Frankfurt DAX Closes Lower Than 24,000 Points

Table of Contents

Economic Indicators Fueling the DAX Decline

Several key economic indicators point towards the downward pressure on the DAX index. The current economic climate is characterized by a confluence of challenges impacting investor confidence and the overall performance of German companies.

-

Rising Inflation and Dampened Consumer Spending: Persistent inflation across the Eurozone is squeezing consumer spending power. Higher prices for essential goods and services are forcing households to cut back, reducing demand and impacting the profitability of companies listed on the DAX. This decreased consumer spending directly translates to lower sales and potentially lower profits for many DAX-listed corporations.

-

Interest Rate Hikes and Increased Borrowing Costs: The European Central Bank (ECB)'s efforts to combat inflation through interest rate hikes have increased borrowing costs for businesses. This makes investments more expensive, potentially slowing down economic growth and impacting business expansion plans. Higher interest rates also make bonds more attractive to investors, potentially drawing capital away from the stock market.

-

Slowing Economic Growth in Germany and the Eurozone: Germany, the largest economy in the Eurozone, is experiencing slowing economic growth. This sluggishness is fueled by factors such as energy price volatility and global economic uncertainty. The projected GDP growth for Germany and the Eurozone is falling short of initial forecasts, further contributing to the negative sentiment surrounding the DAX.

-

Recession Fears: Concerns about a potential recession in Germany and the wider Eurozone are adding to the negative investor sentiment. The combination of high inflation, rising interest rates, and slowing economic growth has led to widespread speculation about an impending recession, prompting risk-averse investors to reduce their exposure to the stock market. Analysis of leading economic indicators suggests a heightened risk of a recessionary period.

Geopolitical Uncertainty and its Impact on the Frankfurt DAX

Geopolitical instability plays a significant role in the DAX's recent decline. Global events create uncertainty that impacts investor confidence and market stability.

-

The Ongoing War in Ukraine and Energy Crisis: The ongoing war in Ukraine continues to disrupt energy supplies and increase energy prices across Europe, significantly impacting German industry and adding pressure to inflation. This energy crisis disproportionately affects energy-intensive industries, many of which are represented within the DAX.

-

Escalating Global Tensions and Market Stability: Rising global tensions, including trade disputes and geopolitical rivalries, contribute to a climate of uncertainty. This uncertainty makes investors hesitant to commit capital, leading to decreased trading volume and downward pressure on stock prices, including those within the DAX index.

-

Uncertainty Surrounding Future Geopolitical Developments: The unpredictable nature of geopolitical events makes it difficult for investors to assess future risks and opportunities, contributing to a climate of risk aversion and negatively impacting the DAX index. The lack of clear resolution in several global conflicts adds to the market volatility.

Investor Sentiment and Market Volatility

The decline in the Frankfurt DAX is strongly linked to shifting investor sentiment and increased market volatility.

-

Declining Investor Confidence: Economic and geopolitical concerns have eroded investor confidence, leading many to adopt a more cautious approach to investments. This reduced confidence translates into decreased demand for stocks, resulting in lower prices.

-

Increased Market Volatility and Trading Activity: The current uncertain climate has led to increased market volatility, characterized by significant daily price fluctuations. This volatility makes it difficult for investors to predict market movements, discouraging active trading and further contributing to downward pressure on the DAX.

-

Rising Risk Aversion Among Investors: The combination of economic and geopolitical risks has fueled risk aversion among investors. Investors are shifting their portfolios towards safer assets, such as government bonds, reducing their exposure to the more volatile DAX stocks. This shift is evident in decreased trading volume in riskier asset classes.

Key Companies Contributing to the DAX Decline

While the entire DAX is experiencing a decline, some companies, such as Volkswagen, Siemens, and BASF, have experienced particularly significant drops in their stock prices. These declines reflect sector-specific challenges and broader economic headwinds affecting these key players. Their performance contributes significantly to the overall downward trend of the DAX index.

