Foreign Airlines Acquire WestJet Stake, Marking Onex Investment Exit

Table of Contents

Details of the WestJet Stake Acquisition

Identifying the Acquiring Airlines

The acquisition of a significant stake in WestJet involves a consortium of prominent foreign airlines. While the exact breakdown of ownership percentages might vary slightly depending on final regulatory approvals, the key players include [insert names of airlines, e.g., Lufthansa, Delta Air Lines, Air France-KLM]. These airlines bring a wealth of experience and global reach to the partnership.

- Lufthansa: Holds a [percentage]% stake, boasting a significant market share in Europe and a substantial long-haul fleet. Their focus on premium service and extensive global network could significantly impact WestJet's international operations.

- Delta Air Lines: Owns a [percentage]% share, a leading airline in North America with a strong focus on connecting flights. Their expertise in hub-and-spoke operations could streamline WestJet's domestic and international networks.

- Air France-KLM: Holds a [percentage]% stake, with considerable experience in the European and transatlantic markets. Their expertise in international route planning could enhance WestJet’s connectivity to Europe.

These airlines have a combined fleet size of [Total Fleet Size] aircraft and operate in diverse regions globally. Delta's prior investments in other North American airlines demonstrate their strategic approach to market expansion. Lufthansa's existing codeshare agreements and Air France-KLM's significant European presence creates opportunities for synergistic growth.

The Financial Terms of the Deal

The total value of the WestJet stake acquisition is reported to be approximately [Dollar Amount], reflecting a price per share of [Dollar Amount]. This represents a significant investment in the Canadian airline market.

- Specific Amounts Invested: [Breakdown of investment amounts from each airline]

- Percentage of Ownership Acquired: [Total percentage acquired by the consortium]

This acquisition could significantly impact investor confidence in WestJet, potentially leading to increased stock prices if the market views the deal positively. The financial health of WestJet, post-acquisition, will be a key indicator of the success of this major investment.

Onex Corp.'s Exit Strategy and Rationale

Onex Corp.'s decision to divest its entire stake in WestJet signals a strategic shift in their investment portfolio. Their rationale likely stems from a combination of factors.

- Reasons for Divestment:

- Maximizing returns on their initial investment in WestJet.

- Restructuring their portfolio to focus on other investment opportunities.

- Recognizing the potential for growth under new ownership with greater international expertise.

- Return on Investment: Onex Corp.’s investment period resulted in [description of return - e.g., a significant profit, achieving their targeted ROI, etc.].

This exit signifies the successful conclusion of a major investment for Onex Corp., allowing them to reinvest capital in other areas of their portfolio.

Implications for WestJet and the Canadian Airline Industry

Impact on WestJet's Operations and Future Strategy

The change in ownership structure will undoubtedly influence WestJet's operations and future strategic direction. The foreign airlines' involvement suggests a shift towards increased international connectivity and potential integration with their existing global networks.

- Potential Changes:

- Expansion of international routes, particularly to Europe and beyond.

- Possible fleet modernization and standardization with the acquiring airlines.

- Enhanced codeshare agreements and alliances.

- Improved passenger loyalty programs through integration.

The integration of WestJet into the global networks of the acquiring airlines could significantly improve WestJet’s ability to compete on a global scale.

Competition and Market Dynamics

The acquisition alters the competitive landscape of the Canadian airline industry, potentially increasing competition with Air Canada and other domestic players. While there could be increased competition on certain routes, there's also potential for collaboration, especially on international routes.

- Potential Effects:

- Increased route choices for passengers.

- Potential fare adjustments based on market dynamics.

- Increased pressure on Air Canada to maintain its market share.

The resulting impact on airfare pricing remains to be seen and will depend on the strategies implemented by the new owners and the overall response of the market.

Regulatory and Political Considerations

The foreign investment in a major Canadian airline like WestJet will undoubtedly face regulatory scrutiny and attract political commentary. Approval processes from the Canadian government and competition authorities are crucial for the deal to proceed smoothly.

- Relevant Regulations: The Investment Canada Act will be a key factor in evaluating the foreign ownership. Competition Bureau reviews are also anticipated.

- Public Opinion: Potential concerns about foreign control over a significant Canadian asset need careful consideration.

Navigating these regulatory and political hurdles is essential for the successful completion and integration of this significant acquisition.

