Gibraltar Industries (ROCK) Earnings Preview: What To Expect

Table of Contents

Key Factors Influencing Gibraltar Industries' Q3 Earnings

Several key factors will significantly shape Gibraltar Industries' Q3 2023 earnings. Analyzing these factors allows for a more accurate prediction of the company's financial results and potential impact on the ROCK stock price.

Revenue Growth Expectations

Projecting Gibraltar Industries' Q3 revenue requires considering several significant market trends.

-

Expected impact of construction market trends: The overall health of the construction industry significantly influences Gibraltar Industries' performance. A robust construction market typically translates to higher demand for building products, driving revenue growth. Conversely, a slowdown in construction activity can negatively impact sales. Analyzing recent housing starts data and construction spending reports is crucial for assessing this factor.

-

Potential influence of raw material costs and supply chain disruptions: Fluctuations in raw material prices (steel, aluminum, etc.) and ongoing supply chain challenges can significantly impact Gibraltar Industries' profitability and revenue. Increased material costs can squeeze margins, while supply chain disruptions can lead to production delays and lost sales.

-

Analysis of recent contract wins and project pipelines: The company's recent contract wins and the size of its project pipeline provide valuable insights into future revenue streams. Larger contracts and a robust pipeline suggest strong future revenue growth potential.

-

Comparison to previous quarters’ revenue performance: Comparing Q3 revenue projections to the previous quarters’ performance (Q1 and Q2 2023) helps establish trends and gauge the company's growth trajectory. Consistent year-over-year growth is a positive indicator.

Earnings Per Share (EPS) Projections

EPS, a key metric for investors, reflects Gibraltar Industries' profitability. Several factors influence the projected EPS for Q3 2023.

-

Impact of operating margins and profitability: Analyzing operating margins reveals the efficiency of Gibraltar Industries' operations. Higher margins indicate stronger profitability and contribute to a higher EPS.

-

Consideration of any one-time charges or gains: Any significant one-time charges (e.g., restructuring costs) or gains (e.g., asset sales) can significantly impact the reported EPS, potentially distorting the underlying performance.

-

Analyst estimates and consensus expectations: Reviewing analyst estimates and consensus expectations provides a benchmark against which to compare the actual results. Beating expectations is generally viewed favorably by the market.

-

Comparison of EPS with previous quarters and year-over-year growth: Analyzing EPS year-over-year and compared to previous quarters helps determine the company's earnings growth trend.

Guidance and Outlook for the Remainder of the Year

Gibraltar Industries' guidance for the remainder of 2023 provides valuable insights into the company's expectations and future plans.

-

Management's comments on future market conditions: Pay close attention to management's commentary on the anticipated market conditions for the rest of the year. Their assessment of industry trends, demand, and potential headwinds is crucial.

-

Projected investments and expansion plans: Any planned investments in new facilities, technologies, or acquisitions indicate the company's growth strategy and potential future performance.

-

Any potential risks or challenges identified by the company: Understanding potential risks (e.g., economic slowdown, increased competition) allows for a more realistic assessment of the company's prospects.

-

Implications for future stock price movements: The company's outlook significantly impacts investor sentiment and can influence the future price movements of ROCK stock.

Analyzing Gibraltar Industries' Stock Performance

Understanding the current valuation and potential risks associated with ROCK stock is crucial for making informed investment decisions.

Current Stock Valuation

A thorough valuation analysis is essential before investing in Gibraltar Industries.

-

Comparison to industry peers' valuations: Compare ROCK's valuation metrics (market capitalization, P/E ratio) to those of its competitors to assess its relative attractiveness.

-

Analysis of the stock's recent price movements and volatility: Examine the recent price trends and volatility of ROCK stock to understand market sentiment and potential risks.

-

Consideration of market sentiment and investor confidence: Investor sentiment and overall market conditions significantly impact stock prices. Assess the general market outlook and investor confidence in Gibraltar Industries.

Risk Factors to Consider

Investing in any stock involves risks, and Gibraltar Industries is no exception. It's crucial to consider the following:

-

Sensitivity to economic downturns and construction market cycles: The building products industry is highly cyclical, making Gibraltar Industries vulnerable to economic downturns and fluctuations in construction activity.

