G-7 Nations To Discuss Reducing Tariffs On Chinese Goods: The De Minimis Threshold

Table of Contents

Understanding the De Minimis Threshold and its Current Impact

The de minimis value represents the monetary threshold below which imported goods are exempt from import duties and taxes. It's a crucial element of import regulations, impacting the cost and complexity of bringing goods into a country. For low-value shipments, this threshold significantly impacts whether or not businesses and individuals face additional customs duties.

-

Definition: The de minimis threshold acts as a tax exemption for small import shipments. Goods valued below this threshold are generally processed faster and with less paperwork.

-

Current Status: The current de minimis thresholds for G7 nations vary regarding Chinese imports. These thresholds often differ based on the type of good and the importing country, adding complexity to international trade. Specific values are subject to change and are best obtained through official government resources.

-

Impact on Businesses: The existing de minimis threshold significantly impacts businesses importing from China. Large businesses often have systems to manage import duties, but smaller businesses may find the current system adds unnecessary administrative burden and complexity, increasing costs. Even small increases in import duties can affect their profit margins.

-

Impact on Consumers: The de minimis threshold indirectly affects consumer prices. Higher thresholds typically translate to lower import costs, potentially resulting in lower prices for consumers. Conversely, a low threshold can lead to higher prices, as businesses pass on these costs.

Proposed Changes to the De Minimis Threshold by the G7

The G7 is considering changes to the de minimis threshold for Chinese imports, suggesting a potential move towards tariff reduction and a simplification of import processes. The proposed alterations are expected to be a significant topic of discussion at upcoming G7 summits.

-

Specific Proposals: While precise proposals remain unclear, speculation suggests either a substantial increase in the de minimis value or a complete removal of tariffs for certain categories of Chinese goods. This would align with efforts to streamline trade and boost economic growth.

-

Reasons for the Proposed Changes: The potential rationale for the G7's consideration includes several key factors: stimulating economic growth by reducing the cost of imported goods, increasing consumer choice and affordability, and engaging in strategic competition with other emerging economic blocs.

-

Potential Benefits: Lowering tariffs could benefit G7 nations by increasing access to cheaper Chinese goods, boosting competition, and potentially lowering inflation. For China, increased access to the G7 markets would represent a significant economic boon.

-

Potential Drawbacks: Conversely, significantly lowering tariffs could negatively impact domestic industries within the G7 nations, potentially leading to job losses in certain sectors and reduced government revenue from import duties. A sudden influx of cheaper goods could also cause disruptions to existing supply chains.

The Role of the WTO in Tariff Reductions

The World Trade Organization (WTO) plays a crucial role in regulating international trade, including tariff adjustments. Any significant changes to the de minimis threshold must comply with WTO rules and agreements.

-

WTO regulations concerning tariff adjustments: The WTO has established rules and guidelines regarding the application of tariffs and non-tariff barriers to trade. The G7’s proposed changes must adhere to these regulations to avoid potential disputes.

-

Potential compliance issues arising from proposed changes: The scale of any changes to the de minimis threshold will determine the potential for compliance issues. Substantial reductions might attract challenges from other WTO members.

-

Potential for trade disputes and how the WTO might resolve them: If the changes are deemed to violate WTO rules, disputes might arise, potentially leading to trade sanctions or retaliatory measures. The WTO's dispute settlement mechanism would be called upon to resolve such conflicts.

Economic and Geopolitical Implications of Lowering Tariffs

The decision to lower tariffs on Chinese goods has far-reaching economic and geopolitical implications, influencing various aspects of the global landscape.

-

Impact on global supply chains and manufacturing: Reduced tariffs could significantly reshape global supply chains, making Chinese-manufactured goods even more competitive. This could lead to both opportunities and challenges for manufacturers worldwide.

-

Influence on inflation and consumer prices: Lower import costs could contribute to lower inflation rates in G7 countries, benefiting consumers through lower prices for various goods.

-

Shift in geopolitical dynamics between the G7 and China: This move could signal a potential easing of trade tensions between the G7 and China, fostering greater economic cooperation. However, it could also spark debates about economic interdependence and national security.

Conclusion

The G7's consideration of lowering tariffs on Chinese goods by adjusting the de minimis threshold presents a complex scenario with both potential advantages and disadvantages. While reduced tariffs could stimulate economic growth, increase consumer choice, and potentially ease geopolitical tensions, there are concerns regarding the impact on domestic industries and the potential for WTO disputes. Careful consideration of these factors is crucial in navigating this pivotal moment in global trade relations.