Conclusion

The acquisition of a substantial stake in WestJet by a consortium of foreign airlines marks a pivotal moment in the Canadian airline industry. Onex Corp.'s strategic exit reflects a successful investment, while the foreign investment introduces significant opportunities and challenges for WestJet and the broader market. The deal's implications – ranging from operational changes to competitive dynamics and regulatory considerations – will shape the future of air travel in Canada.

Call to Action: Stay informed about the evolving dynamics in the Canadian airline industry and the ongoing effects of this significant WestJet stake acquisition. Follow [Your Website/Publication] for continuous updates on WestJet and related news in the Canadian airline market.

Featured Posts

-

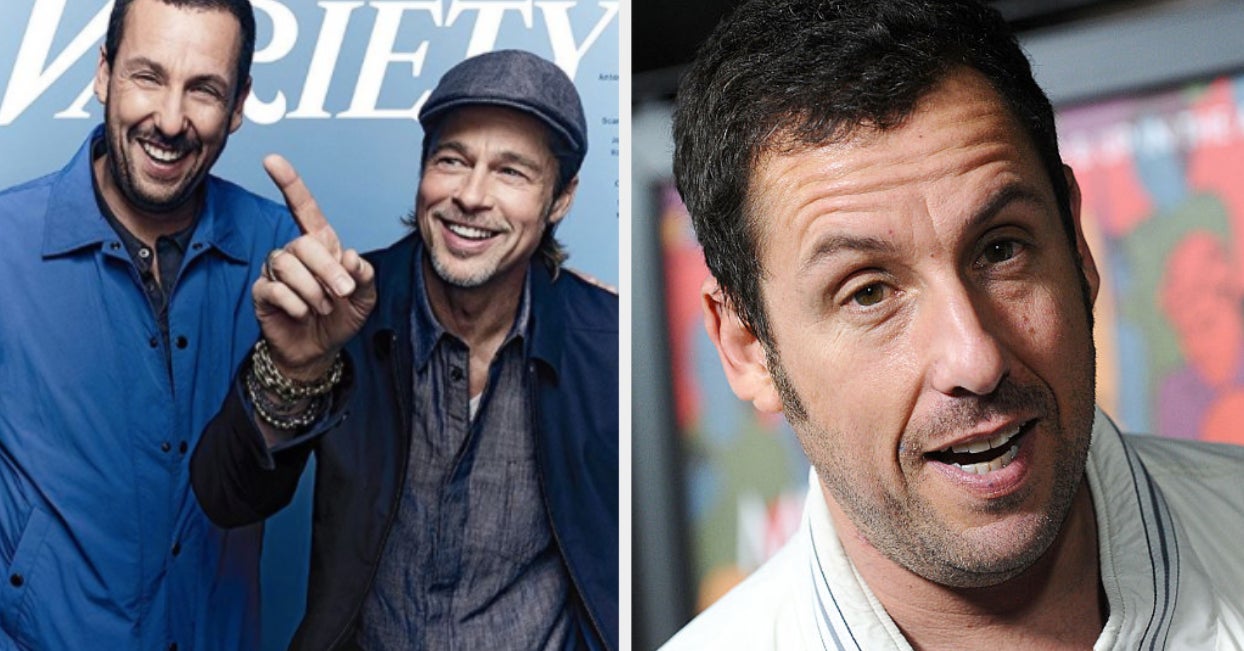

These Adam Sandler Movies All Have The Same Easter Egg

May 11, 2025

These Adam Sandler Movies All Have The Same Easter Egg

May 11, 2025 -

The Next Papal Election Leading Cardinal Candidates

May 11, 2025

The Next Papal Election Leading Cardinal Candidates

May 11, 2025 -

De Schoonheid Van Sylvester Stallones Dochter Een Foto Die Indruk Maakt

May 11, 2025

De Schoonheid Van Sylvester Stallones Dochter Een Foto Die Indruk Maakt

May 11, 2025 -

Is Adam Sandler The Man To Heal Americas Political Divide

May 11, 2025

Is Adam Sandler The Man To Heal Americas Political Divide

May 11, 2025 -

Foreign Airlines Acquire West Jet Stake Onex Investment Recovered

May 11, 2025

Foreign Airlines Acquire West Jet Stake Onex Investment Recovered

May 11, 2025