FTC Challenges Microsoft-Activision Merger: A Legal Battle Ahead

Table of Contents

The FTC's Concerns Regarding Anti-Competitive Practices

The FTC's primary concern centers on the potential for anti-competitive practices stemming from the merger. They argue that Microsoft's acquisition would grant the company undue control, stifling competition and harming consumers.

Market Domination Fears

The FTC argues that the combined entity would create a market behemoth, dominating several key sectors within the gaming industry.

- Microsoft's existing dominance in the PC gaming market: Microsoft already holds a significant share of the PC market through its Windows operating system, giving it a considerable advantage.

- Activision Blizzard's ownership of major franchises: Activision Blizzard boasts a portfolio of immensely popular franchises, including Call of Duty, World of Warcraft, Candy Crush, and many more. These titles represent substantial market share and revenue streams.

- Potential for Call of Duty exclusivity: A key concern revolves around the potential for Microsoft to make Call of Duty exclusive to Xbox consoles, significantly harming PlayStation players and potentially shifting market share dramatically.

- Concerns about stifling competition in the cloud gaming market: The merger raises concerns about reduced competition in the burgeoning cloud gaming market, where Microsoft's Xbox Cloud Gaming service could gain an unfair advantage.

Impact on Game Developers and Publishers

The FTC also worries about the impact on smaller game developers and publishers. The merger could reduce competition, leading to several negative consequences.

- Reduced competition leading to higher prices for consumers: Less competition can result in higher prices for games and gaming services.

- Limited choice for gamers regarding platforms and games: A less competitive market could restrict the variety of games and platforms available to consumers.

- Potential for Microsoft to leverage its market power to impose unfavorable terms on competitors: Microsoft's increased market power could allow it to dictate unfavorable terms to independent developers and publishers, limiting their ability to compete.

Microsoft's Defense Strategy

Microsoft is vigorously defending the merger, arguing that it will ultimately benefit consumers and foster innovation.

Arguments Against Anti-Competitive Behavior

Microsoft maintains that the acquisition will lead to positive outcomes for gamers.

- Bringing more Activision Blizzard titles to Xbox Game Pass: Microsoft plans to add Activision Blizzard's vast library of games to its Xbox Game Pass subscription service, expanding the service's appeal and value to subscribers.

- Plans to continue releasing Call of Duty on PlayStation: Microsoft has publicly stated its intention to continue releasing Call of Duty games on PlayStation consoles, attempting to alleviate concerns about exclusivity.

- Investments in game development and cloud gaming technology: Microsoft argues that the merger will allow for increased investment in game development and the advancement of cloud gaming technology, ultimately benefiting consumers.

Addressing Regulatory Concerns

Microsoft is actively working to address the FTC's concerns and potentially satisfy regulatory bodies.

- Potential commitments to maintain Call of Duty availability on PlayStation: Microsoft is likely to offer concessions, including long-term commitments to keep Call of Duty on PlayStation.

- Negotiations with regulatory bodies in other countries: The merger also faces regulatory scrutiny in other countries, requiring Microsoft to navigate varying legal landscapes.

- Public relations efforts to highlight the potential benefits of the merger: Microsoft is engaged in a significant public relations campaign to showcase the purported benefits of the merger to consumers and policymakers.

The Legal Battle and its Potential Outcomes

The FTC's challenge will likely lead to a protracted legal battle with several potential outcomes.

The Legal Process

The legal process will be complex and lengthy.

- Timeline for the legal process and potential delays: The legal battle could stretch over several months or even years, involving extensive discovery and potential appeals.

- The role of the courts and regulatory bodies in the decision-making process: The courts will play a critical role in determining the outcome, considering evidence and arguments from both sides. International regulatory bodies will also have input.

- Potential for settlements or compromises between Microsoft and the FTC: There is a possibility of a settlement or compromise that would allow the merger to proceed under certain conditions.

Implications for the Gaming Industry

The outcome of this legal battle will have significant and lasting implications for the gaming industry.

- Potential impact on future consolidation within the gaming sector: The ruling will set a precedent for future mergers and acquisitions in the gaming industry.

- Implications for the regulatory landscape surrounding mergers and acquisitions in the tech industry: The case could reshape the regulatory landscape for tech mergers, influencing how future deals are scrutinized.

- Long-term effects on the competitive dynamics of the gaming market: The outcome will significantly affect the competitive landscape of the gaming market for years to come.

