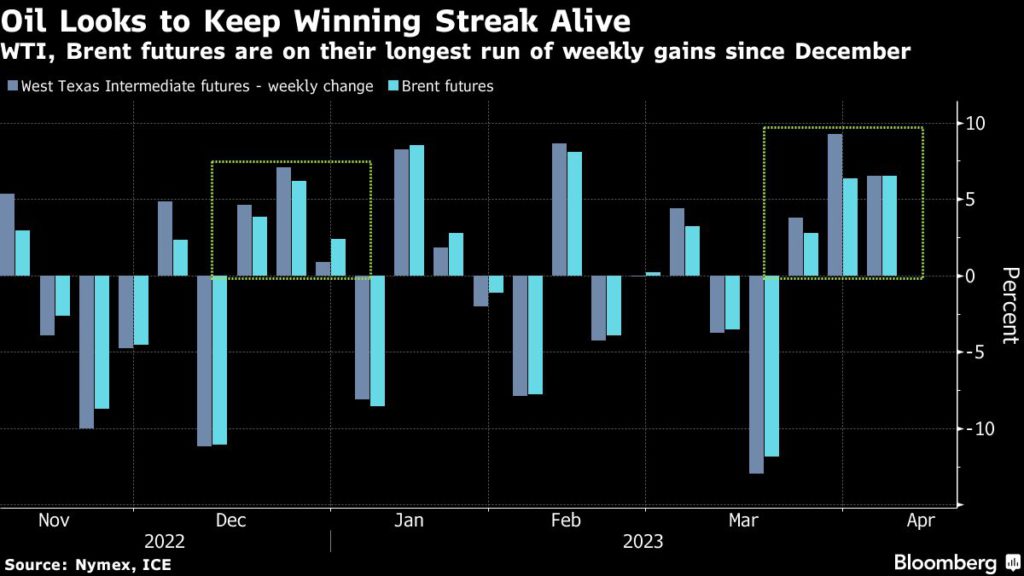

1. Crude Oil Price Chart: Assessing Geopolitical Risks and Supply Chain Dynamics

Analyzing the crude oil price is crucial for understanding the energy sector and the broader global economy. The interplay of geopolitical risk, supply chain disruptions, and fluctuating oil demand significantly impacts Brent crude and WTI crude prices. This week, careful monitoring of the oil market is paramount.

-

Examine the correlation between geopolitical instability and crude oil prices. Tensions in key oil-producing regions or disruptions to major pipelines can lead to sharp price increases due to supply concerns. The ongoing situation in [mention a relevant geopolitical hotspot] is a prime example of such a factor.

-

Assess the impact of sanctions and supply chain disruptions on oil production. Sanctions on specific countries or unforeseen events affecting transportation networks can create bottlenecks, limiting the availability of crude oil and pushing prices higher.

-

Analyze the influence of global economic growth on oil demand. Strong economic growth usually translates to increased industrial activity and transportation, leading to higher oil consumption and potentially higher prices. Conversely, economic slowdown can dampen demand and exert downward pressure on prices.

-

Consider the role of alternative energy sources in influencing oil prices. The growing adoption of renewable energy sources, such as solar and wind power, can gradually reduce reliance on fossil fuels, impacting long-term oil price trends.

2. Natural Gas Price Chart: Monitoring Energy Security and Weather Patterns

The natural gas price chart is another critical indicator, especially during winter months. Energy security concerns and extreme weather patterns significantly influence the natural gas market. Close monitoring of gas storage levels and LNG (Liquified Natural Gas) trade flows is vital this week.

-

Evaluate the impact of winter weather on natural gas consumption. Cold snaps across the northern hemisphere can dramatically increase heating demand, leading to potential shortages and price spikes.

-

Analyze the role of LNG imports and exports in shaping global gas prices. LNG trade plays a vital role in balancing supply and demand globally. Changes in export capacities or trade routes can significantly affect prices.

-

Examine the levels of natural gas storage and their implications for future prices. Low storage levels heading into winter can signal potential price volatility, while ample reserves can suggest price stability.

-

Assess the influence of government policies on natural gas prices. Regulations on production, exploration, and pricing can have a considerable impact on the natural gas market.

3. Agricultural Commodity Price Chart: Tracking Crop Yields and Global Food Security

Keeping an eye on agricultural commodities is crucial for understanding global food security. This week, carefully watch the prices of major crops like corn, soybeans, and wheat. Crop yields are heavily influenced by weather conditions, impacting grain prices and overall market stability.

-

Evaluate the effect of climate change and extreme weather on crop yields. Droughts, floods, and heatwaves can significantly damage crops, leading to reduced harvests and higher prices.

-

Assess the impact of trade policies and geopolitical tensions on agricultural markets. Trade restrictions or disruptions in supply chains can limit access to key agricultural products and inflate prices.

-

Examine the relationship between supply and demand in influencing agricultural commodity prices. Global production levels combined with consumption patterns will drive price fluctuations throughout the week.

-

Discuss the implications of rising fertilizer costs on agricultural production. Increased input costs can reduce profitability for farmers and potentially lead to higher food prices.

4. Precious Metals Price Chart: Gauging Investor Sentiment and Safe-Haven Demand

Precious metals, such as gold price and silver price, often serve as safe-haven assets. Their price movements frequently reflect investor sentiment and economic uncertainty. This week, monitor investor sentiment and the influence of inflation on the precious metals market.

-

Analyze the impact of inflation on precious metal prices. Inflation often drives investors to seek refuge in assets like gold, which can push prices higher.

-

Assess investor sentiment and its influence on precious metal markets. Positive economic news may lead to lower demand for safe-haven assets, while negative news could trigger increased buying.