Stay informed about the evolving trade relations between the G7 and China. Follow future developments regarding the de minimis threshold and its impact on global trade by subscribing to our newsletter or following us on social media (link to your social media). Learn more about the implications of changes to the de minimis threshold and its impact on your import/export business.

Featured Posts

-

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 24, 2025 -

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Uspekhi I Neudachi

May 24, 2025

Chto Udalos Nashemu Pokoleniyu Vzglyad Na Uspekhi I Neudachi

May 24, 2025 -

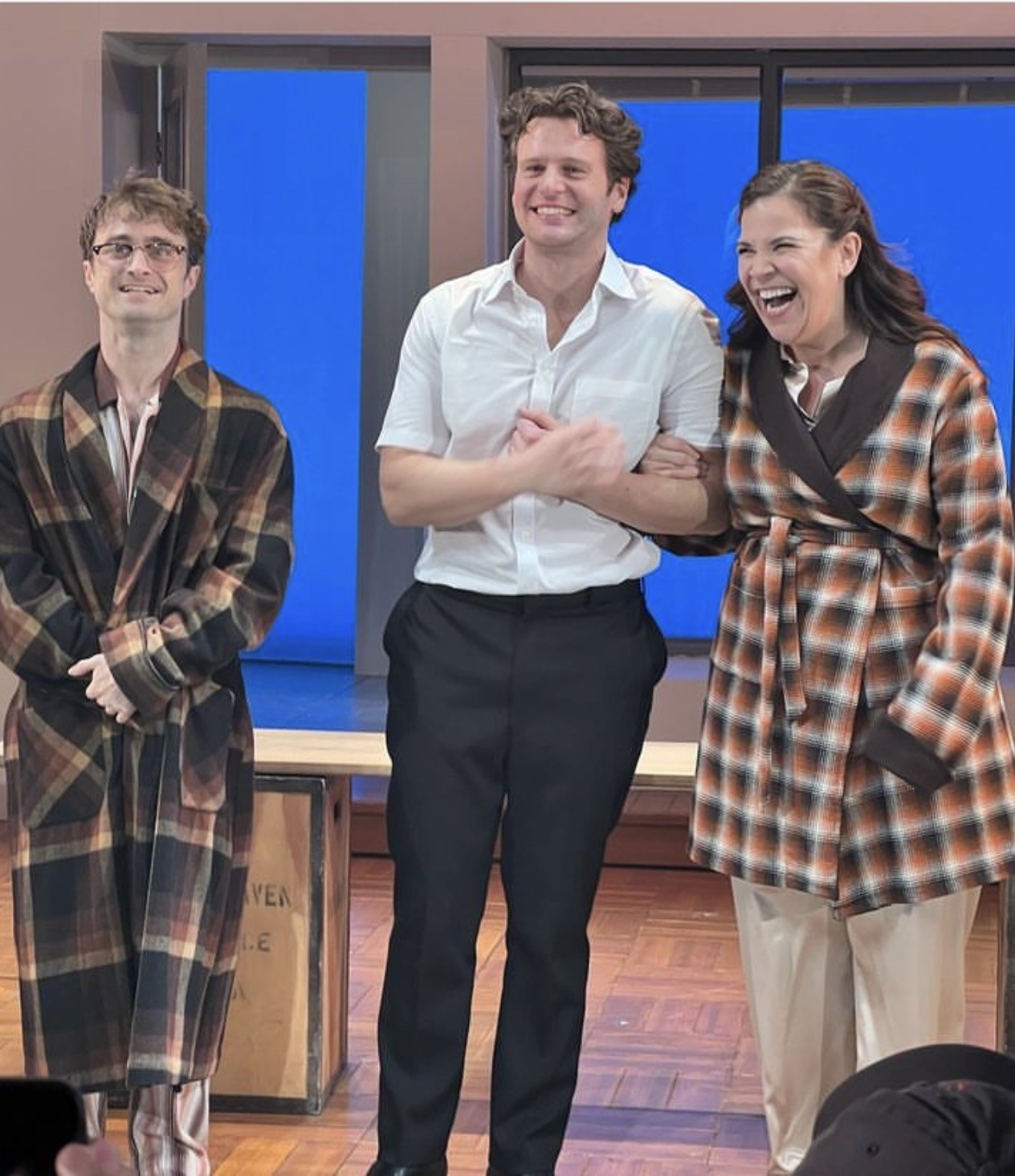

How Joe Jonas Handled A Couples Fight Over Him

May 24, 2025

How Joe Jonas Handled A Couples Fight Over Him

May 24, 2025 -

The Jonas Brothers A Couples Hilarious Fight And Joes Response

May 24, 2025

The Jonas Brothers A Couples Hilarious Fight And Joes Response

May 24, 2025 -

