FTC's Appeal Against Microsoft's Activision Blizzard Acquisition: A Deep Dive

Table of Contents

The FTC's Core Concerns Regarding the Activision Blizzard Acquisition

The Federal Trade Commission (FTC) filed a lawsuit to block the merger, citing concerns about anti-competitive practices and the creation of a gaming monopoly. Their arguments center on several key issues:

Anti-Competitive Practices

The FTC alleges that Microsoft's acquisition of Activision Blizzard would allow them to engage in anti-competitive practices, particularly concerning the immensely popular Call of Duty franchise. This concern stems from several key potential actions:

- Restricting access to Call of Duty on competing consoles like PlayStation: The FTC worries Microsoft could make Call of Duty exclusive to Xbox, harming PlayStation players and giving Xbox a significant competitive advantage. This could lead to a decline in PlayStation's market share and limit consumer choice.

- Potentially raising prices for Call of Duty and other Activision Blizzard games: The reduced competition could allow Microsoft to increase prices for Call of Duty and other Activision Blizzard titles, harming consumers' wallets. This price hike could negatively affect the overall gaming market.

- Leveraging Activision Blizzard's game portfolio to exclude rivals from key gaming markets: The FTC fears that Microsoft could use its expanded game library to shut out competitors in various gaming sectors, stifling innovation and reducing competition. This could lead to a less dynamic and innovative gaming market.

Market Domination and Monopoly Power

The FTC's argument extends beyond Call of Duty, highlighting the potential for unchecked market dominance. They argue the merger would grant Microsoft excessive power in several key areas:

- Microsoft’s existing market share in gaming consoles (Xbox) and cloud gaming (Xbox Cloud Gaming): Combining this existing power with Activision Blizzard's significant market share creates a potent force in the gaming industry.

- Activision Blizzard's substantial market share in the mobile gaming market (King): King, the mobile gaming giant acquired by Activision Blizzard, adds another layer of market dominance for Microsoft.

- Potential for bundling of services to create barriers to entry for competitors: Combining Xbox Game Pass with Activision Blizzard's extensive game catalog could create insurmountable barriers for new entrants, hindering competition.

Microsoft's Defense Strategy and Counterarguments

Microsoft vehemently denies the FTC's allegations, arguing the acquisition will benefit gamers and foster competition. Their defense rests on several key pillars:

Maintaining Competition

Microsoft maintains that the merger will actually increase competition and provide numerous benefits for consumers:

- Promises to continue releasing Call of Duty on PlayStation and other platforms: Microsoft has repeatedly pledged to continue releasing Call of Duty on PlayStation, attempting to alleviate the FTC's primary concern.

- Claims the merger will accelerate innovation and game development: Microsoft argues that combining resources and expertise will lead to faster innovation and a wider variety of high-quality games.

- Highlights the benefits of combining Microsoft's technology with Activision Blizzard's game studios: The integration of technology and expertise is presented as beneficial for game development and improvement across the board.

Addressing FTC's Antitrust Concerns

To further assuage the FTC's concerns, Microsoft has offered various concessions:

- Licensing agreements to ensure continued access to key titles on rival platforms: These agreements aim to guarantee that competitors will not be shut out of access to key games.

- Commitments to maintain fair pricing structures: Microsoft has made promises to ensure fair pricing and avoid exploiting their increased market power.

- Investment in game development to foster competition: Microsoft has committed to invest in game development to further stimulate the industry's competitive environment.

Potential Outcomes and Implications for the Gaming Industry

The outcome of the FTC's appeal will have profound implications for the gaming industry:

FTC Victory

A successful FTC appeal could reshape the gaming industry's landscape:

- Increased regulatory scrutiny of large tech acquisitions: A ruling against Microsoft could set a precedent for stricter regulatory oversight of future mergers and acquisitions.

- Potential for the deal to be blocked or restructured: The merger could be entirely blocked or require significant restructuring to address the FTC's concerns.

- Uncertainty for investors and the gaming industry: Uncertainty surrounding the outcome will create volatility in the market.

Microsoft Victory

Conversely, a Microsoft victory would signal a potential shift in industry dynamics:

- Increased consolidation within the gaming industry: A successful merger could trigger further consolidation, leading to fewer major players in the market.

- Potential for altered game development and distribution models: The combined entity could reshape game development and distribution, potentially impacting how games are created, released, and priced.

- Implications for game pricing and accessibility: This outcome could affect pricing models and accessibility for gamers worldwide.

