FTC To Appeal Microsoft-Activision Merger: What's Next?

Table of Contents

The Microsoft-Activision Blizzard merger, a colossal deal valued at $69 billion, aimed to unite Microsoft's Xbox gaming ecosystem with Activision's portfolio of iconic franchises, including Call of Duty, Candy Crush, and World of Warcraft. However, the FTC initially blocked the deal, citing concerns about anti-competitive practices. Now, with the FTC's appeal, the legal battle continues, leaving the future of the merger hanging in the balance. This article will cover the FTC's arguments, Microsoft's defense, potential outcomes, and the broader implications of this landmark case.

The FTC's Arguments Against the Merger

The FTC's opposition to the Microsoft-Activision merger rests on two primary pillars: concerns regarding competition and market dominance.

Concerns Regarding Competition

The FTC argues that the merger would significantly reduce competition in several key areas of the gaming market. This includes:

- Game Consoles: The FTC believes Microsoft could leverage its ownership of Activision's titles (like Call of Duty) to gain an unfair advantage over competitors like Sony and Nintendo, potentially stifling innovation and choice for gamers.

- Subscription Services: The integration of Activision's games into Xbox Game Pass, Microsoft's subscription service, could give Microsoft an insurmountable lead over competitors offering similar services, limiting consumer choice and potentially raising prices in the long run.

- Specific Game Franchises: The FTC is particularly concerned about the potential for Microsoft to make Activision's popular franchises, especially Call of Duty, exclusive or less accessible to competing platforms, harming consumers who prefer those platforms.

The FTC alleges these practices could lead to:

- Higher prices for games

- Reduced quality of games due to less competition

- Limited innovation in the gaming industry

Market Definition and Dominance

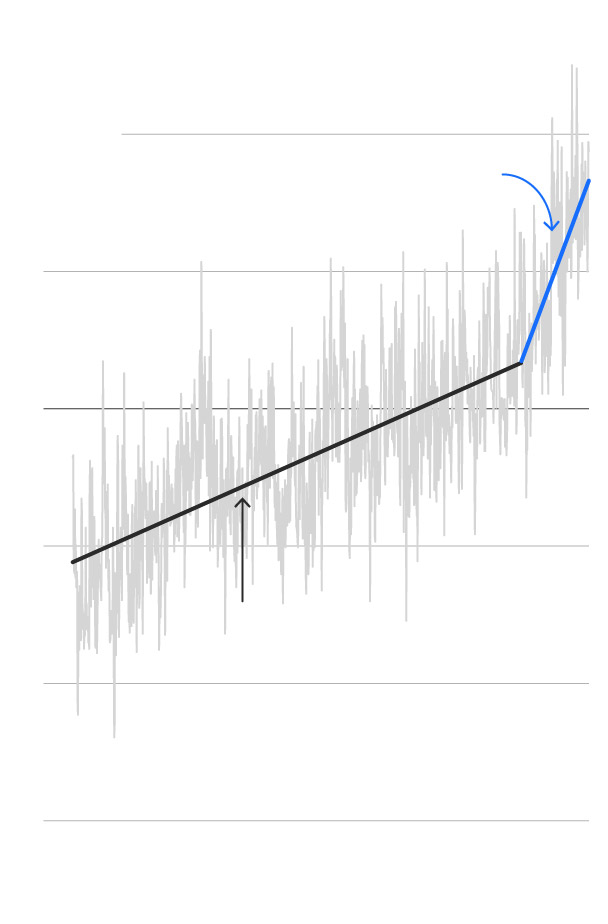

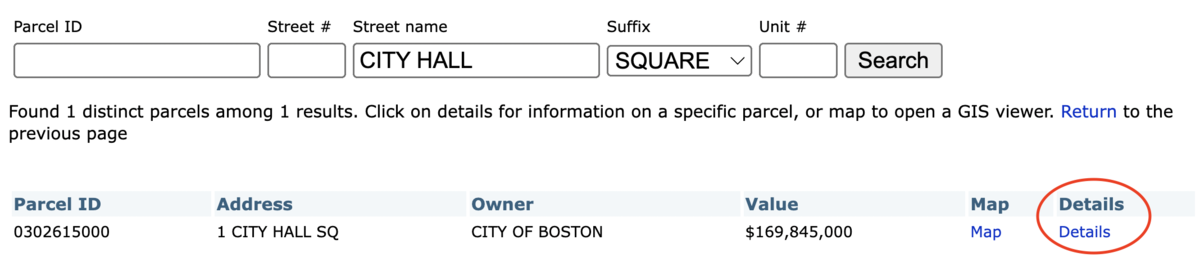

A crucial aspect of the FTC's case is its definition of the relevant market. The FTC argues that the relevant market isn't just the entire gaming industry but rather specific segments, such as high-performance gaming consoles and subscription services. Within these defined markets, the FTC contends that the merger would create a dominant player, giving Microsoft excessive market power. The FTC likely supports its claims using:

- Market share data demonstrating Microsoft's significant presence in the relevant markets.

- Analysis of consumer behavior indicating a strong preference for certain Activision titles.

- Economic modeling to project the impact of the merger on competition and consumer prices.

Microsoft's Defense of the Merger

Microsoft vehemently denies the FTC's allegations, arguing that the merger will actually increase competition and benefit consumers.