Escape To The Country The Pros And Cons Of Rural Living

May 24, 2025

Escape To The Country The Pros And Cons Of Rural Living

May 24, 2025

Latest Posts

-

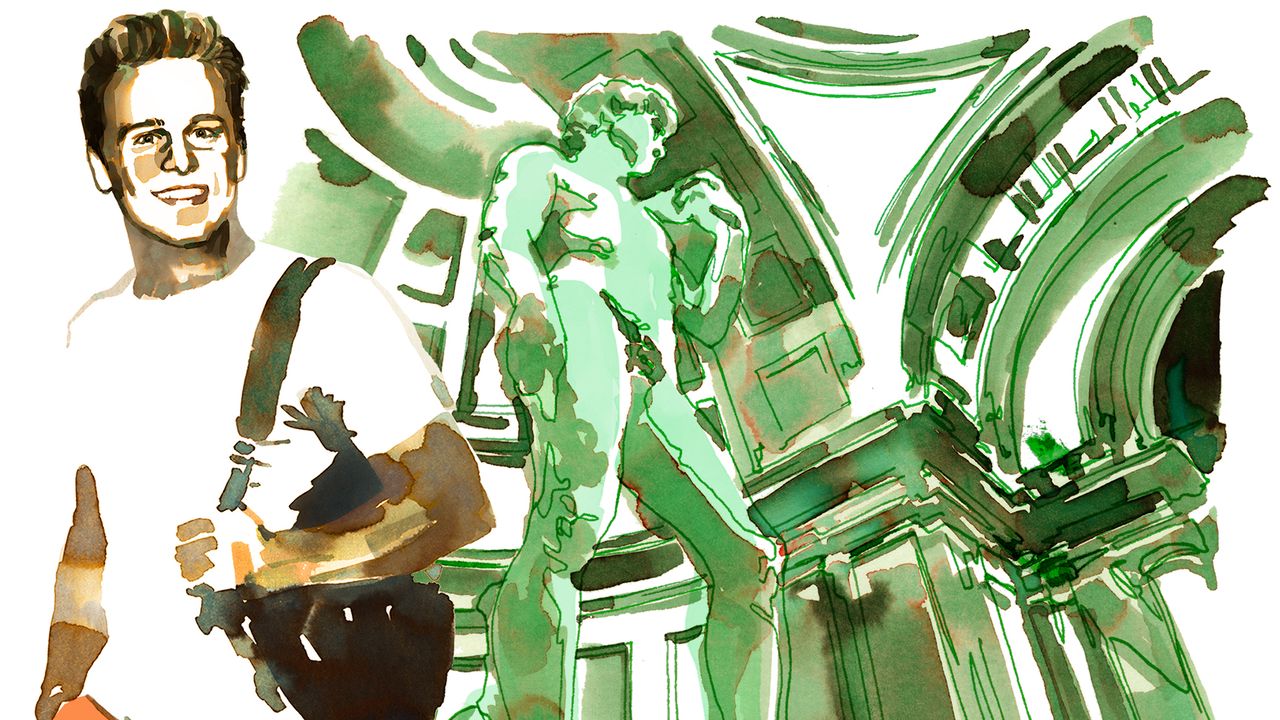

Just In Time A Critical Look At Jonathan Groffs Bobby Darin Performance

May 24, 2025

Just In Time A Critical Look At Jonathan Groffs Bobby Darin Performance

May 24, 2025 -

A Conversation With Jonathan Groff About His Asexual Identity

May 24, 2025

A Conversation With Jonathan Groff About His Asexual Identity

May 24, 2025 -

Review Jonathan Groffs Just In Time A Hit Broadway Musical

May 24, 2025

Review Jonathan Groffs Just In Time A Hit Broadway Musical

May 24, 2025 -

Jonathan Groff Reflecting On His Asexual Past

May 24, 2025

Jonathan Groff Reflecting On His Asexual Past

May 24, 2025 -

Broadway Buzz Jonathan Groffs Immersive Performance Of Just In Time

May 24, 2025

Broadway Buzz Jonathan Groffs Immersive Performance Of Just In Time

May 24, 2025