Fourth Largest Cryptocurrency: Understanding Ripple's (XRP) Market Position And Potential

Table of Contents

Understanding Ripple's Technology and Function

Unlike Bitcoin, a decentralized digital currency designed for peer-to-peer transactions, or Ethereum, a platform for decentralized applications (dApps), Ripple operates on a unique blockchain technology designed primarily for facilitating fast and efficient cross-border payments. XRP, Ripple's native cryptocurrency, plays a crucial role within the RippleNet network, acting as a bridge currency to streamline transactions between different fiat currencies.

This system offers several key advantages:

- Faster Transaction Speeds than Bitcoin: XRP transactions are processed significantly faster than Bitcoin, often within seconds.

- Lower Transaction Fees compared to Ethereum: XRP boasts considerably lower transaction fees, making it a more cost-effective solution for high-volume payments.

- Scalability Solutions for Large-Scale Transactions: RippleNet is designed to handle a large volume of transactions simultaneously, making it suitable for institutional-level use.

- Focus on Institutional Adoption: Ripple actively targets financial institutions, aiming to integrate XRP into their existing infrastructure for global payments. This focus on institutional adoption differentiates it from many other cryptocurrencies.

Ripple's Current Market Position and Performance

As of today, XRP maintains its position as a top-tier cryptocurrency, consistently ranking among the top five by market capitalization. However, its price has been subject to significant volatility, experiencing both dramatic highs and lows throughout its history. This volatility is influenced by various factors, including regulatory uncertainty, market sentiment towards cryptocurrencies in general, and the success of Ripple's partnerships.

Here's a snapshot of key market data:

- Current Market Cap Ranking: (Insert current ranking and market cap data here)

- Trading Volume Analysis: (Insert data on daily/monthly trading volume)

- Price Volatility Metrics: (Include metrics like standard deviation or Beta)

- Historical Price Charts: (Include a visual representation of XRP's price history)

Comparing XRP's performance to Bitcoin and Ethereum requires a nuanced approach. While Bitcoin and Ethereum often lead the market in terms of overall capitalization and price movements, XRP's performance is heavily tied to its adoption by financial institutions and the success of RippleNet.

Ripple's Potential for Future Growth and Adoption

Ripple's potential for future growth rests on several key pillars:

- Expanding partnerships with banks and financial institutions: Ripple's continued success depends on attracting more financial institutions to its network.

- Growing adoption of RippleNet by businesses: Increased usage of RippleNet for cross-border payments will drive demand for XRP.

- Development of new use cases for XRP: Exploring applications beyond payments, such as in decentralized finance (DeFi), could broaden XRP's appeal.

- Positive regulatory developments: A favorable regulatory environment will significantly impact XRP's price and adoption.

The expansion of RippleNet and successful integration within existing financial systems could dramatically increase XRP's utility and propel its growth.

Risks and Challenges Facing Ripple and XRP

Despite its potential, Ripple and XRP face significant challenges:

- Ongoing SEC Lawsuit: The ongoing legal battle with the Securities and Exchange Commission (SEC) poses a considerable risk to XRP's future.

- Competition from other payment networks: Ripple faces stiff competition from other established payment networks and emerging blockchain-based solutions.

- Market volatility and price fluctuations: The cryptocurrency market is inherently volatile, and XRP's price is subject to significant fluctuations.

- Regulatory uncertainty in different jurisdictions: Varying regulatory approaches to cryptocurrencies across the globe create uncertainty and potential obstacles for XRP's adoption.

Conclusion: Investing in the Future of the Fourth Largest Cryptocurrency: Ripple (XRP)

Ripple (XRP), the fourth-largest cryptocurrency, presents a compelling investment proposition, but one that requires careful consideration. While its unique technology and focus on institutional adoption offer significant potential for growth, the ongoing legal challenges and inherent risks of the cryptocurrency market cannot be ignored. XRP's future depends on several factors, including the outcome of the SEC lawsuit, the continued expansion of RippleNet, and the overall evolution of the cryptocurrency landscape.

Before investing in Ripple (XRP) or any other digital asset, it's crucial to conduct thorough research, understand the associated risks, and only invest what you can afford to lose. Learn more about this fourth-largest cryptocurrency and its potential, but always remember to make informed decisions. The future of Ripple (XRP) remains uncertain, but its current position and ambitious plans warrant close attention within the ever-evolving world of blockchain technology and digital assets.

