Foot Locker Inc. (FL): Jim Cramer's Investment Opinion And Stock Analysis

Table of Contents

H2: Jim Cramer's Stance on Foot Locker (FL): A Historical Overview

Jim Cramer, through his various platforms, particularly "Mad Money," has frequently offered opinions on publicly traded companies. His commentary, while not always predictive, often influences investor sentiment. Tracking Cramer's stance on Foot Locker (FL) provides valuable context for understanding the market's perception of the company. Pinpointing exact dates and quotes for all past appearances regarding FL is difficult, as transcripts aren't always readily available and his views can evolve. However, we can observe trends.

- Bullet Points:

- Unconfirmed Anecdotal Evidence: While concrete evidence of specific dates and buy/sell recommendations is difficult to obtain without dedicated subscription access to full Mad Money archives, anecdotal evidence suggests Cramer has expressed both bullish and bearish sentiments about FL stock at different times. His opinions likely reflected the prevailing market conditions and Foot Locker's performance at those times.

- Market Sentiment Influence: Cramer's pronouncements, even if not always based on extensive fundamental analysis, undoubtedly impact market sentiment towards FL. A positive comment could temporarily boost the stock price, while a negative one could trigger a sell-off.

- Lack of Consistent Long-Term View: It is important to remember that Cramer's views are often short-term oriented, focusing on momentum and trading opportunities rather than long-term fundamental value. This makes direct comparison with long-term fundamental analysis more challenging.

H2: Foot Locker (FL) Stock Performance Analysis: Recent Trends and Future Outlook

Analyzing Foot Locker's recent financial performance is crucial for assessing its investment potential. We need to look beyond just the stock price and delve into the underlying fundamentals.

- Bullet Points:

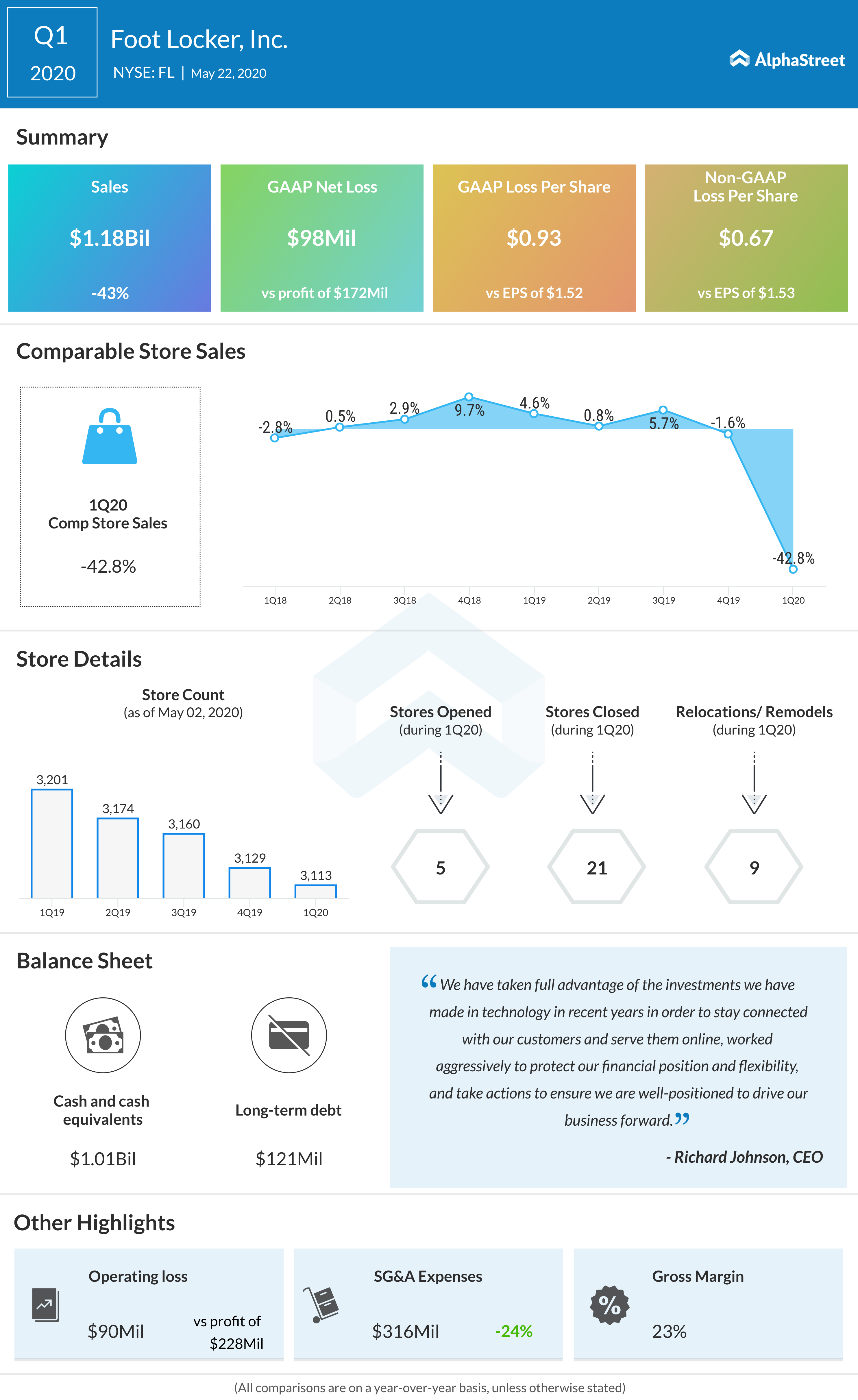

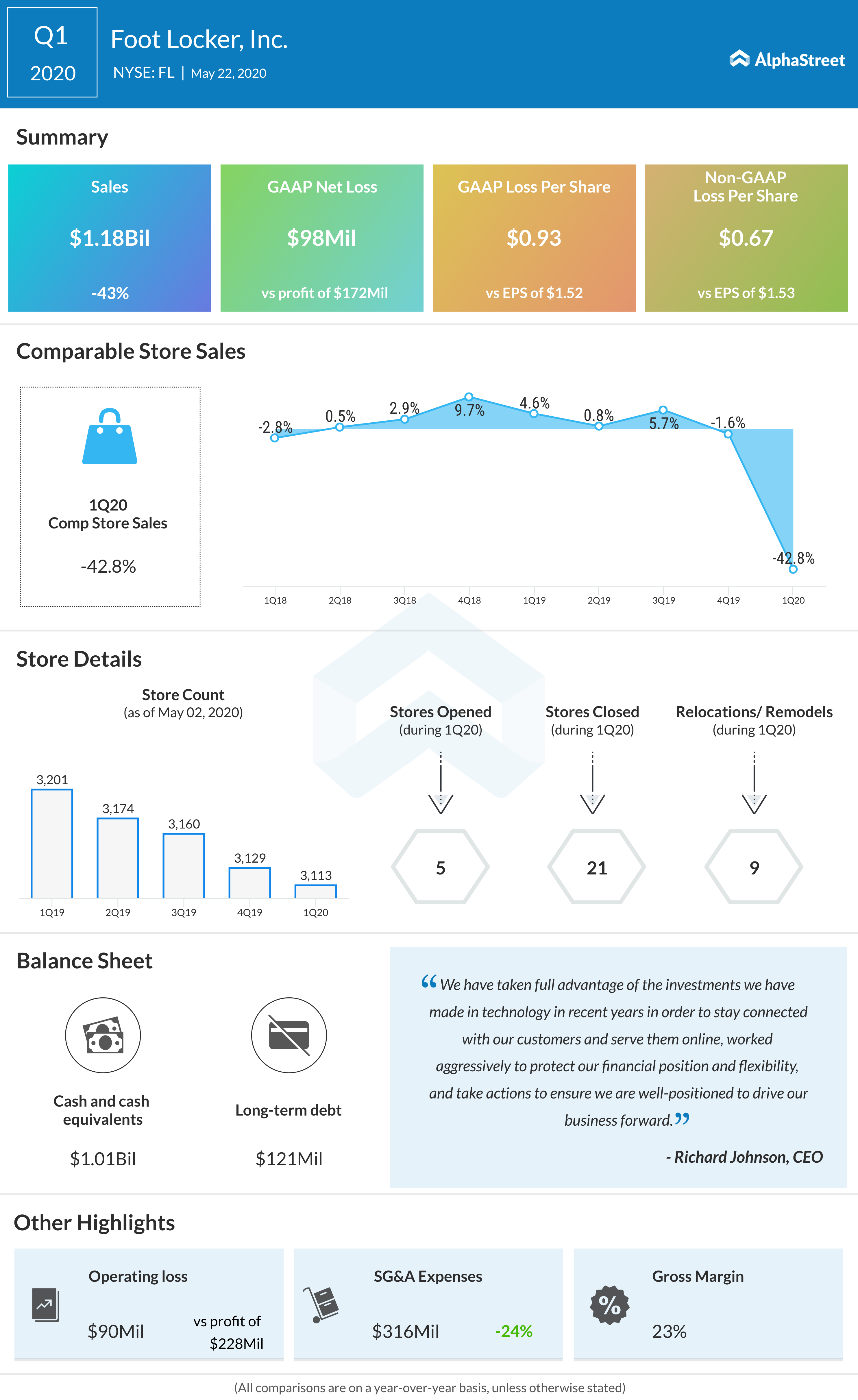

- Revenue and Earnings: Review recent quarterly earnings reports to assess revenue growth, EPS (earnings per share), and profit margins. Are they increasing, decreasing, or stagnating? This data offers insight into Foot Locker's operational efficiency and financial health.

- Competition: Foot Locker faces stiff competition from other athletic retailers, both online and brick-and-mortar. Analyzing the competitive landscape, including Nike's direct-to-consumer strategy and the growth of online marketplaces, is critical.

- Consumer Spending: Consumer discretionary spending is a major factor affecting Foot Locker. Economic downturns or shifts in consumer preferences can significantly impact sales.

- Supply Chain: Supply chain disruptions can affect inventory levels and profitability. Examining how effectively Foot Locker manages its supply chain is crucial.

- Debt Levels: High debt levels can increase financial risk. Analyzing Foot Locker's debt-to-equity ratio provides insight into its financial leverage.

H3: Evaluating the Foot Locker (FL) Stock Valuation

A thorough valuation involves multiple methods to arrive at a fair price estimate.

- Bullet Points:

- Price-to-Earnings Ratio (P/E): Comparing Foot Locker's P/E ratio to its competitors and industry averages provides insights into its relative valuation.

- Price-to-Sales Ratio (P/S): Analyzing the P/S ratio offers a broader perspective, especially useful when earnings are volatile.

- Discounted Cash Flow (DCF) Analysis: A DCF model projects future cash flows and discounts them to their present value, providing a more intrinsic value estimate. This is a more complex method requiring assumptions about future growth rates.

- Comparable Company Analysis: Comparing Foot Locker's valuation metrics to those of its competitors helps determine if it's overvalued or undervalued relative to its peers.

H2: Comparing Cramer's Opinion to Fundamental Analysis

To gain a comprehensive view, we must contrast Jim Cramer's perspective with the results of our fundamental analysis.

- Bullet Points:

- Alignment of Opinions: Do Cramer's past comments align with the findings of the fundamental analysis regarding Foot Locker's financial health, competitive position, and growth prospects?

- Discrepancies: If discrepancies exist, why might that be? Are there factors that Cramer might have overlooked in his commentary? Perhaps his focus on short-term market movements differs from a long-term fundamental valuation.

- Technical Analysis: While primarily focused on fundamental analysis in this article, a brief look at technical indicators like moving averages and chart patterns could provide further perspective, although technical analysis is not always a reliable predictor of future stock performance.

3. Conclusion:

Determining whether Foot Locker (FL) stock is a worthwhile investment requires careful consideration of both Jim Cramer's opinions and thorough fundamental analysis. While Cramer's pronouncements can influence market sentiment, they shouldn't be the sole basis for investment decisions. Our analysis shows the importance of evaluating a company's financial health, competitive position, and future growth prospects. Remember, past performance is not indicative of future results. Conduct your own thorough research of Foot Locker (FL) stock before investing, considering all available information and your personal risk tolerance. Consult with a financial advisor before making any investment decisions. Learn more about effective investment strategies using Foot Locker (FL) as a case study to further your understanding of the stock market.

Featured Posts

-

Ontarios Gas Tax Cut Permanent Relief And Highway 407 East Toll Removal

May 15, 2025

Ontarios Gas Tax Cut Permanent Relief And Highway 407 East Toll Removal

May 15, 2025 -

San Jose Earthquakes Vs Lafc Impact Of Goalkeeper Injury On Match Outcome

May 15, 2025

San Jose Earthquakes Vs Lafc Impact Of Goalkeeper Injury On Match Outcome

May 15, 2025 -

Should You Take Creatine Weighing The Pros And Cons

May 15, 2025

Should You Take Creatine Weighing The Pros And Cons

May 15, 2025 -

Wayne Gretzkys Fast Facts Stats Records And More

May 15, 2025

Wayne Gretzkys Fast Facts Stats Records And More

May 15, 2025 -

10 Gainers On Bse Sensex Rally And Winning Stocks

May 15, 2025

10 Gainers On Bse Sensex Rally And Winning Stocks

May 15, 2025