Conclusion

The FTC's appeal against Microsoft's Activision Blizzard acquisition is a pivotal moment for the gaming industry and antitrust law. The outcome will significantly influence the future of mergers and acquisitions in the sector and set a precedent for regulatory oversight. This complex case highlights the interplay between competition, innovation, and consumer welfare in the dynamic gaming world. Understanding the intricacies of this case—the FTC's concerns, Microsoft’s defense, and potential outcomes—is crucial. Stay informed about developments in this ongoing FTC's appeal against Microsoft's Activision Blizzard acquisition and its implications for the future of gaming.

Featured Posts

-

Three Injured In Yate House Explosion Gas Leak Suspected

Apr 30, 2025

Three Injured In Yate House Explosion Gas Leak Suspected

Apr 30, 2025 -

What Not To Bring On A Cruise Ship

Apr 30, 2025

What Not To Bring On A Cruise Ship

Apr 30, 2025 -

Channing Tatum And Inka Williams A New Relationship Blossoms

Apr 30, 2025

Channing Tatum And Inka Williams A New Relationship Blossoms

Apr 30, 2025 -

Dismissed Ftc Commissioners The Struggle For Reappointment

Apr 30, 2025

Dismissed Ftc Commissioners The Struggle For Reappointment

Apr 30, 2025 -

Independent Office For Police Conduct Iopc Challenges Chris Kaba Panorama On Ofcom

Apr 30, 2025

Independent Office For Police Conduct Iopc Challenges Chris Kaba Panorama On Ofcom

Apr 30, 2025

Latest Posts

-

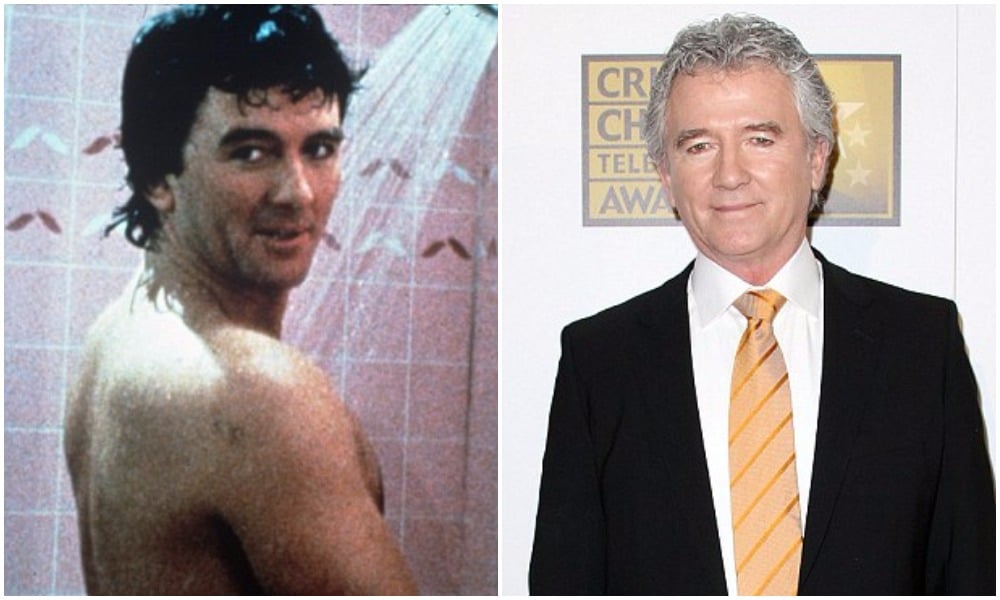

Death Of Dallas And Carrie Actress Daughter Amy Irving Pays Tribute

May 01, 2025

Death Of Dallas And Carrie Actress Daughter Amy Irving Pays Tribute

May 01, 2025 -

Dallas Icon Dies At 100 Remembering A Life Well Lived

May 01, 2025

Dallas Icon Dies At 100 Remembering A Life Well Lived

May 01, 2025 -

Priscilla Pointer Dalla Star Dies At 100 A Legacy Remembered

May 01, 2025

Priscilla Pointer Dalla Star Dies At 100 A Legacy Remembered

May 01, 2025 -

Amy Irving Mourns The Passing Of Dallas And Carrie Star

May 01, 2025

Amy Irving Mourns The Passing Of Dallas And Carrie Star

May 01, 2025 -

Centenarian Dallas Star Passes Away

May 01, 2025

Centenarian Dallas Star Passes Away

May 01, 2025