Featured Posts

-

Kshmyr Ke Tnaze Pr Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 02, 2025

Kshmyr Ke Tnaze Pr Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Drkhwast

May 02, 2025 -

Fortnite Item Shop Update Key Changes And Improvements

May 02, 2025

Fortnite Item Shop Update Key Changes And Improvements

May 02, 2025 -

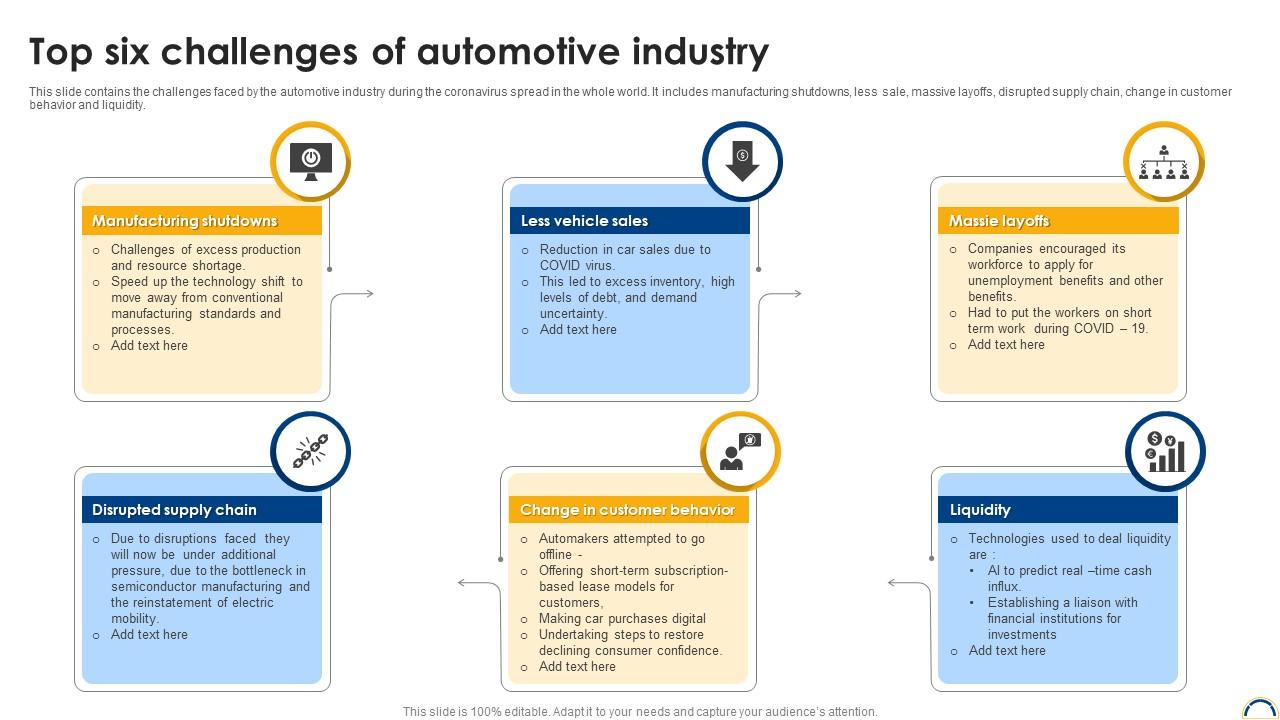

Bmw And Porsches China Challenges A Growing Trend In The Automotive Industry

May 02, 2025

Bmw And Porsches China Challenges A Growing Trend In The Automotive Industry

May 02, 2025 -

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents

May 02, 2025

Ai Driven Podcast Creation Analyzing Repetitive Scatological Documents

May 02, 2025 -

April 9th Lotto Draw Winning Numbers Announced

May 02, 2025

April 9th Lotto Draw Winning Numbers Announced

May 02, 2025

Latest Posts

-

Excellence In Voter Id Nebraska Campaign Awarded

May 02, 2025

Excellence In Voter Id Nebraska Campaign Awarded

May 02, 2025 -

Nebraskas Voter Id Program A National Clearinghouse Award Winner

May 02, 2025

Nebraskas Voter Id Program A National Clearinghouse Award Winner

May 02, 2025 -

Decoding Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025

Decoding Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025 -

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025 -

North Carolina Supreme Court Gop Candidate Challenges Recent Orders

May 02, 2025

North Carolina Supreme Court Gop Candidate Challenges Recent Orders

May 02, 2025