Get A $500 Instant Loan With Chime: A Guide For Direct Deposit Users

Table of Contents

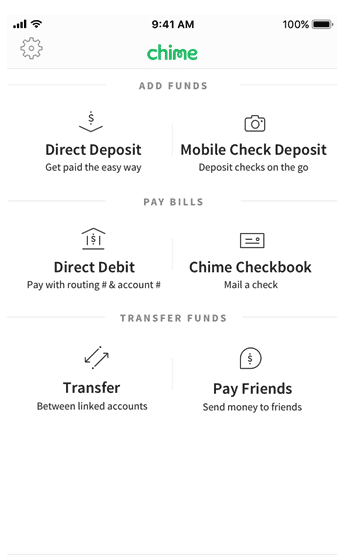

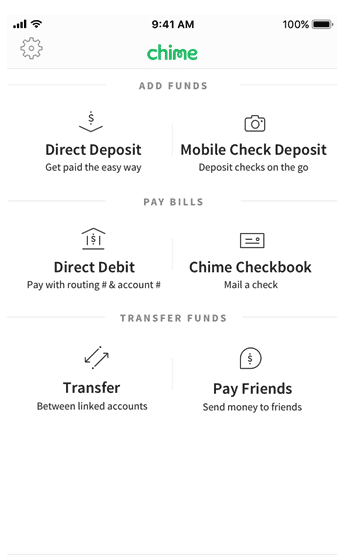

Understanding Chime's Services and Loan Options

Many Chime users wonder if their account offers direct loan products. Let's clarify Chime's features and their limitations concerning obtaining a $500 instant loan. Chime offers services like SpotMe and a Credit Builder, but these are not traditional loans.

- SpotMe: This overdraft protection feature provides small amounts of cash to cover overdrafts, but its limits are significantly lower than $500, and eligibility depends on factors like direct deposit frequency and account activity. It's not a loan in the traditional sense, as it's linked to your account and balances.

- Chime Credit Builder: This secured credit card helps build credit scores over time. A better credit score can improve your chances of qualifying for a $500 loan from external lenders, but it doesn't offer direct loan access.

- Lack of Direct Chime Loans: It's crucial to understand that Chime does not currently offer its own loan products, including instant loans.

Exploring Alternative Lending Options for Chime Users

Since Chime doesn't provide loans directly, you'll need to explore alternative lenders offering quick cash loans. Several options exist, each with its own terms and conditions:

- Payday Loans: These short-term, high-interest loans are designed for quick repayment, typically within a couple of weeks. While they offer fast access to cash, the extremely high interest rates make them a costly option and should be considered only as a last resort.

- Online Lenders: Many online lenders offer personal loans, including some that advertise "instant" approval and funding. These loans usually have lower interest rates than payday loans but often require a credit check. Carefully compare interest rates, fees, and repayment terms before choosing an online lender. Look for lenders specializing in short-term loans if you need a $500 instant loan.

- Personal Installment Loans: These loans are repaid in monthly installments over a longer period, generally offering lower interest rates than payday or short-term loans. However, the approval process may take longer.

Eligibility Requirements for $500 Instant Loans

Getting approved for a $500 instant loan, regardless of the lender, depends on meeting specific eligibility criteria. Lenders assess several factors:

- Minimum Credit Score: Lenders typically require a minimum credit score, although this varies depending on the lender and loan type. A higher credit score significantly increases your chances of approval and potentially secures a better interest rate.

- Income Verification: Proof of regular income is essential. Providing information about your direct deposit into your Chime account streamlines this process, proving your income stability and reliability.

- Debt-to-Income Ratio (DTI): Lenders assess your DTI, which is the ratio of your monthly debt payments to your gross monthly income. A lower DTI indicates a better ability to manage debt, increasing approval likelihood.

- Active Chime Account: Maintaining an active and verified Chime account is beneficial because it simplifies income verification for many lenders.

Using Direct Deposit to Streamline the Loan Application

Using direct deposit with your Chime account significantly accelerates the loan application and disbursement process.

- Faster Funding: Direct deposit ensures quicker loan disbursement once approved. Many lenders prioritize applications with direct deposit information.

- Simplified Verification: Providing your direct deposit details streamlines income verification, speeding up the approval process. It serves as a clear indication of your financial stability and regular income stream.

Conclusion

While Chime itself doesn't offer $500 instant loans, various alternative lending options are available to its users, particularly those with direct deposits. Remember that obtaining a quick cash loan involves careful consideration of interest rates, fees, and repayment terms. Research reputable lenders, compare options, and ensure you understand the complete terms and conditions before applying. Thoroughly check your eligibility requirements before proceeding. Need a $500 instant loan? Start researching today to find the best solution for your financial needs.

Featured Posts

-

Chanel Through Tylas Lens A Study In Power And Style

May 14, 2025

Chanel Through Tylas Lens A Study In Power And Style

May 14, 2025 -

Commission D Enquete Budgetaire Coquerel Saisit La Justice Apres Le Refus De Kohler

May 14, 2025

Commission D Enquete Budgetaire Coquerel Saisit La Justice Apres Le Refus De Kohler

May 14, 2025 -

New Mission Impossible Sneak Peek Tom Cruise Conquers 140 Mph Winds At 8000 Feet

May 14, 2025

New Mission Impossible Sneak Peek Tom Cruise Conquers 140 Mph Winds At 8000 Feet

May 14, 2025 -

Swiateks World No 2 Ranking In Jeopardy After Rome Loss

May 14, 2025

Swiateks World No 2 Ranking In Jeopardy After Rome Loss

May 14, 2025 -

El Sevilla Fc Despide A Garcia Pimienta Y Nombra A Joaquin Caparros Como Nuevo Entrenador

May 14, 2025

El Sevilla Fc Despide A Garcia Pimienta Y Nombra A Joaquin Caparros Como Nuevo Entrenador

May 14, 2025