Conclusion

The Frankfurt DAX's fall below 24,000 points reflects a confluence of factors. Rising inflation, increased interest rates, slowing economic growth, geopolitical uncertainty, and declining investor confidence all contributed to this significant drop. The resulting market volatility and risk aversion highlight the challenges faced by investors in the current economic climate. Understanding these interconnected factors is crucial for navigating the complexities of the German and broader European stock markets. Stay updated on the Frankfurt DAX and its movements to better understand and manage your investment portfolio in this dynamic market. Monitor the Frankfurt DAX for future market trends and continue to learn about the factors impacting the Frankfurt DAX to make informed investment decisions.

Featured Posts

-

Annie Kilner Spotted Running Errands After Kyle Walkers Evening With Two Women

May 24, 2025

Annie Kilner Spotted Running Errands After Kyle Walkers Evening With Two Women

May 24, 2025 -

Annie Kilners Social Media Posts After Kyle Walker Incident

May 24, 2025

Annie Kilners Social Media Posts After Kyle Walker Incident

May 24, 2025 -

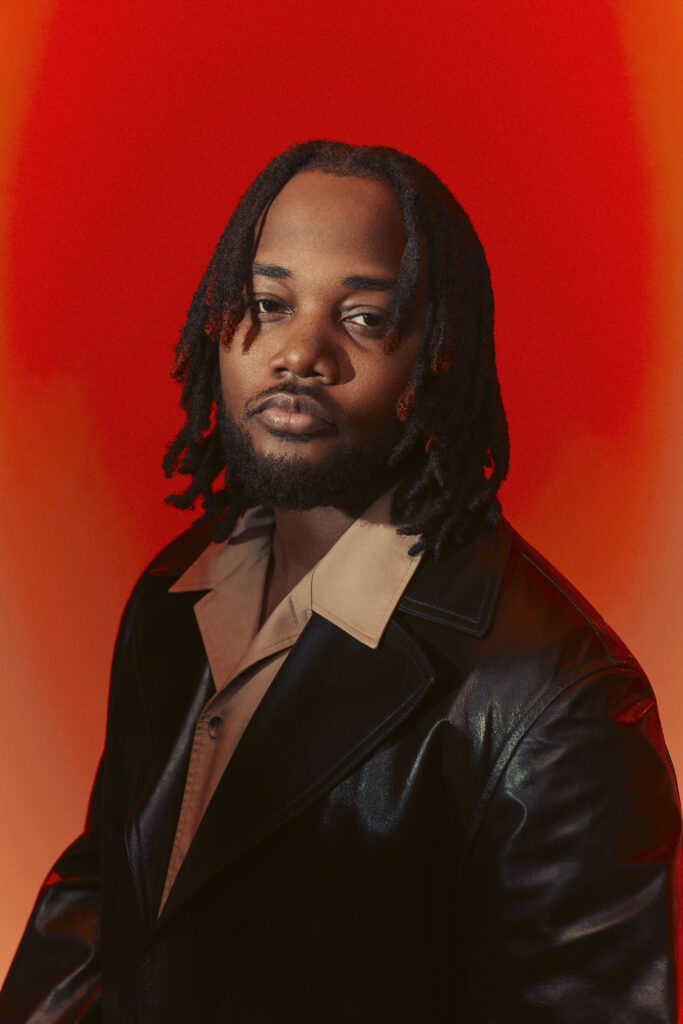