-

Potential impact of inflation and rising interest rates: Inflation and rising interest rates can increase input costs and reduce demand, negatively impacting profitability.

-

Exposure to supply chain disruptions and material costs: Disruptions to supply chains and fluctuating material costs can impact production and profitability.

-

Competitive landscape and market share dynamics: Gibraltar Industries operates in a competitive market. Analyzing its competitive position and market share is essential.

Investment Implications of the Earnings Report

The Q3 earnings report will likely significantly influence investor sentiment and ROCK stock price.

Potential Scenarios and Investor Reactions

The market's reaction to the earnings report will depend heavily on whether Gibraltar Industries meets or exceeds expectations.

-

Scenarios: The three most likely scenarios are: Gibraltar Industries beating expectations (positive reaction), meeting expectations (neutral reaction), and missing expectations (negative reaction).

-

Potential market reactions to each scenario: A positive surprise could lead to a significant price increase, while a negative surprise could cause a sharp decline. Meeting expectations might lead to a relatively flat reaction or a minor price adjustment.

-

Implications for buy, sell, or hold decisions: Based on the results and market reaction, investors will make decisions about buying, selling, or holding ROCK stock.

Long-Term Outlook for Gibraltar Industries

Despite short-term fluctuations, the long-term outlook for Gibraltar Industries depends on various factors.

-

Long-term market trends in the building products sector: The overall growth of the construction industry and demand for building products will play a significant role in Gibraltar Industries' long-term success.

-

Gibraltar Industries' competitive advantages and strategic initiatives: The company's competitive advantages, innovative products, and strategic initiatives will determine its ability to maintain or gain market share.

-

Sustainability and ESG considerations: Increasingly, investors consider environmental, social, and governance (ESG) factors. Gibraltar Industries' commitment to sustainability will influence investor perception.

Conclusion

The upcoming Gibraltar Industries (ROCK) Q3 earnings report will be a key event for investors. Analyzing revenue growth, EPS, guidance, and considering potential risks is crucial for making informed investment decisions. By understanding the factors influencing ROCK stock and conducting thorough research, you can develop a sound investment strategy. Stay tuned for the Q3 earnings release and continue monitoring Gibraltar Industries (ROCK) stock for potential investment opportunities. Remember to conduct your own thorough due diligence before investing in Gibraltar Industries (ROCK) or any other stock.

Featured Posts

-

Gibraltar At Sidoti Small Cap Conference A Focus On Specific Area Of Presentation If Known

May 13, 2025

Gibraltar At Sidoti Small Cap Conference A Focus On Specific Area Of Presentation If Known

