Forecasting Key Price Levels For Apple Stock (AAPL)

Table of Contents

Fundamental Analysis of Apple Stock (AAPL): Assessing Intrinsic Value

Fundamental analysis focuses on evaluating the intrinsic value of a company to determine if its stock is undervalued or overvalued. For AAPL, this involves examining several key aspects:

Revenue and Earnings Growth: Projecting AAPL's Future Performance

Analyzing Apple's historical and projected revenue and earnings growth is crucial for AAPL stock forecast. This involves looking beyond short-term fluctuations and considering long-term trends.

- Recent Financial Reports: Apple consistently releases strong financial reports, showcasing robust growth across its product segments. Examining these reports provides valuable insights into current performance and identifies potential areas of future growth.

- Analyst Predictions: Numerous financial analysts provide AAPL earnings forecast and revenue growth projections. While these predictions should be viewed with caution, they offer a consensus view of market expectations.

- New Product Launches: The success of new product launches, such as the iPhone 15 series or new Apple Watches, will significantly impact future revenue and earnings. The anticipation and market reception of these products are crucial factors in predicting AAPL's financial trajectory. Analyzing pre-orders and initial sales figures will provide early indicators of success. Keywords: AAPL earnings forecast, Apple revenue growth, iPhone sales projections.

Competitive Landscape and Market Share: Navigating the Tech Arena

Apple operates in a highly competitive tech industry. Understanding its competitive position is essential for any accurate Apple stock price target.

- Market Share Trends: Apple maintains a significant market share in smartphones, tablets, and wearables. Analyzing trends in market share helps assess its ability to maintain and grow its dominance against competitors like Samsung, Google, and others.

- Threats and Opportunities: The emergence of new technologies and competitors presents both threats and opportunities. For example, the growing popularity of foldable phones could pose a challenge, while advancements in augmented reality (AR) could create new revenue streams.

- Innovation Capacity: Apple's ability to innovate and introduce groundbreaking products is vital for maintaining its competitive edge. Analyzing its research and development efforts, patent filings, and overall innovation strategy provides insights into its future potential. Keywords: Apple market share, Apple competition, tech market analysis.

Valuation Metrics: Determining Fair Value for AAPL Stock

Valuation metrics help determine whether Apple stock is currently trading at a fair price.

- Price-to-Earnings Ratio (P/E): Comparing AAPL's P/E ratio to its historical average and industry peers helps assess whether it's currently overvalued or undervalued. A high P/E ratio might suggest investor optimism about future growth, while a low P/E ratio might indicate undervaluation.

- Price-to-Sales Ratio (P/S): The P/S ratio offers another perspective on valuation, particularly useful for companies with high growth potential but potentially negative earnings.

- Other Metrics: Other relevant metrics include the Price-to-Book ratio (P/B) and free cash flow yield. Considering multiple metrics provides a more comprehensive valuation picture. Keywords: AAPL valuation, Apple P/E ratio, stock valuation metrics.

Technical Analysis of Apple Stock (AAPL): Identifying Chart Patterns and Trends

Technical analysis uses historical price and volume data to identify trends and predict future price movements. For AAPL stock forecast, this involves several key techniques:

Chart Patterns: Decoding Price Action

Analyzing Apple's price charts can reveal significant support and resistance levels, trend lines, and chart patterns.

- Support and Resistance Levels: These levels represent price points where buying or selling pressure is expected to be strong. Breakouts above resistance or below support can signal significant price movements.

- Trend Lines: Connecting significant price highs or lows creates trend lines that show the overall direction of the price movement. A break of a trend line can indicate a change in momentum.

- Chart Patterns (Head and Shoulders, Double Bottoms, etc.): These patterns provide visual representations of potential price reversals or continuations. Keywords: AAPL chart analysis, Apple technical analysis, stock chart patterns.

Moving Averages and Indicators: Gauging Momentum

Moving averages (SMA, EMA) and other technical indicators provide insights into the momentum and potential direction of price movement.

- Simple Moving Average (SMA): A simple average of closing prices over a specified period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to recent changes.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): Identifies changes in momentum by comparing two moving averages. Keywords: Apple stock moving average, technical indicators AAPL.

Volume Analysis: Confirming Price Movements

Analyzing trading volume provides confirmation of price movements and can identify potential breakouts.

- High Volume Breakouts: A significant price increase accompanied by high trading volume suggests strong buying pressure and a potential continuation of the upward trend.

- Low Volume Rallies: A price increase with low volume may be less sustainable and potentially indicate a weakening trend.

- Volume Confirmation: Volume should generally confirm the direction of price movement. Increasing volume during an uptrend is a positive sign, while decreasing volume during an uptrend could signal weakening momentum. Keywords: AAPL trading volume, volume analysis stock.

External Factors Influencing Apple Stock (AAPL) Price

Beyond fundamental and technical analysis, external factors can significantly impact Apple stock price.

Macroeconomic Conditions: The Broader Economic Picture

Broader economic factors influence investor sentiment and can impact Apple's performance.

- Inflation and Interest Rates: High inflation and rising interest rates can negatively impact consumer spending and increase borrowing costs for companies, potentially affecting Apple's profitability and stock price.

- Global Economic Growth: Strong global economic growth generally benefits Apple, while economic downturns can lead to reduced demand for its products and a decline in stock price. Keywords: Macroeconomic factors, Apple stock and economy.

Geopolitical Events: Global Uncertainty

Geopolitical events can create uncertainty and affect supply chains, demand, and investor confidence.

- Trade Wars and Tariffs: Trade disputes can increase the cost of components or restrict access to markets, impacting Apple's profitability.