Conclusion

The FTC's challenge to the Microsoft-Activision merger is a pivotal moment for the gaming industry. The legal battle will determine the fate of this massive acquisition and shape the future of competition and innovation in the sector. The arguments concerning anti-competitive practices, market dominance, and consumer benefits are central to this debate. The outcome will undoubtedly influence the regulatory environment and the future of gaming. Stay informed on this evolving legal battle surrounding the Microsoft-Activision merger to fully understand its profound impact on the gaming world and the broader tech landscape.

Featured Posts

-

Ja Morant Faces Nba Probe Following Latest Incident

Apr 24, 2025

Ja Morant Faces Nba Probe Following Latest Incident

Apr 24, 2025 -

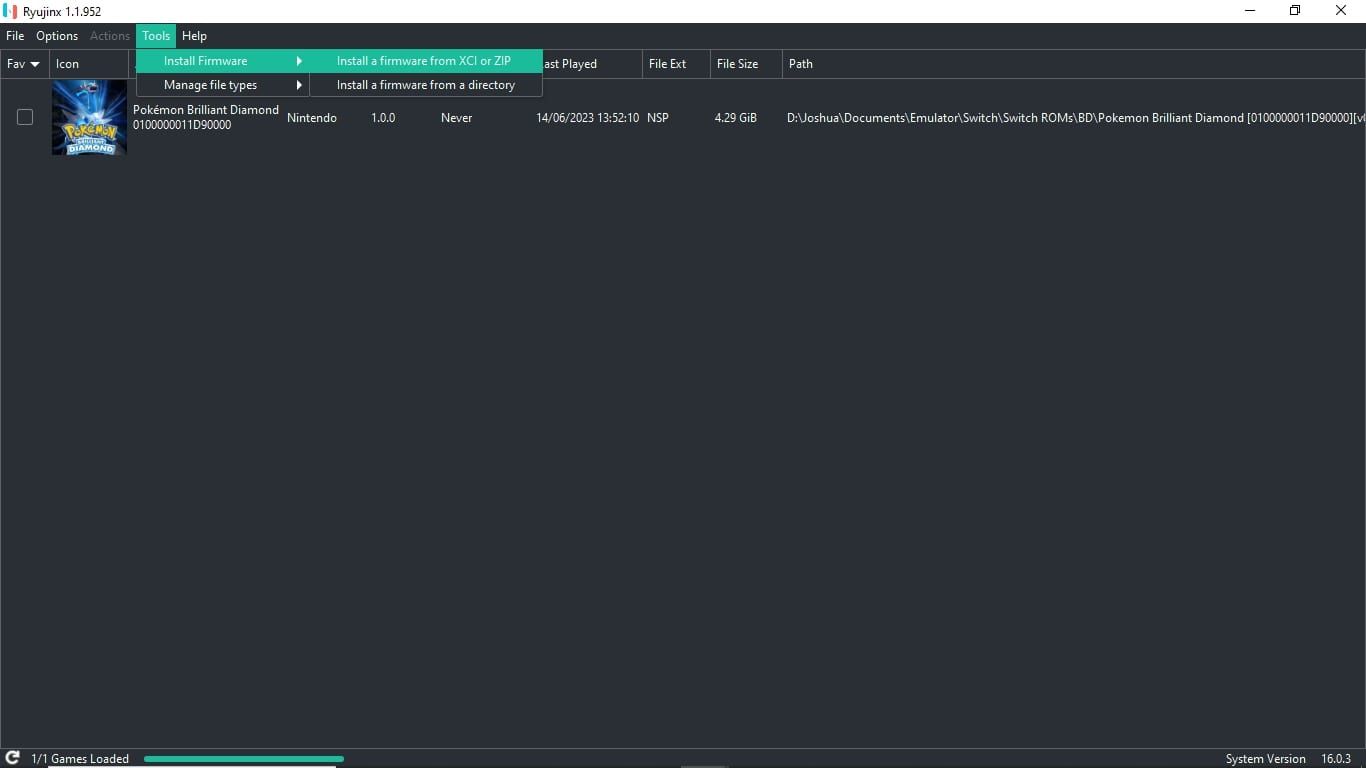

The Ryujinx Switch Emulator Development Officially Stopped

Apr 24, 2025

The Ryujinx Switch Emulator Development Officially Stopped

Apr 24, 2025 -

Section 230 And Banned Chemicals The Impact On E Bay Listings

Apr 24, 2025

Section 230 And Banned Chemicals The Impact On E Bay Listings

Apr 24, 2025 -

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025 -

Subsystem Issue Forces Blue Origin To Abort Rocket Launch

Apr 24, 2025

Subsystem Issue Forces Blue Origin To Abort Rocket Launch

Apr 24, 2025