Ford's Brazilian Decline: How BYD Is Capitalizing On The EV Market

Table of Contents

Ford's Struggles in the Brazilian Market

Declining Sales and Market Share

Ford's sales figures in Brazil paint a stark picture. Over the past five years, the company has witnessed a dramatic decrease in market share, falling from a respectable [Insert Percentage]% in [Year] to a significantly lower [Insert Percentage]% in [Year]. This decline is far steeper than that experienced by many of its competitors.

- Specific sales data: [Insert specific sales figures with sources for each year mentioned].

- Comparison to competitors: [Compare Ford's sales decline to that of other major automakers in Brazil, e.g., Volkswagen, GM].

- Reasons for the decline: Beyond external economic factors, internal issues like a lack of significant investment in new models tailored for the Brazilian market and a slow response to the growing demand for SUVs contribute significantly to the fall. An aging model lineup, compared to competitors, also plays a role.

Lack of Investment in EVs

Ford's limited investment in electric vehicles for the Brazilian market stands in stark contrast to its competitors. While BYD and other manufacturers are aggressively introducing new EV models, Ford's presence in the Brazilian EV segment remains minimal.

- Comparison of EV models: [Compare the number and types of EV models offered by Ford and BYD in Brazil]. BYD currently offers a diverse range of vehicles from compact cars to SUVs, while Ford's offering is substantially smaller.

- Lack of charging infrastructure support: Ford has yet to establish a robust charging infrastructure network in Brazil, a key factor in EV adoption.

- Marketing strategies: Ford's marketing efforts regarding EVs in Brazil appear considerably less aggressive than those of BYD and other EV competitors.

Failure to Adapt to Changing Consumer Preferences

Ford's failure to adapt to the evolving preferences of Brazilian consumers further exacerbates its challenges. The increasing demand for electric vehicles and sustainable transportation options has not been met with a commensurate response from Ford.

- Consumer surveys: [Cite relevant consumer surveys highlighting the increasing demand for EVs in Brazil].

- Analysis of preferred vehicle types: Brazilian consumers are increasingly favoring SUVs and compact vehicles, and Ford has not adequately responded to this shift in demand with modern, competitive offerings.

- Comparison of Ford's marketing with BYD’s: BYD's targeted marketing campaigns emphasize sustainability and affordability, while Ford's messaging has fallen behind in reaching environmentally conscious consumers.

BYD's Strategic Success in the Brazilian EV Market

Aggressive Pricing and Product Strategy

BYD's success stems largely from its aggressive pricing strategy and a diverse range of EV models catering to various consumer segments. This directly contrasts with Ford's higher price points and limited options.

- Price comparisons: [Provide price comparisons between comparable Ford and BYD models in Brazil]. BYD consistently undercuts Ford in price while providing similar or better features.

- Range and features of BYD's models: BYD offers competitive range and features, exceeding consumer expectations in terms of battery life and technology.

- Targeting specific consumer segments: BYD has successfully targeted various consumer segments with its diverse vehicle offerings, including budget-conscious buyers and those seeking advanced technological features.

Strong Local Partnerships and Infrastructure Development

BYD's commitment to local partnerships and infrastructure development has been instrumental in its success. This proactive approach contrasts sharply with Ford's more passive strategy.

- Manufacturing partnerships: [Mention specific partnerships BYD has established in Brazil for manufacturing or distribution].

- Charging station initiatives: BYD is actively investing in or partnering to expand EV charging infrastructure, addressing a key barrier to EV adoption.

- Government collaborations: BYD's strong relationships with the Brazilian government have facilitated smoother market entry and provided access to incentives.

Effective Marketing and Brand Building

BYD has effectively cultivated brand awareness and trust amongst Brazilian consumers through targeted marketing campaigns and strong public relations.

- Marketing campaigns: [Mention examples of BYD's successful marketing campaigns in Brazil, highlighting their effectiveness].

- Social media engagement: BYD actively engages with consumers on social media, building a strong online presence.

- Public relations efforts: BYD has successfully positioned itself as a leader in sustainable transportation in Brazil.

The Impact of Government Policies and Regulations

Government Incentives for EVs

Brazilian government policies incentivizing EV adoption have significantly impacted the automotive market, benefiting BYD more than Ford.

- Tax breaks: [Detail the tax breaks and subsidies offered by the Brazilian government for EVs].

- Subsidies: The availability of government subsidies has made BYD's EVs more affordable.

- Emission regulations: Stringent emission regulations are pushing consumers towards cleaner vehicles, creating a favorable environment for BYD.

Infrastructure Development and Support

Government investments in EV charging infrastructure have indirectly impacted both Ford and BYD, but BYD is better positioned to capitalize on these developments.

- Government initiatives: [Discuss government initiatives to develop charging infrastructure].

- Private sector investments: Increased private sector investments in charging stations are further facilitating EV adoption.

- Challenges in infrastructure development: While challenges exist, the overall trend is positive and favors companies already investing in this space.

