Frankfurt Stock Market Update: DAX Under 24,000 After Losses

Table of Contents

DAX Index Performance and Current State

DAX Closing Price and Percentage Change

At the close of trading today, the DAX index registered at 23,950 points, representing a 2.5% decrease compared to yesterday's closing price and a 4% drop from last week's close. This places the DAX significantly below its yearly high of 26,500, reached in [Month, Year], and only slightly above its yearly low of 23,800 recorded in [Month, Year]. This substantial drop signals considerable market volatility and uncertainty within the German Stock Market.

Volume and Turnover

Trading volume on the Frankfurt Stock Exchange was significantly higher than average today, indicating heightened investor activity and potentially amplified market sentiment. The high turnover reflects substantial buying and selling pressure as investors reacted to the market downturn. This increased activity reinforces the gravity of the DAX's decline and the market's response to recent economic pressures.

- Specific DAX component stocks showing the biggest losses: Among the hardest hit were automotive giants Volkswagen (-3.8%) and BMW (-3.5%), reflecting concerns about slowing global demand and supply chain disruptions. Additionally, Allianz (-2.9%) and BASF (-2.7%) experienced considerable losses.

- Significant price fluctuations throughout the trading day: The DAX experienced a sharp decline in the early hours of trading, briefly dipping below 23,900 before recovering slightly, only to fall further towards the closing bell. This volatility illustrates the uncertainty currently pervading the market.

- Reference to relevant charts or graphs illustrating the DAX's performance: [Insert link to relevant chart or graph showing the DAX's recent performance. Alternatively, describe the chart's key features.].

Underlying Causes of the DAX Decline

Global Economic Factors

The current decline in the DAX is intertwined with several significant global economic factors. Persistently high inflation rates in Europe, coupled with the European Central Bank's (ECB) ongoing interest rate hikes, are dampening economic growth and increasing borrowing costs for businesses. Geopolitical instability, particularly the ongoing conflict in Ukraine, adds further uncertainty to the economic outlook, impacting energy prices and supply chains. The fluctuating price of natural gas, a critical energy source for German industry, significantly contributes to inflationary pressures and business uncertainty.

Company-Specific News

Beyond global economic headwinds, company-specific news has also contributed to the DAX's decline. For example, [Company Name]'s disappointing Q3 earnings report, revealing lower-than-expected profits and a revised outlook for the next quarter, sent ripples throughout the market. Similarly, concerns about [another company's] ongoing supply chain issues also negatively impacted investor sentiment.

- Interconnectedness of global markets and their impact on the DAX: The DAX, as a major European index, is highly sensitive to global economic trends. Negative news from other major markets (e.g., the US or Asia) often translates to downward pressure on the DAX.

- Sector-specific impacts: The energy and automotive sectors, particularly vulnerable to geopolitical events and fluctuating energy prices, have been significantly impacted, dragging the overall DAX performance down.

- Significant analyst predictions or comments: Several analysts have expressed concerns about the DAX's near-term outlook, citing persistent inflation and the possibility of a recession in the Eurozone as key factors impacting investor sentiment.

Investor Sentiment and Market Outlook

Analyst Opinions and Predictions

Analyst opinions regarding the future performance of the DAX are currently mixed. Some analysts remain cautiously optimistic, pointing to potential rebounds based on [mention specific factors]. Others maintain a more bearish outlook, predicting further declines in the near term due to persistent economic headwinds. A broad range of predictions reflects the significant uncertainty surrounding the market's future trajectory.

Potential Investment Strategies

Given the current market volatility, investors should consider employing risk mitigation strategies. Diversification across different asset classes and sectors can help reduce the impact of potential losses. Investors with a longer-term horizon may choose to hold their DAX-related investments, while more risk-averse investors might consider reducing their exposure or shifting to more conservative investments.

- Upcoming economic indicators or events that could influence the DAX: The upcoming release of [mention specific economic data, e.g., GDP figures, inflation data] will likely significantly influence the DAX's performance.

- Potential support and resistance levels for the DAX: Technical analysts have identified [mention support and resistance levels] as key levels to watch in the coming days and weeks.

- Advice on whether to buy, sell, or hold DAX-related investments: The decision to buy, sell, or hold DAX investments should be based on individual risk tolerance, investment goals, and a thorough assessment of market conditions. Seeking professional financial advice is highly recommended.

