FTC V. Meta: A Deep Dive Into The Antitrust Case Against WhatsApp And Instagram

Table of Contents

The FTC's Allegations of Anti-Competitive Conduct

The FTC's core argument centers on the assertion that Meta illegally maintained its monopoly power by acquiring potential competitors WhatsApp and Instagram. The commission claims these acquisitions were not about innovation or market expansion but rather about eliminating nascent threats to Meta's already considerable market share.

The specific allegations against Meta include:

- Eliminating WhatsApp as a Competitor: The FTC argues that Meta acquired WhatsApp to neutralize a significant threat in the burgeoning mobile messaging market, preventing it from potentially becoming a major competitor to Facebook Messenger.

- Stifling Instagram's Growth: Similarly, the FTC contends that the acquisition of Instagram prevented it from evolving into a serious rival to Facebook's social networking dominance. Instagram's unique photo-sharing features and growing user base presented a competitive challenge that Meta allegedly sought to eliminate.

- Anti-Competitive Tactics Post-Acquisition: The FTC alleges that after acquiring WhatsApp and Instagram, Meta engaged in anti-competitive practices to maintain its market dominance. This may have included integrating services in ways that limited interoperability with competing platforms, creating barriers for other companies to enter the market.

The FTC's case relies heavily on Section 7 of the Clayton Act, which prohibits mergers and acquisitions that may substantially lessen competition or tend to create a monopoly.

Meta's Defense Strategies

Meta vigorously defends its acquisitions, arguing that they were pro-competitive and ultimately benefited consumers. Their defense rests on several key points:

- Innovation and Consumer Benefits: Meta claims that the acquisitions led to significant innovations and improvements in messaging and photo-sharing services, ultimately enhancing the user experience. They point to features and functionalities developed after the acquisitions as evidence of this.

- No Elimination of Significant Competition: Meta argues that even after the acquisitions, significant competition remained in both the messaging and photo-sharing markets. They highlight the existence of other players with considerable market share and user bases.

- Narrow Market Definition: A crucial element of Meta's defense challenges the FTC's definition of the relevant market. Meta argues that the FTC's definition is too narrow and doesn't accurately reflect the competitive landscape, which includes various communication and social networking platforms.

Meta also heavily emphasizes the role of network effects and economies of scale in its argument. The company contends that the integration of these platforms enhances user experience due to increased network effects, justifying the acquisitions as economically sound and beneficial to consumers.

Key Legal Challenges and Arguments

The FTC v. Meta case presents several significant legal challenges and complex arguments. Antitrust cases related to mergers and acquisitions are inherently intricate, requiring careful examination of market dynamics, competitive effects, and legal precedents.

The FTC bears the burden of proof, needing to demonstrate that the acquisitions substantially lessened competition or tended to create a monopoly. This requires presenting strong evidence and meeting rigorous standards. Procedural challenges and jurisdictional issues may also arise throughout the case. Key considerations include:

- Defining the Relevant Market: A critical aspect of the case involves precisely defining the relevant markets for both messaging apps and social networking platforms. This is crucial in determining the extent of Meta's market power and the potential anti-competitive effects of the acquisitions.

- Impact on Future Mergers and Acquisitions: The outcome of this case will set a significant precedent for future tech mergers and acquisitions, potentially influencing regulatory scrutiny and the approach taken by companies considering similar deals.

Potential Outcomes and Implications of the FTC v. Meta Case

Several potential outcomes exist for the FTC v. Meta antitrust case:

- FTC Victory and Divestiture: The FTC could win, potentially forcing Meta to divest itself of WhatsApp and/or Instagram, essentially unwinding the acquisitions.

- Meta Victory: A Meta victory would uphold the acquisitions, potentially setting a precedent for future mergers and acquisitions in the tech industry.

- Settlement Agreement: The FTC and Meta may reach a settlement agreement, potentially involving concessions from Meta without a full-scale divestiture.

The broader implications for the tech industry and antitrust enforcement are significant:

- Impact on Future Mergers and Acquisitions: The outcome will significantly influence future mergers and acquisitions in the tech sector, potentially increasing regulatory scrutiny and making such deals more challenging.

- Effect on Innovation and Competition: The decision could affect innovation and competition in the social media and messaging sectors, potentially leading to more or less fragmented markets.

- The Role of Antitrust Regulators: The case highlights the ongoing debate regarding the role and effectiveness of antitrust regulators in overseeing Big Tech companies and preventing anti-competitive practices.

Conclusion: Understanding the FTC v. Meta Antitrust Case and Its Significance

The FTC v. Meta antitrust case presents a complex legal battle with far-reaching implications for the tech industry and antitrust law. The FTC alleges anti-competitive conduct by Meta in acquiring WhatsApp and Instagram, while Meta defends its actions as pro-competitive and beneficial to consumers. The outcome will shape the future of antitrust enforcement and the regulatory landscape for tech mergers and acquisitions. Stay updated on the FTC v. Meta antitrust case developments and further research the topic by searching keywords like "Meta antitrust lawsuit," "WhatsApp antitrust," "Instagram antitrust," and "FTC v. Meta updates." Share this article to help spread awareness of this important case!

Featured Posts

-

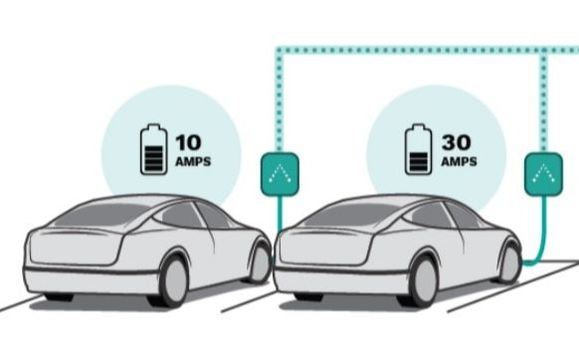

Byd 5 Minute Ev Charging Fact Or Fiction Our Findings

May 13, 2025

Byd 5 Minute Ev Charging Fact Or Fiction Our Findings

May 13, 2025 -

Kean Jadi Pahlawan Fiorentina Menang Tipis Atas Atalanta

May 13, 2025

Kean Jadi Pahlawan Fiorentina Menang Tipis Atas Atalanta

May 13, 2025 -

Aryn Sabalenkas Miami Open Victory Defeating Pegula

May 13, 2025

Aryn Sabalenkas Miami Open Victory Defeating Pegula

May 13, 2025 -

Plano Islamic Center Development Under Texas Rangers Investigation Following Gov Abbotts Order

May 13, 2025

Plano Islamic Center Development Under Texas Rangers Investigation Following Gov Abbotts Order

May 13, 2025 -

Problem Byd V Evrope Analyza Situace A Plan Pro Hybridni Ofenzivu S Evropskym Tymem

May 13, 2025

Problem Byd V Evrope Analyza Situace A Plan Pro Hybridni Ofenzivu S Evropskym Tymem

May 13, 2025

Latest Posts

-

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025 -

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025 -

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025 -

Country Musics Future Scotty Mc Creerys Sons Impressive Voice

May 14, 2025

Country Musics Future Scotty Mc Creerys Sons Impressive Voice

May 14, 2025 -

A Chip Off The Old Block Scotty Mc Creerys Son Sings George Strait

May 14, 2025

A Chip Off The Old Block Scotty Mc Creerys Son Sings George Strait

May 14, 2025