Conclusion

Ford's struggles in the Brazilian market are multifaceted, stemming from a lack of investment in EVs, failure to adapt to changing consumer preferences, and an overall less aggressive approach compared to competitors. Conversely, BYD's strategic success highlights the importance of aggressive pricing, strong local partnerships, effective marketing, and a commitment to developing the necessary infrastructure to support EV adoption. The connection between Ford's decline and BYD's rise underscores the rapidly shifting dynamics of the Brazilian automotive industry. Understanding Ford's Brazilian decline and BYD's success offers valuable insights into the rapidly evolving automotive landscape. Further research into the strategies employed by companies like BYD will be crucial for navigating the future of the Brazilian EV market and understanding the broader implications of the global shift towards electric vehicles.

Featured Posts

-

Chinas Byd Challenges Fords Legacy In Brazils Electric Vehicle Market

May 13, 2025

Chinas Byd Challenges Fords Legacy In Brazils Electric Vehicle Market

May 13, 2025 -

Trumps State Of The Union Local Community Demonstrates Discontent

May 13, 2025

Trumps State Of The Union Local Community Demonstrates Discontent

May 13, 2025 -

Sue Crane 1931 2023 Dedicated Portola Valley Public Servant

May 13, 2025

Sue Crane 1931 2023 Dedicated Portola Valley Public Servant

May 13, 2025 -

Pertandingan Venezia Atalanta Aksi Jay Idzes Bek Timnas Indonesia

May 13, 2025

Pertandingan Venezia Atalanta Aksi Jay Idzes Bek Timnas Indonesia

May 13, 2025 -

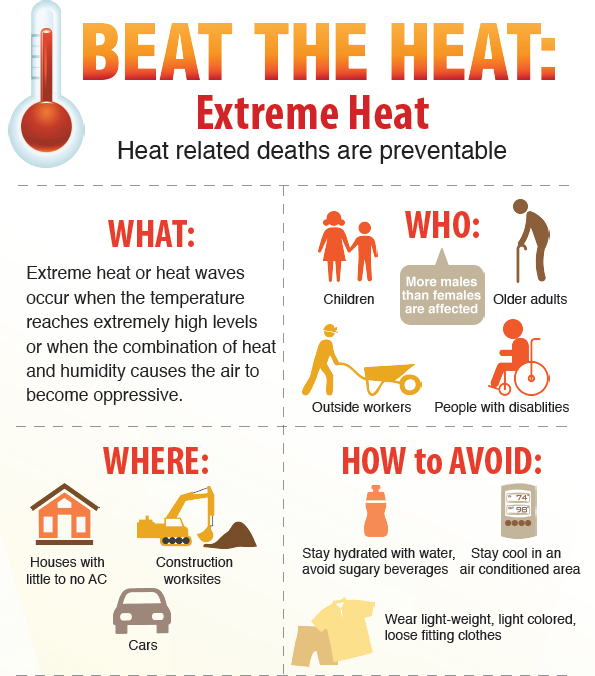

Extreme Heat In Indore 40 C Temperature Triggers Health Warning

May 13, 2025

Extreme Heat In Indore 40 C Temperature Triggers Health Warning

May 13, 2025

Latest Posts

-

1035 The Beat Tory Lanez And 50 Cent On The Megan Thee Stallion Verdict

May 13, 2025

1035 The Beat Tory Lanez And 50 Cent On The Megan Thee Stallion Verdict

May 13, 2025 -

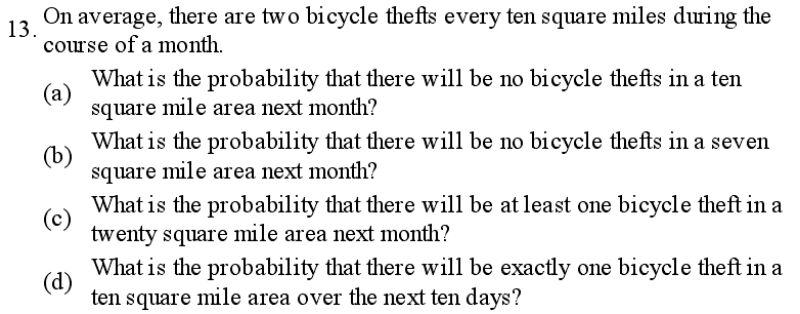

Dutch Bicycle Thefts Reach All Time High Amsterdam Worst Affected

May 13, 2025

Dutch Bicycle Thefts Reach All Time High Amsterdam Worst Affected

May 13, 2025 -

The Megan Thee Stallion Case Tory Lanez And 50 Cents Responses

May 13, 2025

The Megan Thee Stallion Case Tory Lanez And 50 Cents Responses

May 13, 2025 -

Amsterdam Bike Thefts Surge To Unprecedented Levels

May 13, 2025

Amsterdam Bike Thefts Surge To Unprecedented Levels

May 13, 2025 -

Reactions To Megan Thee Stallion Verdict Tory Lanez And 50 Cents Statements

May 13, 2025

Reactions To Megan Thee Stallion Verdict Tory Lanez And 50 Cents Statements

May 13, 2025