Top R And B Tracks This Week Featuring Leon Thomas And Flo

May 24, 2025

Top R And B Tracks This Week Featuring Leon Thomas And Flo

May 24, 2025 -

Escape To The Country Top Locations For A Countryside Getaway

May 24, 2025

Escape To The Country Top Locations For A Countryside Getaway

May 24, 2025 -

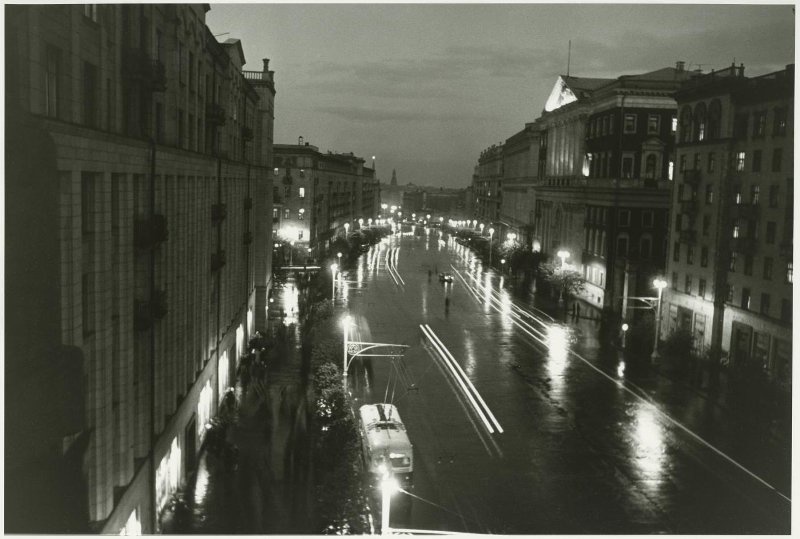

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Latest Posts

-

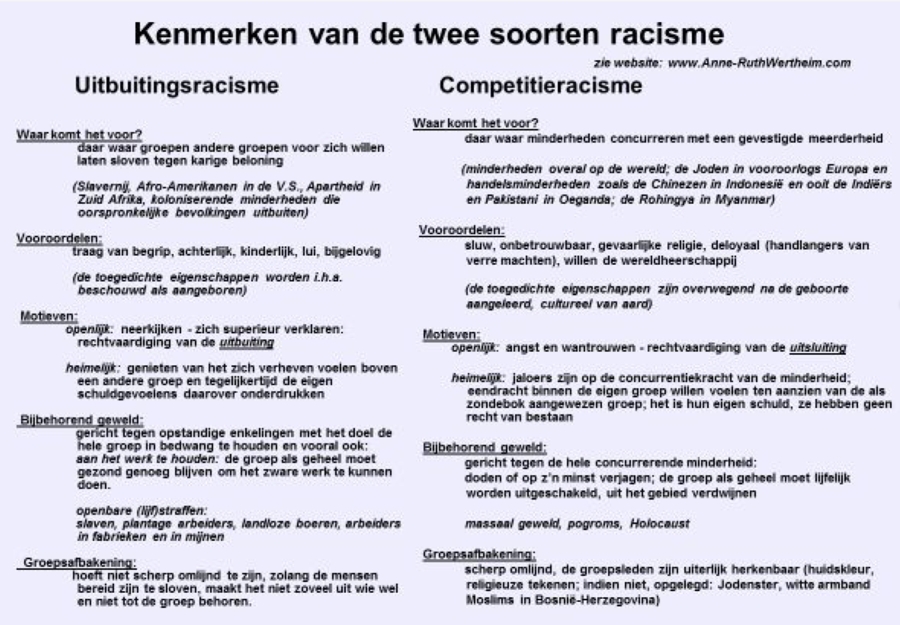

Aex Stijgt Terwijl Amerikaanse Beurzen Dalen Analyse Van De Markttrends

May 24, 2025

Aex Stijgt Terwijl Amerikaanse Beurzen Dalen Analyse Van De Markttrends

May 24, 2025 -

Onrust Op Amerikaanse Beurs Aex Scoort Ondanks Tegenwind

May 24, 2025

Onrust Op Amerikaanse Beurs Aex Scoort Ondanks Tegenwind

May 24, 2025 -

Amsterdam Stock Market Trade War Fears Trigger 7 Opening Drop

May 24, 2025

Amsterdam Stock Market Trade War Fears Trigger 7 Opening Drop

May 24, 2025 -

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025 -

Snelle Marktdraai Europese Aandelen Tijdelijke Verschuiving Of Blijvende Trend Ten Opzichte Van Wall Street

May 24, 2025

Snelle Marktdraai Europese Aandelen Tijdelijke Verschuiving Of Blijvende Trend Ten Opzichte Van Wall Street

May 24, 2025