Arguments for Pro-Competitive Effects

Microsoft claims the merger will:

- Expand game availability to a wider range of platforms and players through Game Pass.

- Drive innovation by combining Activision's creative talent with Microsoft's technological resources.

- Result in lower prices for games due to increased competition and economies of scale.

Microsoft has offered various concessions to address the FTC's concerns, including:

- Commitments to keep Call of Duty available on PlayStation for a significant period.

- Agreements to ensure fair access to Activision's titles for other subscription services.

Addressing the FTC's Concerns

Microsoft directly counters the FTC's arguments by emphasizing:

- The existence of strong competitors in the gaming market, such as Sony and Nintendo.

- The dynamism of the gaming industry, which allows for new players and technologies to emerge.

- The benefits of combining Activision's strengths with Microsoft's resources to create a more competitive landscape.

Potential Outcomes of the Appeal

The FTC's appeal presents several possible scenarios:

Scenarios and Probabilities

- FTC Wins: The court could uphold the FTC's decision, blocking the merger entirely. This is a significant possibility, given the FTC's strong stance and the potential precedent-setting nature of the case.

- Microsoft Wins: The court could overturn the FTC's decision, allowing the merger to proceed. This scenario is also plausible, particularly if Microsoft's arguments regarding pro-competitive effects and its concessions are deemed persuasive.

- Settlement: Both parties could reach a settlement, potentially involving modifications to the merger agreement to address the FTC's concerns.

Timeline and Next Steps

The appeal process is likely to be lengthy and complex, involving multiple court hearings and legal briefs. Key milestones could include:

- Discovery phase, where both sides gather and exchange evidence.

- Oral arguments before the court.

- A final ruling from the court, which could be appealed further.

Impact on the Gaming Industry and Beyond

The outcome of this appeal will have far-reaching consequences.

Implications for Game Developers and Publishers

Smaller game studios and independent publishers could face:

- Increased pressure from larger companies if the merger increases market concentration.

- Challenges in securing fair distribution deals and marketing opportunities.

- Potential for reduced innovation and risk-taking due to less competition.

Broader Implications for Antitrust Law

This case sets a crucial precedent for future mergers and acquisitions in the tech industry, potentially:

- Influencing how regulators assess mergers in dynamic and rapidly evolving markets.

- Leading to stricter enforcement of antitrust laws in the tech sector.

- Shaping the debate over the role of large tech companies and their impact on competition.

Conclusion: FTC to Appeal Microsoft-Activision Merger: What's Next?

The FTC's appeal of the Microsoft-Activision merger represents a pivotal moment for the gaming industry and antitrust law. The FTC's concerns regarding reduced competition and market dominance are significant, while Microsoft's defense emphasizes the pro-competitive benefits and its proposed remedies. The potential outcomes range from a complete block of the merger to its approval, with significant implications for game developers, consumers, and the future of antitrust enforcement. Stay informed about this ongoing legal battle; follow updates on the "Microsoft-Activision merger appeal," the "FTC's Activision lawsuit," and related news to understand the evolving situation and its far-reaching impact on the gaming landscape. The future of gaming, and perhaps antitrust law itself, may depend on the final outcome.

Featured Posts

-

Supreme Courts Latest Decision Impact On Deportations Under Wartime Law

May 18, 2025

Supreme Courts Latest Decision Impact On Deportations Under Wartime Law

May 18, 2025 -

Impact Of Weakening Ocean Currents On Us Sea Level Rise

May 18, 2025

Impact Of Weakening Ocean Currents On Us Sea Level Rise

May 18, 2025 -

Trumps Response To Indias Offer To Lower Us Tariffs

May 18, 2025

Trumps Response To Indias Offer To Lower Us Tariffs

May 18, 2025 -

Navigating High Stock Market Valuations Insights From Bof A For Investors

May 18, 2025

Navigating High Stock Market Valuations Insights From Bof A For Investors

May 18, 2025 -

Alka Yagnk Ky Khwdnwsht Asamh Bn Ladn Ka Dhkr

May 18, 2025

Alka Yagnk Ky Khwdnwsht Asamh Bn Ladn Ka Dhkr

May 18, 2025

Latest Posts

-

Quebec Labour Tribunal Hears Amazon Union Case Over Warehouse Shutdowns

May 18, 2025

Quebec Labour Tribunal Hears Amazon Union Case Over Warehouse Shutdowns

May 18, 2025 -

Scrutinizing Trumps Aerospace Transactions Assessing The Details

May 18, 2025

Scrutinizing Trumps Aerospace Transactions Assessing The Details

May 18, 2025 -

220 Million Lawsuit Filed Against Mohawk Council By Kahnawake Casino Owners

May 18, 2025

220 Million Lawsuit Filed Against Mohawk Council By Kahnawake Casino Owners

May 18, 2025 -

Litige Amazon Syndicat Fermeture D Entrepots Au Quebec

May 18, 2025

Litige Amazon Syndicat Fermeture D Entrepots Au Quebec

May 18, 2025 -

The Trump Presidency And Aerospace A Look At Dealmaking And Disclosure

May 18, 2025

The Trump Presidency And Aerospace A Look At Dealmaking And Disclosure

May 18, 2025