Conclusion

Today's Frankfurt Stock Market update reveals a significant decline in the DAX, falling below the 24,000 mark. This downturn is attributable to a combination of global economic headwinds, including high inflation, rising interest rates, geopolitical uncertainty, and company-specific news. Analyst sentiment is mixed, reflecting the inherent uncertainty in the current market environment. Investors should adopt prudent strategies, such as diversification and risk mitigation, when navigating this volatile period. Understanding DAX fluctuations and developing informed investment strategies is crucial for success in this dynamic market environment. To stay informed about the Frankfurt Stock Market and the DAX, regularly check for updates from reputable financial news sources and consider seeking professional financial advice before making any investment decisions. Remember, staying informed is key to making smart decisions in the Frankfurt Stock Market and understanding DAX movements.

Featured Posts

-

Strong Pmi Data Supports Continued Dow Jones Growth

May 25, 2025

Strong Pmi Data Supports Continued Dow Jones Growth

May 25, 2025 -

Pochti 40 Par Pozhenilis Na Kharkovschine Udachnaya Data Dlya Svadeb Foto

May 25, 2025

Pochti 40 Par Pozhenilis Na Kharkovschine Udachnaya Data Dlya Svadeb Foto

May 25, 2025 -

Glastonbury 2025 Lineup Confirmed Performers And Ticket Availability

May 25, 2025

Glastonbury 2025 Lineup Confirmed Performers And Ticket Availability

May 25, 2025 -

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 25, 2025

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 25, 2025 -

Motorway Incident Car Overturn On M56 Paramedics On Scene

May 25, 2025

Motorway Incident Car Overturn On M56 Paramedics On Scene

May 25, 2025

Latest Posts

-

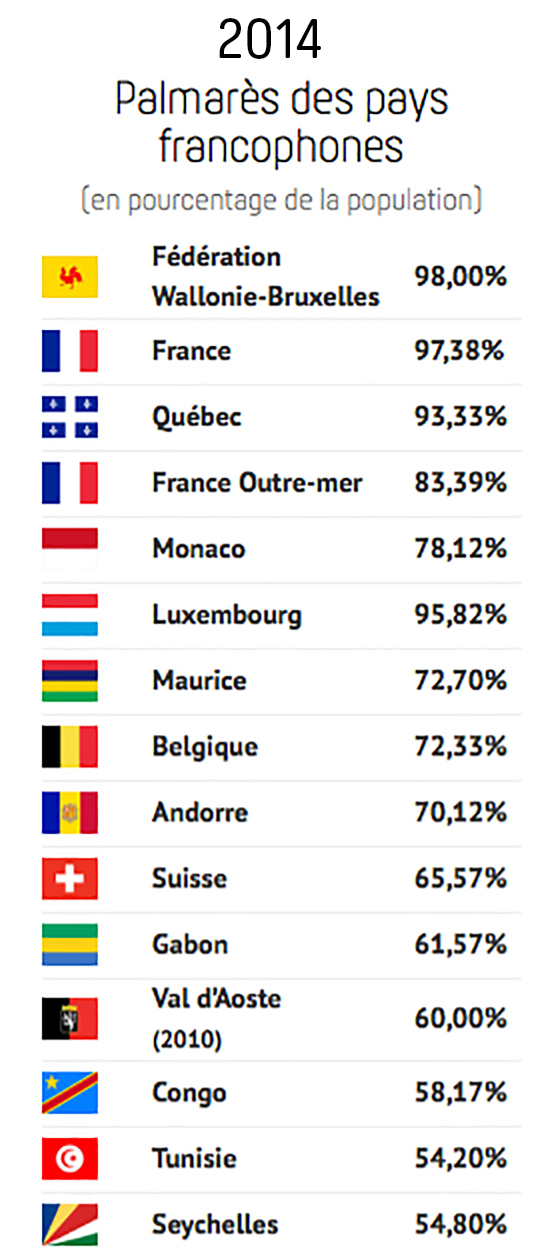

Mathieu Avanzi Et La Revitalisation De La Langue Francaise

May 25, 2025

Mathieu Avanzi Et La Revitalisation De La Langue Francaise

May 25, 2025 -

Le Francais Selon Mathieu Avanzi Depasser Les Cliches De La Langue Classique

May 25, 2025

Le Francais Selon Mathieu Avanzi Depasser Les Cliches De La Langue Classique

May 25, 2025 -

L Evolution Du Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 25, 2025

L Evolution Du Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 25, 2025 -

Promoting Collaboration And Growth The 2nd Best Of Bangladesh In Europe

May 25, 2025

Promoting Collaboration And Growth The 2nd Best Of Bangladesh In Europe

May 25, 2025 -

Mathieu Avanzi Au Dela Des Professeurs Qui Parle Francais Aujourd Hui

May 25, 2025

Mathieu Avanzi Au Dela Des Professeurs Qui Parle Francais Aujourd Hui

May 25, 2025