May 13, 2025 -

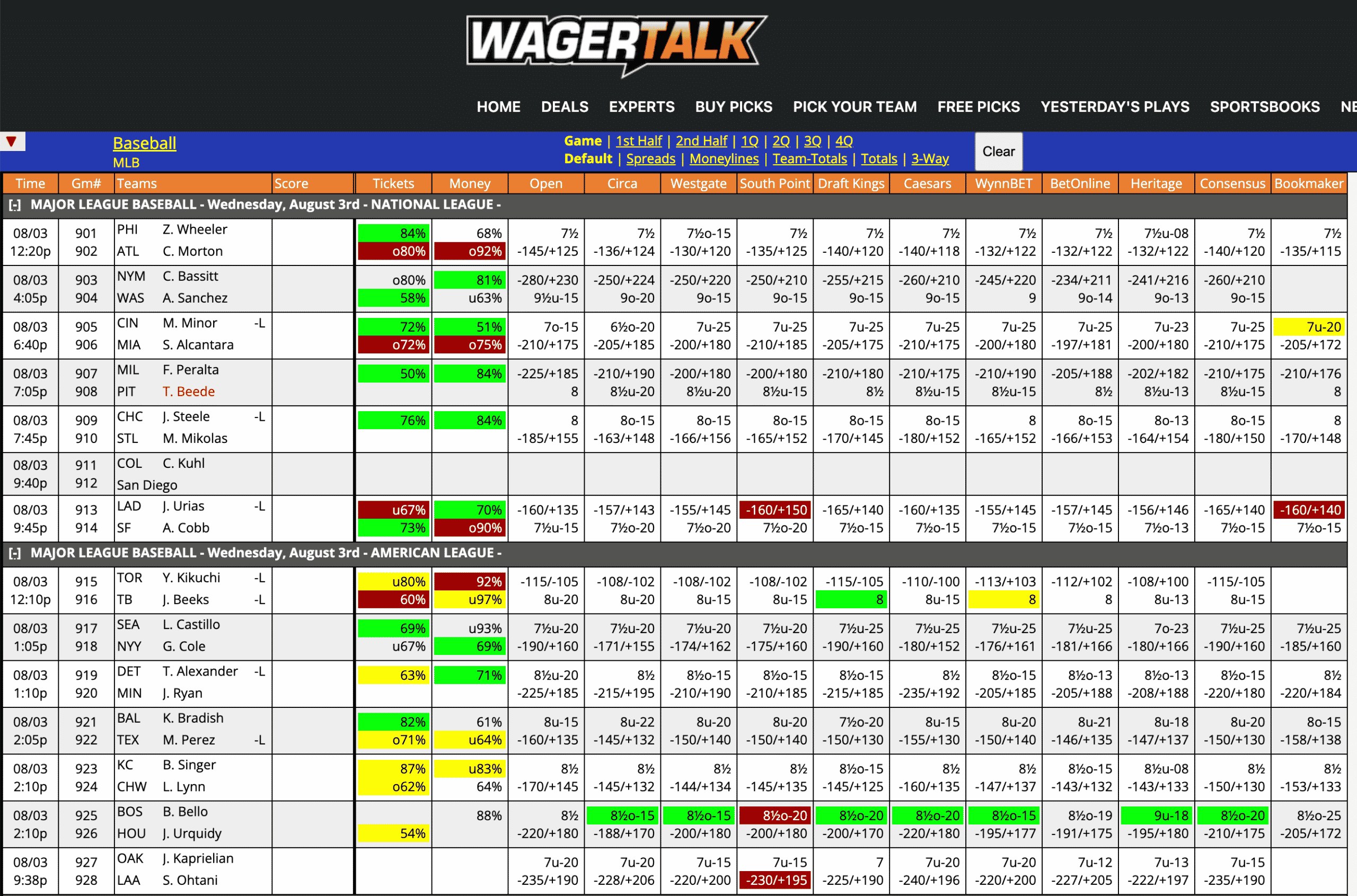

Mlb Baseball Home Run Prop Picks And Odds For April 26th

May 13, 2025

Mlb Baseball Home Run Prop Picks And Odds For April 26th

May 13, 2025 -

Alle Schueler In Sicherheit Entwarnung An Braunschweiger Schule Nach Alarm

May 13, 2025

Alle Schueler In Sicherheit Entwarnung An Braunschweiger Schule Nach Alarm

May 13, 2025 -

Where To Watch Duke Vs Oregon Ncaa Tournament Game

May 13, 2025

Where To Watch Duke Vs Oregon Ncaa Tournament Game

May 13, 2025 -

Abi Research On Tech Tariffs Unpacking The High Stakes Impact Of The Trump Trade War

May 13, 2025

Abi Research On Tech Tariffs Unpacking The High Stakes Impact Of The Trump Trade War

May 13, 2025

Latest Posts

-

Dutch Bicycle Thefts Reach All Time High Amsterdam Worst Affected

May 13, 2025

Dutch Bicycle Thefts Reach All Time High Amsterdam Worst Affected

May 13, 2025 -

The Megan Thee Stallion Case Tory Lanez And 50 Cents Responses

May 13, 2025

The Megan Thee Stallion Case Tory Lanez And 50 Cents Responses

May 13, 2025 -

Amsterdam Bike Thefts Surge To Unprecedented Levels

May 13, 2025

Amsterdam Bike Thefts Surge To Unprecedented Levels

May 13, 2025 -

Reactions To Megan Thee Stallion Verdict Tory Lanez And 50 Cents Statements

May 13, 2025

Reactions To Megan Thee Stallion Verdict Tory Lanez And 50 Cents Statements

May 13, 2025 -

The Fallout And Resolution Partynextdoor And Tory Lanezs Public Dispute

May 13, 2025

The Fallout And Resolution Partynextdoor And Tory Lanezs Public Dispute

May 13, 2025