- Political Instability: Political instability in key markets can disrupt operations and affect demand for Apple products. Keywords: Geopolitical risk, Apple stock and global events.

Regulatory Changes: Navigating the Regulatory Landscape

Regulatory changes in various jurisdictions can impact Apple's operations and profitability.

- Antitrust Concerns: Investigations into monopolistic practices can lead to fines or other penalties, affecting Apple's financial performance.

- Data Privacy Regulations: Stricter data privacy regulations can increase compliance costs and impact Apple's business model. Keywords: Apple regulation, tech regulation impact.

Conclusion: Developing Your AAPL Investment Strategy

Forecasting Apple stock price (AAPL) requires a multifaceted approach combining fundamental analysis, technical analysis, and a keen awareness of external factors. While predicting exact price levels remains challenging, this analysis provides valuable insights into potential scenarios and helps inform investment decisions. By integrating these approaches, investors can develop a more informed perspective and potentially identify favorable entry and exit points for AAPL stock. Remember to conduct your own thorough research and consider your personal risk tolerance before making any investment decisions. Continue researching and monitoring Apple stock price prediction (AAPL) to stay informed about future price movements and refine your investment strategy.

Featured Posts

-

Dax Stable Despite Recent Record Run Frankfurt Stock Market Update

May 25, 2025

Dax Stable Despite Recent Record Run Frankfurt Stock Market Update

May 25, 2025 -

Porsche 356 Riwayat Produksi Dan Warisan Pabrik Zuffenhausen

May 25, 2025

Porsche 356 Riwayat Produksi Dan Warisan Pabrik Zuffenhausen

May 25, 2025 -

Budget Friendly Country Living Homes Under 1 Million

May 25, 2025

Budget Friendly Country Living Homes Under 1 Million

May 25, 2025 -

Nemecky Pracovny Trh V Krize Rozsiahle Prepustanie V Najvaecsich Firmach

May 25, 2025

Nemecky Pracovny Trh V Krize Rozsiahle Prepustanie V Najvaecsich Firmach

May 25, 2025 -

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 25, 2025

Brest Urban Trail Les Visages De La Course Benevoles Artistes Et Partenaires

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

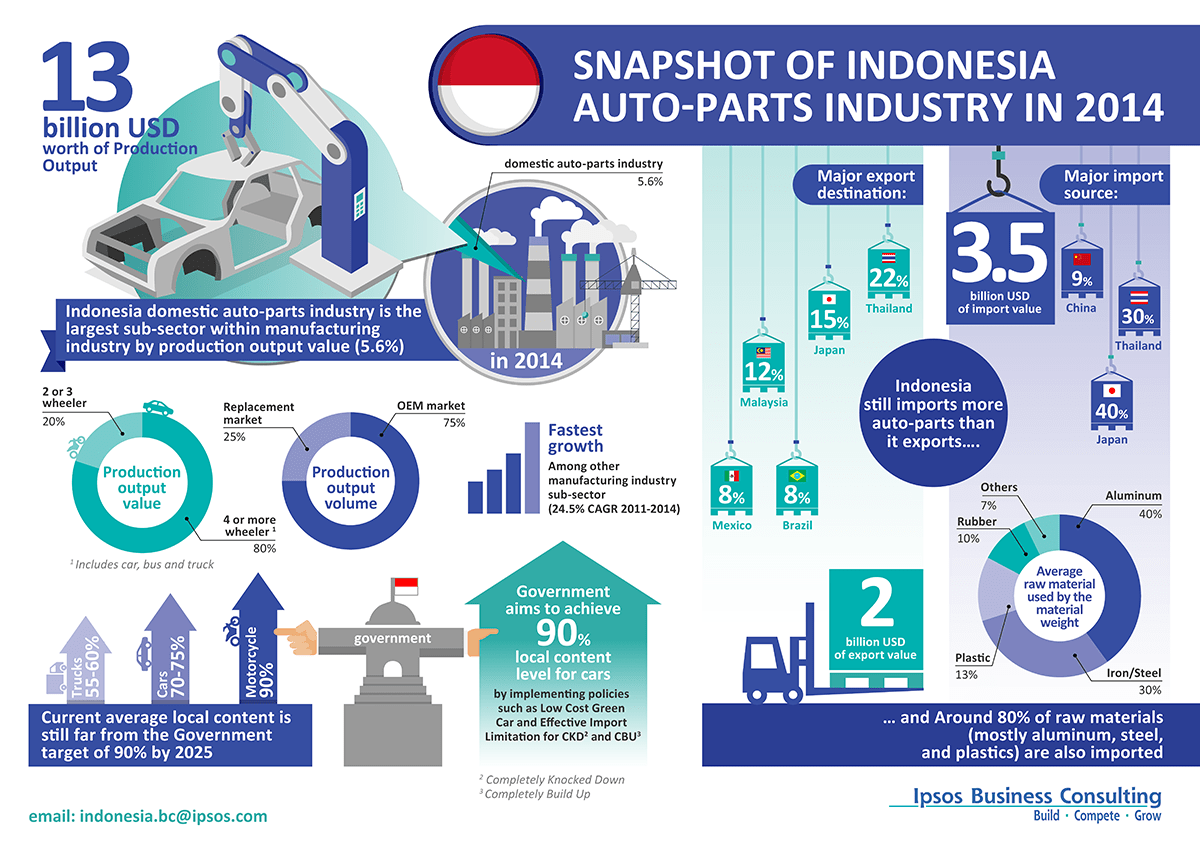

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025