-

Examine the role of central bank policies in influencing precious metal prices. Central bank actions on interest rates and monetary policy can significantly influence the value of precious metals.

-

Consider the industrial demand for precious metals in various sectors. Industrial applications of metals like platinum and palladium also contribute to price fluctuations.

5. Base Metals Price Chart: Analyzing Industrial Activity and Economic Growth

Base metals, including copper price and aluminum price, serve as indicators of global industrial activity and economic growth. The manufacturing sector heavily relies on these metals, making their price movements crucial to watch.

-

Analyze the correlation between base metal prices and manufacturing output. Strong manufacturing activity usually increases demand for base metals, pushing prices upward.

-

Assess the impact of economic growth in major economies on base metal demand. Robust economic growth in key regions like China and the US often leads to increased demand and higher base metal prices.

-

Examine the role of supply chain disruptions on base metal prices. Any disruption in the supply chain can impact the availability of these metals and affect prices.

-

Consider the influence of government policies on the mining and metal sectors. Regulations and policies related to mining and metal production can have a direct impact on market supply and prices.

Conclusion

This week's global commodity market landscape requires careful observation. The five key charts discussed above – crude oil, natural gas, agricultural commodities, precious metals, and base metals – offer crucial insights into the current market dynamics. By closely monitoring these charts and understanding the underlying factors driving price fluctuations, traders and investors can make more informed decisions and navigate the complexities of the global commodity markets. Stay informed, continue to analyze these global commodity markets, and make strategic moves based on data-driven insights. Remember to regularly consult updated commodity charts for the most current information.

Featured Posts

-

Jogo Do Corinthians Hoje Confira O Horario E Onde Assistir

May 05, 2025

Jogo Do Corinthians Hoje Confira O Horario E Onde Assistir

May 05, 2025 -

Formula 1 Verstappen Becomes A Father

May 05, 2025

Formula 1 Verstappen Becomes A Father

May 05, 2025 -

Britains Got Talent Semi Final Teddy Magics Absence Explained

May 05, 2025

Britains Got Talent Semi Final Teddy Magics Absence Explained

May 05, 2025 -

A New Era For The Economy Carneys Promises And Plans

May 05, 2025

A New Era For The Economy Carneys Promises And Plans

May 05, 2025 -

Bruno Surace Vs Jaime Munguia 2 May 3rd Fight Details And Predictions

May 05, 2025

Bruno Surace Vs Jaime Munguia 2 May 3rd Fight Details And Predictions

May 05, 2025

Latest Posts

-

Mindy Kalings Peplum Look At Hollywood Walk Of Fame Ceremony

May 06, 2025

Mindy Kalings Peplum Look At Hollywood Walk Of Fame Ceremony

May 06, 2025 -

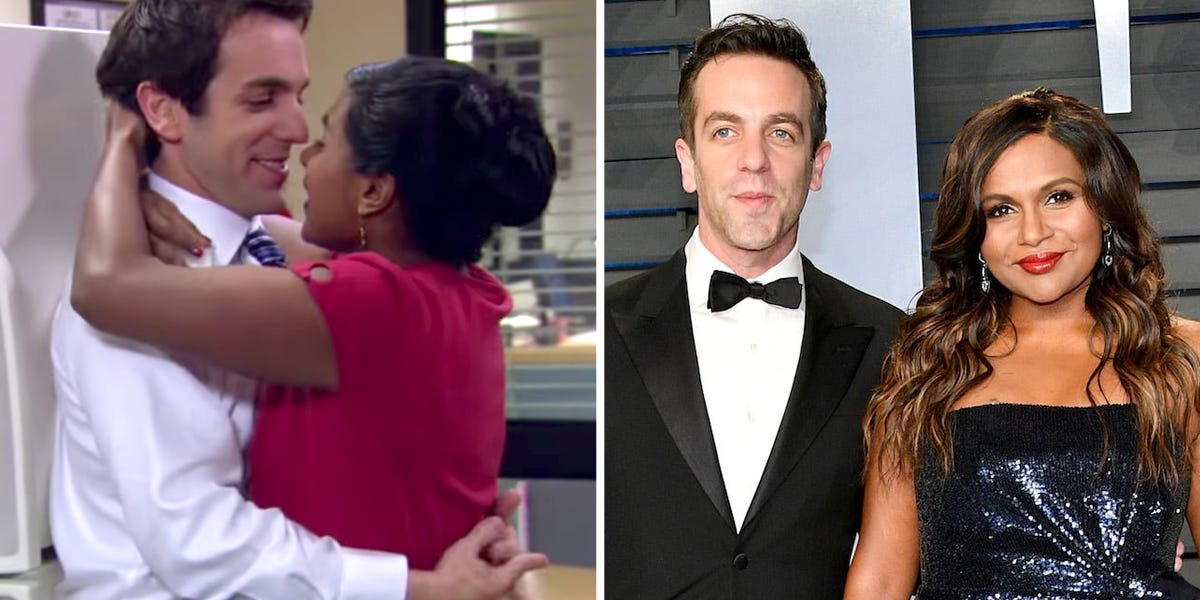

Understanding The Public Perception Of Bj Novak And Delaney Rowes Romance

May 06, 2025

Understanding The Public Perception Of Bj Novak And Delaney Rowes Romance

May 06, 2025 -

Bj Novak And Delaney Rowes Relationship Public Reaction And Analysis

May 06, 2025

Bj Novak And Delaney Rowes Relationship Public Reaction And Analysis

May 06, 2025 -

Bj Novak And Delaney Rowe A Normal Relationship

May 06, 2025

Bj Novak And Delaney Rowe A Normal Relationship

May 06, 2025 -

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025

Mindy Kalings Dramatic Weight Loss A New Look At The Premiere

May 06, 2025